This is a due diligence document request list requesting certain documents to be used in the due diligence review. It asks for corporate and organizational documents, securities documents, business descriptions, financing documents, and other documents necessary for the due diligence review.

Maryland Equity Investment Due Diligence Request Form

Description

How to fill out Equity Investment Due Diligence Request Form?

Are you presently in the placement in which you require paperwork for either business or personal reasons virtually every time? There are a lot of lawful record themes available online, but getting types you can rely on isn`t easy. US Legal Forms delivers a huge number of form themes, just like the Maryland Equity Investment Due Diligence Request Form, which can be written in order to meet federal and state demands.

When you are previously informed about US Legal Forms site and get a free account, just log in. Afterward, you may acquire the Maryland Equity Investment Due Diligence Request Form format.

If you do not offer an accounts and want to start using US Legal Forms, adopt these measures:

- Discover the form you need and make sure it is to the right area/state.

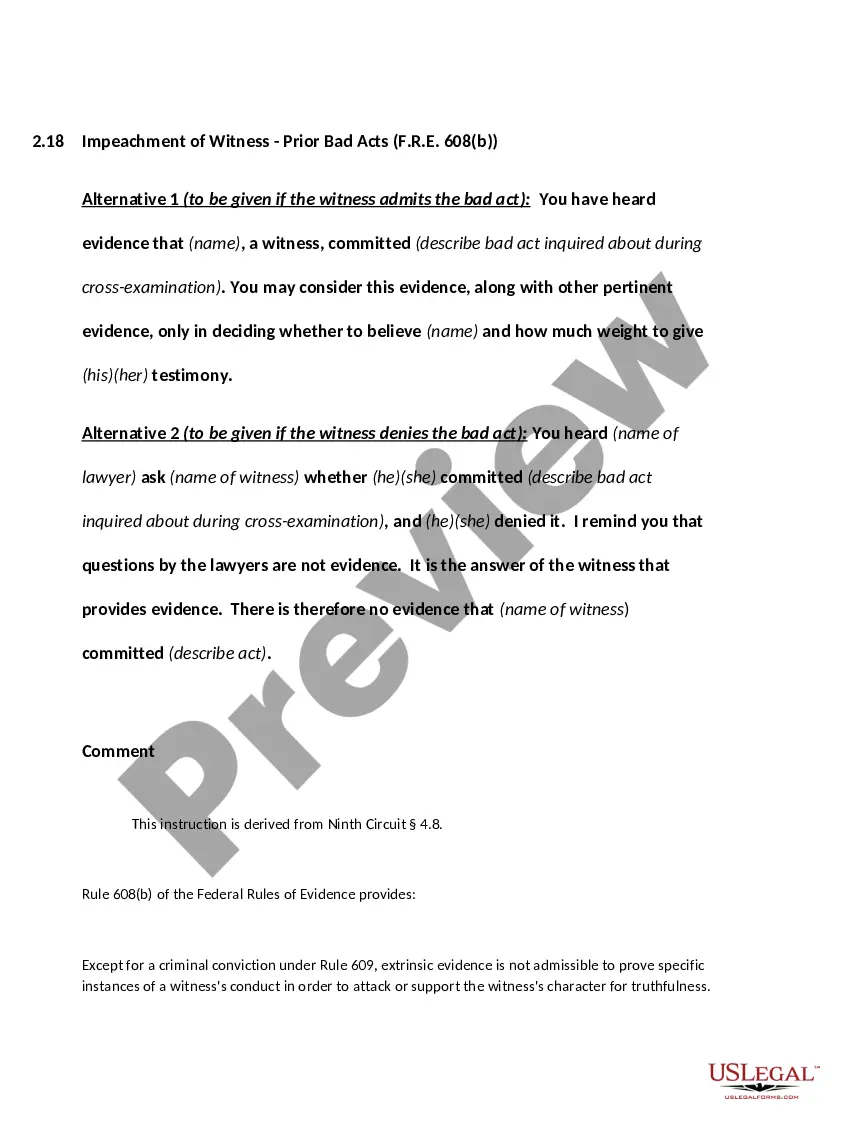

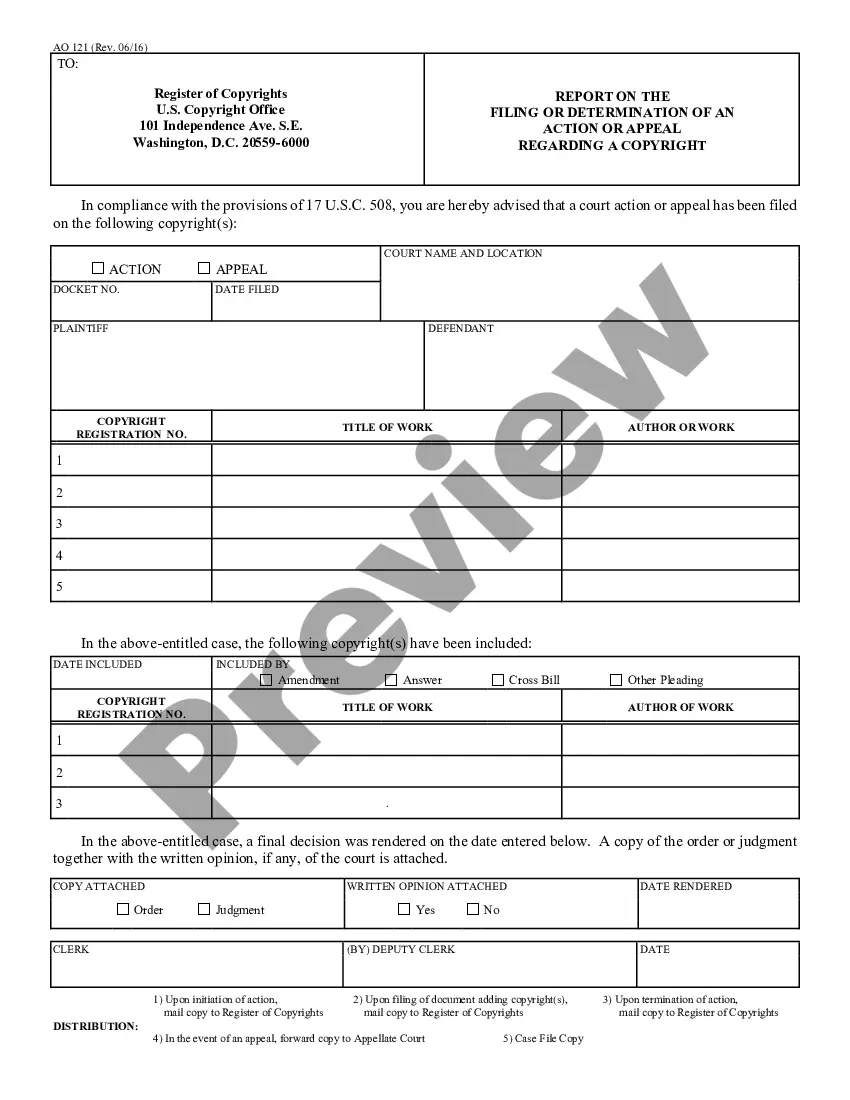

- Take advantage of the Preview option to analyze the shape.

- See the explanation to actually have chosen the right form.

- In the event the form isn`t what you are seeking, take advantage of the Look for area to find the form that suits you and demands.

- When you discover the right form, just click Get now.

- Choose the costs plan you desire, fill out the specified details to generate your account, and pay for your order making use of your PayPal or charge card.

- Select a practical document format and acquire your duplicate.

Find every one of the record themes you possess bought in the My Forms food list. You can get a additional duplicate of Maryland Equity Investment Due Diligence Request Form at any time, if required. Just select the needed form to acquire or produce the record format.

Use US Legal Forms, one of the most considerable collection of lawful kinds, in order to save efforts and avoid errors. The assistance delivers appropriately manufactured lawful record themes which can be used for a range of reasons. Create a free account on US Legal Forms and commence producing your lifestyle a little easier.

Form popularity

FAQ

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property, and the board of directors.

The Four Due Diligence Requirements Complete and Submit Form 8867. (Treas. Reg. section 1.6695-2(b)(1)) ... Compute the Credits. (Treas. Reg. section 1.6695-2(b)(2)) ... Knowledge. (Treas. Reg. section 1.6695-2(b)(3)) ... Keep Records for Three Years.

To prove this, just keep records of household bills, mortgage payments, property taxes, food and other necessary expenses you pay for. Second, you will need to show that your dependent lived with you for the entire year. School or medical records are a great way to do this.

How to Perform Due Diligence for Stocks Step 1: Analyze the Capitalization of the Company. ... Step 2: Revenue, Profit, and Margin Trends. ... Step 3: Competitors and Industries. ... Step 4: Valuation Multiples. ... Step 5: Management and Share Ownership. ... Step 6: Balance Sheet. ... Step 7: Stock Price History. ... Step 8: Stock Dilution Possibilities.

The due diligence process helps the investor determine if its initial decision to provide funding is based on accurate information. As such, investors check your finances, your company's structure, legal documents, key personnel, employment contracts, vendors, clients and more.

The private equity due diligence process typically involves the following steps: General Industry Research. Financial Due Diligence. Commercial and Operational Due Diligence. Technology and IT Due Diligence. Legal Due Diligence.

About Form 8867, Paid Preparer's Due Diligence Checklist | Internal Revenue Service.

Tax Preparation Due Diligence Requirements Checklist Tax preparers can use IRS Form 8867 as a checklist.