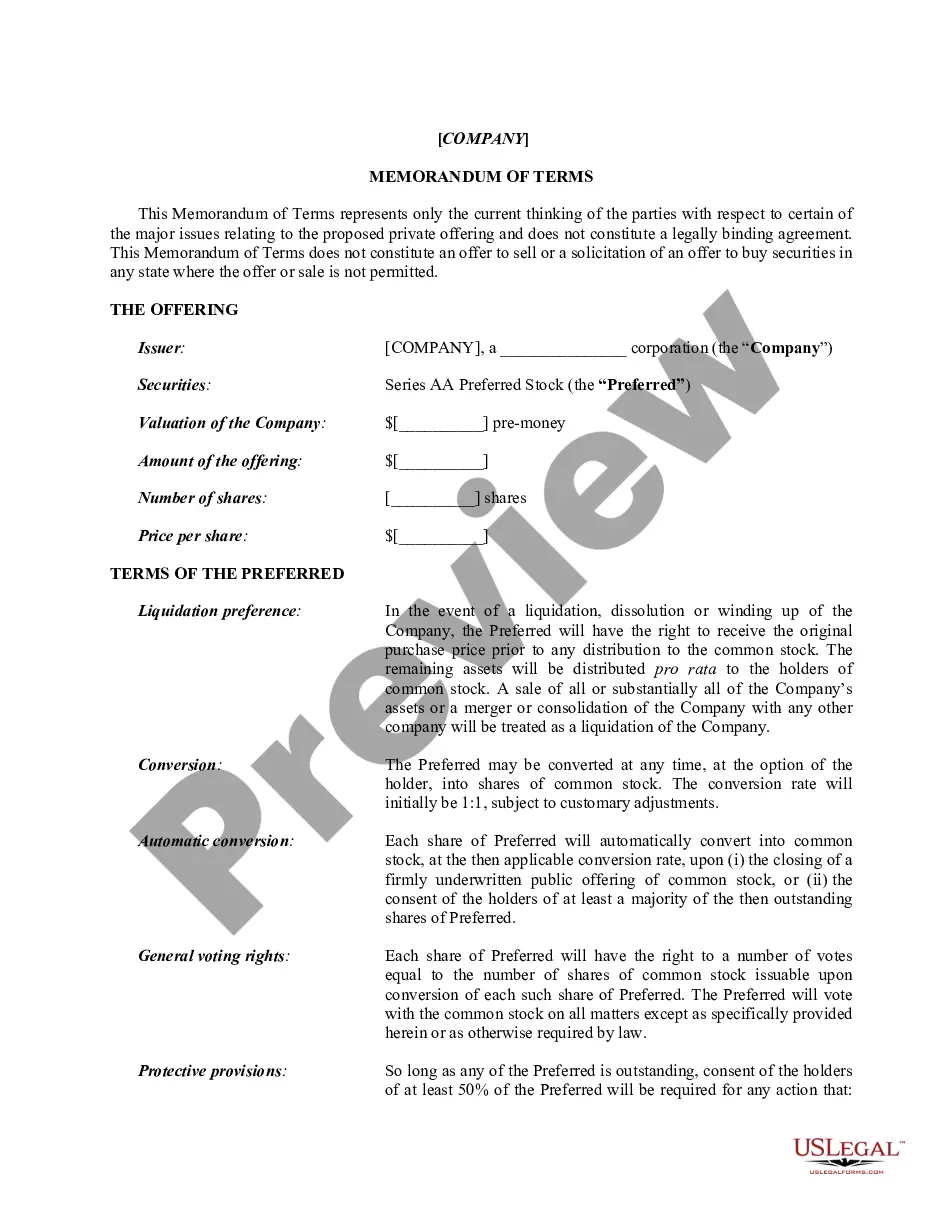

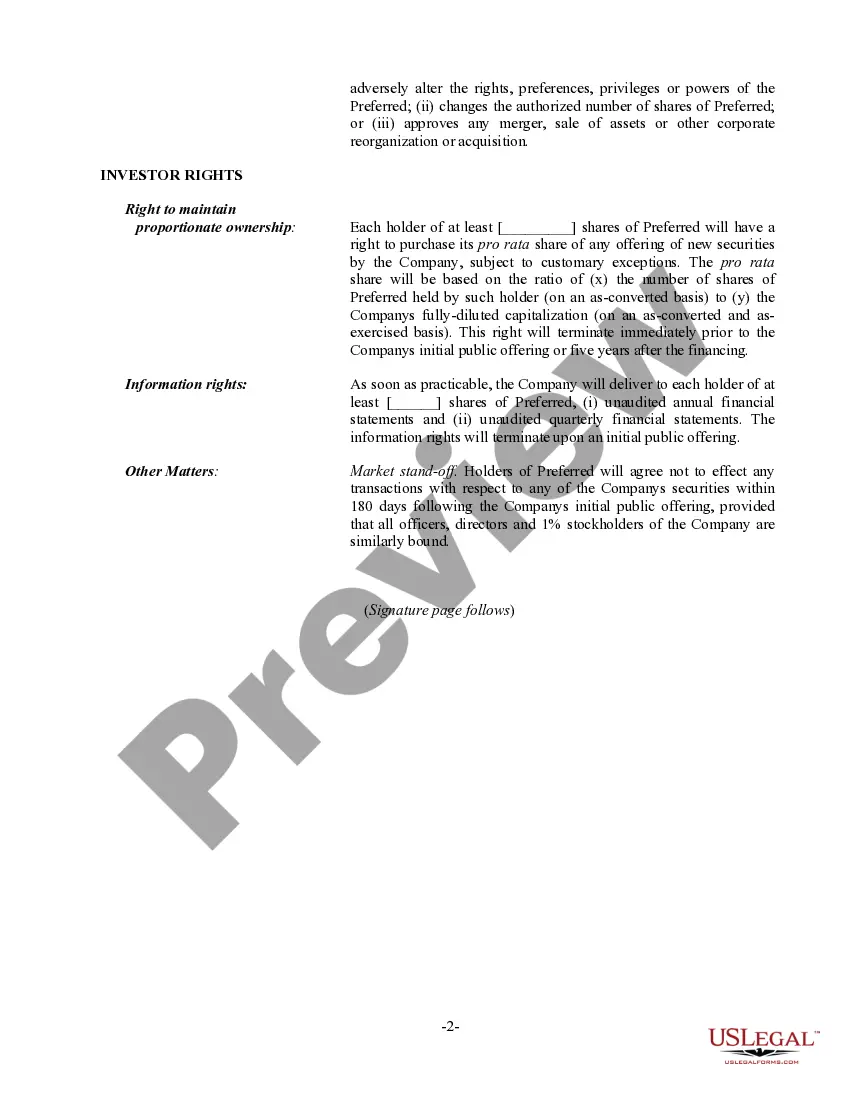

An Angel Investor Term Sheet is a document which outlines the terms of an investment from an angel investor, such as the amount of money invested, the rights of the investor, the valuation of the company, the return on investment, and the exit strategy. There are two types of Angel Investor Term Sheets: convertible debt term sheets and equity term sheets. Convertible debt term sheets involve an angel investor loaning money to a startup company. The startup company will then pay back the loan with interest, and the loan will convert into equity (shares of the company) at a predetermined valuation. Equity term sheets involve the angel investor buying shares of the company in exchange for cash. The term sheet will outline the number of shares, the price per share, the investor’s rights, and the investor’s return on investment. Both types of term sheet will outline the rights of the angel investor and the exit strategy. The exit strategy outlines how the investor can exit their investment, such as through an initial public offering or a sale of the company.

Angel Investor Term Sheet

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Angel Investor Term Sheet: A term sheet is a non-binding agreement outlining the basic terms and conditions under which an investment will be made by an angel investor. It serves as a template to develop more detailed legal documents.

Step-by-Step Guide

- Understanding Needs: Identify the capital needed and what you are willing to offer to the angel investor.

- Researching Investors: Find angel investors who align with your company's market and values.

- Initial Contact: Reach out to potential investors with your pitch and executive summary.

- Term Sheet Drafting: Work together to draft a term sheet that includes valuation, equity, roles, and responsibilities.

- Negotiation: Discuss and negotiate the terms with the angel investor to reach an agreement suitable for both parties.

- Finalization: Convert the agreed-upon term sheet into legally binding documents and finalize the investment.

Risk Analysis

- Valuation Disputes: Misalignment in company valuation can lead to prolonged negotiations or deal failure.

- Dilution of Ownership: More investment can mean less control as you distribute equity to investors.

- Investor Influence: Some investors may demand more decision-making power, which can affect company direction.

Key Takeaways

Clear Communication: Ensuring that both parties are on the same wavelength can prevent potential conflicts. Legal Advice: Having legal counsel during the drafting and negotiation of the term sheet is crucial to safeguard interests. Flexibility: Being open to negotiating different aspects of the term sheet can lead to a more favorable investment deal.

Best Practices

- Comprehensive Disclosure: Provide full transparency to the investor about the company's financial status and future plans.

- Realistic Valuations: Base your company's valuation on realistic revenue forecasts and market analysis.

- Maintain Control: Structure the deal to maintain strategic decision-making power within the founding team.

Common Mistakes & How to Avoid Them

- Overvaluing the Company: Avoid unrealistic high valuations that turn off investors or are impossible to justify.

- Ignoring Legal Implications: Not consulting with a legal professional can lead to problematic clauses in the term sheet.

- Lack of Exit Strategy: Always have a clear exit strategy defined in the term sheet for the benefit of both parties.

How to fill out Angel Investor Term Sheet?

Preparing official paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them correspond with federal and state laws and are verified by our specialists. So if you need to fill out Angel Investor Term Sheet, our service is the best place to download it.

Obtaining your Angel Investor Term Sheet from our catalog is as easy as ABC. Previously authorized users with a valid subscription need only log in and click the Download button once they find the proper template. Afterwards, if they need to, users can get the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few minutes. Here’s a quick guide for you:

- Document compliance check. You should carefully review the content of the form you want and check whether it suits your needs and complies with your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library using the Search tab above until you find a suitable blank, and click Buy Now when you see the one you need.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Angel Investor Term Sheet and click Download to save it on your device. Print it to fill out your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service today to obtain any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

Angel round is when you raise from Individual investors. It could come before seed or after a seed round.

During an angel investment round, investors can purchase equity in the company, giving them a certain percentage of the ownership. This equity stake can then be cashed out at a later date when the company has increased in valuation, earning a profit for the investors.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

Angel rounds typically range from $25,000 to $1 million, and the money is typically used to help the startup get off the ground. In exchange for their investment, angel investors usually get equity in the company.

Size of Investment ? Private Equity vs. Venture Capital / Seed Investors. Seed and angel investors really have no minimum size, but typically it's at least $10,000 to $100,000 and can be as high as a few million in some cases.

Active angels work with term sheets regularly, but not every investor fully understands the sometimes arcane language in these highly-specialized documents. What are term sheets, what do they signify, and why are they so important? If you will walk through this short series on deal terms with us, we can explain.

Angel investors are also called informal investors, angel funders, private investors, seed investors or business angels. These are individuals, normally affluent, who inject capital for startups in exchange for ownership equity or convertible debt.