Maryland Self-Employed Mechanic Services Contract

Description

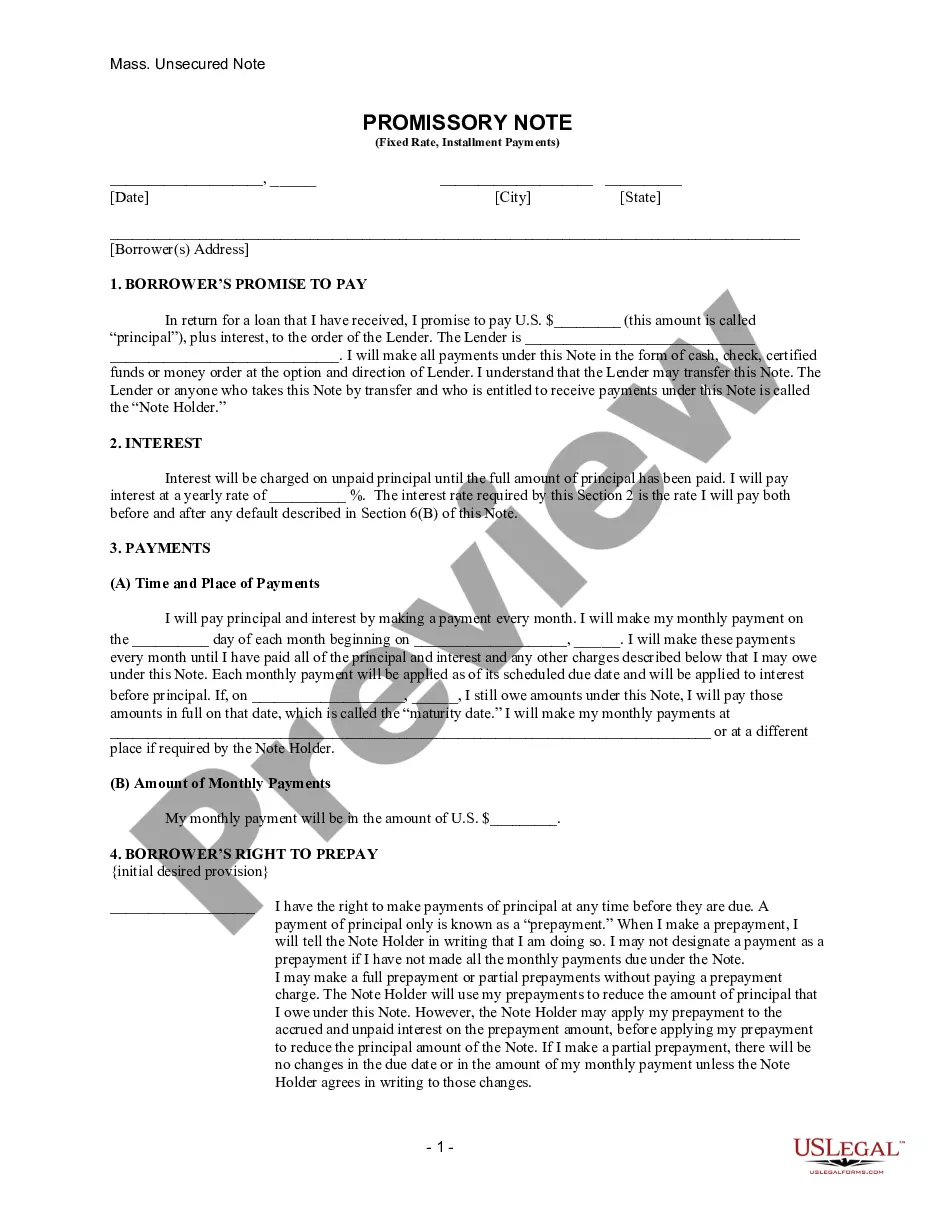

How to fill out Self-Employed Mechanic Services Contract?

You might spend numerous hours online searching for the legal document template that meets the state and federal requirements you desire.

US Legal Forms provides a plethora of legal documents that are reviewed by experts.

You can download or print the Maryland Self-Employed Mechanic Services Agreement from the service.

If available, use the Preview button to look through the document template as well.

- If you already have a US Legal Forms account, you can sign in and click the Obtain button.

- After that, you can fill out, edit, print, or sign the Maryland Self-Employed Mechanic Services Agreement.

- Every legal document template you obtain is yours forever.

- To get another copy of the downloaded form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Check the form description to ensure you have chosen the correct document.

Form popularity

FAQ

In Maryland, there is no statutory minimum amount required for filing a mechanic's lien. However, the claim must reflect a legitimate debt for the services provided or materials supplied. It is advisable to document all transactions clearly and concisely, especially when using a Maryland Self-Employed Mechanic Services Contract. By doing so, you enhance the validity of your claim in case of disputes.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

The state of Maryland does not require general contractors to obtain a license to do business. It is not necessary to have a license if you are doing electrical, plumbing, or HVACR work or are working on home improvement projects.

A 1099 employee is a contractor rather than a full-time employee. These employees may also be referred to as freelancers, self-employed workers, or independent contractors. If you are a business that is contracting 1099 employees, determine what type of work this individual will do for your business.

To be declared an independent contractor the individual (1) must be free from control and direction over his work both in fact and pursuant to the contract between the employer and contractor; (2) must be customarily engaged in independent business or contracting; and (3) the work must be outside the usual course of

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.7 Sept 2021

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.