Maryland Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005

Description

This form is data enabled to comply with CM/ECF electronic filing standards. This form is for post 2005 act cases.

How to fill out Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005?

You can invest several hours on-line attempting to find the legitimate record template which fits the federal and state demands you require. US Legal Forms offers 1000s of legitimate types which can be reviewed by specialists. It is possible to acquire or produce the Maryland Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005 from our assistance.

If you already have a US Legal Forms accounts, you can log in and click on the Download button. Following that, you can full, revise, produce, or signal the Maryland Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005. Each legitimate record template you purchase is the one you have permanently. To acquire another version associated with a obtained develop, proceed to the My Forms tab and click on the related button.

If you work with the US Legal Forms site initially, adhere to the straightforward directions listed below:

- Very first, ensure that you have chosen the best record template for that area/city of your choosing. Look at the develop description to ensure you have chosen the right develop. If available, make use of the Review button to appear from the record template as well.

- If you wish to find another version of your develop, make use of the Search field to discover the template that fits your needs and demands.

- When you have identified the template you desire, just click Buy now to move forward.

- Choose the pricing prepare you desire, type in your credentials, and register for a free account on US Legal Forms.

- Complete the transaction. You should use your credit card or PayPal accounts to fund the legitimate develop.

- Choose the format of your record and acquire it to your system.

- Make adjustments to your record if required. You can full, revise and signal and produce Maryland Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005.

Download and produce 1000s of record themes using the US Legal Forms website, that offers the most important assortment of legitimate types. Use expert and express-distinct themes to tackle your company or specific requirements.

Form popularity

FAQ

Some of the most common types of unsecured creditors include credit card companies, utilities, landlords, hospitals and doctor's offices, and lenders that issue personal or student loans (though education loans carry a special exception that prevents them from being discharged). Unsecured Creditor Defined, Types, vs. Secured Creditor - Investopedia investopedia.com ? terms ? unsecuredcreditor investopedia.com ? terms ? unsecuredcreditor

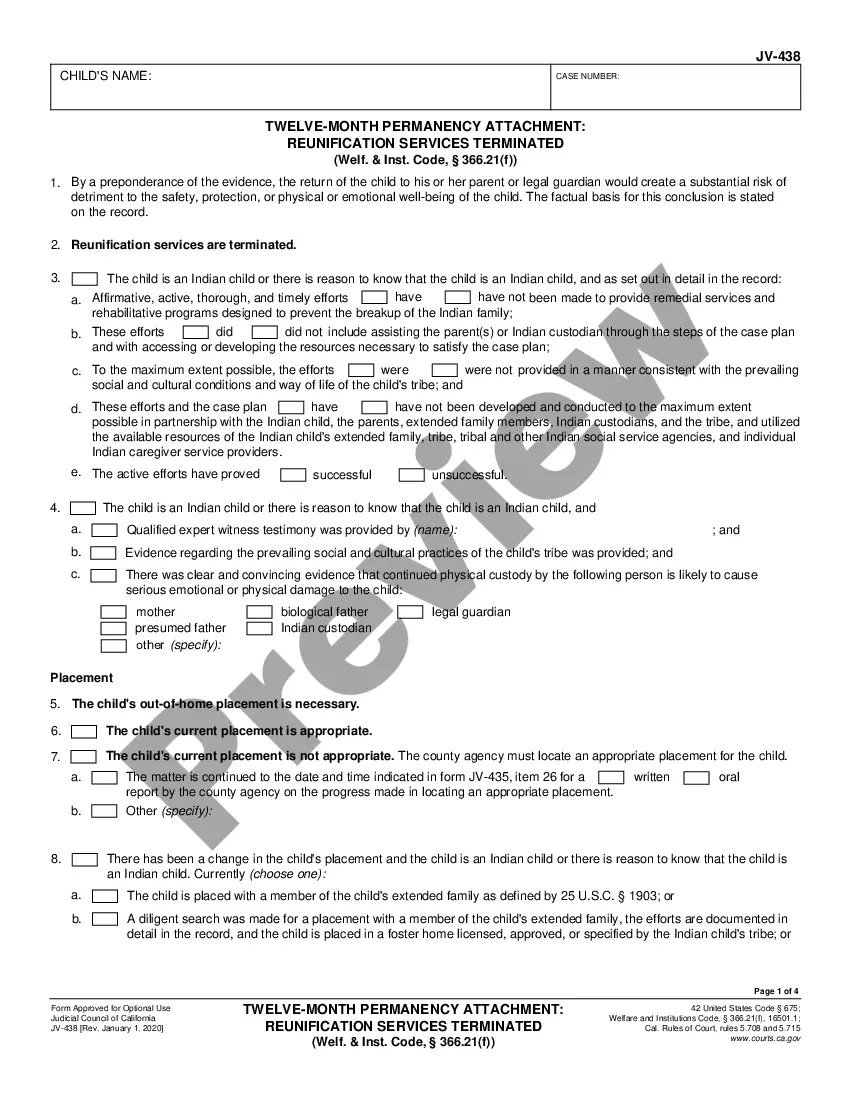

Schedule D is part of a series of documents a debtor files with the bankruptcy court. It is formally called "Official Bankruptcy Form 106D" or "Schedule D - Creditors Who Have Claims Secured by Property." Unlike unsecured debts like medical bills or credit cards, secured debts have collateral like cars and houses.

Unsecured Creditors, like credit card issuers, suppliers, and some cash advance companies (although this is changing), do not hold a lien on its debtor's property to assure payment of the debt if there is a default. The secured creditor holds priority on debt collection from the property on which it holds a lien.