Maryland Post-Employment Information Sheet

Description

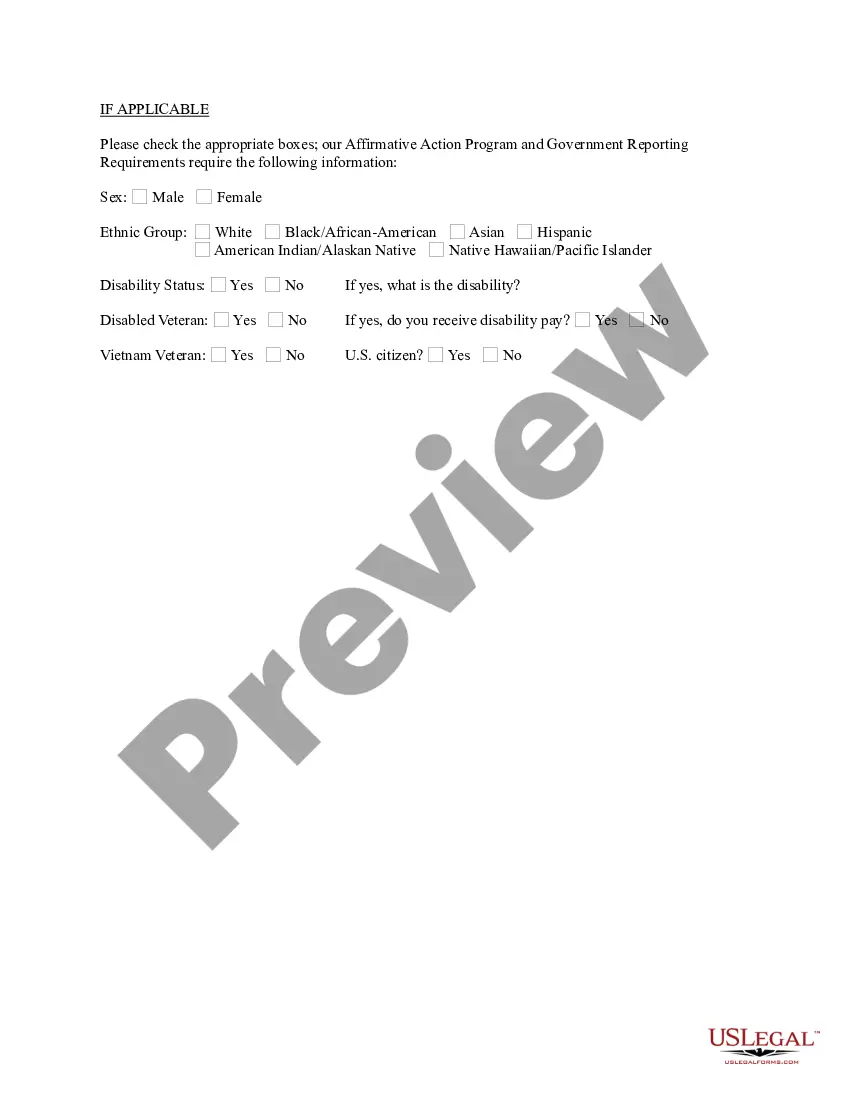

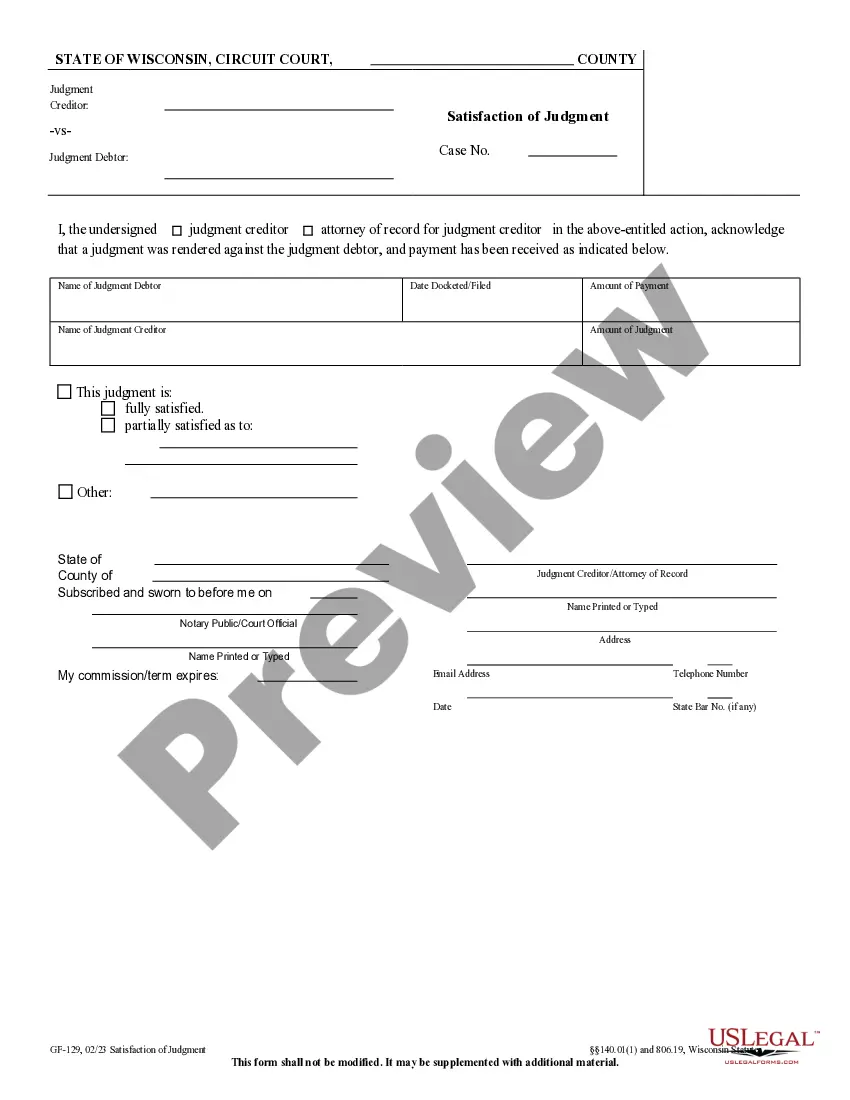

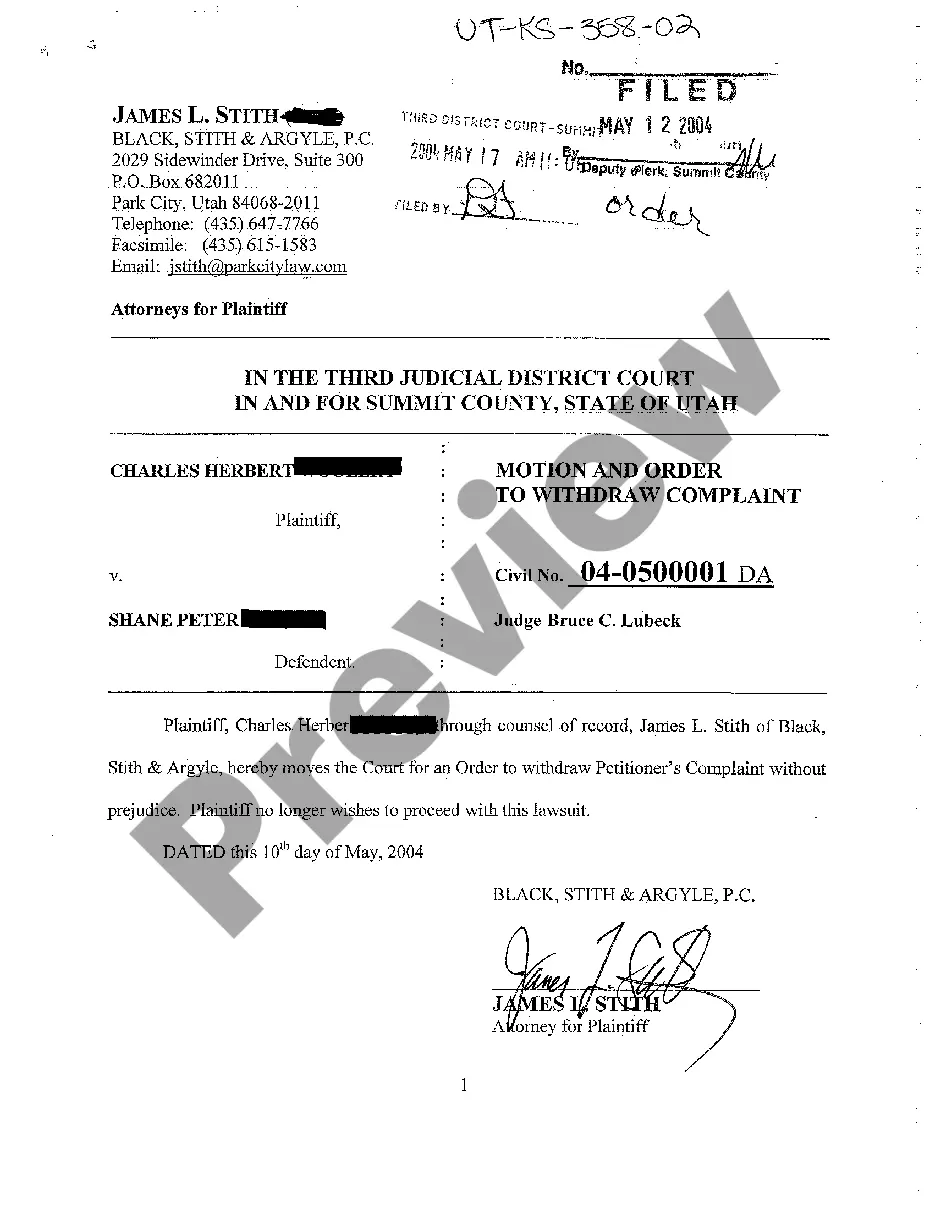

How to fill out Post-Employment Information Sheet?

If you need to finalize, acquire, or print out sanctioned document templates, utilize US Legal Forms, the prime repository of legal forms, accessible online.

Leverage the site's straightforward and user-friendly search to locate the documents you require.

Various templates for commercial and personal purposes are organized by categories and jurisdictions, or keywords.

Every legal document template you retrieve is yours permanently. You have access to every form you downloaded in your account. Click the My documents area and select a form to print or download again.

Stay competitive and download, and print the Maryland Post-Employment Information Sheet with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to acquire the Maryland Post-Employment Information Sheet in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the Maryland Post-Employment Information Sheet.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to read the details.

- Step 3. If you are not satisfied with the document, utilize the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify and print or sign the Maryland Post-Employment Information Sheet.

Form popularity

FAQ

What Information can an Employer Release for Employment Verification?Job performance.Reason for termination or separation.Knowledge, qualifications, and skills.Length of employment.Pay level and wage history (where legal)Disciplinary action.Professional conduct.Work-related information

Providing a Reference Many employers will release only basic information when contacted for a reference to protect themselves from lawsuits. They usually confirm employment dates and job responsibilities, salary history, and might include information about whether you were dismissed or chose to leave on your own.

General information, such as hire and termination dates. Information about the employee's job performance. The reason for the employee's termination, if applicable. Examples of misconduct or workplace violence, especially if a minor or vulnerable adult was put at risk.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

New Hire Form (PDF)Multistate Reporting Form (PDF)W-4 Form (IRS)I-9 Form (INS)MW507- Employee's Maryland Withholding Exemption Certificate Link.

Maryland Minimum Wage: $12.50 - Effective 01/2022Maryland Minimum Wage: $12.50 - Effective 01/2022.Equal Pay for Equal Work.Earned Sick and Safe Leave.Maryland Minimum Wage and Overtime Law.Unemployment Insurance.See all included notices.

For questions about new hire reporting you can contact the Maryland New Hire Registry at (410) 281-6000, or toll-free at (888) 634-4737 for any questions regarding the new hire reporting process. Our telephone system can help you 24 hours a day, seven days a week.

There is no Maryland law preventing an employer from proving a reference for a former employee. There is no Maryland law that provides that an employer can only provide dates of employment and position held in response to a reference inquiry.

There is no Maryland law that provides that an employer can only provide dates of employment and position held in response to a reference inquiry. An employer, under Maryland law, can provide an employee reference that may not be true but not considered defamatory because of a qualified privilege.

There are no federal laws restricting what information an employer can - or cannot - disclose about former employees. If you were fired or terminated from employment, the company can say so. They can also give a reason.