Maryland Contract Administrator Agreement - Self-Employed Independent Contractor

Description

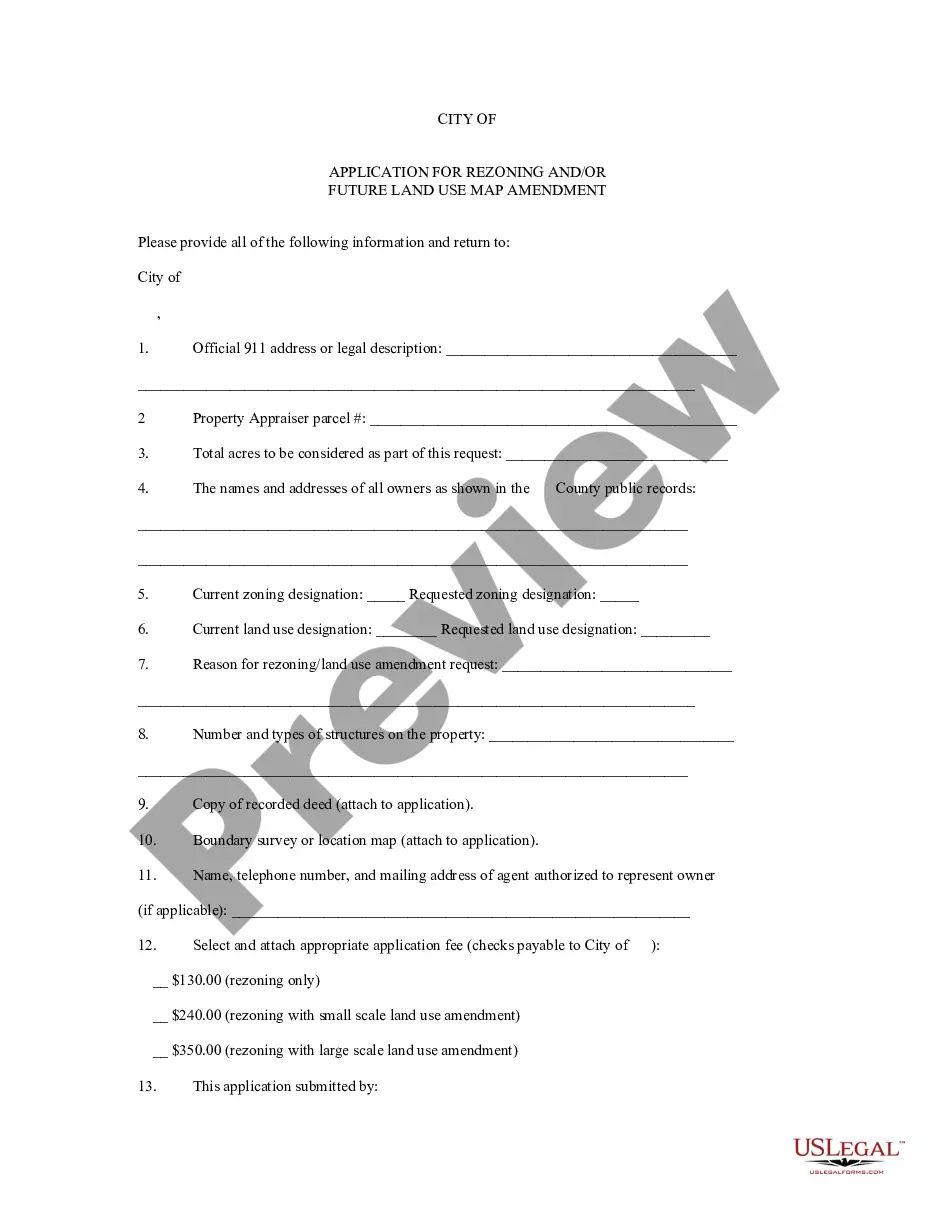

How to fill out Contract Administrator Agreement - Self-Employed Independent Contractor?

You can spend hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that can be reviewed by professionals.

It is easy to download or print the Maryland Contract Administrator Agreement - Self-Employed Independent Contractor from our service.

- If you have a US Legal Forms account, you can Log In and click the Download option.

- Next, you can complete, edit, print, or sign the Maryland Contract Administrator Agreement - Self-Employed Independent Contractor.

- Every legal document template you receive is yours permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/town of your choice.

- Review the form description to confirm that you have chosen the right form.

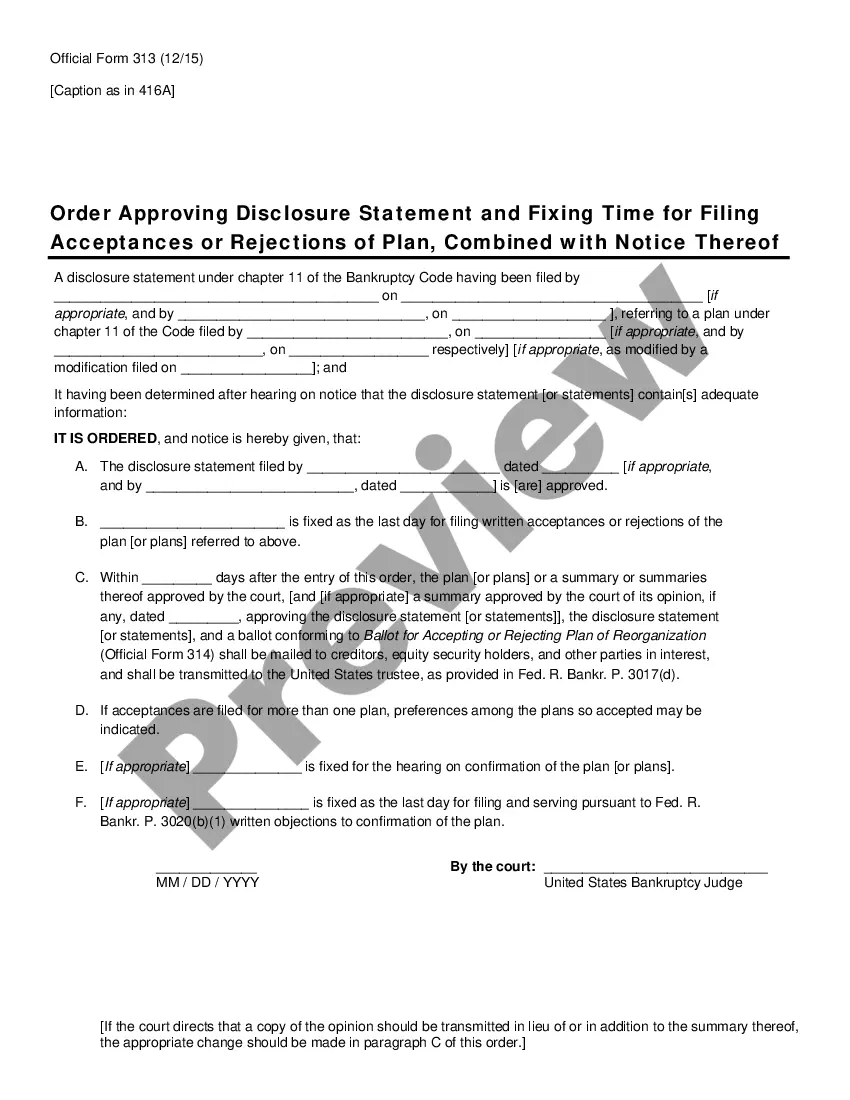

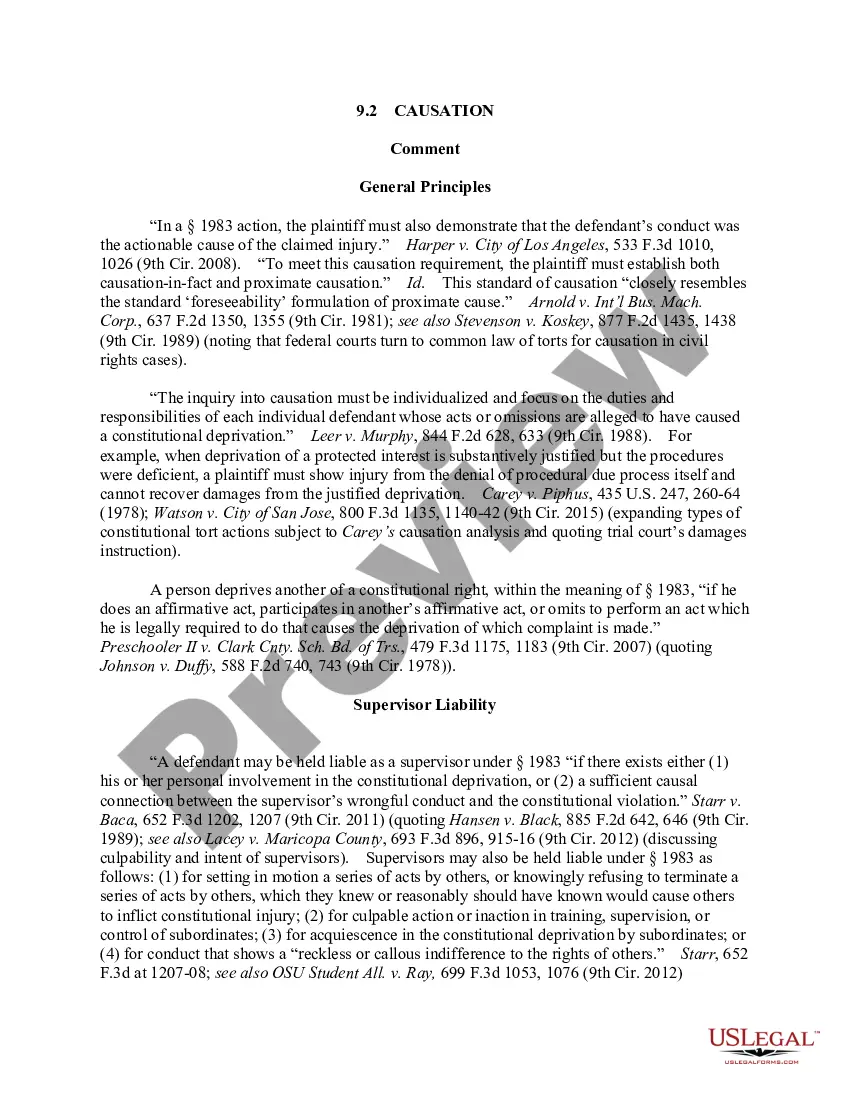

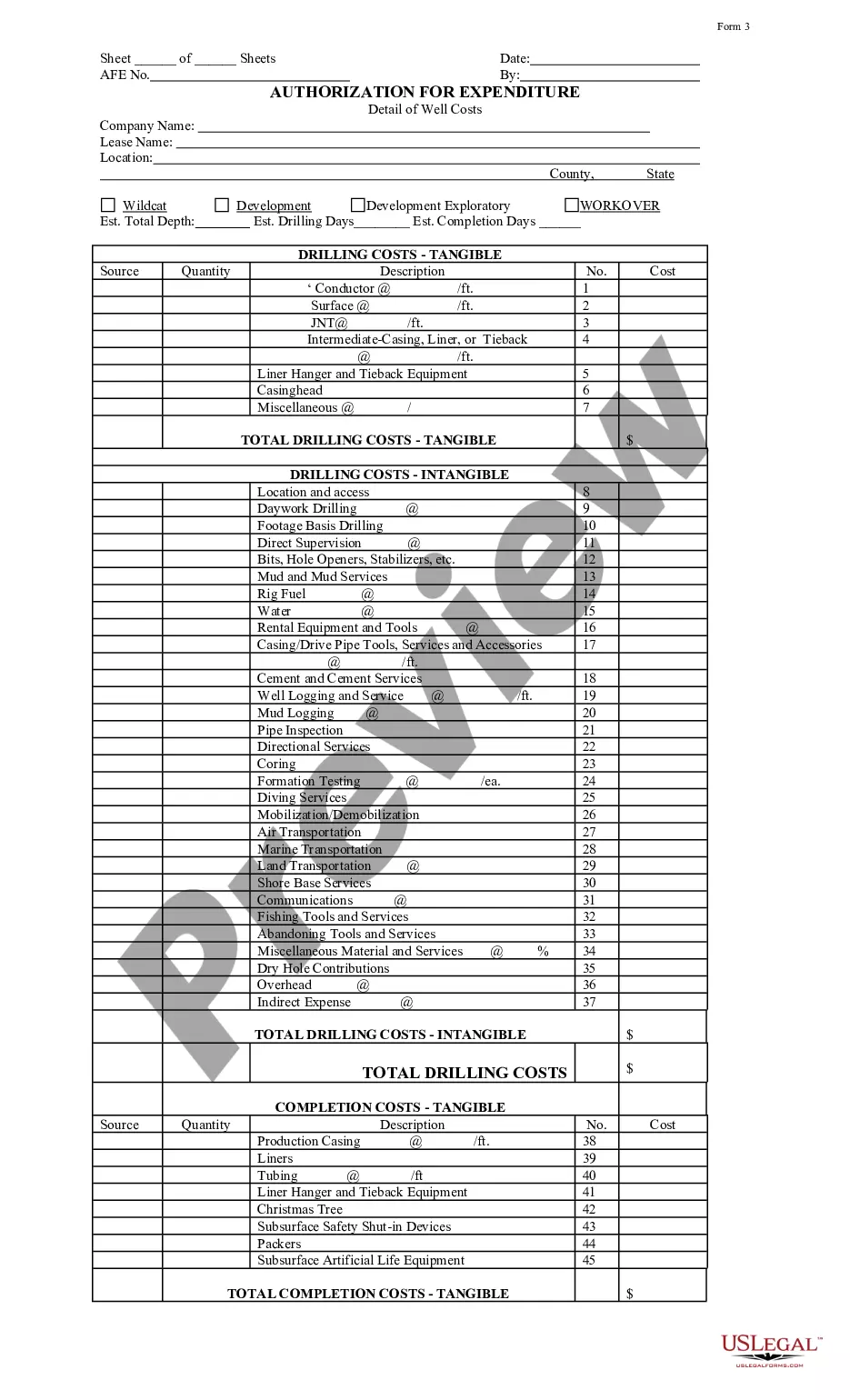

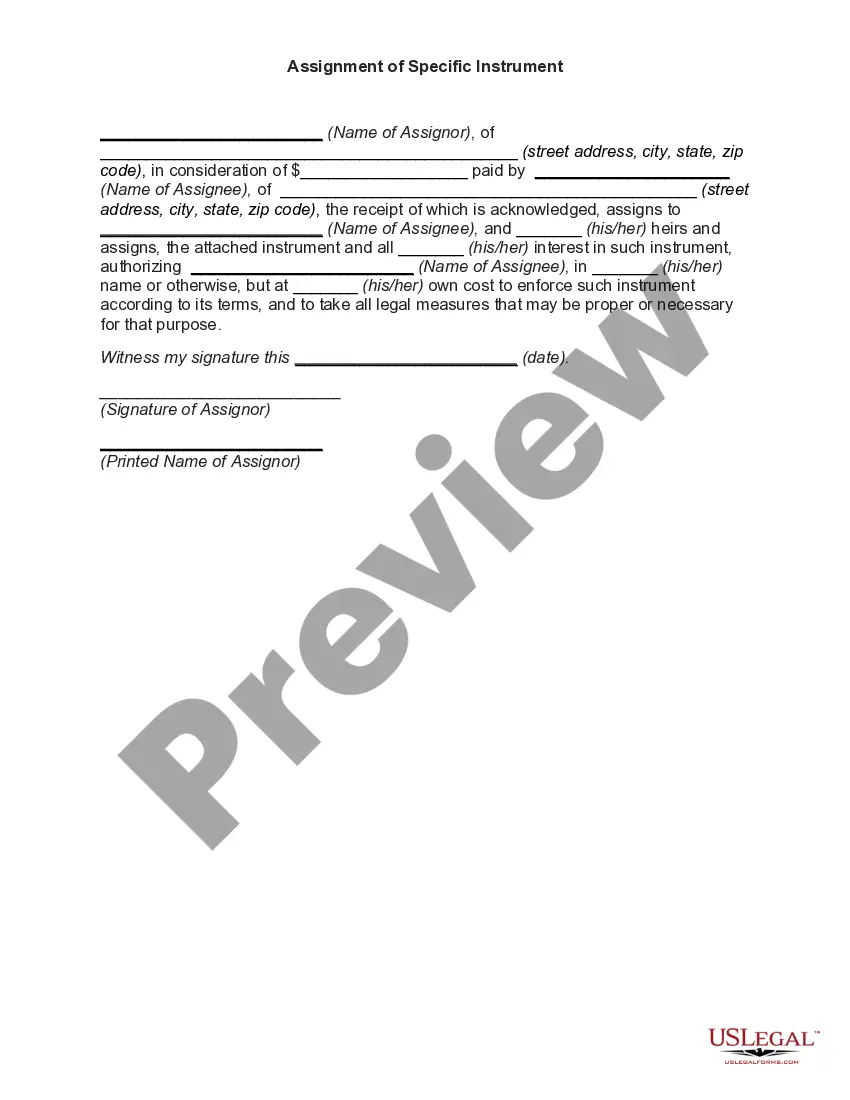

- If available, take advantage of the Review option to examine the document template as well.

- If you wish to find another version of the form, utilize the Lookup field to locate the template that fits your needs and specifications.

- Once you have found the template you require, click Purchase now to proceed.

- Select the pricing plan needed, enter your details, and sign up for your account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal form.

- Choose the format of the document and download it to your device.

- Make modifications to your document if necessary. You can complete, edit, and sign and print the Maryland Contract Administrator Agreement - Self-Employed Independent Contractor.

- Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms.

- Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

Yes, contract work counts as self-employment. When you enter into a contract to provide services, such as those outlined in a Maryland Contract Administrator Agreement - Self-Employed Independent Contractor, you are effectively running your own business. This arrangement offers flexibility and independence, allowing you to manage your work and clients as you see fit.

Micromanaging an independent contractor is generally not advisable. Independent contractors thrive on their autonomy and typically expect to complete tasks with minimal oversight. A Maryland Contract Administrator Agreement - Self-Employed Independent Contractor can help establish clear expectations without impinging on their independent working style, fostering a trusting and productive relationship.

Recent changes for self-employed individuals include updated tax regulations and rights to benefits. Staying informed about these changes is crucial for maintaining compliance. Obtaining a Maryland Contract Administrator Agreement - Self-Employed Independent Contractor can help navigate new legal requirements and ensure that your agreements reflect any new rules. Understanding these dynamics empowers you to manage your business effectively.

The terms self-employed and independent contractor can be used interchangeably, but they may convey slightly different connotations. Self-employed generally encompasses a broader category of individuals working for themselves, while independent contractors refer specifically to those working for clients under a contract. When discussing your work, a Maryland Contract Administrator Agreement - Self-Employed Independent Contractor can clarify your role and communicate your services effectively.

Yes, an independent contractor is typically considered self-employed. This classification means they operate their own business rather than working for an employer. With a Maryland Contract Administrator Agreement - Self-Employed Independent Contractor, you can reinforce your status and provide your clients with a formal understanding of your service terms. This clarity can lead to more successful working relationships.

Absolutely, a self-employed person can have a contract. Using a Maryland Contract Administrator Agreement - Self-Employed Independent Contractor is essential to define the scope of work and payment terms. Such contracts help secure your position and give both you and your client a clear understanding of expectations. Establishing a written agreement can greatly benefit your business relationships.

Yes, you can have a contract if you're self-employed. A Maryland Contract Administrator Agreement - Self-Employed Independent Contractor can provide a solid foundation for your work arrangements. This contract outlines the terms of your services, ensuring clarity between you and your clients. By having a contract, you protect your rights and responsibilities in your business dealings.

Filling out an independent contractor agreement involves careful attention to detail. Start by entering personal information, such as your name and that of the client. Next, specify the scope of work, payment arrangements, and timelines. For a comprehensive approach, you might want to use the Maryland Contract Administrator Agreement - Self-Employed Independent Contractor from USLegalForms, which guides you through the necessary sections.

In Maryland, independent contractors typically do not need workers' compensation insurance, but it can be beneficial. Workers' compensation coverage protects you in case of job-related injuries. Nevertheless, some clients may require you to have this insurance as a condition of the contract. To be prepared, refer to the Maryland Contract Administrator Agreement - Self-Employed Independent Contractor, which may include clauses regarding insurance requirements.

Yes, having a contract is crucial even if you are self-employed. A contract serves as a formal agreement that defines the terms and conditions of the services being offered. This document protects your rights and helps avoid misunderstandings with clients. When drafting the contract, look for resources like the Maryland Contract Administrator Agreement - Self-Employed Independent Contractor to ensure you include all necessary components.