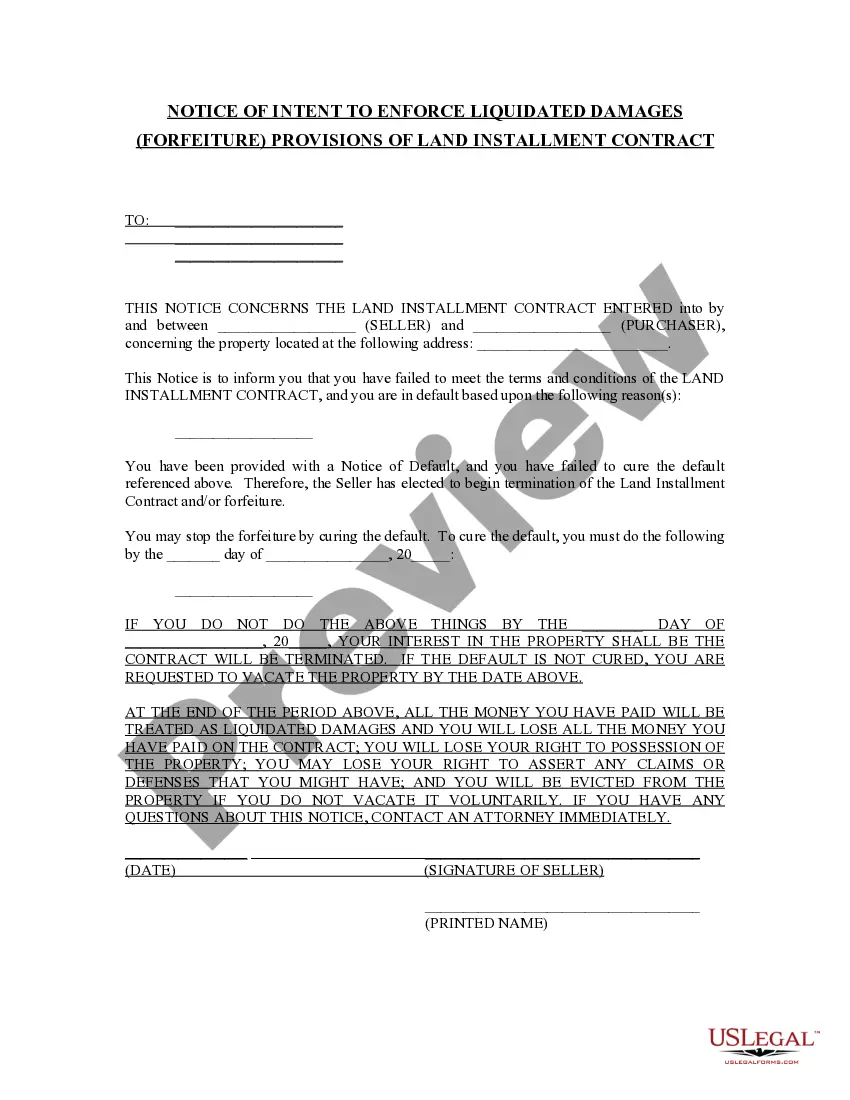

This Notice of Intent to Enforce Forfeiture Provisions of Contract for Deed is an initial notice of Seller's intent to enforce the forfeiture remedy of contract for deed if nonpayment or other breach is not cured. It is used specifically to inform the buyer that he/she has failed to meet the terms and conditions of the Contract for Deed and as a result, are in default based upon the reasons specified.

Maine Notice of Intent to Enforce Forfeiture Provisions of Contact for Deed

Description

How to fill out Maine Notice Of Intent To Enforce Forfeiture Provisions Of Contact For Deed?

Utilize US Legal Forms to obtain a printable Maine Notice of Intent to Enforce Forfeiture Provisions of Contract for Deed.

Our court-acceptable forms are crafted and consistently refreshed by experienced attorneys.

Our collection is the most extensive forms repository online and provides economical and precise templates for customers, legal practitioners, and small to medium-sized businesses.

Hit Buy Now if it’s the desired template. Create an account and pay using PayPal or a card|credit card. Download the document to your device and feel free to use it multiple times. Use the Search field to find additional document templates. US Legal Forms offers thousands of legal and tax templates and packages for both business and individual requirements, including the Maine Notice of Intent to Enforce Forfeiture Provisions of Contract for Deed. Over three million users have successfully utilized our service. Select your subscription plan and acquire high-quality documents in just a few clicks.

- The documents are categorized based on state regulations and some can be viewed before downloading.

- To access templates, users must possess a subscription and Log In to their account.

- Click Download next to any form you require and locate it in My documents.

- For users without a subscription, adhere to the following steps to readily find and download the Maine Notice of Intent to Enforce Forfeiture Provisions of Contract for Deed.

- Confirm that you have the correct form for the required state.

- Examine the form by reviewing the description and utilizing the Preview feature.

Form popularity

FAQ

If your 401(k) Plan has made employer contributions to your company's 401(k) account, you may have built up amounts in an account called. Forfeitures. These 401(k) forfeiture accounts hold the employer contribution amounts that accrue when an employee leaves the Plan and their account is not fully vested.

Forfeiture refers to a loss of any property, money, or assets without consideration or compensation in return. A forfeiture generally occurs due to default in complying with repayment obligations under a contract. It can also be used as a penalty for an illegal way of conducting business.

How to avoid 401(k) forfeiture. The easiest way to make sure you won't have to forfeit employer contributions in your 401(k) plan account is to stay employed long enough to become fully vested in your plan account.

Forfeiture is the loss of any property without compensation as a result of defaulting on contractual obligations, or as a penalty for illegal conduct.

The company can Redistribute the forfeited amount to the remaining eligible participants. Or they can Apply the forfeited money towards reasonable plan expenses. This reduces the employer's out of pocket expense of maintaining the plan. Or The forfeited money can be used by the employer to reduce future contributions.

Forfeited funds, instead of employer assets, may be used to pay for employer contributions or plan expenses. Forfeitures generally exist in plans with vesting schedules, and Internal Revenue Code (IRC) rules, plan terms, and in some cases the exercise of fiduciary discretion determine their use.

Forfeiture laws allow the government to keep the seized cash and property, destroy the property, or sell it and keep the proceeds to fund a number of activities.

401(k) plan forfeitures occur when a participant terminates employment (voluntarily or involuntarily) prior to satisfying the required service years to become fully vested in his/her account.Participants are generally always 100% vested in the contributions made by the participant.

The term money judgment is used to describe a particular kind of directly forfeitable property. It is a short-hand way of describing the defendant's continuing obligation to forfeit the money derived from or used to commit his criminal offense whether he has retained the actual dollars in his possession or not.