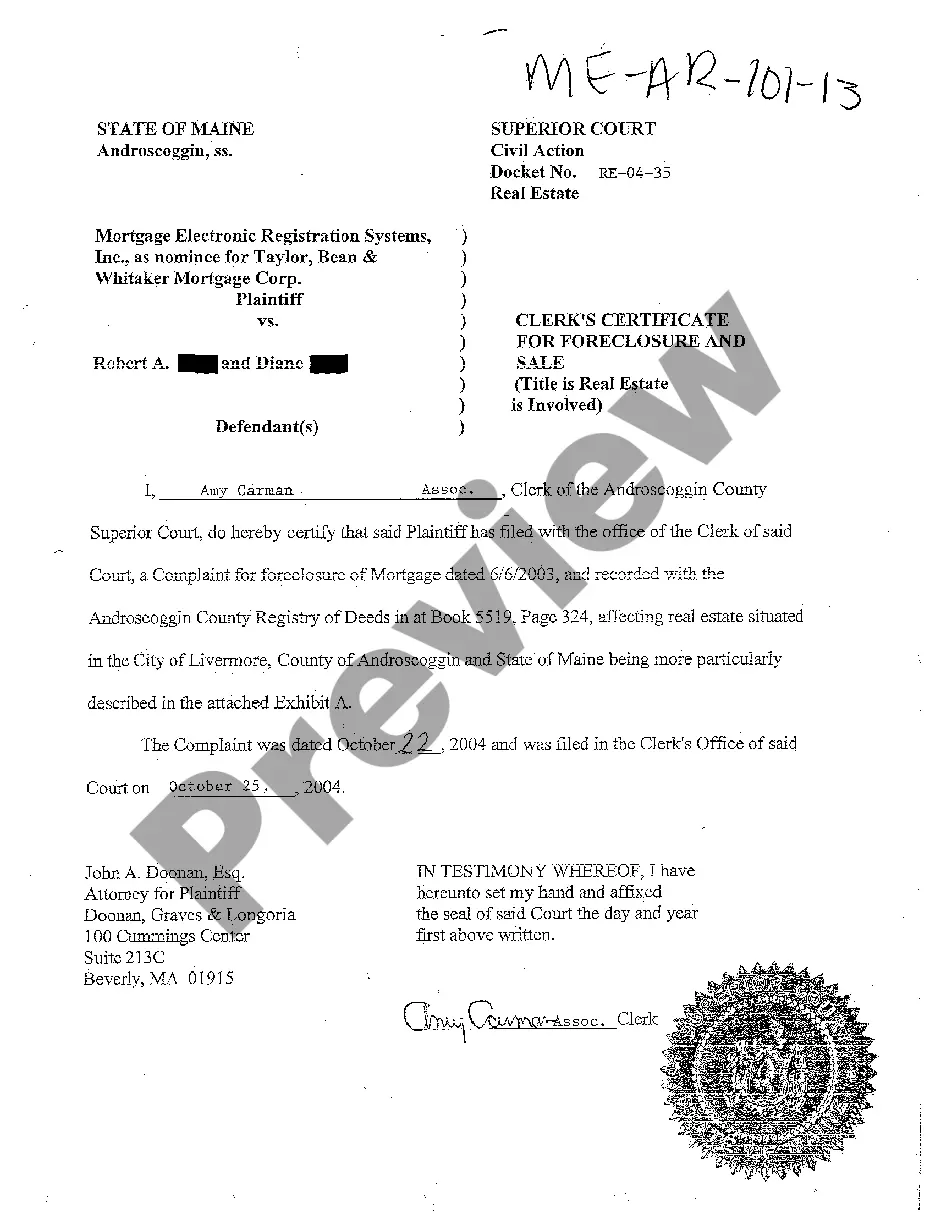

Maine Clerk's Certificate For Foreclosure and Sale

Description

How to fill out Maine Clerk's Certificate For Foreclosure And Sale?

You are invited to the largest legal document repository, US Legal Forms.

Here you can discover any template like the Maine Clerk's Certificate For Foreclosure and Sale forms and retain them (as many as you desire/need). Prepare official papers within hours instead of days or even weeks, without paying a fortune to a lawyer.

Obtain the state-specific template in just a few clicks and rest assured with the understanding that it was created by our licensed attorneys.

If the example meets all your requirements, simply click Buy Now. To create an account, select a pricing plan. Use a credit card or PayPal account to register. Download the document in the format you prefer (Word or PDF). Print the document and fill it out with your or your business's information. Once you’ve completed the Maine Clerk's Certificate For Foreclosure and Sale, send it to your attorney for verification. It’s an extra step, but a crucial one to ensure you're fully protected. Register for US Legal Forms today and gain access to a vast array of reusable templates.

- If you're already a registered user, just sign in to your account and click Download next to the Maine Clerk's Certificate For Foreclosure and Sale you require.

- Since US Legal Forms is internet-based, you will typically have access to your saved documents, regardless of the device you’re using.

- Find them in the My documents section.

- If you do not have an account yet, what are you waiting for.

- Review our guidelines below to get started.

- If this is a state-specific document, verify its relevance in the state you reside.

- Examine the description (if available) to ensure it is the correct template.

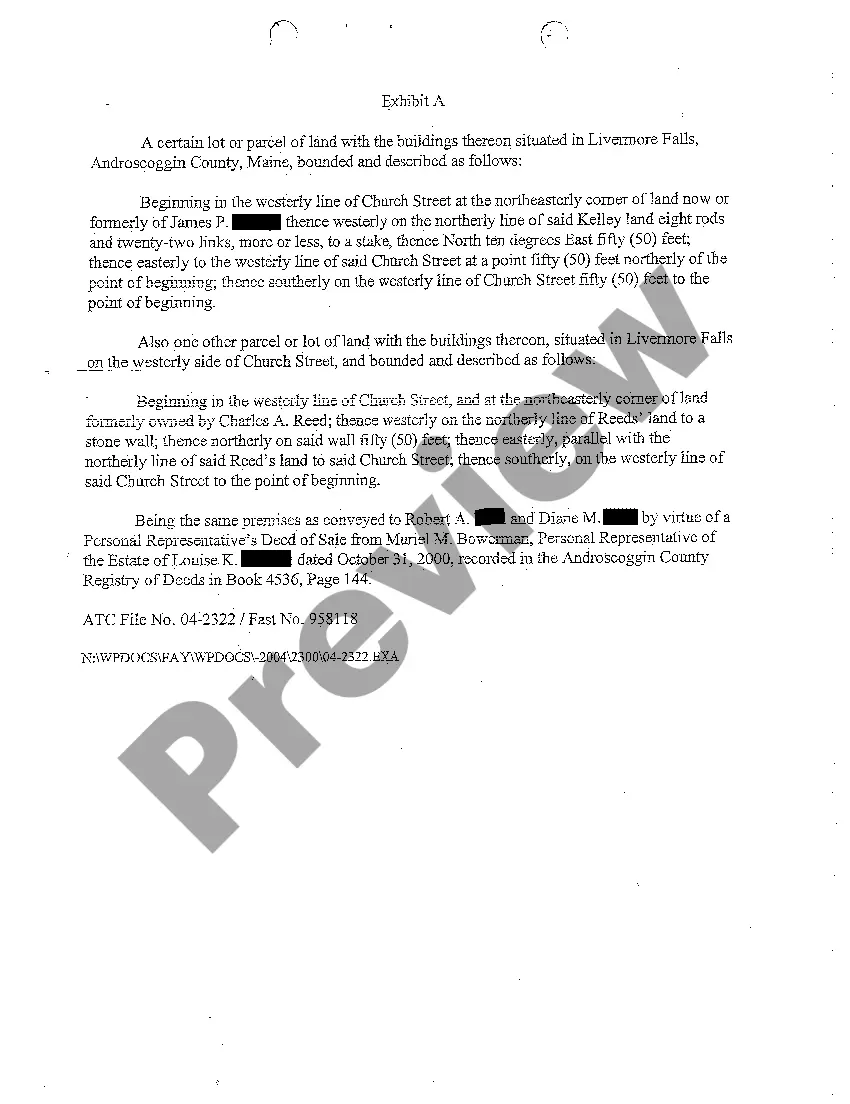

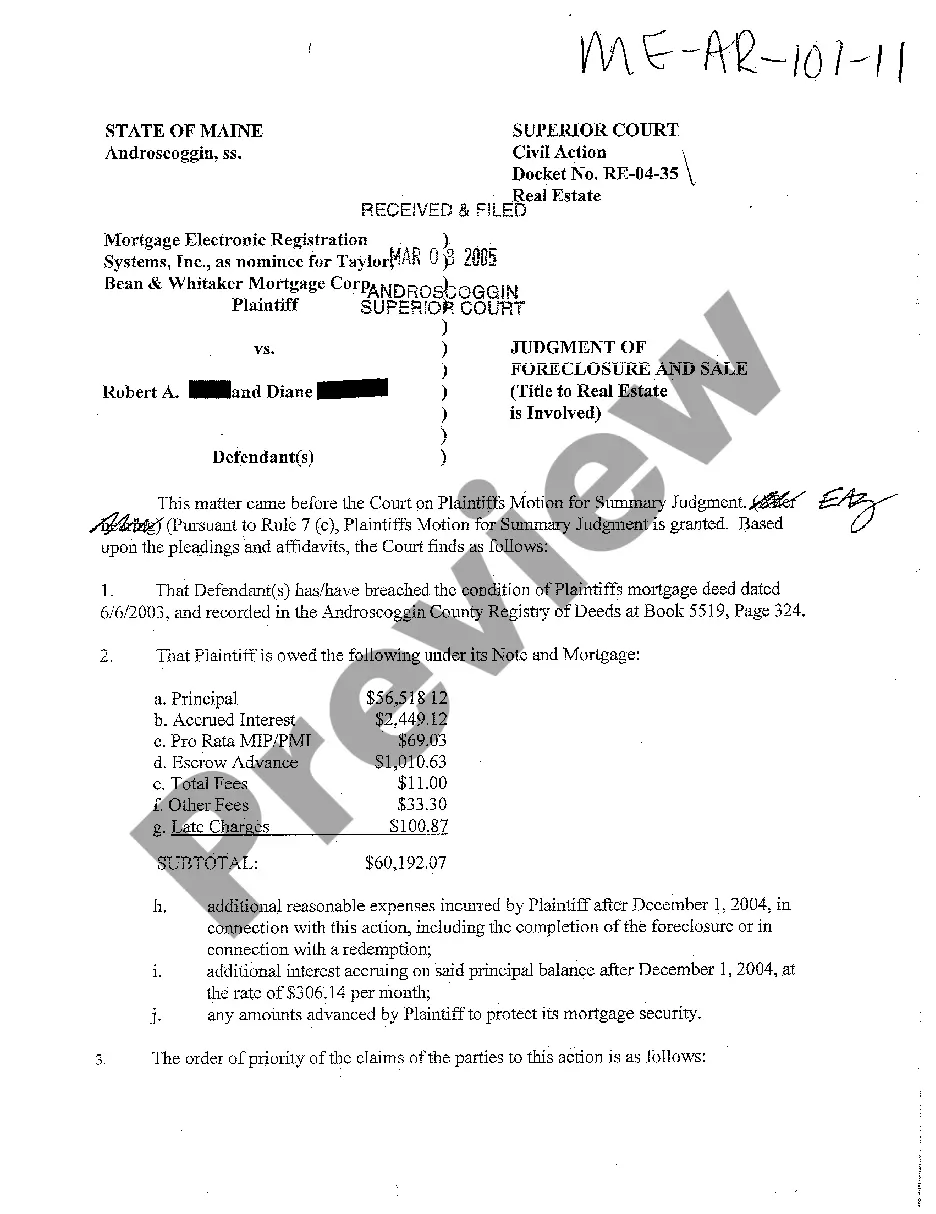

- Utilize the Preview feature to see more content.

Form popularity

FAQ

More specifically, it's a legal process by which the owner forfeits all rights to the property. If the owner can't pay off the outstanding debt, or sell the property via short sale, the property then goes to a foreclosure auction. If the property doesn't sell there, the lending institution takes possession of it.

The borrower defaults on the loan. The lender issues a notice of default (NOD). A notice of trustee's sale is recorded in the county office. The lender tries to sell the property at a public auction.

The borrower defaults on the loan. The lender issues a notice of default (NOD). A notice of trustee's sale is recorded in the county office. The lender tries to sell the property at a public auction.

In general, mortgage companies start foreclosure processes about 3-6 months after the first missed mortgage payment. Late fees are charged after 10-15 days, however, most mortgage companies recognize that homeowners may be facing short-term financial hardships.

Judicial foreclosure involves filing a lawsuit to get a court order to sell the home (foreclose). It is used when there is no power-of-sale clause in the mortgage or deed of trust. Generally, after the court orders the sale of your home, it will be auctioned off to the highest bidder.

Phase 1: Payment Default. Phase 2: Notice of Default. Phase 3: Notice of Trustee's Sale. Phase 4: Trustee's Sale. Phase 5: Real Estate Owned (REO) Phase 6: Eviction. The Bottom Line.

In Maine, lenders may foreclose on mortgages in default by using either a judicial or strict foreclosure process. Although Maine allows lenders to pursue foreclosure by judicial methods, which involves filing a lawsuit to obtain a court order to foreclose, it is only used in special circumstances.

During foreclosure, the mortgage lender may seize the property and sell it to recoup the money it lost from the mortgage default. The lender is allowed to take back the home because a mortgage is a secured loan. That means the borrower guarantees repayment by providing collateral.

The auction notice, or Notice of Sale, is your final notice that the lender intends to sell the property at auction. The county prints the location, time and date of the trustee's auction on the Notice of Sale. It also contains the name and contact information for the trustee in charge of the sale.