Maryland Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Agreement To Compromise Debt By Returning Secured Property?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There is a wide range of legal document templates available online, but locating ones you can trust is challenging.

US Legal Forms offers numerous template options, such as the Maryland Agreement to Resolve Debt by Returning Secured Assets, which are designed to comply with state and federal regulations.

Once you obtain the correct template, click on Purchase now.

Select the pricing plan you prefer, fill in the required information to create your account, and make the payment using your PayPal or Visa/Mastercard. Choose a convenient document format and download your version. You can find all the document templates you have purchased in the My documents menu. You can download or print the document template anytime you need it by clicking on the required template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you will be able to download the Maryland Agreement to Resolve Debt by Returning Secured Assets template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it corresponds to the correct city/state.

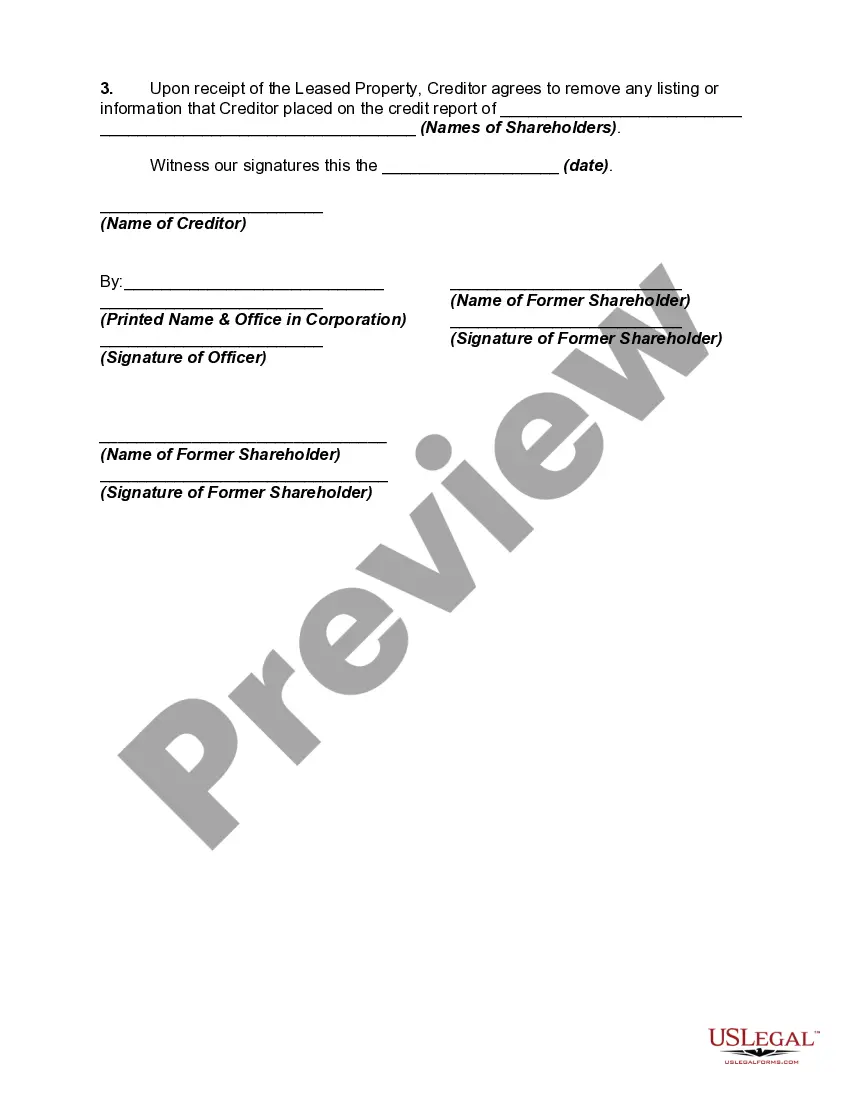

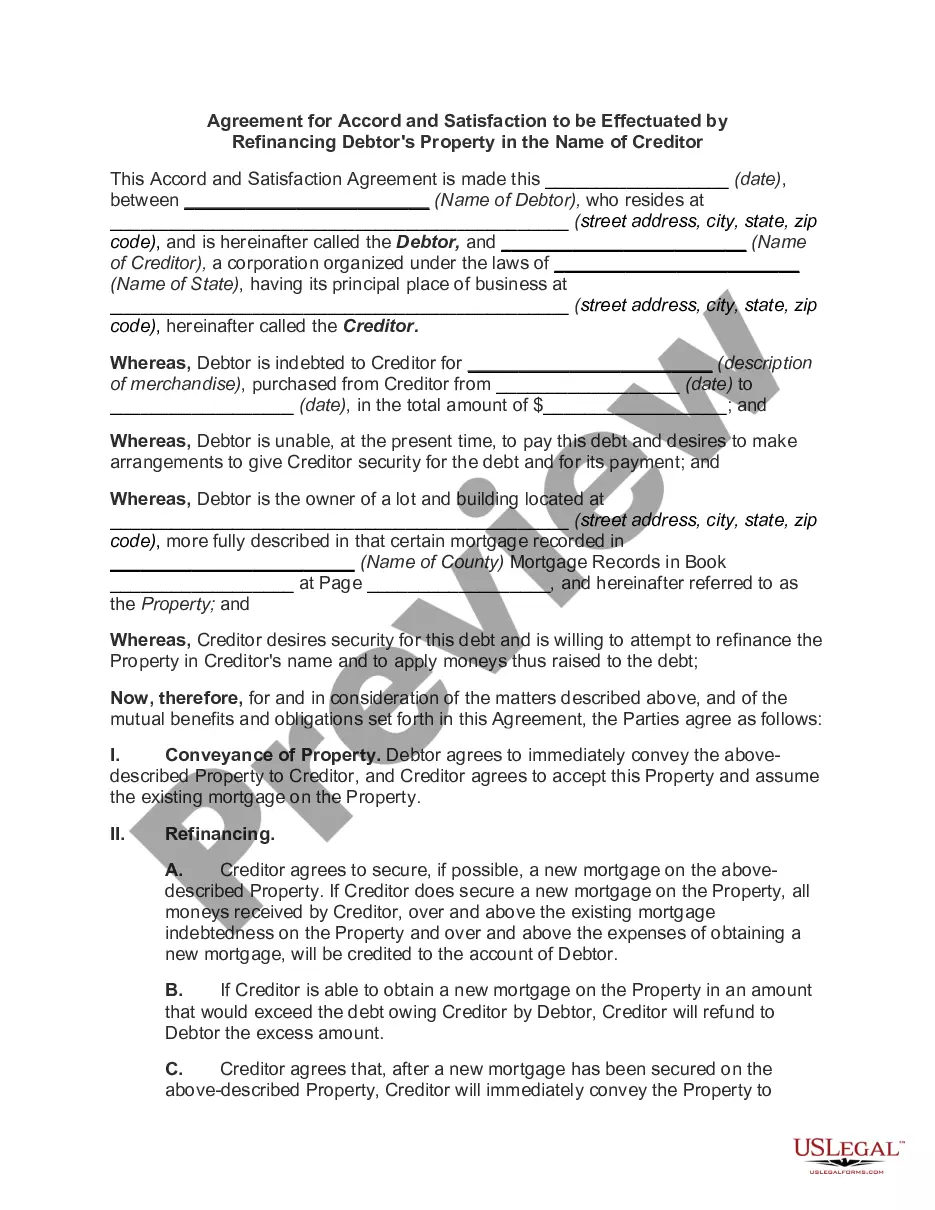

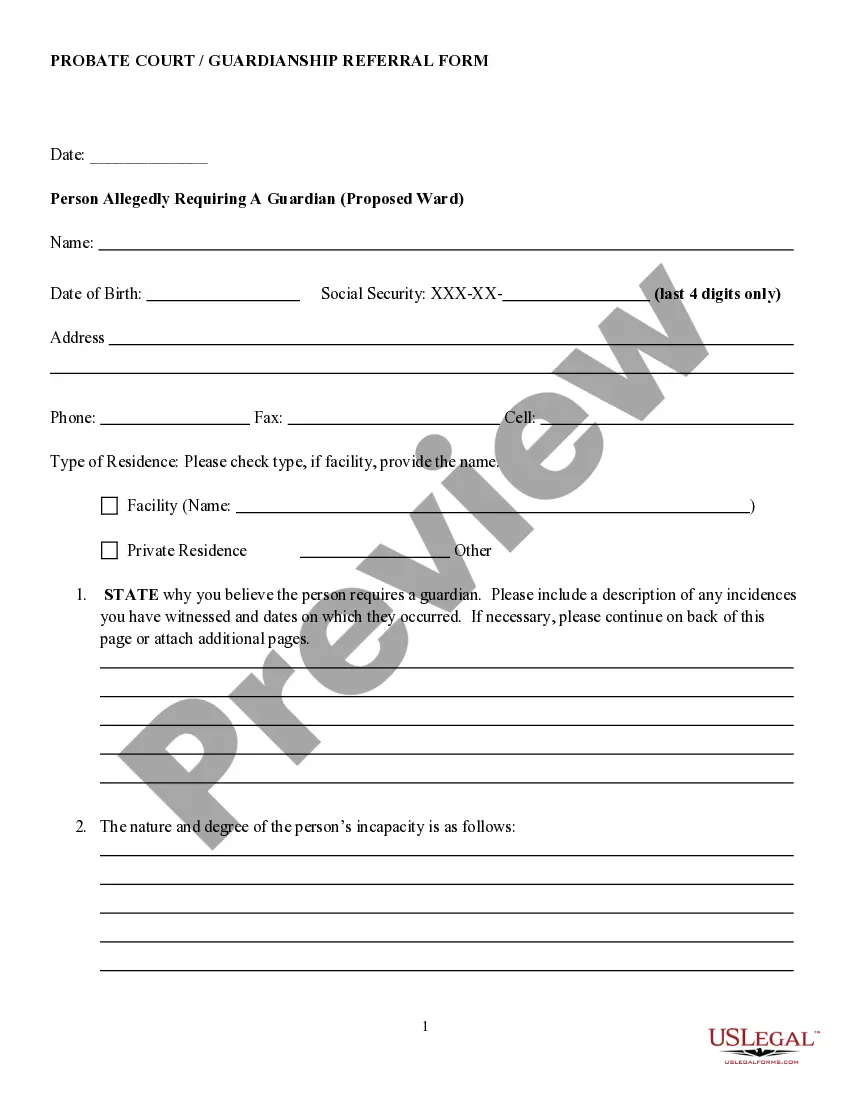

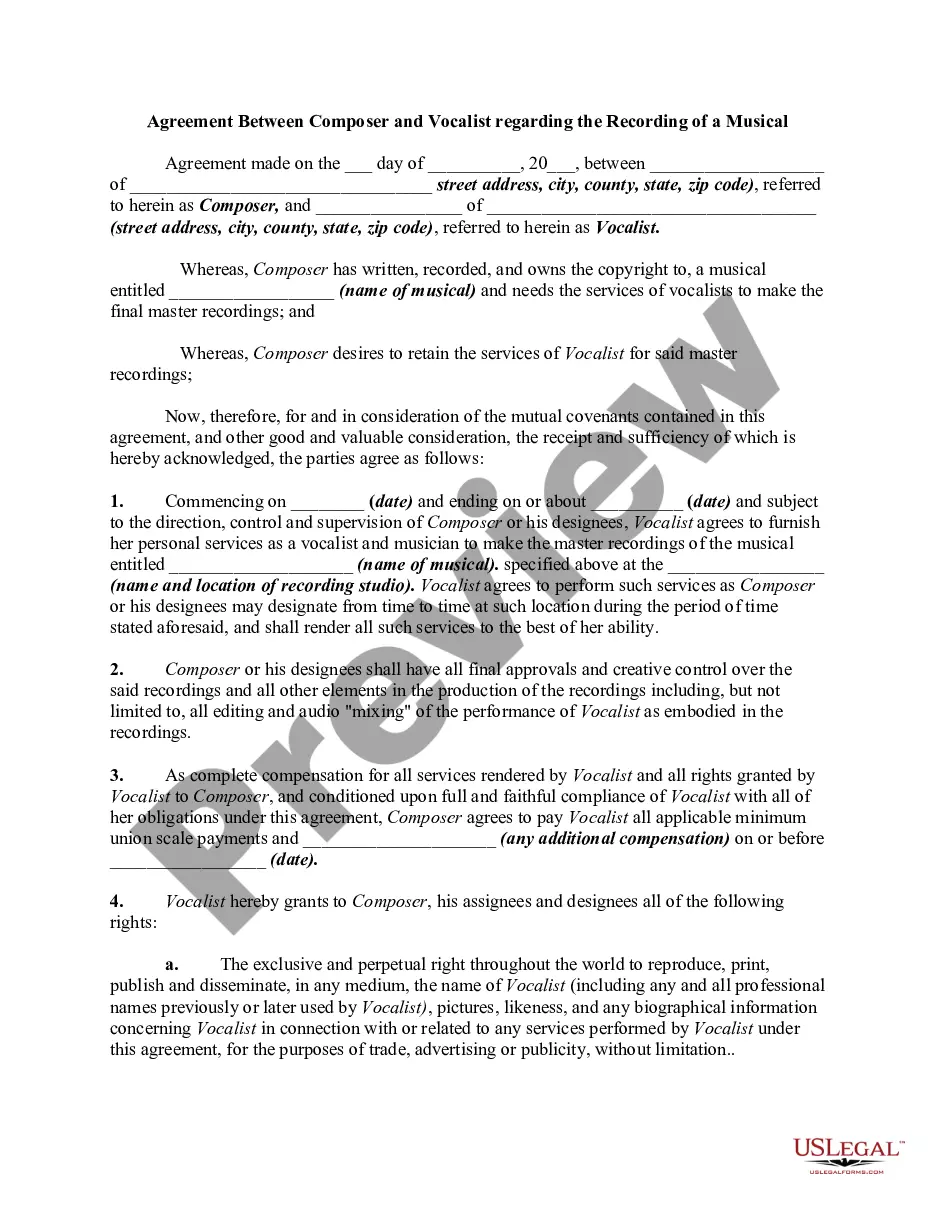

- Utilize the Preview button to review the document.

- Read the description to confirm you have chosen the correct template.

- If the document is not what you are looking for, use the Search box to locate the template that fits your needs.

Form popularity

FAQ

Determining the right amount to offer the IRS requires a careful assessment of your finances. Consider your income, expenses, assets, and the amount of tax debt owed. To maximize your chances of acceptance, aim to propose an amount that reflects what the IRS deems collectible. The Maryland Agreement to Compromise Debt by Returning Secured Property can guide you in calculating an appropriate offer.

To remove a tax lien in Maryland, you should first settle the debt in question. Once the debt is resolved, you can request the release of the lien from the Maryland State Comptroller's office. Additionally, maintaining a clean tax record going forward can help avoid future liens. Utilizing the Maryland Agreement to Compromise Debt by Returning Secured Property may facilitate a smoother resolution.

Form 656 is the official document you submit to the IRS when proposing an offer in compromise. This form outlines your financial situation and the amount you wish to offer. By completing this form accurately, you provide the IRS with the details needed to assess your offer. The Maryland Agreement to Compromise Debt by Returning Secured Property can be a beneficial strategy when using Form 656.

One potential downside of an offer in compromise includes the possibility of rejection by the IRS. If your offer is rejected, you still owe the original debt, which can cause additional stress. Moreover, an accepted offer can have tax implications and may impact your credit report. Understanding the Maryland Agreement to Compromise Debt by Returning Secured Property can help you weigh the pros and cons of your situation.

You can contact the IRS about an offer in compromise by calling their customer service at 1-800-829-1040 or by visiting their website for more information. It’s crucial to have your information ready, such as your Social Security number and details related to your offer. If you're considering the Maryland Agreement to Compromise Debt by Returning Secured Property, clarifying your doubts with the IRS can ensure you're on the right track.

The IRS accepts offers in compromise based on your financial situation and the amount owed. Generally, if the IRS believes it will receive more through an offer than through other means, there is a good chance of acceptance. Engaging in the Maryland Agreement to Compromise Debt by Returning Secured Property can significantly strengthen your position when dealing with the IRS.

Yes, you can file an offer in compromise yourself without hiring professional help. However, consider the intricacies involved in the filing process, as errors can lead to delays or denial of your application. Utilizing resources such as the Maryland Agreement to Compromise Debt by Returning Secured Property can assist you in achieving a favorable outcome.

While you can handle an offer in compromise with the IRS without an attorney, having legal representation might be beneficial. An attorney can help you navigate the complexities of the process and improve your chances of success. If you're considering the Maryland Agreement to Compromise Debt by Returning Secured Property, consulting with a knowledgeable attorney can provide you with valuable insights and guidance.

In Maryland, the statute of limitations on tax debt is generally three years from the date the tax return was filed. However, if no return was filed, this period may extend indefinitely. It's essential to understand your rights regarding the Maryland Agreement to Compromise Debt by Returning Secured Property, as this agreement may help alleviate your debt burdens effectively.

An offer of compromise in Maryland allows debtors to negotiate a settlement with creditors, typically for less than the amount owed. This can provide a valuable opportunity for those struggling with debt to regain financial stability. By understanding the Maryland Agreement to Compromise Debt by Returning Secured Property, you can navigate this process more successfully.