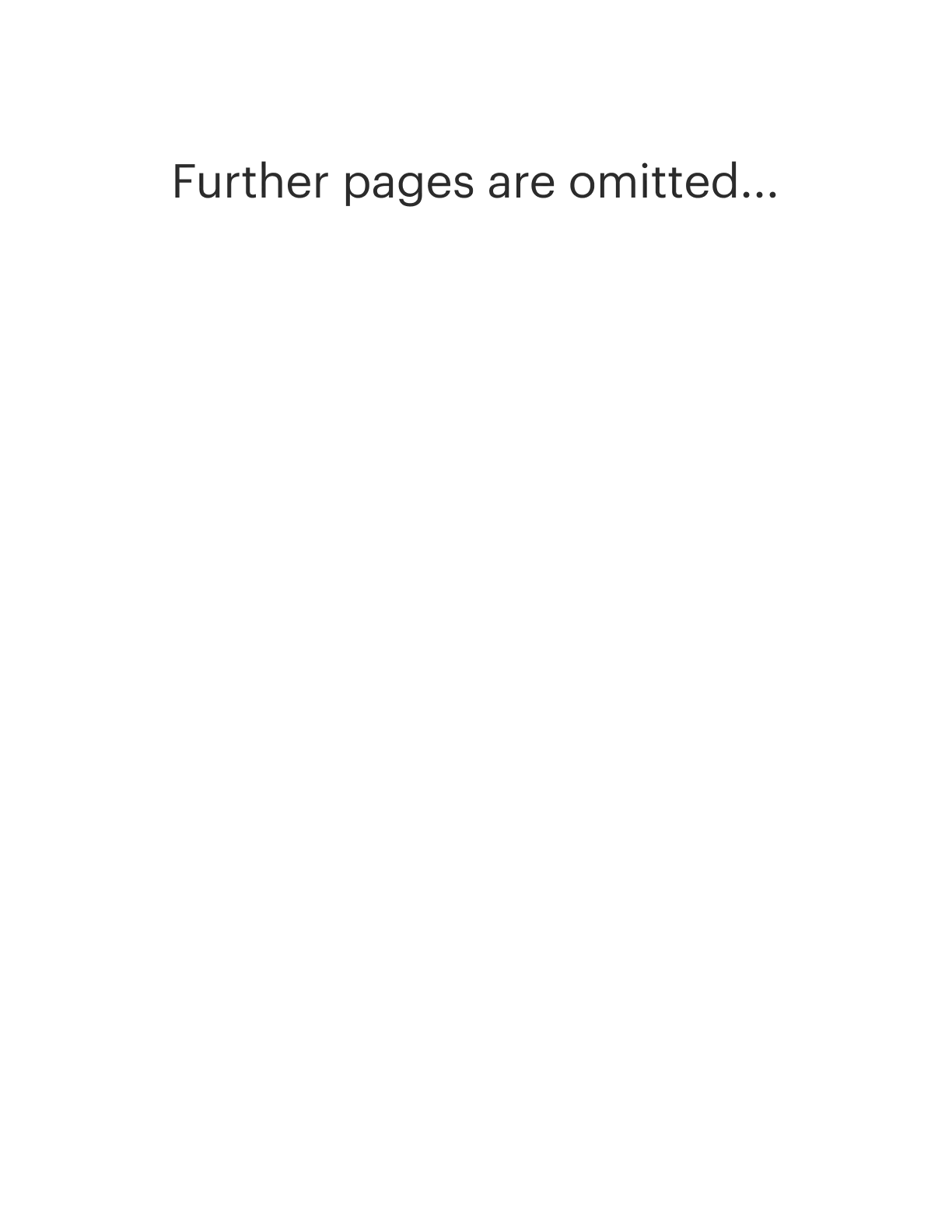

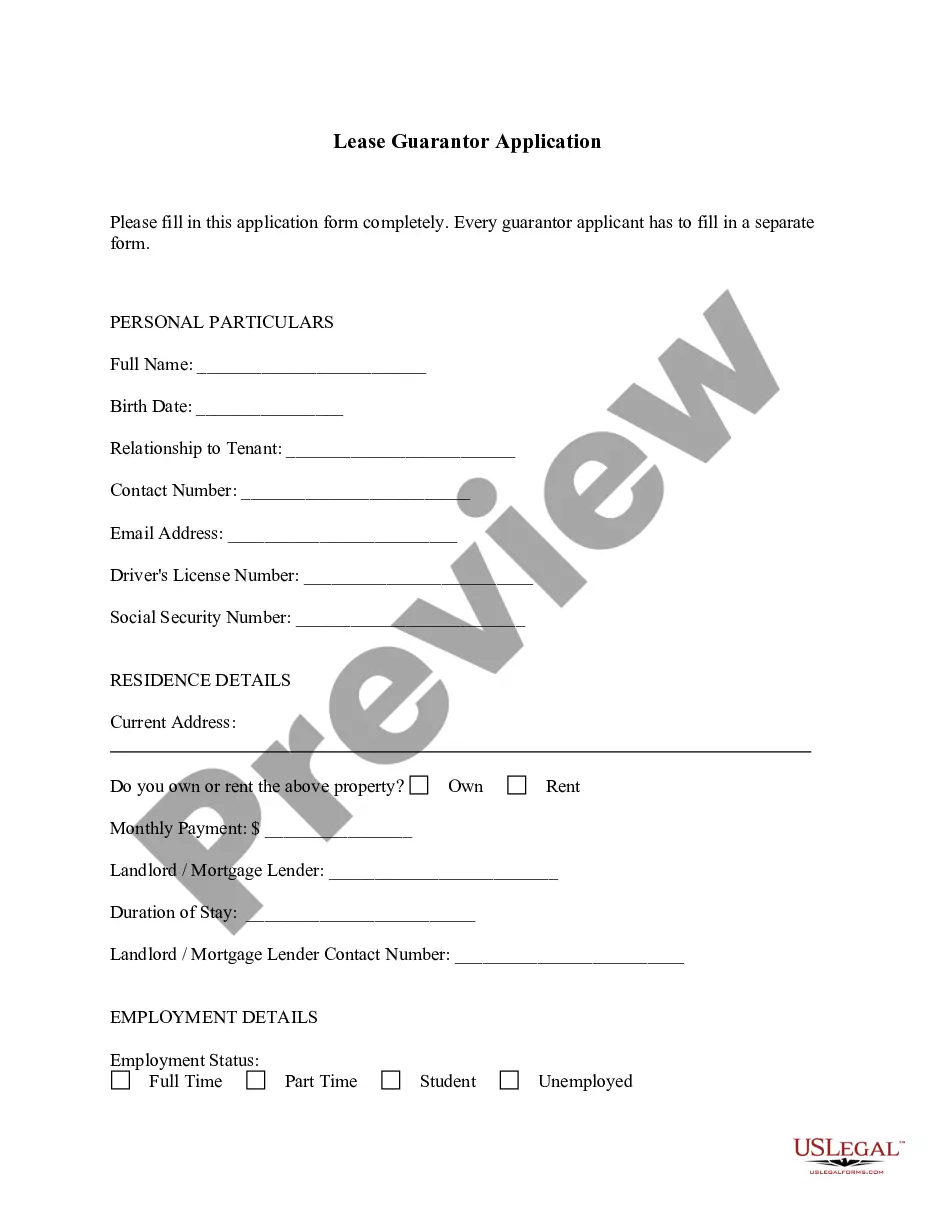

North Carolina Information Statement - Common Stock

Description

How to fill out Information Statement - Common Stock?

If you have to full, obtain, or print out legitimate record templates, use US Legal Forms, the largest assortment of legitimate forms, which can be found online. Use the site`s simple and easy hassle-free lookup to obtain the documents you want. Different templates for business and personal functions are categorized by groups and says, or keywords and phrases. Use US Legal Forms to obtain the North Carolina Information Statement - Common Stock in just a couple of mouse clicks.

Should you be currently a US Legal Forms customer, log in to the bank account and click the Obtain key to find the North Carolina Information Statement - Common Stock. You can also entry forms you formerly acquired from the My Forms tab of your own bank account.

Should you use US Legal Forms the first time, follow the instructions under:

- Step 1. Make sure you have selected the shape for the right metropolis/country.

- Step 2. Take advantage of the Review choice to look through the form`s information. Never forget about to see the information.

- Step 3. Should you be not satisfied together with the develop, use the Lookup field on top of the display screen to get other versions of the legitimate develop template.

- Step 4. Upon having found the shape you want, click on the Purchase now key. Choose the rates strategy you prefer and add your accreditations to register for the bank account.

- Step 5. Method the transaction. You should use your Мisa or Ьastercard or PayPal bank account to complete the transaction.

- Step 6. Choose the structure of the legitimate develop and obtain it on your gadget.

- Step 7. Total, modify and print out or indication the North Carolina Information Statement - Common Stock.

Each and every legitimate record template you get is the one you have permanently. You may have acces to each and every develop you acquired in your acccount. Click on the My Forms area and pick a develop to print out or obtain once again.

Remain competitive and obtain, and print out the North Carolina Information Statement - Common Stock with US Legal Forms. There are thousands of expert and state-particular forms you can utilize for your business or personal requires.

Form popularity

FAQ

Trusts and estates are taxed at the rate levied in N.C. Gen. Stat. 105-153.7 for individual income tax.

The North Carolina Offer In Compromise program allows qualifying, financially distressed taxpayers the opportunity to put overwhelming tax liabilities behind them by paying a lump sum amount in exchange for the liability being settled in full. The law provides specific re- quirements for accepting an offer.

Your living trust North Carolina keeps your assets from needing to go through probate. Probate is the court process through which a will is verified and carried out. These procedures can take months to complete and involve the costs of an executor, attorney, and court fees.

Income from a trust is taxable, which is a major downside for beneficiaries. The trust itself must file a tax return when the trustor passes away, as there are no real tax benefits for trusts. However, this is often preferable to probate court, where a judge takes similar actions with the deceased's assets.

You must file a North Carolina income tax return if you received income while being a resident of NC or received income from NC sources. If you had North Carolina income tax withheld but do not meet the filing requirements, you must file a North Carolina return in order to receive a refund for any withholdings.