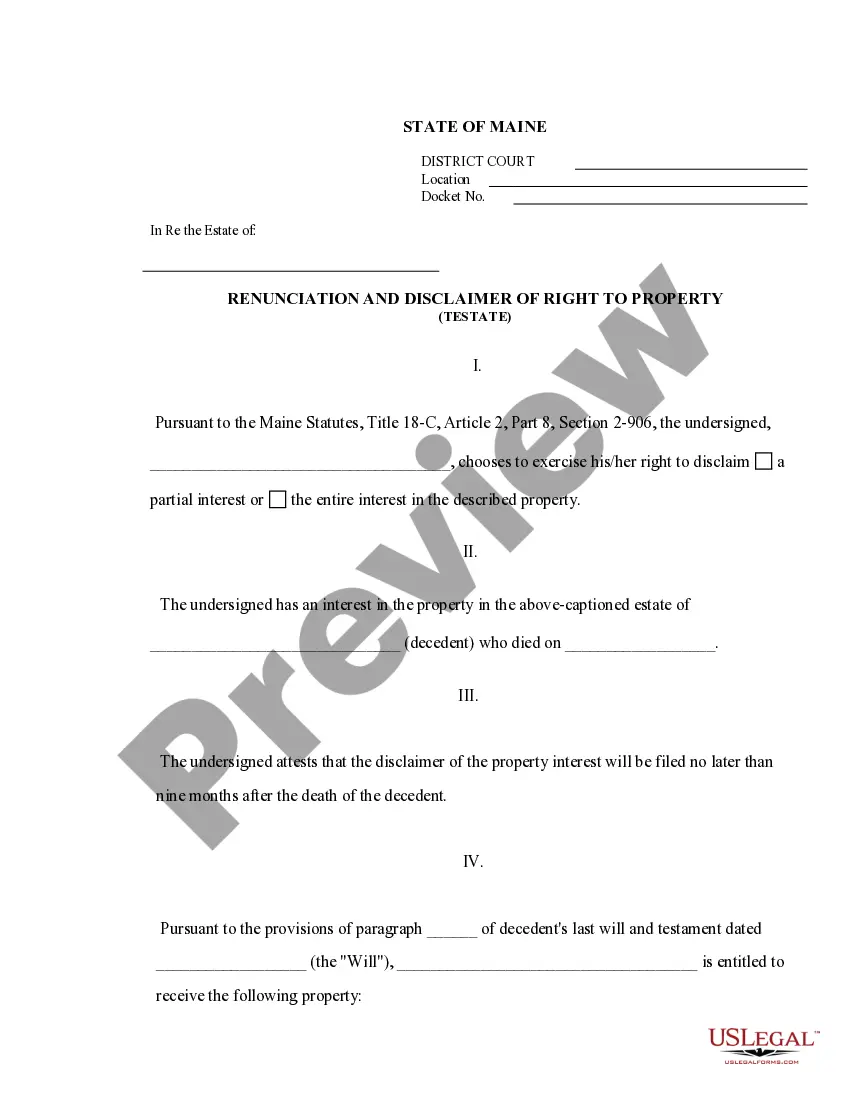

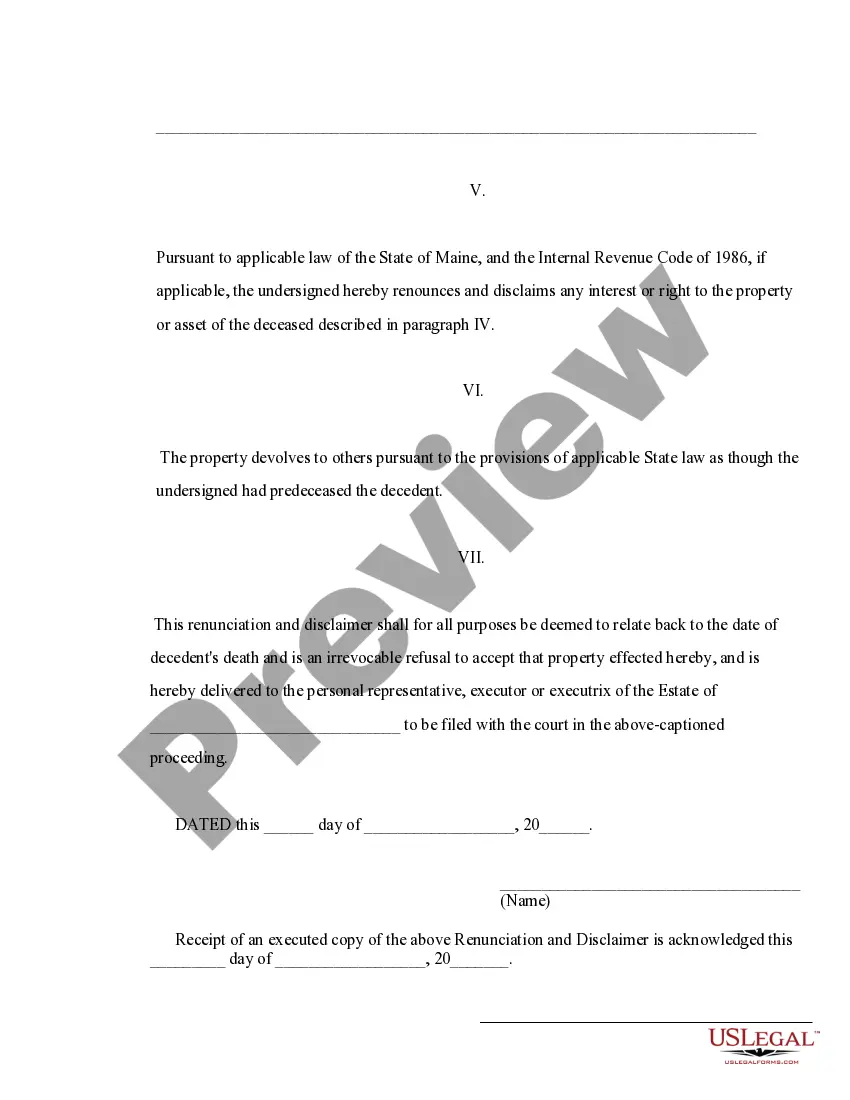

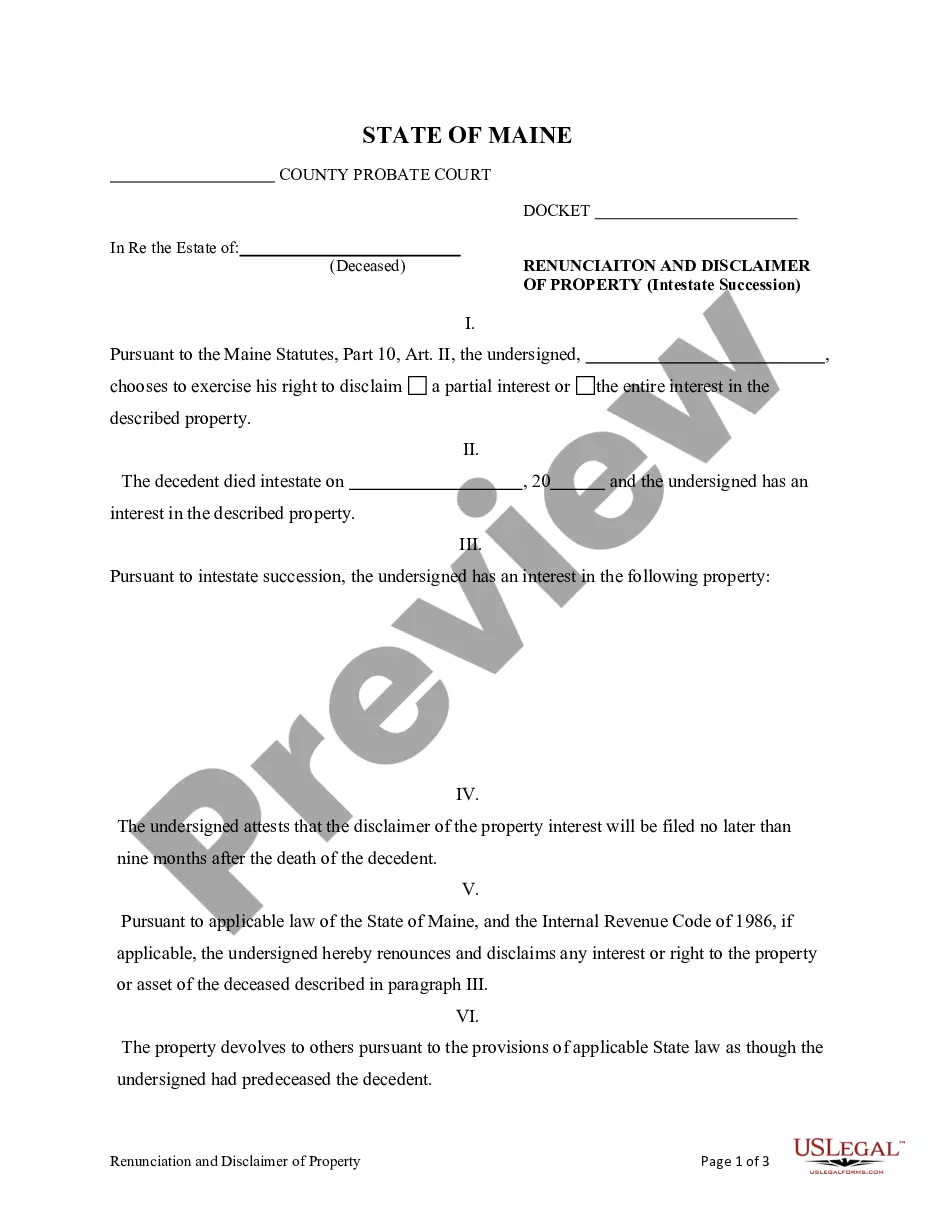

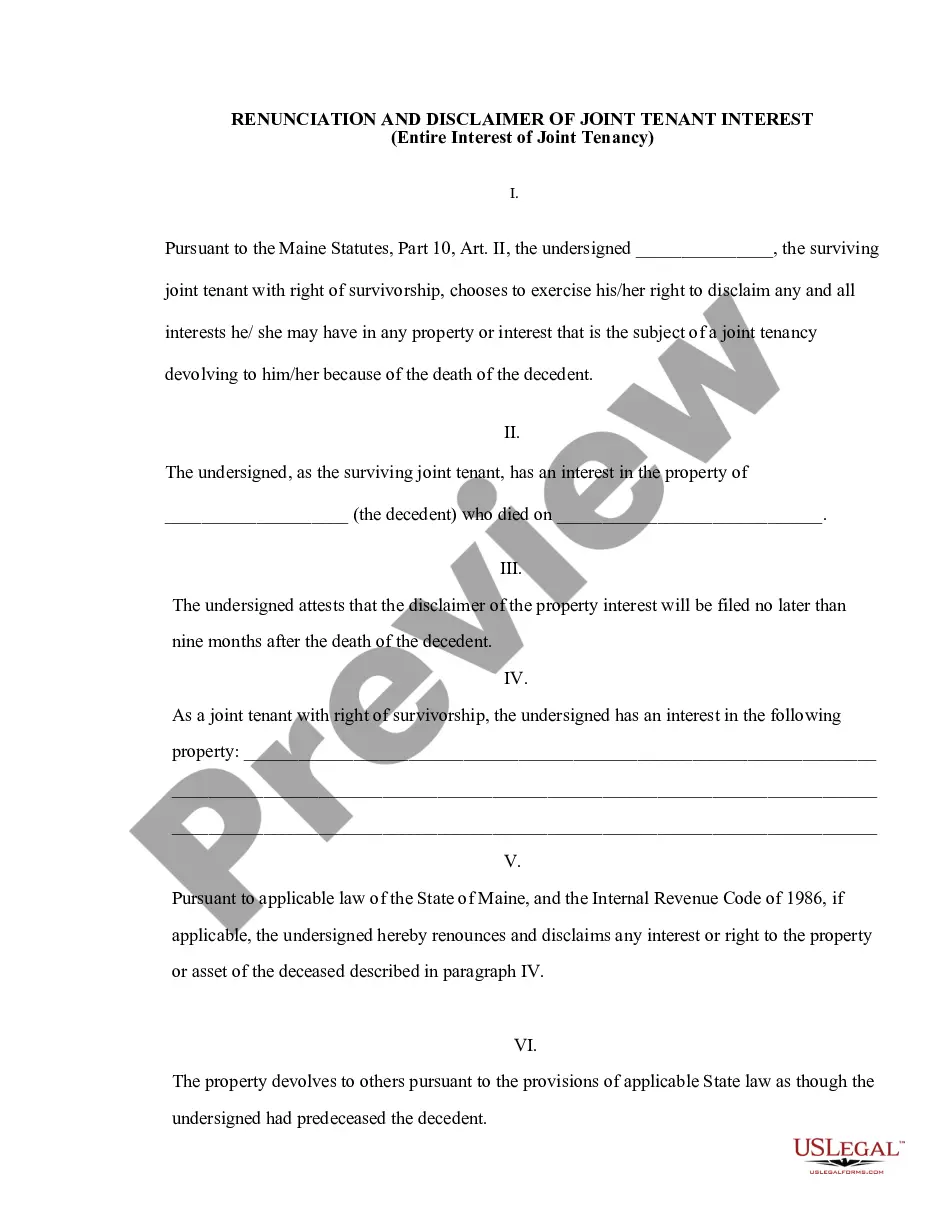

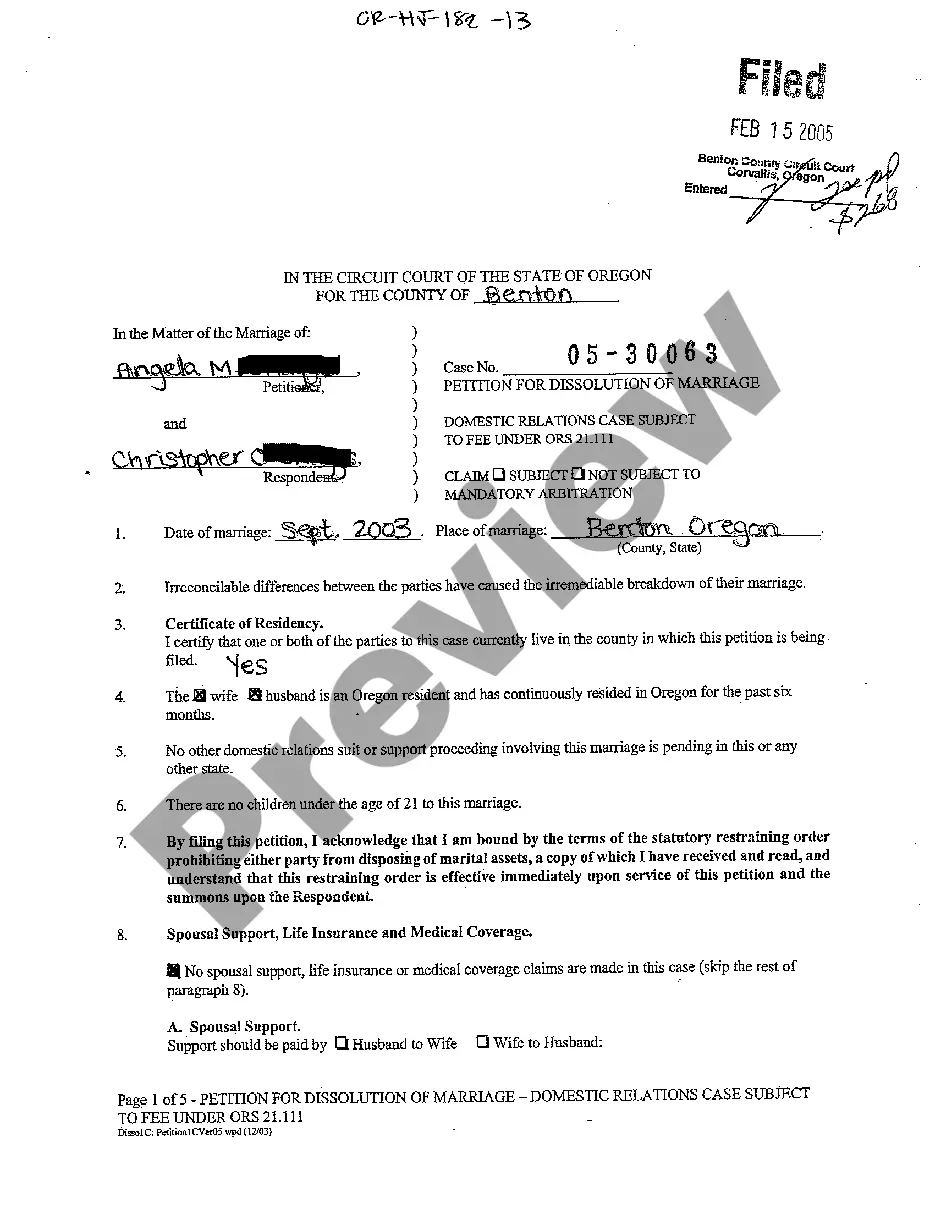

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through the last will and testament of the decedent.

Maine Renunciation and Disclaimer of Property from Will by Testate

Description

How to fill out Maine Renunciation And Disclaimer Of Property From Will By Testate?

Greetings to the finest repository of legal documents, US Legal Forms. Here, you can acquire any template including Maine Renouncement and Exemption of Estate from Will by Testator forms and reserve them (as numerous as you wish or require). Prepare official documentation in merely a few hours, rather than days or weeks, without needing to pay a fortune to an attorney. Obtain your state-specific template in a few clicks and feel secure knowing that it was crafted by our expert legal professionals.

If you’re already a member, simply Log Into your account and subsequently click Download next to the Maine Renouncement and Exemption of Estate from Will by Testator you need. Given that US Legal Forms is online-based, you will consistently have access to your downloaded documents, no matter the device you’re on. View them in the My documents section.

If you don't possess an account yet, what are you waiting for? Follow our instructions below to get started.

Once you’ve filled out the Maine Renouncement and Exemption of Estate from Will by Testator, send it to your attorney for verification. It’s an extra measure but a crucial one to ensure you’re completely protected. Join US Legal Forms today and gain access to a large number of reusable templates.

- If this is a state-specific template, verify its relevance for the state you reside in.

- Examine the description (if available) to determine if it’s the correct template.

- See additional details with the Preview option.

- If the document meets all your specifications, simply click Buy Now.

- To establish an account, select a pricing package.

- Utilize a credit card or PayPal account to enroll.

- Download the document in the format you prefer (Word or PDF).

- Print the document and complete it with your or your company’s information.

Form popularity

FAQ

Word forms: disclaimers A disclaimer is a statement in which a person says that they did not know about something or that they are not responsible for something. formal The company asserts in a disclaimer that it won't be held responsible for the accuracy of information.

A disclaimer warns readers that website content is for informational purposes only, and that users should not act on the information they read there or interpret it as actionable advice.Disclaimers are one of the defensive weapons in your digital arsenal that help protect you from lawsuits and liability.

Put your disclaimer where users can easily find it. You can put your disclaimer or disclaimers on a separate page, then link to that page in your website menu, website footer, or impressum page if you have one. You should also put your disclaimers on relevant content.

In your disclaimer, cover any and all liabilities for the product or service that you provide. You should warn consumers of any dangers or hazards posed by your product. You should list specific risks while at the same time acknowledging that the list is not exhaustive. For example, you could write, NOTICE OF RISK.

A disclaimer is generally any statement intended to specify or delimit the scope of rights and obligations that may be exercised and enforced by parties in a legally recognized relationship.

Get the free how to fill letter of disclaimer sbi form Balance Rs. Annexure A LETTER OF DISCLAIMER To be duly stamped as per the Stamp Act applicable to the State The Branch Manager / Chief Manager / Asstt. General Manager State Bank of India Dear Sir Account No in the name of Shri / Smt. / Kum Balance Rs.

In your disclaimer, cover any and all liabilities for the product or service that you provide. You should warn consumers of any dangers or hazards posed by your product. You should list specific risks while at the same time acknowledging that the list is not exhaustive. For example, you could write, NOTICE OF RISK.

While T&C's contain general liability waivers, Disclaimers address specific issues with your product or service. Disclaimers may cover medical or health risks, professional liability and earnings claims. If your website or app creates a risk of user error or misuse, a disclaimer will do more to help you than hurt you.

A beneficiary of an estate, whether by Will or the laws of intestacy is perfectly within their rights to reject their inheritance. Beneficiaries may wish to vary dispositions of property following death in order to redirect benefits to other family members who are more in need or less well provided for and to save tax.

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.