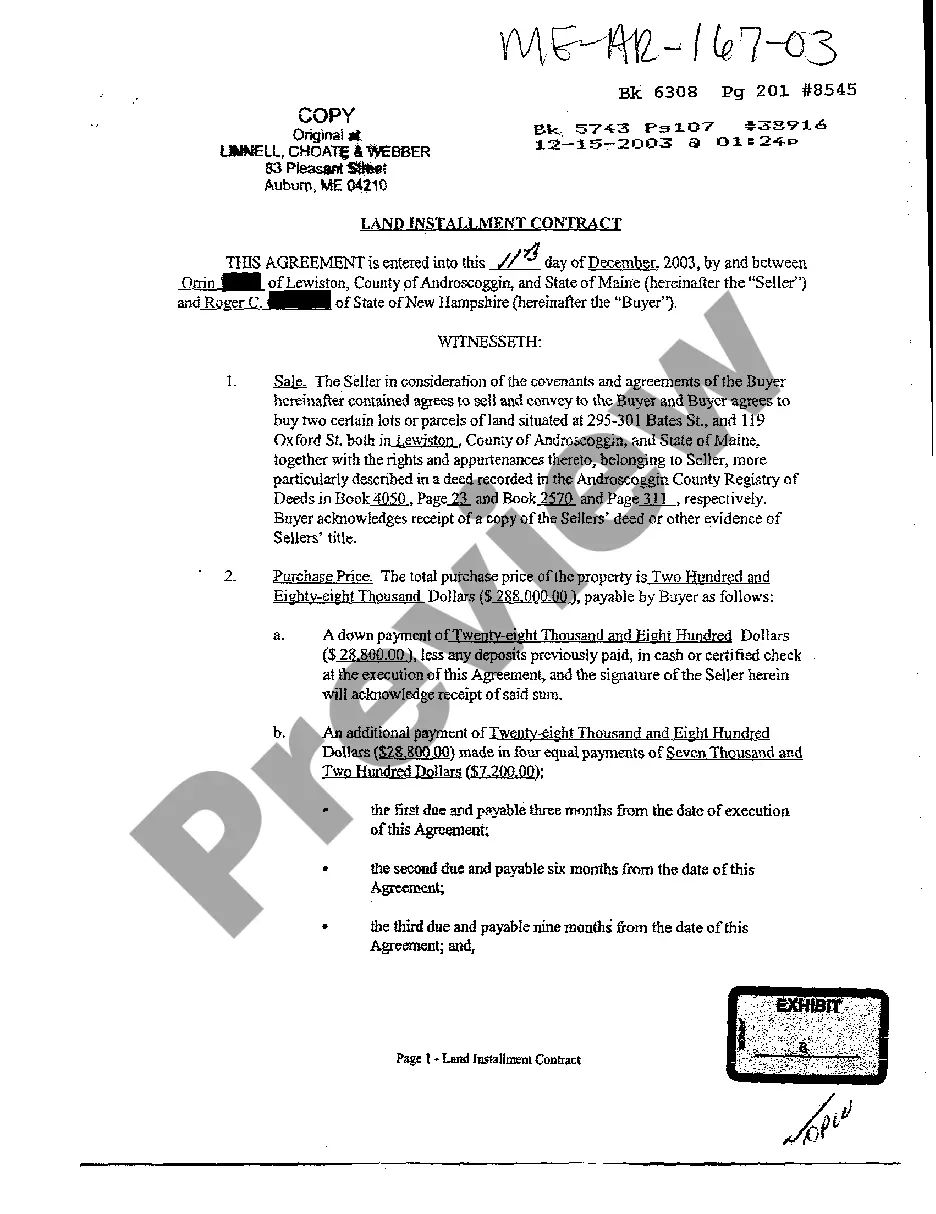

Maine Land Installment Contract

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maine Land Installment Contract?

Greetings to the finest legal documents collection, US Legal Forms. Here, you can obtain any template, including Maine Land Installment Contract samples, and download them (as many as you desire). Prepare formal documents in just a few hours, instead of days or weeks, without incurring hefty fees with a lawyer. Acquire your state-specific template with just a few clicks and be assured it was prepared by our experienced legal experts.

If you are already a registered user, simply Log Into your account and then click Download beside the Maine Land Installment Contract you need. Since US Legal Forms is a web-based solution, you will always have access to your saved documents, no matter the device you are using. View them in the My documents section.

If you haven't created an account yet, what are you waiting for? Follow our steps below to get started.

Once you’ve filled out the Maine Land Installment Contract, forward it to your attorney for verification. It’s an additional step but a crucial one to ensure you’re fully protected. Become a member of US Legal Forms today and gain access to a vast array of reusable templates.

- If this is a state-specific document, verify its relevance in your state.

- Review the description (if provided) to determine if it’s the correct template.

- Explore additional information using the Preview feature.

- If the document meets your needs, click Buy Now.

- To establish an account, choose a subscription plan.

- Utilize a credit card or PayPal account to sign up.

- Save the file in your preferred format (Word or PDF).

- Print the document and complete it with your or your business’s details.

Form popularity

FAQ

A land contract in New York is an agreement between a buyer and seller for property sale. Under this contract, the buyer makes payments to the seller over time, akin to a mortgage. It allows buyers to secure property ownership without needing traditional financing. Understanding the nuances of a Maine Land Installment Contract can help if you're exploring options in New York.

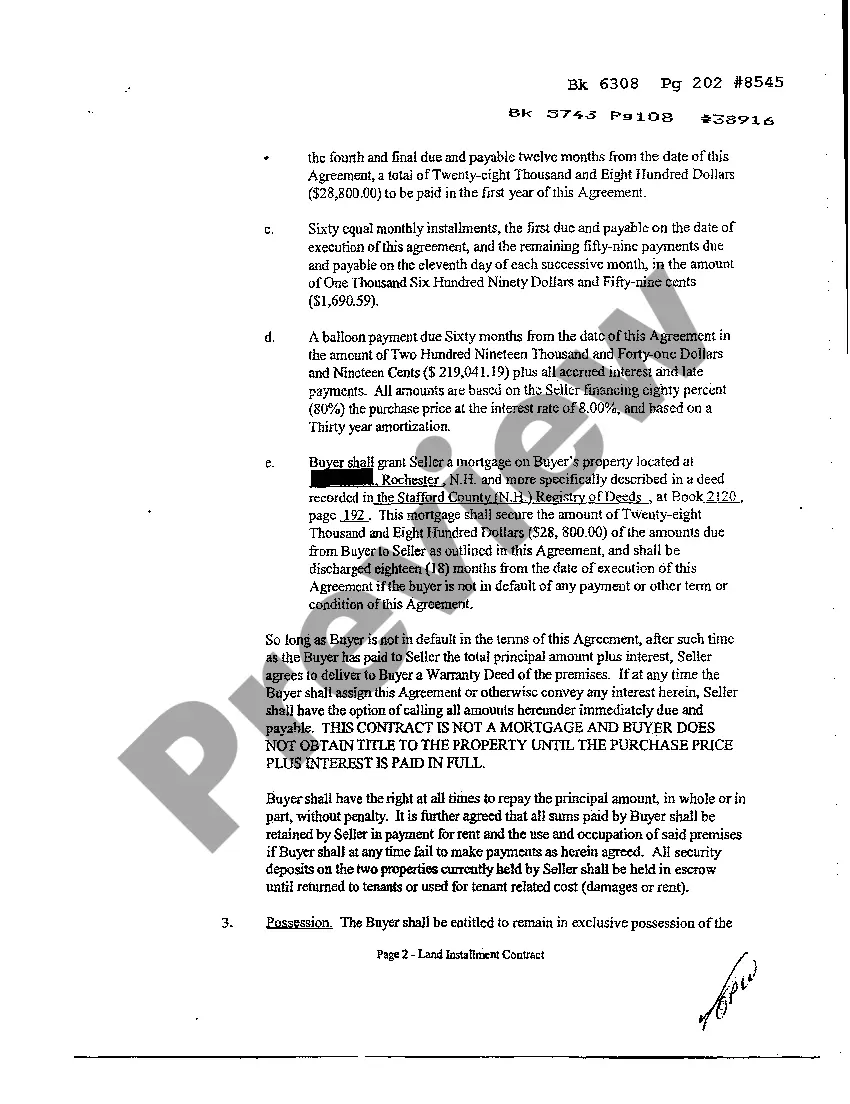

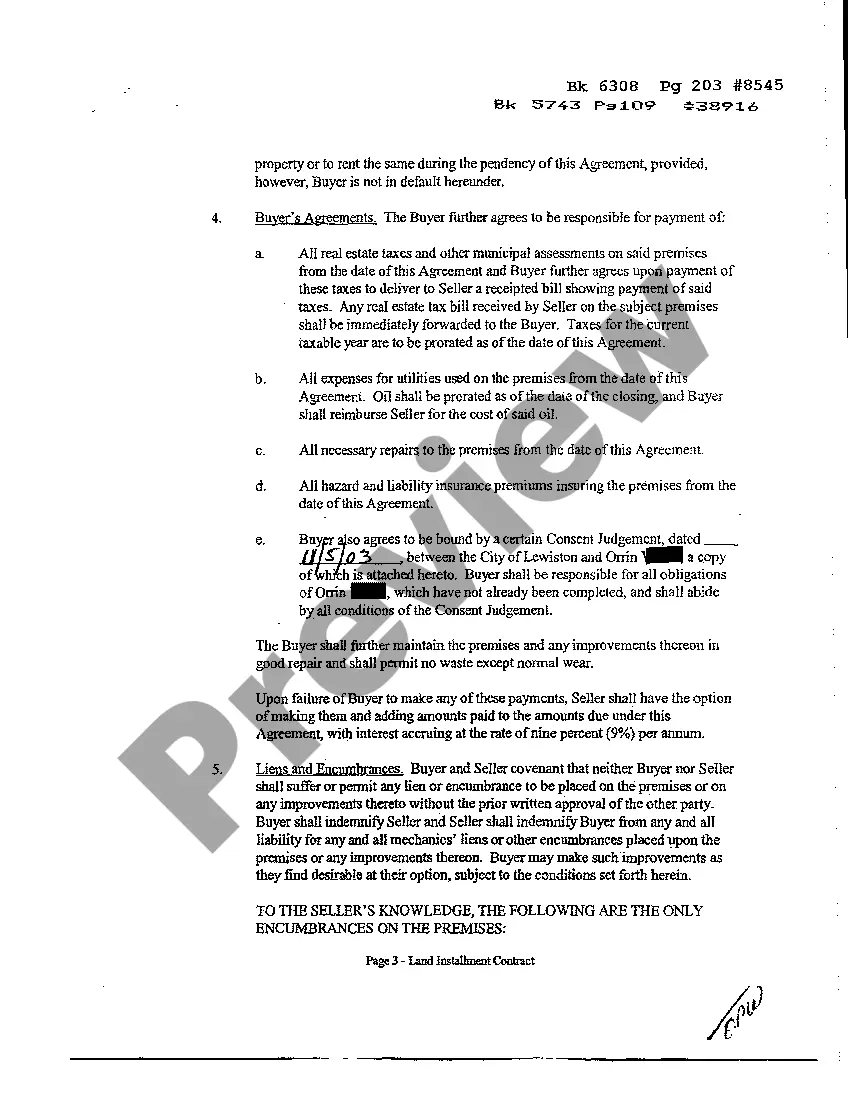

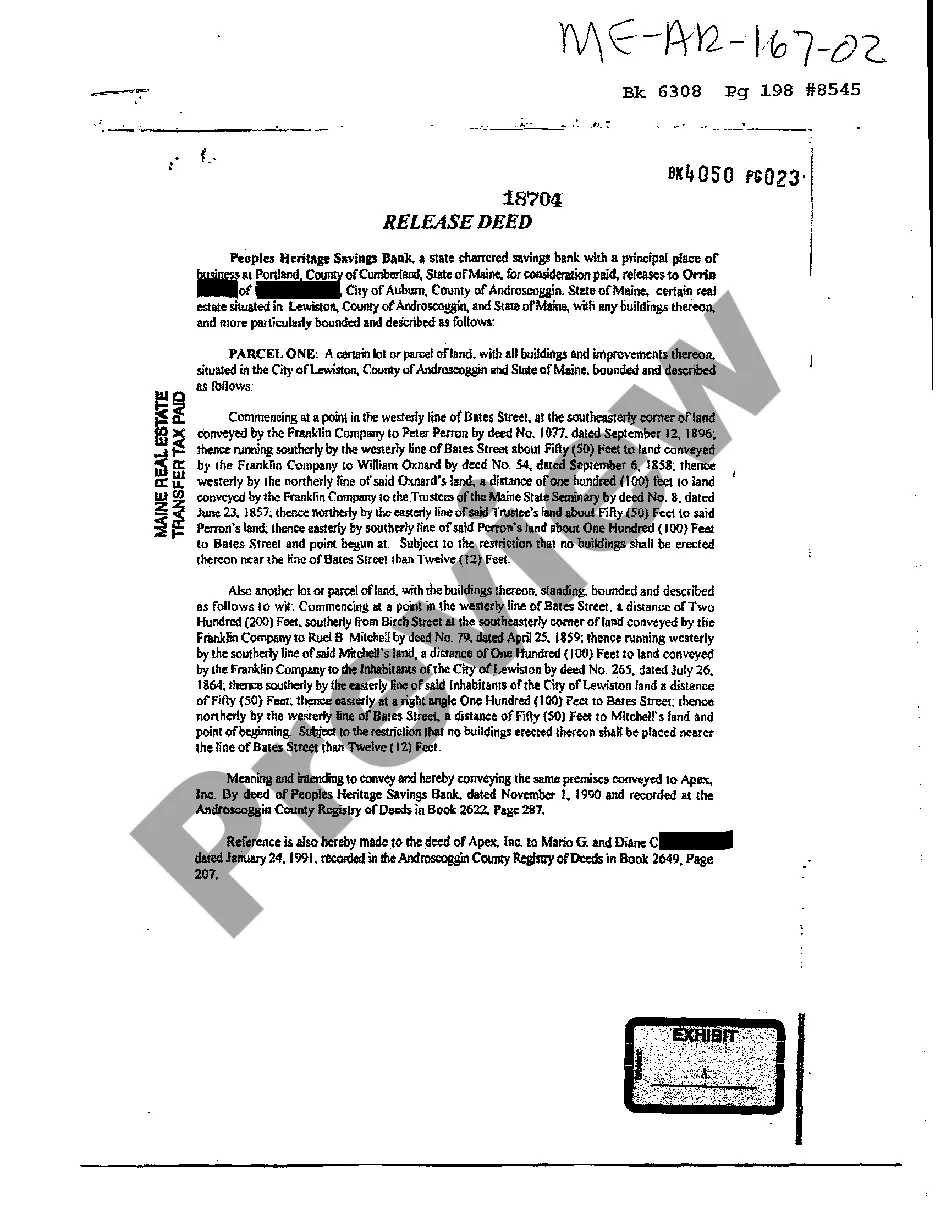

An installment agreement requires the buyer of real estate to pay the seller the purchase price in installments over time; the buyer takes immediate possession of the property but the seller retains legal title as security until the buyer pays in full.

Other terms for a land contract include: terms contract. contract for deed. agreement for deed.

A land contract is a real estate transaction in which a buyer finances a property by making installment payments to the seller. The buyer gains access to the home, but the seller maintains the legal title until the buyer pays off the loan.

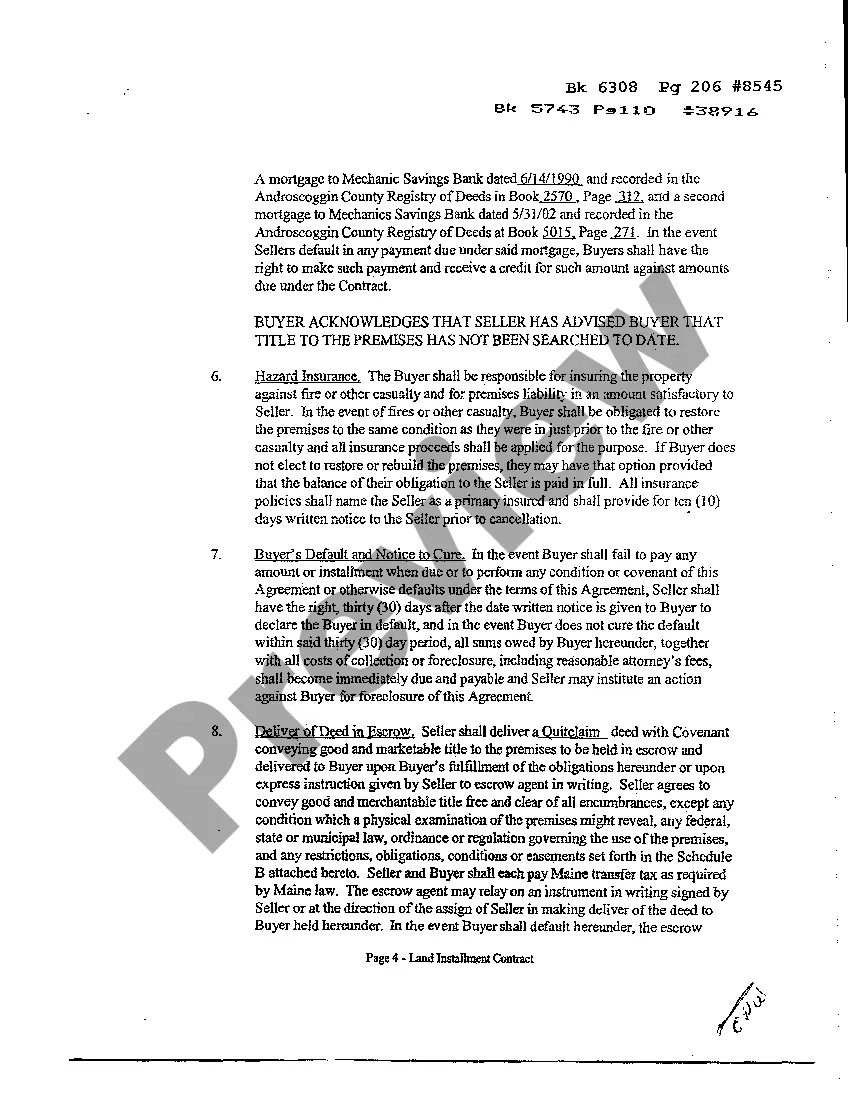

The seller retains legal title to the real property until the purchaser fully pays off the loan, at which point the seller records a deed transferring legal title to the purchaser. A purchaser under an installment land contract is usually not protected by foreclosure statutes as with a mortgage or deed of trust.

One of the biggest negatives that can occur with a land contract is when a buyer purchases a property on which the seller is still making mortgage payments.

A land contract carries purchase obligations as the buyer had already committed into a financing agreement for the full purchase. On the other hand, a rent to own contract involves less obligations whereby the buyer has the option, but is not obligated to buy the property after the contract period.

Read your land contract carefully, or have an attorney help you. Confirm the payoff amount with the contract holder and let her know that your intent is to pay off the property. Draft a grant deed form that the contract holder can sign to transfer the legal title of the property to you.

Land contracts are useful instruments for sellers who are selling a home and contemplating carrying the financing for a buyer. It gives sellers a built-in income and generally a better interest rate than rates offered on money market accounts or certificates of deposit.