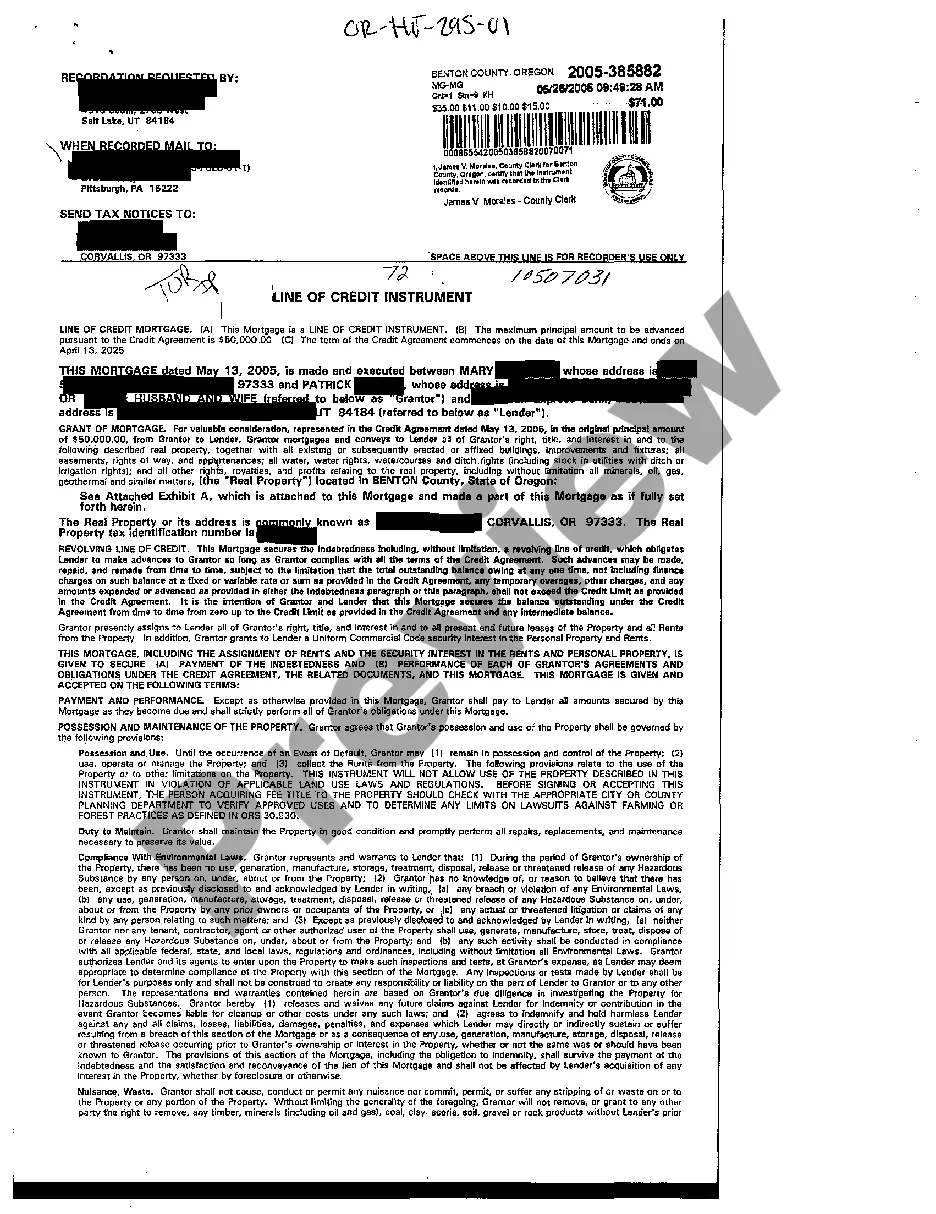

Oregon Line of Credit Instrument

Description

How to fill out Oregon Line Of Credit Instrument?

The work with papers isn't the most straightforward job, especially for people who rarely work with legal papers. That's why we recommend using accurate Oregon Line of Credit Instrument templates created by skilled attorneys. It gives you the ability to prevent problems when in court or dealing with formal institutions. Find the templates you require on our website for high-quality forms and accurate descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you are in, the Download button will immediately appear on the template page. Right after accessing the sample, it will be stored in the My Forms menu.

Users without an activated subscription can quickly get an account. Make use of this short step-by-step help guide to get your Oregon Line of Credit Instrument:

- Make certain that the sample you found is eligible for use in the state it is necessary in.

- Confirm the document. Utilize the Preview option or read its description (if available).

- Buy Now if this form is the thing you need or use the Search field to get a different one.

- Choose a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a required format.

After finishing these straightforward actions, you are able to fill out the form in your favorite editor. Recheck completed info and consider requesting an attorney to review your Oregon Line of Credit Instrument for correctness. With US Legal Forms, everything gets easier. Try it out now!

Form popularity

FAQ

: a document (as check, letter of credit, or bond) other than paper money that evidences a debt.

The credit instrument enables the creditor to hold the host instrument to collect from his debtor. Credit instruments facilitate exchange transactions. To increase volume production, producer's farmers, manufacture and merchants avail themselves credit both use of the proper credit instrument.

Banking instruments include cheques, drafts, bills of exchange, credit notes etc. It is a document guaranteeing the payment of a specific amount of money, either on demand, or at a set time, with the payer named on the document.

Promissory Note: Bill of exchange: Advantages of a bill of exchange: Hundis: Cheques: Advantages of Cheques: Bank Drafts: Clearing House:

Investment Credit Instrument (BONDS) Bonds are the promises to pay the principal as well as the interest to its holder at a certain specified time indicated in the instrument. Bonds represent certificates of indebtedness on the part of the corporation which issued them.

In general, bank instruments are denominated debt instrument (papers) issued by large banks and institutions to named parties for specified terms. These instruments may be used as funding collateral or to enhance credit, trade or to enter into private placement programs.

FEATURES OF A CREDIT INSTRUMENT: It is a written evidence of the existence of an obligation on the part of the debtor, or a claim on the part of the creditor. It shows the degree of risk that confronts the creditor with respect too the collection of the debt. It shows the nature of the debtor-creditor relationship.