This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Louisiana Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness

Description

How to fill out Assignment Of All Of Expected Interest In Estate In Order To Pay Indebtedness?

Are you currently inside a position where you need to have papers for possibly organization or personal uses almost every time? There are a variety of legitimate document themes accessible on the Internet, but locating versions you can trust is not easy. US Legal Forms provides 1000s of type themes, such as the Louisiana Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness, which are written in order to meet state and federal needs.

Should you be presently knowledgeable about US Legal Forms internet site and have an account, simply log in. Following that, you are able to down load the Louisiana Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness format.

Should you not come with an profile and need to begin using US Legal Forms, adopt these measures:

- Get the type you want and make sure it is to the correct town/region.

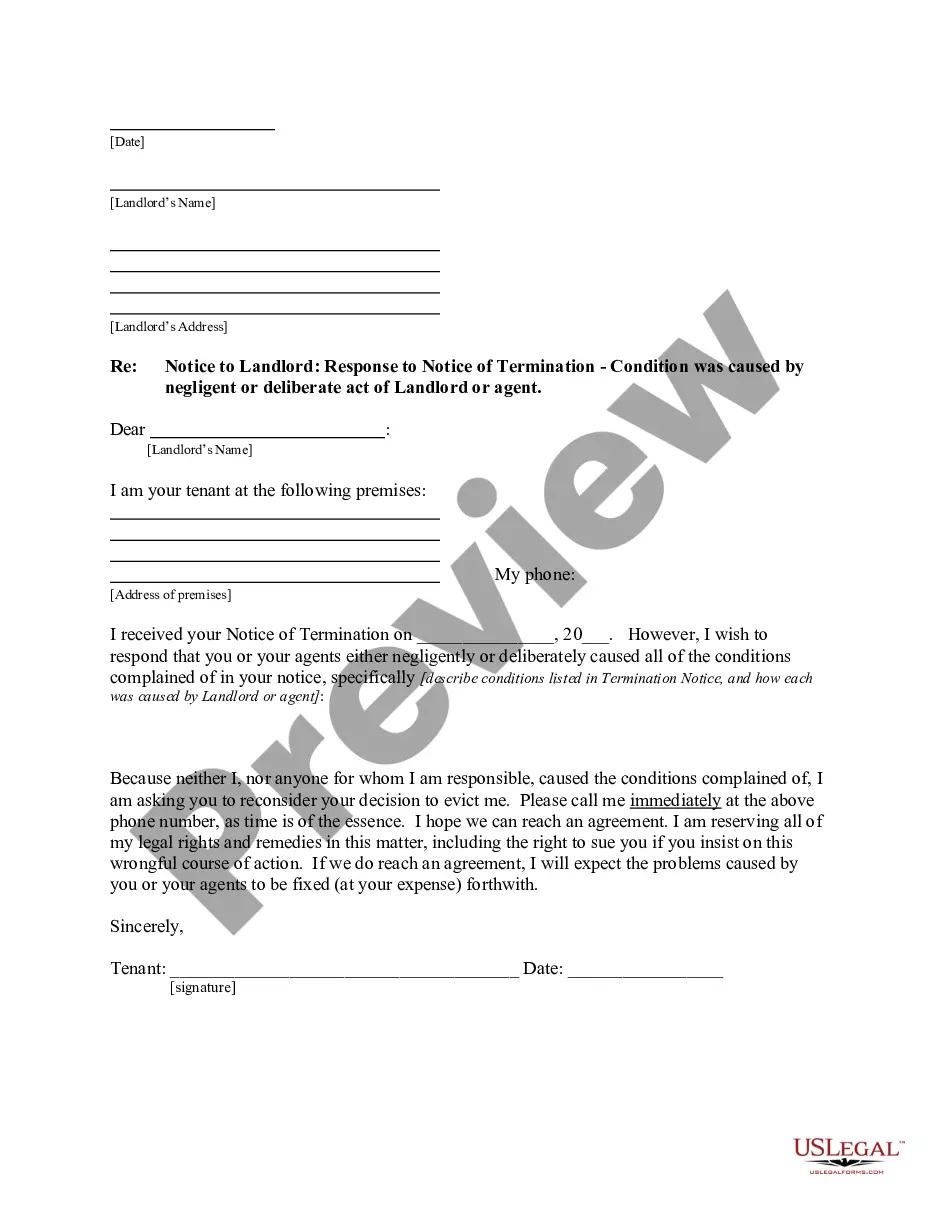

- Use the Review key to analyze the form.

- Look at the description to actually have chosen the right type.

- In the event the type is not what you are looking for, take advantage of the Research area to get the type that meets your needs and needs.

- Whenever you get the correct type, click on Acquire now.

- Opt for the costs prepare you need, submit the necessary info to produce your money, and buy an order using your PayPal or Visa or Mastercard.

- Select a hassle-free file formatting and down load your version.

Find every one of the document themes you possess bought in the My Forms food selection. You may get a extra version of Louisiana Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness anytime, if necessary. Just click the necessary type to down load or print the document format.

Use US Legal Forms, by far the most extensive collection of legitimate varieties, to conserve time as well as prevent mistakes. The support provides professionally created legitimate document themes that you can use for an array of uses. Produce an account on US Legal Forms and start generating your life a little easier.

Form popularity

FAQ

Credit card debt that's left after someone dies is often paid for by their estate, but in some cases, it can become the responsibility of a beneficiary.

Typically, fees ? such as fiduciary, attorney, executor, and estate taxes ? are paid first, followed by burial and funeral costs. If the deceased member's family was dependent on him or her for living expenses, they will receive a ?family allowance? to cover expenses. The next priority is federal taxes.

Secured debts will get paid first, as they are connected to the assets themselves. Unsecured debts, like credit cards or personal loans, are generally paid last. As executor, it is your legal obligation to put off payment of unsecured debts until funeral costs, estate expenses, taxes, and medical expenses are paid off.

The credit card companies will not have a claim against the assets to pay off the credit card debts after your death. Talk to a knowledgeable California estate planning lawyer to learn more about your options. Worried about leaving substantial debts to your heirs?

If the estate can't pay it and there's no one who shared responsibility for the debt, it may go unpaid. Generally, when a person dies, their money and property will go towards repaying their debt. If there's no money in their estate, the debts will usually go unpaid.

As an executor, you aren't personally responsible for paying the deceased debts, unless you cosigned on a loan or are a joint account holder on a credit card. Where you might run into trouble is if you ignore your state's laws, sell the car and pocket the difference or distribute it to other heirs.

As noted above, you generally are not personally liable for an estate's debts as the executor. However, there are a few situations in which this rule does not apply. If you cosigned for a loan or held a credit card jointly with the decedent, you may be personally liable for that debt.

When someone dies, their debts are generally paid out of the money or property left in the estate. If the estate can't pay it and there's no one who shared responsibility for the debt, it may go unpaid. Generally, when a person dies, their money and property will go towards repaying their debt.