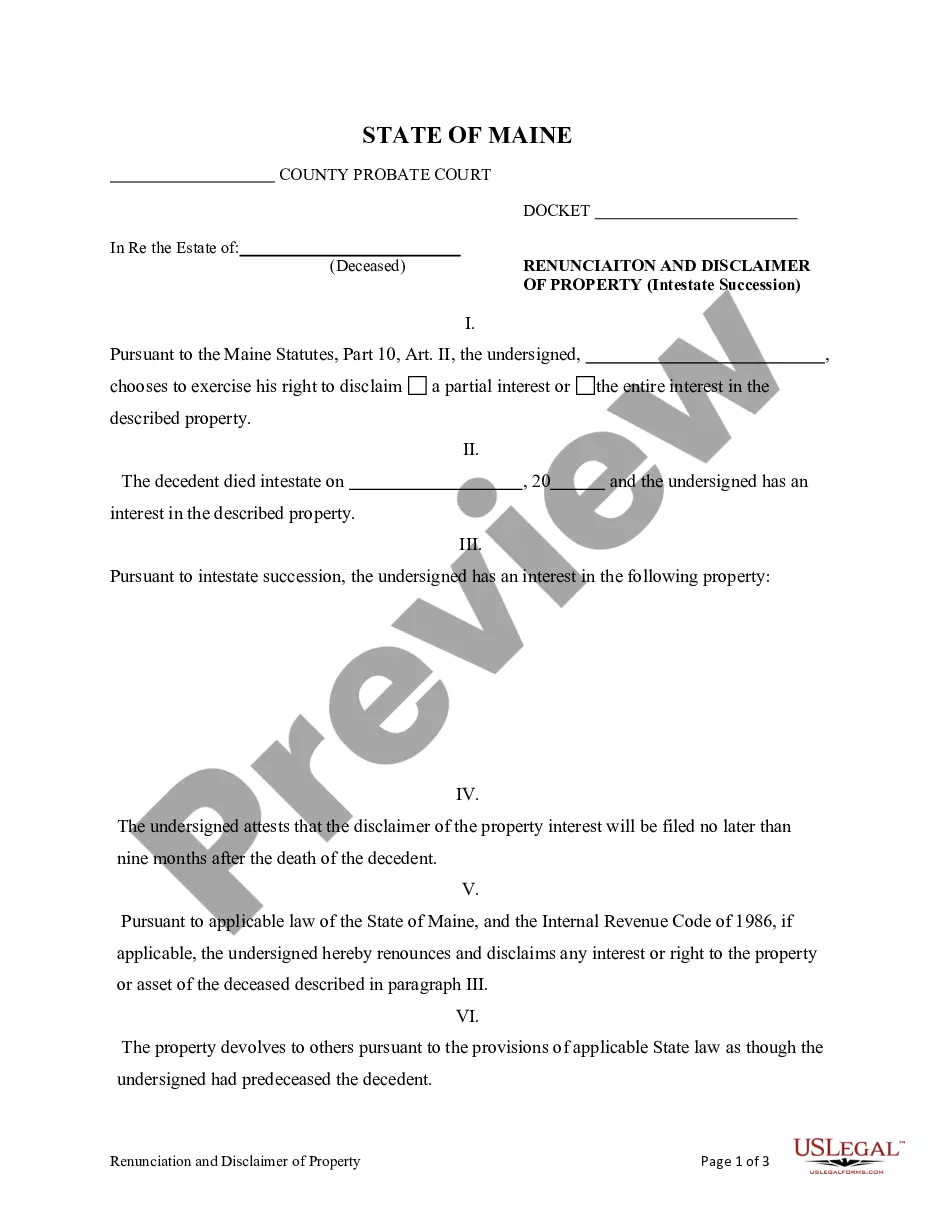

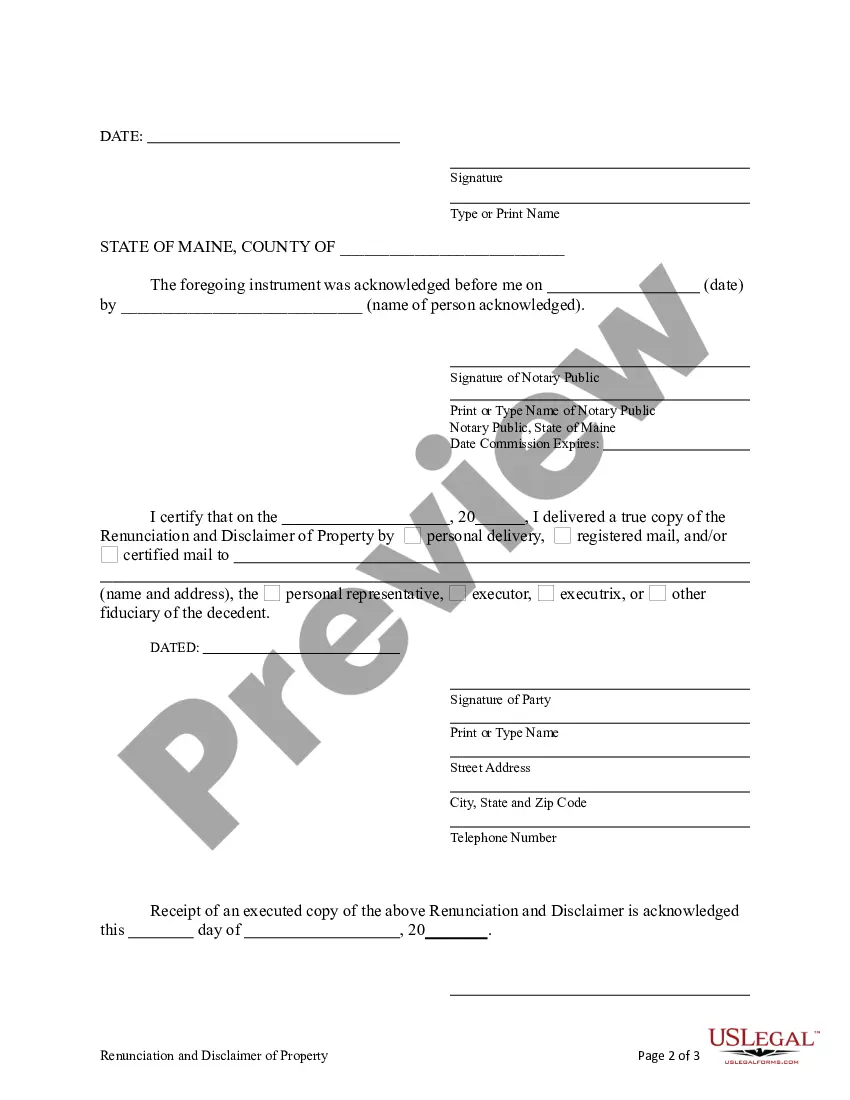

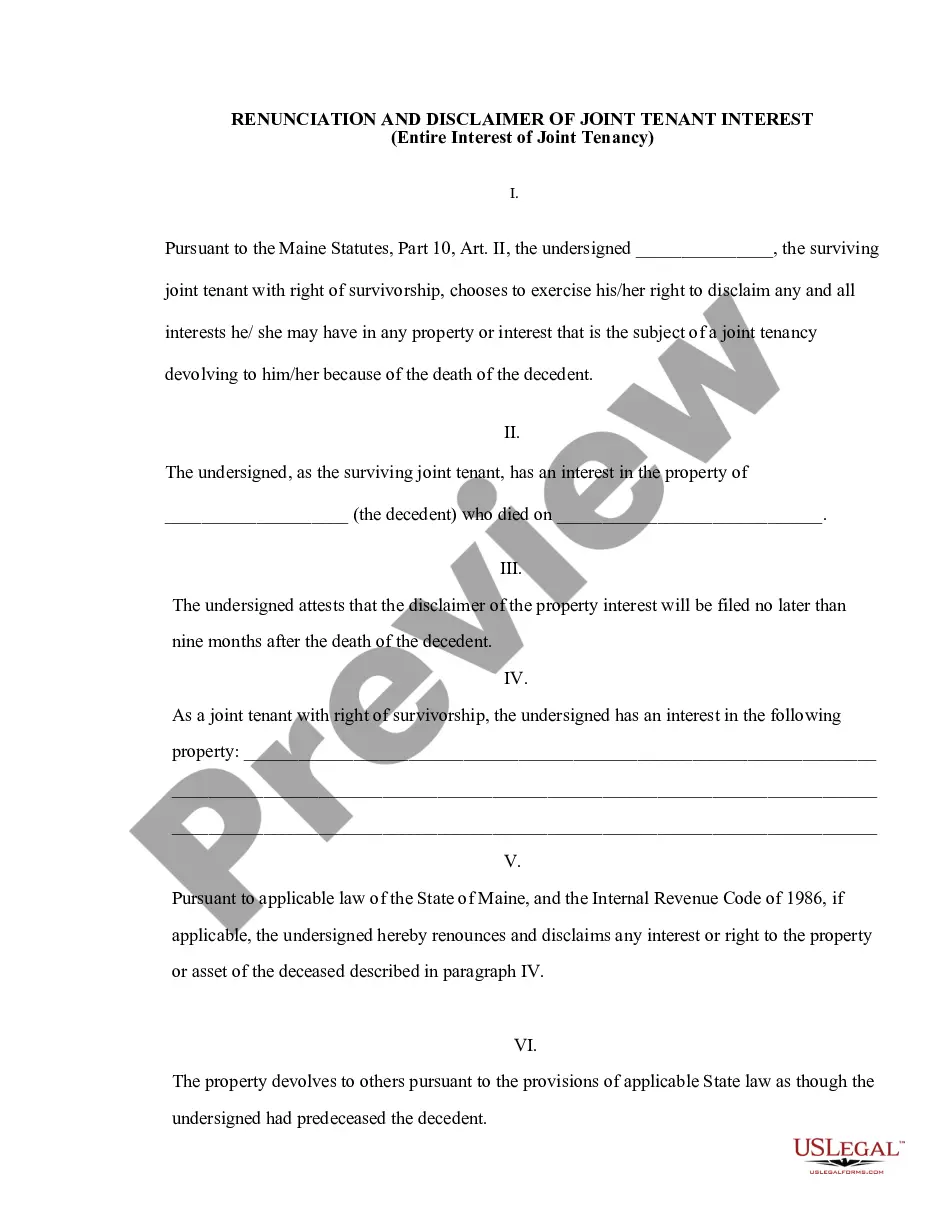

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property. However, pursuant to the Maine Statutes, Part 10, Art. II, the beneficiary has decided to renounce a portion of or the entire interest in the property. The property will devolve to others as though the beneficiary predeceased the decedent. The form also includes a state specific acknowledgment and a certificate to verify delivery.

Maine Renunciation and Disclaimer of Property received by Intestate Succession

Description

How to fill out Maine Renunciation And Disclaimer Of Property Received By Intestate Succession?

Greetings to the most important legal documents repository, US Legal Forms.

Here you can discover any template such as Maine Renunciation and Disclaimer of Property obtained through Intestate Succession options and save them (as many as you desire). Craft official paperwork in just a few hours, instead of days or weeks, without spending excessively on a legal practitioner.

Acquire your state-specific document in just a few clicks and have the confidence that it was created by our state-approved attorneys.

To establish an account, select a pricing plan. Utilize a credit card or PayPal account for registration. Download the document in your preferred format (Word or PDF). Print the document and fill it out with your or your business’s details. Once you’ve filled out the Maine Renunciation and Disclaimer of Property received from Intestate Succession, send it to your attorney for review. It’s an additional step but a crucial one to ensure you’re fully protected. Join US Legal Forms today and gain access to a large collection of reusable templates.

- If you’re already a registered user, simply Log Into your account and click Download next to the Maine Renunciation and Disclaimer of Property you need.

- As US Legal Forms operates online, you’ll always have access to your downloaded documents, regardless of the device you’re using.

- Find them in the My documents section.

- If you haven't created an account yet, what are you waiting for? Review our instructions below to get started.

- If this is a state-specific template, verify its relevance within your state.

- Check the description (if available) to determine if it’s the right template.

- Explore additional content with the Preview feature.

- If the sample suits your requirements, click Buy Now.

Form popularity

FAQ

Transferring property after a parent's death without a will can be complex. Typically, you may need to go through intestate succession laws to distribute the property according to state guidelines. In Maine, you can utilize the Maine Renunciation and Disclaimer of Property received by Intestate Succession to formally renounce your rights, if desired. For a clear step-by-step process tailored to your situation, US Legal Forms offers a wealth of templates and instructions.

Next of kin meaning In the event of someone's death, next of kin may also be used to describe the person or people who stand to inherit the most. This is usually the spouse or civil partner, but it could also be their children or parents in certain circumstances.

Intestacy refers to the condition of an estate of a person who dies without a will, and owns property with a total value greater than that of their outstanding debts.Typically, property goes to a surviving spouse first, then to any children, then to extended family and descendants, following common law.

Intestate succession specifically refers to the order in which spouses, children, siblings, parents, cousins, great-aunts/uncles, second cousins twice removed, etc. are entitled to inherit from a family member when no will or trust exists.

An heir is a person who is legally entitled to collect an inheritance, when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants or other close relatives of the decedent.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

Intestate succession specifically refers to the order in which spouses, children, siblings, parents, cousins, great-aunts/uncles, second cousins twice removed, etc. are entitled to inherit from a family member when no will or trust exists.

If you pass away without making one, in legal jargon, you are said to have died intestate. The Irish rules on intestacy will dictate how your estate your assets, money and possessions will be allocated.If one partner dies, they will not automatically inherit from each other unless there is a will.