Maryland Basic Debt Instrument Workform

Description

How to fill out Basic Debt Instrument Workform?

If you require to access, download, or print sanctioned document templates, utilize US Legal Forms, the finest collection of legal forms available online.

Take advantage of the website's intuitive and user-friendly search function to find the documentation you need.

Numerous templates for commercial and individual uses are categorized by types and states, or keywords.

Step 4. After locating the form you need, click the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the Maryland Basic Debt Instrument Form within just a few clicks.

- If you are already a US Legal Forms member, Log Into your account and click the Download button to access the Maryland Basic Debt Instrument Form.

- You can also retrieve forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

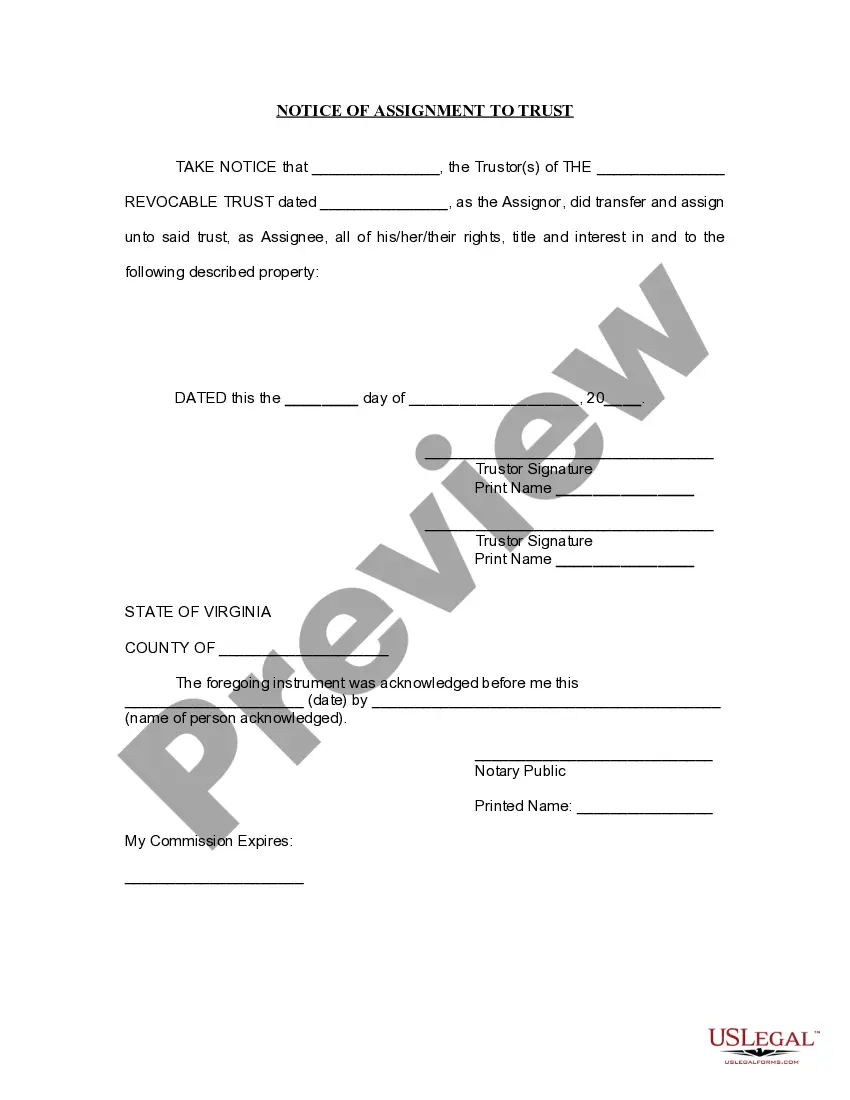

- Step 2. Use the Review feature to examine the form’s details. Don't forget to read the description.

- Step 3. If you are unsatisfied with the template, use the Search feature at the top of the page to find alternative versions of the legal form template.

Form popularity

FAQ

There are different types of Debt Instruments available in India such as;Bonds.Certificates of Deposit.Commercial Papers.Debentures.Fixed Deposit (FD)G - Secs (Government Securities)National savings Certificate (NSC)

Under the amortized cost method, the debt investment is initially recorded as an asset at its cost; any excess of the purchase price over par value is recorded as bond premium and any excess of par value over bond price is recorded as a bond discount.

A debt instrument is a fixed income asset that allows the lender (or giver) to earn a fixed interest on it besides getting the principal back while the issuer (or taker) can use it to raise funds at a cost.

A company lists its long-term debt on its balance sheet under liabilities, usually under a subheading for long-term liabilities.

A debt instrument is an asset that individuals, companies, and governments use to raise capital or to generate investment income. Investors provide fixed-income asset issuers with a lump-sum in exchange for interest payments at regular intervals.

Credit cards, credit lines, loans, and bonds can all be types of debt instruments. Typically, the term debt instrument primarily focuses on debt capital raised by institutional entities.

Held-to-maturity debt investments are accounted for using the amortized cost; trading debt investments are carried at fair value and any changes in fair value are reported in income statement and the available for sale debt investments are carried at fair value and any changes in fair value are reported other

2.2 The four basic categories of debt instruments are simple loans, discount bonds, coupon bonds, and fixed-payment loans.

Debt instruments are assets that require a fixed payment to the holder, usually with interest. Examples of debt instruments include bonds (government or corporate) and mortgages. The equity market (often referred to as the stock market) is the market for trading equity instruments.

If the debt is payable in more than one year, record the debt in a long-term debt account. This is a liability account. If the debt is in the form of a credit card statement, this is typically handled as an account payable, and so is simply recorded through the accounts payable module in the accounting software.