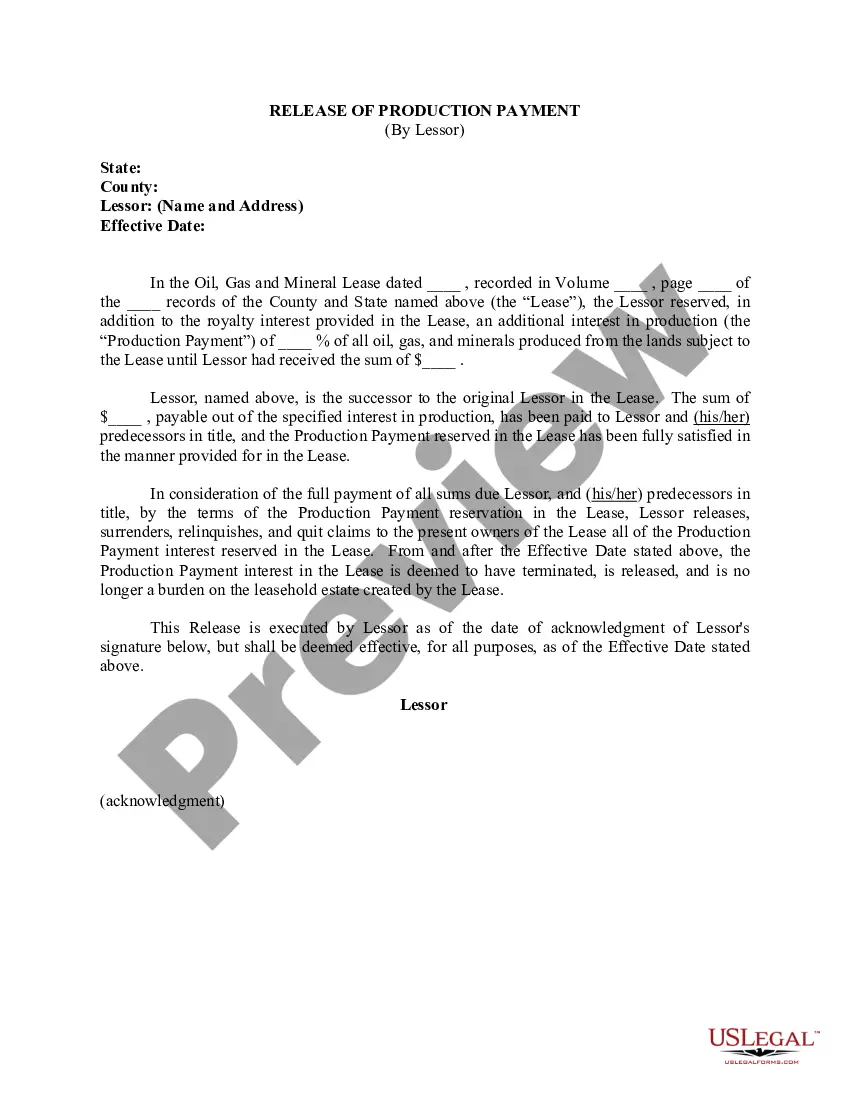

This form of release is used when Lessor releases, relinquishes, and quit claims to the present owners of the Lease all of a Production Payment interest. From and after the Effective Date, the Production Payment interest in the Lease is deemed to have terminated and is no longer a burden on the leasehold estate created by the Lease.

Maryland Release of Production Payment by Lessor

Description

How to fill out Release Of Production Payment By Lessor?

Choosing the right lawful file format might be a have difficulties. Needless to say, there are plenty of themes available on the Internet, but how do you get the lawful kind you need? Take advantage of the US Legal Forms internet site. The service offers a large number of themes, for example the Maryland Release of Production Payment by Lessor, that you can use for enterprise and personal demands. All of the types are checked by pros and meet up with federal and state specifications.

In case you are previously registered, log in in your account and then click the Down load key to get the Maryland Release of Production Payment by Lessor. Use your account to appear throughout the lawful types you might have bought earlier. Check out the My Forms tab of your own account and obtain another duplicate of your file you need.

In case you are a whole new consumer of US Legal Forms, allow me to share easy guidelines that you can follow:

- Initial, be sure you have selected the correct kind to your city/area. You can look over the form making use of the Preview key and study the form information to ensure this is the best for you.

- When the kind fails to meet up with your preferences, use the Seach field to discover the correct kind.

- Once you are positive that the form is suitable, go through the Acquire now key to get the kind.

- Choose the costs strategy you desire and type in the required information and facts. Design your account and pay for the order making use of your PayPal account or Visa or Mastercard.

- Choose the submit formatting and acquire the lawful file format in your device.

- Full, revise and printing and sign the obtained Maryland Release of Production Payment by Lessor.

US Legal Forms may be the biggest library of lawful types for which you can discover different file themes. Take advantage of the service to acquire expertly-made files that follow status specifications.

Form popularity

FAQ

All legal business entities formed, qualified, or registered to do business in Maryland MUST file an Annual Report: Legal business entities (Corporations, LLC, LP, LLP, etc.), whether they are foreign or domestic, must file a Form 1 Annual Report (fees apply)

Landlords are required to give tenants sixty (60) days' notice before the lease officially ends. In contrast, tenants are only obligated to notify their landlord thirty (30) days before they intend to terminate the lease.

If the landlord allows you to stay after the original lease has expired, you enter into a month-to-month lease (unless the original lease said something different). If you were originally in a week-to-week lease, the holdover period will also be on a week-to-week basis.

A Maryland month-to-month lease is tenancy without a commitment to an end date and can be canceled at any time with 60 days' notice. Either the landlord or tenant can terminate the lease by sending a notice to the other party.

3. Timeline Lease Agreement or Type of TenancyNotice to ReceiveWeekly7-Day Notice to QuitMonthly60-Day Notice to QuitYearly90-Day Notice to Quit

Maryland law does not generally provide the right to break a lease for good cause. If a tenant wants to break a lease that does not have a cancellation section, Maryland law permits early termination of a lease only under certain circumstances.

Entities Required to File Every other PTE that is subject to Maryland income tax law must file Form 510. Any PTE that has credits in Maryland and a PTE that is a member of a PTE that is required to file in Maryland must file Form 511 if it is an Electing PTE, or Form 510 if it not an Electing PTE.

Tenants may start a rent escrow case by completing a Complaint for Rent Escrow, form DC-CV-083. File the form at the District Court in the county where the property is located. The form is available at the clerk's office or online at mdcourts.gov/courtforms. There is a fee to file.