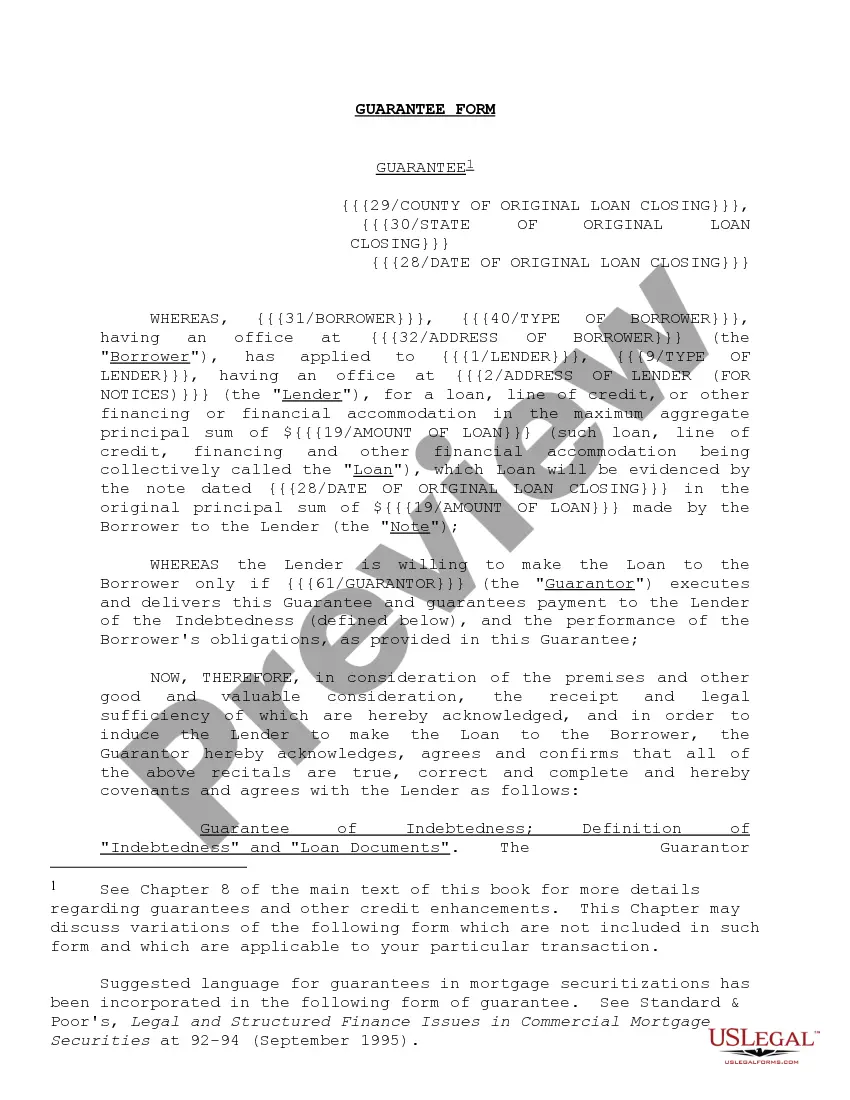

"Guarantee Form and Variations" is a American Lawyer Media form. This form is guarantee form and there different variations.

Maryland Guarantee Form and Variations

Description

How to fill out Guarantee Form And Variations?

Choosing the right legitimate record template can be a battle. Naturally, there are plenty of templates available on the Internet, but how would you find the legitimate form you will need? Use the US Legal Forms internet site. The services offers a huge number of templates, including the Maryland Guarantee Form and Variations, which you can use for organization and personal demands. Every one of the types are examined by specialists and meet up with federal and state needs.

When you are previously signed up, log in to your bank account and then click the Down load button to find the Maryland Guarantee Form and Variations. Utilize your bank account to search with the legitimate types you have acquired previously. Visit the My Forms tab of the bank account and obtain an additional version in the record you will need.

When you are a brand new customer of US Legal Forms, allow me to share basic guidelines that you should comply with:

- First, make certain you have chosen the right form for your personal town/area. You may examine the form using the Review button and study the form outline to guarantee this is the right one for you.

- If the form will not meet up with your preferences, utilize the Seach area to get the proper form.

- Once you are certain the form is proper, click on the Buy now button to find the form.

- Pick the rates plan you want and enter in the needed details. Design your bank account and buy the transaction using your PayPal bank account or Visa or Mastercard.

- Select the file structure and acquire the legitimate record template to your product.

- Comprehensive, edit and produce and signal the obtained Maryland Guarantee Form and Variations.

US Legal Forms is the largest catalogue of legitimate types that you will find numerous record templates. Use the company to acquire expertly-created papers that comply with express needs.

Form popularity

FAQ

Use Form 1040-X to correct any previously filed 1040. Keep in mind that Form 1040-X cannot be filed electronically; amended returns must be mailed to the IRS. Check the Form 1040-X instructions for your state's IRS Service Center address where you will mail the amended return.

Electing PTEs must file Form 511. Every other PTE that is subject to Maryland income tax law must file Form 510. A PTE that has credits in Maryland and a PTE that is a member of a PTE that is required to file in Maryland must file Form 511 if it is an Electing PTE, or Form 510 if it is not an Electing PTE.

How to Fill MW-507 Form Line 1 ? The line includes the total amount of personal exemptions. Line 2 ? Review additional withholdings. ... Line 3 ? Employees mark line 3 if they did not owe any Maryland income tax in the previous year and earned a full refund.

If you've made a mistake on your tax return, the first step is to file an amended return. The deadline for amending a return is typically three years after the original deadline, or two years after taxes were paid for that year ? whichever comes later.

If you need to make a change or adjustment on a return already filed, you can file an amended return. Use Form 1040-X, Amended U.S. Individual Income Tax Return, and follow the instructions.

To avoid delays, file Form 1040-X only after you've filed your original return. Generally, for a credit or refund, you must file Form 1040-X within 3 years after the date you filed your original return or within 2 years after the date you paid the tax, whichever is later.

Forms 502X, 505X, and 505NR are Forms used for the Tax Amendment. Current and previous tax year: You can NOT prepare a Maryland Tax Amendment on eFile.com, however you must mail in the amendment as you can not e-File a Maryland tax amendment.

You must file your Maryland Amended Form 502X electronically to claim, or change information related to, business income tax credits from Form 500CR. Changes made as part of an amended return are subject to audit for up to three years from the date that the amended return is filed.