This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Maine Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness

Description

How to fill out Assignment Of All Of Expected Interest In Estate In Order To Pay Indebtedness?

Are you in a situation that you require files for either business or individual reasons just about every time? There are a variety of legal record layouts accessible on the Internet, but discovering ones you can trust isn`t effortless. US Legal Forms offers a huge number of kind layouts, like the Maine Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness, which are created to meet state and federal requirements.

Should you be currently informed about US Legal Forms website and possess your account, merely log in. Following that, you are able to obtain the Maine Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness format.

Unless you have an profile and want to begin using US Legal Forms, follow these steps:

- Get the kind you need and ensure it is for that proper area/state.

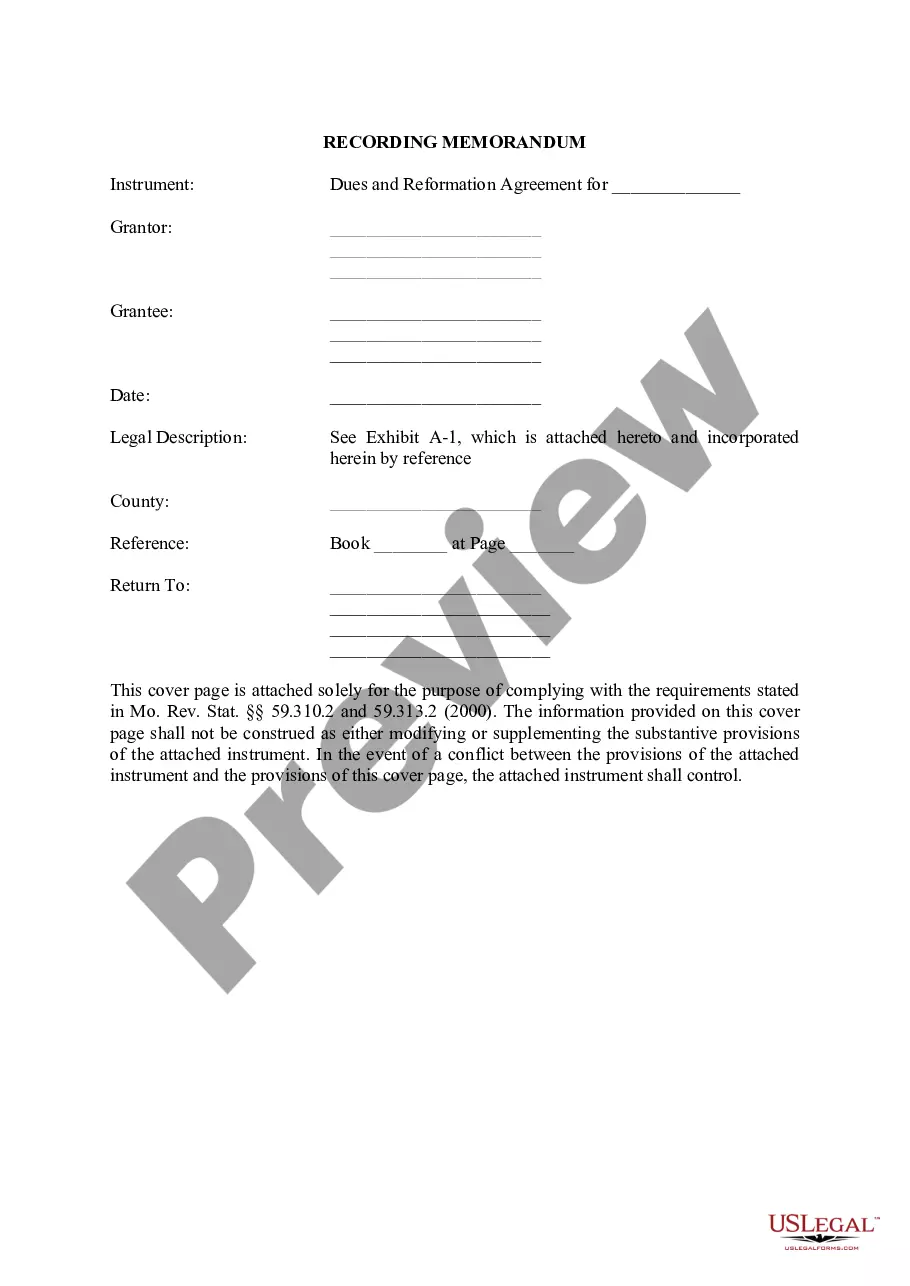

- Take advantage of the Review button to check the form.

- See the outline to actually have chosen the proper kind.

- In case the kind isn`t what you`re seeking, use the Search discipline to discover the kind that meets your requirements and requirements.

- If you discover the proper kind, just click Acquire now.

- Choose the costs program you need, submit the necessary details to produce your account, and purchase the order making use of your PayPal or charge card.

- Select a practical file formatting and obtain your copy.

Find every one of the record layouts you might have purchased in the My Forms food list. You can aquire a further copy of Maine Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness at any time, if necessary. Just go through the necessary kind to obtain or printing the record format.

Use US Legal Forms, one of the most extensive selection of legal types, to save efforts and steer clear of errors. The service offers appropriately made legal record layouts that you can use for a variety of reasons. Create your account on US Legal Forms and initiate making your life easier.

Form popularity

FAQ

In Maine, if an estate is worth no more than $40,000, it is considered a ?small estate.? Small estates can be wrapped up quickly by filing a document called a ?Small Estate Affidavit.? This is usually a simple process, but there are some legal steps that must be taken before you can wrap up a small estate.

Under current Maine law, creditors have a maximum time limit of 9 months from the date of death to present their claims to the Personal Representative. The 9-month period can be shortened if you provide a written notice to the creditor and request that the creditor promptly file the claim.

Payment of Debts and Taxes: The personal representative uses the estate's funds to pay off any outstanding debts and taxes. In Maine, creditors have four months from the notification to file claims against the estate.

After your loved one dies, you will need to inform creditors of their death. From there, creditors have a time limit to submit claims and you will have to respond within a certain time frame. Overall in California, creditors have only one year to collect on a debt. In general, you cannot inherit someone else's debt.

Personal Representatives are reimbursed for all legitimate out-of-pocket expenses incurred in the process of management and distribution of the deceased estate. In addition, you are entitled to reasonable fees, based on a number of factors, unless the decedent's will says otherwise.

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor.

A debt collector may not commence a collection action more than 6 years after the date of the consumer's last activity on the debt. This limitations period applies notwithstanding any other applicable statute of limitations, unless a shorter limitations period is provided under the laws of this State.

Appropriate probate, appointment or testacy proceedings may be commenced in relation to a claim for personal injury made against the decedent by a person without actual notice of the death of the decedent at any time within 6 years after the cause of action accrues.