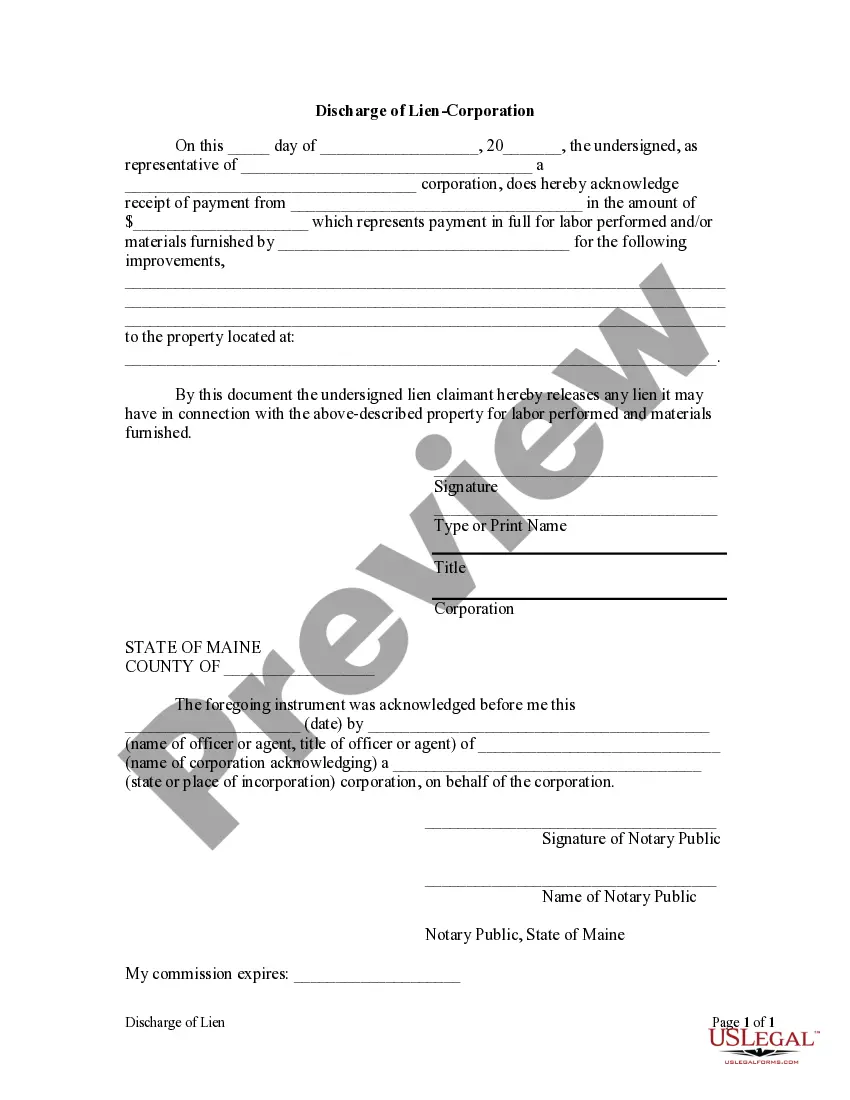

While Maine law does not have a specific provision that addresses how liens are released, this form is a general purpose form which allows a lien holder to release a lien after being paid in full.

Maine Discharge of Lien by Corporation or LLC

Description

How to fill out Maine Discharge Of Lien By Corporation Or LLC?

Greetings to the most important legal documents repository, US Legal Forms. Here, you can obtain any template including Maine Discharge of Lien by Corporation or LLC forms and store them (as many as you require). Prepare official documentation in a matter of hours, rather than days or weeks, without spending a fortune with a legal representative. Acquire the state-specific example in just a few clicks and be confident knowing it was crafted by our certified attorneys.

If you’re already a registered user, simply Log In to your account and then click Download next to the Maine Discharge of Lien by Corporation or LLC you need. Since US Legal Forms is an online service, you’ll consistently have access to your downloaded documents, regardless of the device you’re using. Locate them within the My documents section.

If you haven't created an account yet, what are you hesitating for? Review our instructions below to begin.

After you’ve filled out the Maine Discharge of Lien by Corporation or LLC, forward it to your legal representative for verification. It’s an extra step but a crucial one to ensure you’re completely protected. Join US Legal Forms today and gain access to thousands of reusable templates.

- If this is a state-specific template, verify its relevance in the state where you reside.

- Examine the description (if available) to determine if it’s the appropriate template.

- View additional content using the Preview feature.

- If the template meets your needs, click Buy Now.

- To establish an account, select a pricing plan.

- Utilize a credit card or PayPal account for registration.

- Save the document in the format you need (Word or PDF).

- Print out the document and complete it with your/your company's information.

Form popularity

FAQ

The easiest way to prevent a lien on your home is to pay your bills on time. "But if you can't," Chadow says, "especially in this economy, banks and other creditors will be willing to work out debt.

Mechanic's lien. Which of the following liens does not need to be recorded to be valid? A statutory lien is created by statute. A real estate tax lien, then, is an involuntary, statutory lien.

Parties that did not contract directly with the property owner must file the mechanics lien claim in the county registry of deeds within 90 days of last furnishing materials or labor to the project, as well as filing the lien like the general contractor (file a complaint in the Superior Court or District Court) within

Therefore, liens are not officially recorded, and personal property could be sold off to a third party who is unaware of the lien's existence. In most states, judgment liens must be filed by the creditor through the county or state.

Preliminary Title Report- California case law is clear that a preliminary title report cannot be relied upon as a true and reliable condition of title to real property.No duties or liabilities arise with a preliminary title report. Therefore, there is no liability to a title company if any recorded document is missed.

Liens are a matter of public record, so it's simple to find out if there's one on your property, or on anyone else's property for that matter. In most states, you can typically search by address with the county recorder, clerk, or assessor's office online.

Creating a voluntary lien on real estate usually means granting a mortgage to a lender.In either instance, you'll need a mortgage document prepared, and the mortgage will need to be recorded with the county.

In Maine, all lien claimants without a contract directly with the property owner must file their lien claim (called a Notice of Lien) in the registry of deeds for the county in which the property is located within 90 days of the date of last furnishing labor or materials for the project.

A lien is a legal right to claim a security interest in a property provided by the owner of the property to the creditor.The grantor (the owner of the property) is called the lienee while the party that receives the lien is referred to as the lienor or lien holder.