Maine Discharge of Lien by Corporation or LLC

What is this form?

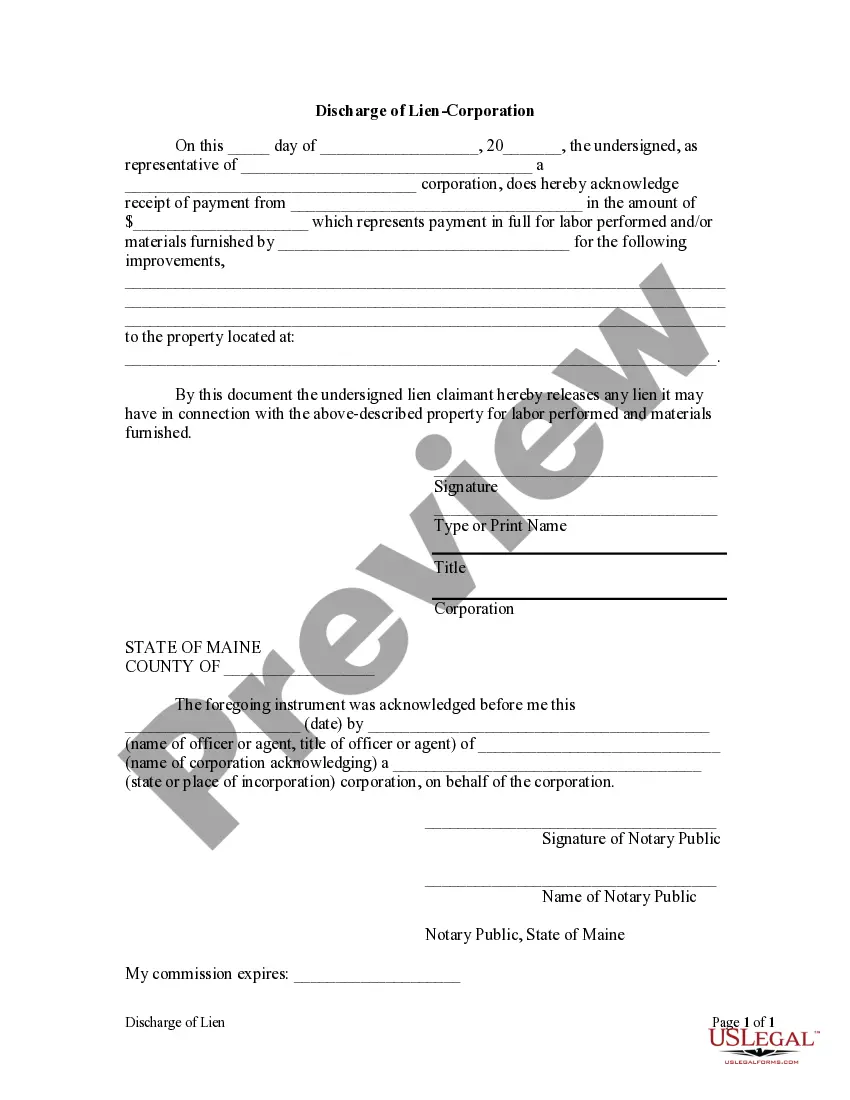

The Discharge of Lien by Corporation or LLC is a legal document that enables a lien holder to formally release a lien after receiving full payment. This form is particularly important in Maine, where there are no specific provisions for releasing liens, making this general-purpose template necessary for ensuring that the lien is officially acknowledged as satisfied.

Key components of this form

- Date of the lien discharge.

- Name of the authorized representative of the corporation or LLC.

- Details of the payment received, including the amount and purpose.

- Description of the improvements related to the lien.

- Identification of the property where the improvements were made.

- Notary acknowledgement section to validate the document.

When to use this form

This form should be used when a corporation or LLC has completed all obligations for labor and materials regarding a property improvement and has received full payment. It is necessary to release the lien formally so that the property is no longer encumbered, allowing for clear ownership and title.

Who needs this form

- Corporations or LLCs who have provided services or materials that incurred a lien.

- Property owners or contractors who have settled debts associated with those services.

- Legal representatives or agents acting on behalf of the corporation or LLC.

How to prepare this document

- Fill in the date when the lien is discharged.

- Enter the name and type of the corporation or LLC releasing the lien.

- Specify the name of the party that made the payment and the amount paid.

- Provide a description of the work or materials that justified the lien.

- Include details of the property associated with the lien.

- Have the form notarized with the signatures of the authorized representative and a notary public.

Does this document require notarization?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include all relevant information about the payment and services.

- Not obtaining the notary acknowledgment when required.

- Submitting the form without a clear description of the improvements.

- Not using the proper legal name of the corporation or LLC.

Why complete this form online

- Easy access to a professionally drafted template that meets legal standards.

- Conveniently fill out and customize the form to suit specific needs.

- Save time and avoid errors with an organized format that guides completion.

- Download and print immediately for timely submission.

Looking for another form?

Form popularity

FAQ

The easiest way to prevent a lien on your home is to pay your bills on time. "But if you can't," Chadow says, "especially in this economy, banks and other creditors will be willing to work out debt.

Mechanic's lien. Which of the following liens does not need to be recorded to be valid? A statutory lien is created by statute. A real estate tax lien, then, is an involuntary, statutory lien.

Parties that did not contract directly with the property owner must file the mechanics lien claim in the county registry of deeds within 90 days of last furnishing materials or labor to the project, as well as filing the lien like the general contractor (file a complaint in the Superior Court or District Court) within

Therefore, liens are not officially recorded, and personal property could be sold off to a third party who is unaware of the lien's existence. In most states, judgment liens must be filed by the creditor through the county or state.

Preliminary Title Report- California case law is clear that a preliminary title report cannot be relied upon as a true and reliable condition of title to real property.No duties or liabilities arise with a preliminary title report. Therefore, there is no liability to a title company if any recorded document is missed.

Liens are a matter of public record, so it's simple to find out if there's one on your property, or on anyone else's property for that matter. In most states, you can typically search by address with the county recorder, clerk, or assessor's office online.

Creating a voluntary lien on real estate usually means granting a mortgage to a lender.In either instance, you'll need a mortgage document prepared, and the mortgage will need to be recorded with the county.

In Maine, all lien claimants without a contract directly with the property owner must file their lien claim (called a Notice of Lien) in the registry of deeds for the county in which the property is located within 90 days of the date of last furnishing labor or materials for the project.

A lien is a legal right to claim a security interest in a property provided by the owner of the property to the creditor.The grantor (the owner of the property) is called the lienee while the party that receives the lien is referred to as the lienor or lien holder.