Maryland Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Nonqualified Defined Benefit Deferred Compensation Agreement?

If you wish to accumulate, acquire, or print sanctioned document templates, utilize US Legal Forms, the premier collection of legal forms, accessible online.

Employ the site's straightforward and user-friendly search feature to locate the documents you require.

Various templates for business and personal uses are categorized by types and states, or keywords.

Step 4. Once you have identified the form you need, click the Get now button. Select your preferred pricing plan and enter your details to register for the account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Maryland Nonqualified Defined Benefit Deferred Compensation Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to find the Maryland Nonqualified Defined Benefit Deferred Compensation Agreement.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

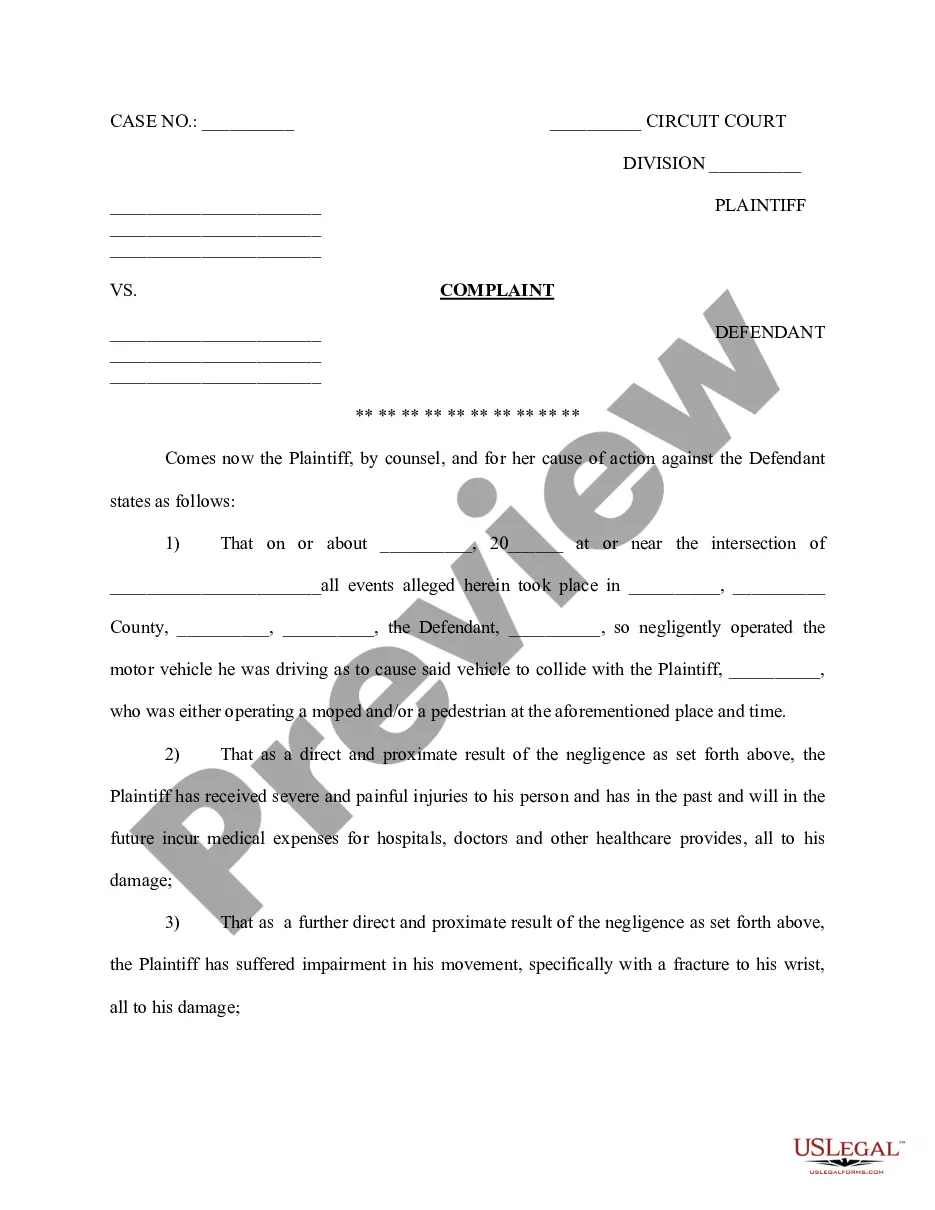

- Step 2. Use the Review option to peruse the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other templates in the legal form design.

Form popularity

FAQ

In Maryland, certain pensions and retirement accounts can be exempt from state taxes, providing valuable financial relief. Notably, pensions from the federal government, state of Maryland, and local government organizations often qualify for tax exemptions. Additionally, some forms of deferred compensation, including components of a Maryland Nonqualified Defined Benefit Deferred Compensation Agreement, may also have favorable tax treatments. It's essential to consult a financial advisor to navigate these complexities effectively.

457 plans are generally considered nonqualified deferred compensation plans. These plans, including those available in Maryland, allow state and local government employees to defer a portion of their income without facing immediate taxation. Thus, while they provide valuable benefits similar to a Maryland Nonqualified Defined Benefit Deferred Compensation Agreement, understanding their specific regulations is key to maximizing their advantages.

Nonqualified deferred compensation plans, including the Maryland Nonqualified Defined Benefit Deferred Compensation Agreement, do present some disadvantages. These plans may expose participants to higher risks, such as the possibility of employer insolvency, which could affect the security of deferred funds. Additionally, nonqualified plans do not receive the same favorable tax treatment as qualified plans until distributions occur, which could lead to unexpected tax burdens at withdrawal.

The classification of deferred compensation plans often depends on their design and regulatory compliance. Many plans are nonqualified, such as the Maryland Nonqualified Defined Benefit Deferred Compensation Agreement, which provides flexibility in terms of contributions and distributions. Participants can benefit from tax advantages that qualified plans may not offer. Understanding whether your plan is qualified or nonqualified is crucial for effective financial planning.

A deferred compensation plan can either be qualified or nonqualified, depending on how it meets certain tax regulations. A Maryland Nonqualified Defined Benefit Deferred Compensation Agreement is an example of a nonqualified plan that allows employees to defer income to a later date, often after retirement. This can be beneficial for high earners looking to save more for their future. In contrast, qualified plans must adhere to strict IRS guidelines which may limit contributions.

A nonqualified deferred compensation arrangement is a financial agreement that allows employees to defer a portion of their income until a later date, typically after retirement. This arrangement is especially beneficial for high-earning individuals, as it provides tax advantages while helping to secure retirement income. The Maryland Nonqualified Defined Benefit Deferred Compensation Agreement specifically offers these benefits to employees in Maryland, ensuring compliance with local laws. By using platforms like USLegalForms, you can easily create and manage these agreements to provide financial stability for yourself and your employees.

A nonqualified deferred compensation plan is an arrangement that allows employees to defer a portion of their income to a future date, typically retirement. Unlike qualified plans, these agreements do not have to adhere to strict IRS rules, offering greater flexibility. A Maryland Nonqualified Defined Benefit Deferred Compensation Agreement enables employers to provide additional benefits, often appealing to high-earning employees looking for ways to maximize their retirement savings.

Nonqualified deferred compensation plans can be an excellent idea for businesses seeking to attract and retain top talent. These plans provide flexibility and can be tailored to meet unique company needs. With a Maryland Nonqualified Defined Benefit Deferred Compensation Agreement, you can incentivize key employees while providing a valuable tax-deferred compensation option that enhances employee satisfaction.

To set up a nonqualified deferred compensation plan, start by defining the benefits you want to offer employees. Next, draft a Maryland Nonqualified Defined Benefit Deferred Compensation Agreement with the assistance of legal and financial professionals. This agreement should outline contribution limits, eligibility criteria, and distribution rules to ensure it aligns with your objectives and retains key talent.

Setting up a nonqualified deferred compensation plan requires careful planning and a clear understanding of your business goals. Begin by consulting with a financial advisor or attorney who specializes in such agreements. They can help you design a Maryland Nonqualified Defined Benefit Deferred Compensation Agreement that meets your business needs while ensuring compliance with regulatory requirements.