This form is a memorandum summarizes the results of a due diligence investigation relating to the possible acquisition of a company.

Maryland Executive Summary of Preliminary Due Diligence Findings

Description

How to fill out Executive Summary Of Preliminary Due Diligence Findings?

If you wish to acquire, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site’s straightforward and user-friendly search feature to find the documents you require. A variety of templates for business and personal uses are organized by categories and regions, or keywords.

Use US Legal Forms to locate the Maryland Executive Summary of Preliminary Due Diligence Findings with just a few clicks.

Every legal document template you obtain is yours permanently. You have access to every form you have downloaded in your account. Click on the My documents section and select a form to print or download again.

Download and print the Maryland Executive Summary of Preliminary Due Diligence Findings using US Legal Forms. There are numerous professional and state-specific templates you can use for your business or personal needs.

- If you are already a US Legal Forms member, Log In to your account and select the Download option to retrieve the Maryland Executive Summary of Preliminary Due Diligence Findings.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for your corresponding city/state.

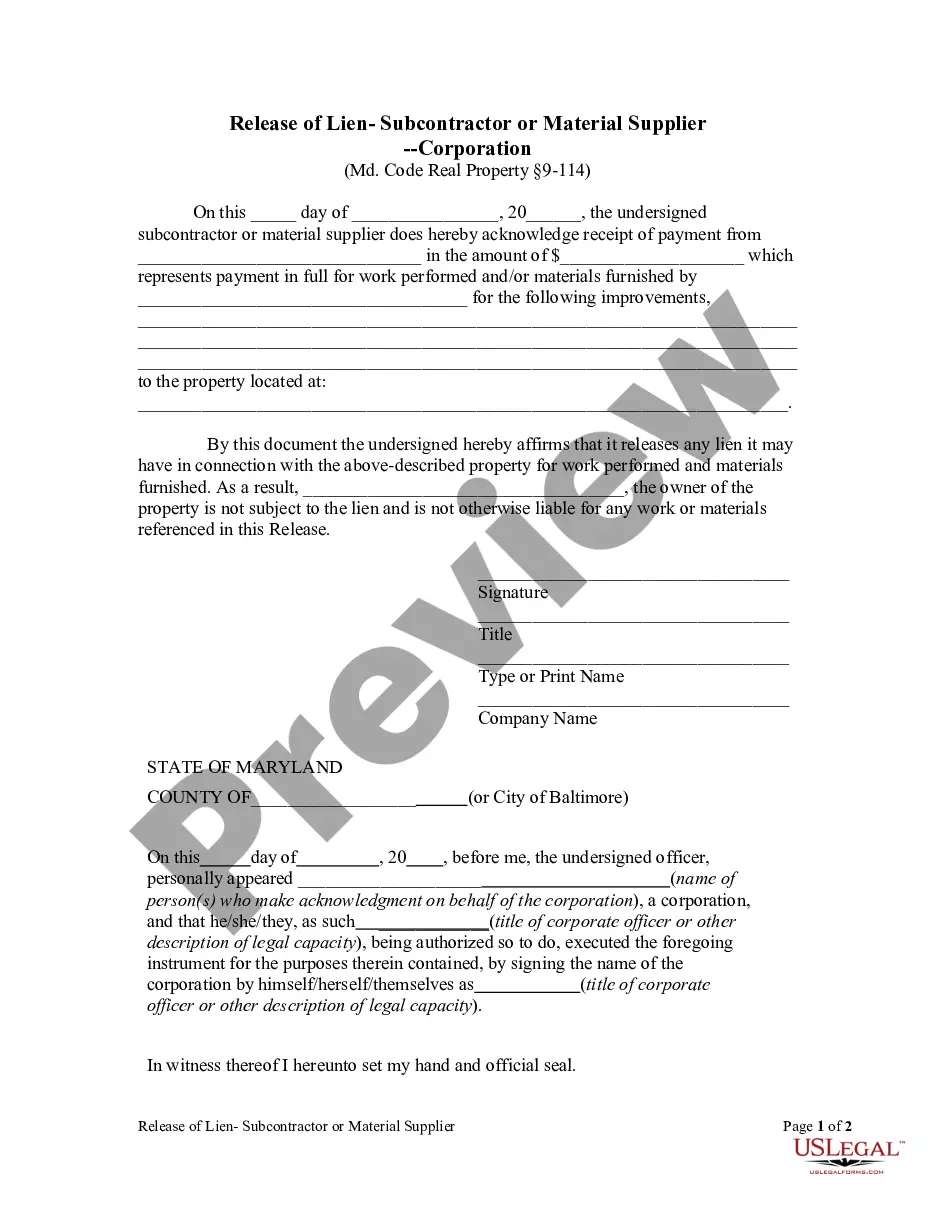

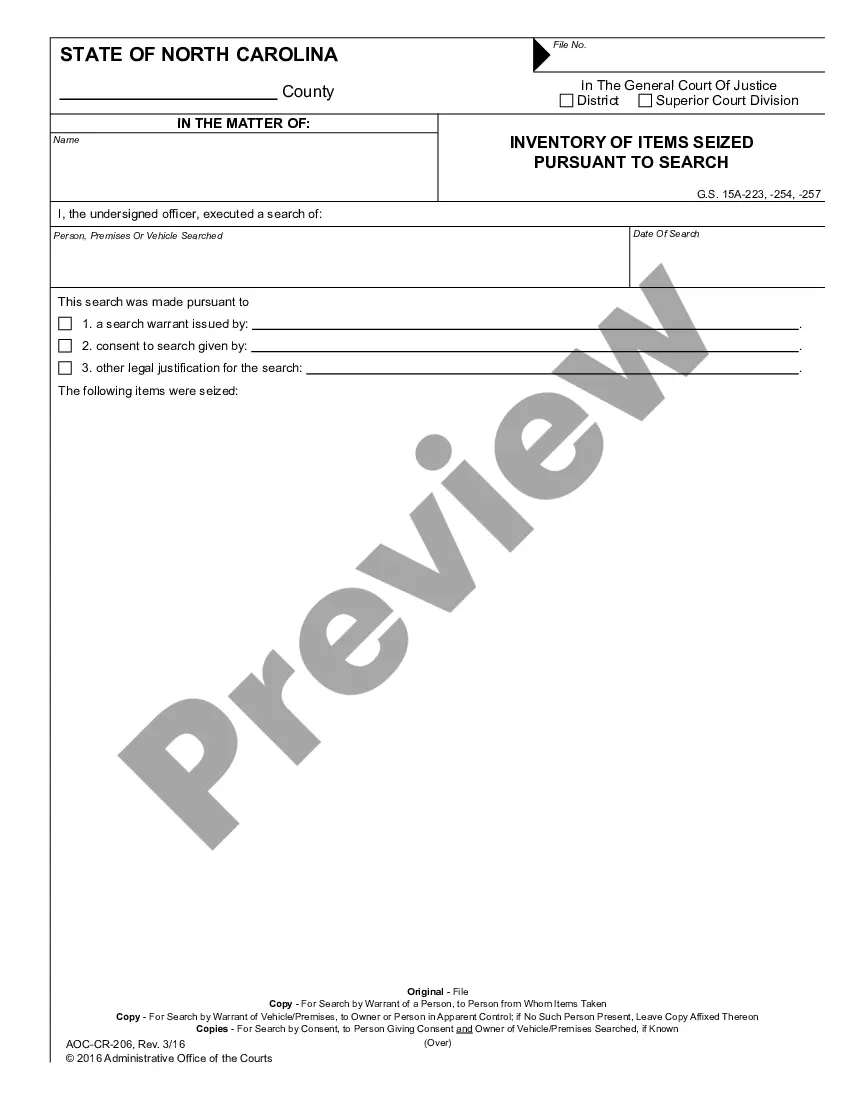

- Step 2. Use the Preview option to review the details of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the page to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Buy now button. Choose the pricing plan you prefer and provide your information to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the payment.

- Step 6. Choose the format of the legal form and download it onto your device.

- Step 7. Complete, modify, and print or sign the Maryland Executive Summary of Preliminary Due Diligence Findings.

Form popularity

FAQ

Completing due diligence involves a systematic approach to investigating all relevant aspects of a potential deal. Start by gathering necessary documents, performing a financial analysis, and reviewing legal compliance. Structured reporting, such as the Maryland Executive Summary of Preliminary Due Diligence Findings, helps present your findings clearly. Utilizing platforms like USLegalForms can equip you with the needed templates and guidance to ensure a thorough process.

When proving due diligence, consider the thoroughness of your investigation, the relevance of the documents reviewed, and the compliance with applicable laws. Each factor plays a crucial role in demonstrating that you have taken reasonable actions to assess risks and values. Incorporating insights from the Maryland Executive Summary of Preliminary Due Diligence Findings can enhance your strategic approach. USLegalForms offers valuable resources to help clarify these elements.

Filling a due diligence form requires gathering accurate information and reviewing relevant documentation. Start by collecting financial statements, operational data, and legal contracts. Use clear and concise language when documenting findings. If you are unsure, the Maryland Executive Summary of Preliminary Due Diligence Findings offers guidance on key components, and USLegalForms offers templates that simplify the filling process.

A due diligence report sample typically includes various sections such as executive summary, financial analysis, and legal compliance overview. This document serves as an overview of the findings during the due diligence process, helping stakeholders make informed decisions. For those focusing on Maryland Executive Summary of Preliminary Due Diligence Findings, accessing tailored templates can streamline creating your report. Platforms like USLegalForms can provide useful resources.

The 4 P's of due diligence refer to Purpose, Property, People, and Paper. Understanding these elements allows businesses to evaluate the necessity of the transaction, the asset involved, the personnel used, and the legal documents generated. Each P contributes vital insights into the overall assessment process. By integrating Maryland Executive Summary of Preliminary Due Diligence Findings into your strategy, you enhance your analytical approach.

Creating a due diligence report involves gathering, analyzing, and summarizing relevant information about a business or property. Start by identifying key areas such as financials, legal compliance, and operational risks. For a Maryland Executive Summary of Preliminary Due Diligence Findings, you may want to leverage tools and resources from platforms like uslegalforms to ensure thoroughness and accuracy. Finally, compile your findings into a clear document that effectively communicates risks and opportunities.

A legal due diligence executive summary distills complex legal findings into a clear, concise format. In the context of a Maryland Executive Summary of Preliminary Due Diligence Findings, this document highlights essential legal risks and compliance requirements. It enables professionals to quickly grasp the legal landscape surrounding their transactions. Consequently, such a summary aids in informed decision-making and risk management.

Yes, Maryland follows the principles of due diligence, making thorough investigations necessary for various transactions. When drafting a Maryland Executive Summary of Preliminary Due Diligence Findings, individuals and businesses must adhere to legal standards and industry best practices to safeguard their interests. This process ensures that all relevant information is reviewed and understood. Thus, being informed is crucial to making sound decisions in Maryland.

A due diligence summary provides a comprehensive overview of crucial findings from preliminary investigations into a business or property. In the context of a Maryland Executive Summary of Preliminary Due Diligence Findings, the summary highlights significant risks, compliance issues, and potential opportunities. This summary is essential for decision-makers to assess the viability of their investments. Overall, it serves as a foundational document for subsequent actions.