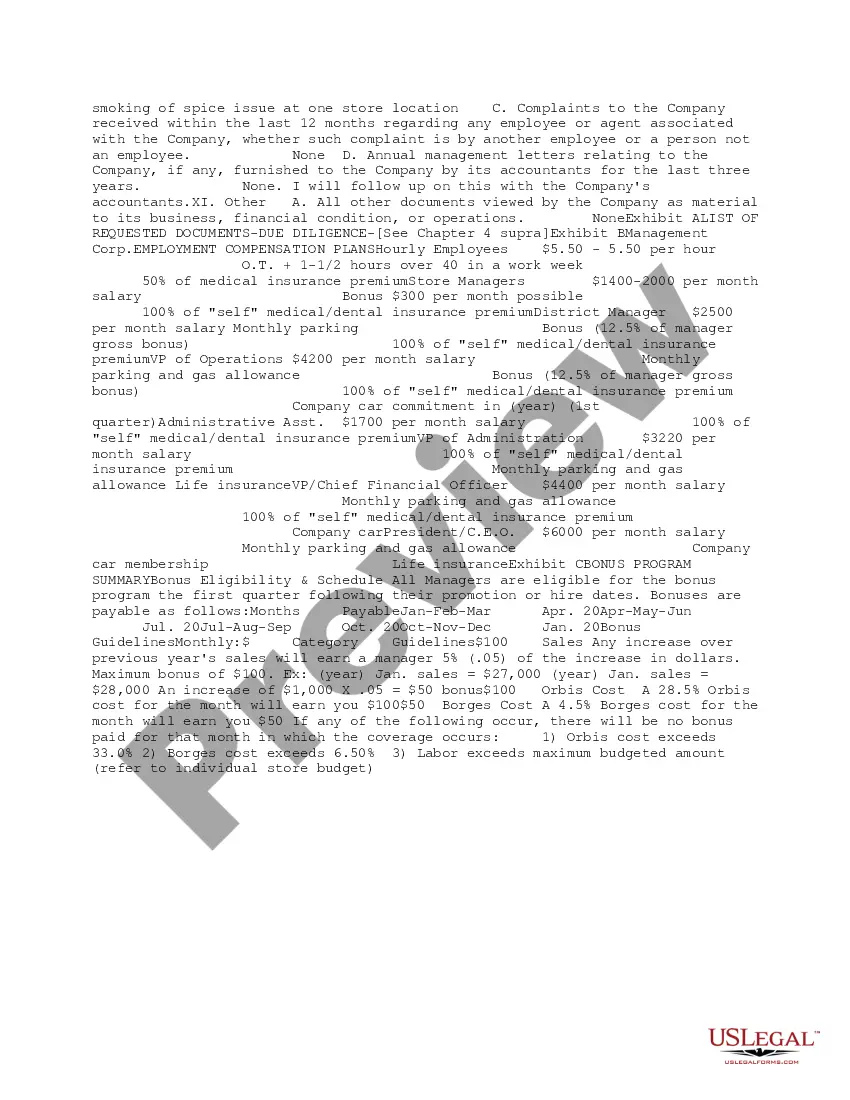

This due diligence form is a memorandum that summarizes the review of documents and the formation produced by a company in response to a list of requested materials.

Maryland Summary Initial Review of Response to Due Diligence Request

Description

How to fill out Summary Initial Review Of Response To Due Diligence Request?

Selecting the appropriate official document format can be quite challenging.

Of course, there are numerous templates accessible online, but how can you acquire the official format you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Maryland Summary Initial Review of Response to Due Diligence Request, which you can utilize for business and personal purposes.

Initially, ensure you have selected the correct form for your city or county. You can view the form using the Preview button and review the form details to confirm it is suitable for you.

- All of the documents are reviewed by experts and satisfy state and federal requirements.

- If you are already registered, Log In to your account and then click the Acquire button to obtain the Maryland Summary Initial Review of Response to Due Diligence Request.

- Use your account to search through the official documents you have previously ordered.

- Visit the My documents tab of your account and obtain another copy of the document you need.

- If you are a first-time user of US Legal Forms, here are simple instructions that you can follow.

Form popularity

FAQ

The due diligence process of a proposal review involves a careful examination of proposed agreements or projects. This includes assessing financial viability, legal ramifications, and operational implications. By conducting a Maryland Summary Initial Review of Response to Due Diligence Request, you can identify potential risks and validate the proposal's integrity. Utilizing solutions like uslegalforms can streamline this process effectively.

In Maryland, you generally have 30 days to respond to discovery requests. This timeframe applies to various types of discovery, including interrogatories and requests for production of documents. It is crucial to meet this deadline to avoid court penalties. For a thorough understanding, consider a Maryland Summary Initial Review of Response to Due Diligence Request to ensure compliance with your obligations.

Rule 1 323 in Maryland outlines the procedures for submitting a Summary Initial Review of Response to a Due Diligence Request. This rule ensures that parties involved in legal proceedings adhere to standardized protocols, promoting efficiency and clarity. Understanding Rule 1 323 can significantly impact your ability to navigate the legal landscape effectively. For those seeking to manage their due diligence requests, US Legal Forms provides a reliable platform to streamline this process and ensure compliance.

In Maryland, summary judgment rules allow a party to win a case without a full trial if there are no disputes over the important facts. To succeed, the party must demonstrate that they are entitled to judgment as a matter of law. If you consider the implications for the Maryland Summary Initial Review of Response to Due Diligence Request, understanding these rules can significantly impact your legal strategy and outcomes.

In Maryland, due diligence requirements for unclaimed property involve specific notifications and reporting. Entities must generally contact property owners before reporting unclaimed property to the state. Completing the Maryland Summary Initial Review of Response to Due Diligence Request ensures you fulfill all obligations and adhere to the legal requirements concerning unclaimed property.

A due diligence review is a thorough examination of information and documents related to a transaction or investment. This process helps you assess risks and confirm the accuracy of claims made by another party. Understanding this review is crucial for the Maryland Summary Initial Review of Response to Due Diligence Request, as it provides insight into potential liabilities and identifies areas needing further investigation.

The due diligence process generally includes several key steps. Initially, you should identify the purpose and scope of the review, focusing on your specific objectives. Next, collect relevant documentation and information necessary for the Maryland Summary Initial Review of Response to Due Diligence Request. Finally, analyze the findings and make informed decisions based on the results.

A due diligence summary is a condensed report compiling key findings from the due diligence process. It highlights the most important information regarding an organization’s financial status, operational viability, and any potential risks identified. In the context of a Maryland Summary Initial Review of Response to Due Diligence Request, such a summary is vital for stakeholders as it provides a clear overview, facilitating informed decision-making.

Responding to due diligence requests requires a strategic approach, where you gather all pertinent documents and provide clear, concise information. This may include financial records, contracts, and operational policies. A well-prepared Maryland Summary Initial Review of Response to Due Diligence Request can streamline this process by organizing the information and addressing typical concerns raised by potential partners. This ensures you present your company in the best light.

A good example of due diligence is a company reviewing the financial records and history of a business it intends to acquire. This includes verifying past earnings, assessing liabilities, and understanding market position. In a Maryland Summary Initial Review of Response to Due Diligence Request context, summarizing these findings enables clearer insights and sound decision-making, reducing potential risks during the acquisition process.