Maryland Personal Property - Schedule B - Form 6B - Post 2005

Description

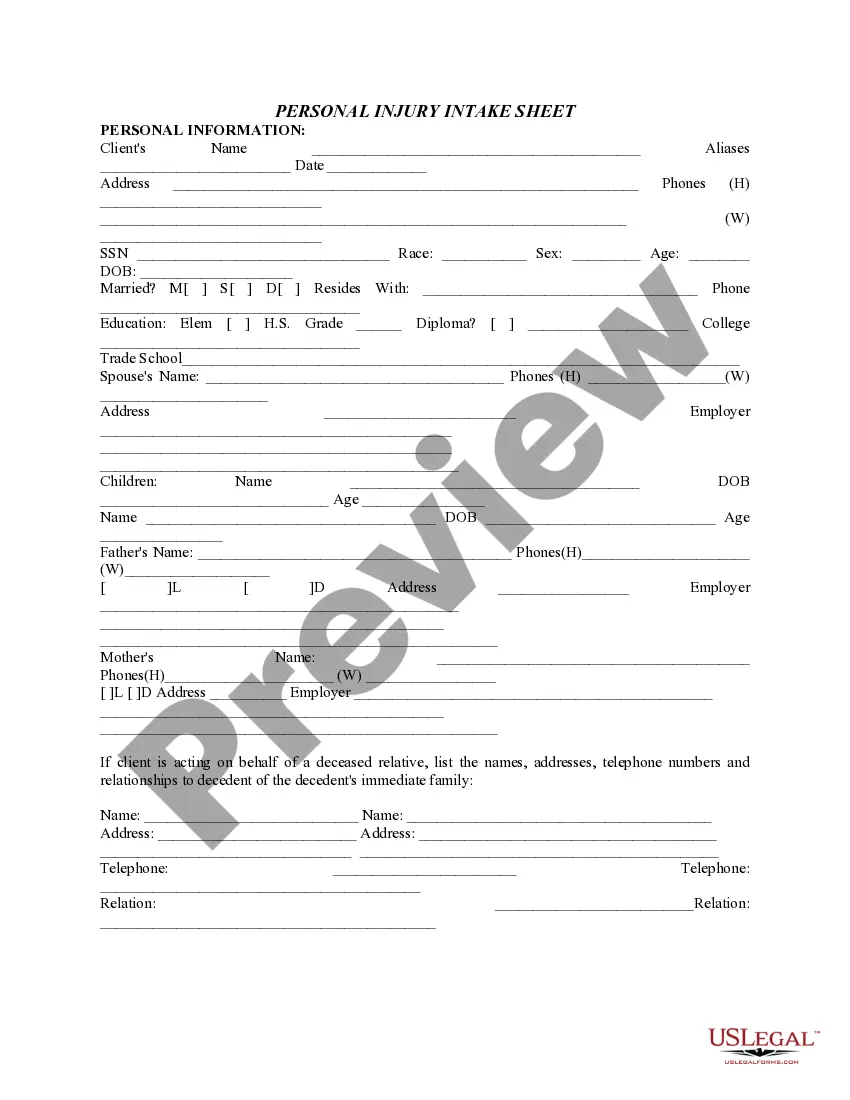

How to fill out Personal Property - Schedule B - Form 6B - Post 2005?

US Legal Forms - among the largest libraries of authorized forms in America - gives a wide array of authorized file templates it is possible to down load or produce. Making use of the internet site, you can find 1000s of forms for company and specific reasons, sorted by categories, suggests, or keywords and phrases.You will find the most up-to-date variations of forms like the Maryland Personal Property - Schedule B - Form 6B - Post 2005 within minutes.

If you already have a membership, log in and down load Maryland Personal Property - Schedule B - Form 6B - Post 2005 in the US Legal Forms library. The Acquire switch will appear on every single type you look at. You have accessibility to all earlier delivered electronically forms within the My Forms tab of your bank account.

If you would like use US Legal Forms for the first time, here are straightforward guidelines to get you started off:

- Make sure you have selected the best type for your personal city/region. Select the Review switch to check the form`s content. Browse the type explanation to ensure that you have selected the appropriate type.

- When the type doesn`t match your specifications, make use of the Research field at the top of the display to discover the one that does.

- When you are content with the shape, affirm your decision by clicking the Acquire now switch. Then, pick the pricing program you want and offer your references to register to have an bank account.

- Process the purchase. Make use of your credit card or PayPal bank account to accomplish the purchase.

- Pick the formatting and down load the shape on the device.

- Make modifications. Load, modify and produce and signal the delivered electronically Maryland Personal Property - Schedule B - Form 6B - Post 2005.

Every design you included in your account lacks an expiry day and is your own property permanently. So, in order to down load or produce an additional copy, just check out the My Forms portion and then click on the type you will need.

Obtain access to the Maryland Personal Property - Schedule B - Form 6B - Post 2005 with US Legal Forms, probably the most considerable library of authorized file templates. Use 1000s of skilled and state-certain templates that fulfill your company or specific demands and specifications.

Form popularity

FAQ

Personal Property Tax Returns are due to the SDAT by April 15th each year. Extensions of the filing deadline up to 60 days can be granted if the requests are made on or before April 15th. Visit SDAT to file an extension.

Responsibility for the assessment of all personal property throughout Maryland rests with the Department of Assessments and Taxation. Personal property generally includes furniture, fixtures, office and industrial equipment, machinery, tools, supplies, inventory and any other property not classified as real property.

BUSINESS PERSONAL PROPERTY RETURN An Annual Report must be filed by all business entities formed, qualified or registered to do business in the State of Maryland, as of January 1st.

You can pay your taxes online, by mail or in person. Search and pay for real or personal property tax information online. Note: You will need a parcel ID, account number or property address, which you will find on your tax bill.

All other returns (including those without payment by check or money order), other payments, and correspondence regarding your personal or business tax account(s) should be sent to:: Comptroller of Maryland, Revenue Administration Division, 110 Carroll Street, Annapolis, Maryland 21411-0001.

To file, you must download and print the Annual Personal Property Return form from the Secretary of State website. Then, complete it mail in to the Maryland State Department of Assessments and Taxation along with the filing form.

Amended returns or second filings are to be sent to the Department of Assessments and Taxation, Personal Property Division, 301 W. Preston Street, Baltimore, MD 21201-2395.