A public offering is an invitation to participate in a debt or equity offering that extends to the public. In the US, a public offering must comply with an extensive set of securities law and associated SEC rules. Moreover, additional laws governing a public offering exist at the state level. In contrast to a public offering, a more limited offering or an investment opportunity is known as a private placement. Like the public offering, a private placement is ordinarily regulated by securities law, but some exceptions are made for the accredited investor. In the equity markets, when a company goes public, the first public offering of stock is known as an initial public offering, or IPO. Following the initial public offering, a company's stock is publicly traded, generally on a stock exchange. The IPO is certainly the most glamorous and closely followed type of public offering.

Checklist for Limited Security Offering

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Checklist For Limited Security Offering?

Use the most comprehensive legal library of forms. US Legal Forms is the best platform for finding up-to-date Checklist for Limited Security Offering templates. Our service offers 1000s of legal documents drafted by certified lawyers and sorted by state.

To download a sample from US Legal Forms, users only need to sign up for a free account first. If you’re already registered on our platform, log in and choose the template you need and buy it. After purchasing forms, users can see them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the steps below:

- Find out if the Form name you’ve found is state-specific and suits your requirements.

- If the template features a Preview option, use it to check the sample.

- In case the template does not suit you, make use of the search bar to find a better one.

- Hit Buy Now if the sample corresponds to your needs.

- Choose a pricing plan.

- Create a free account.

- Pay with the help of PayPal or with yourr debit/visa or mastercard.

- Select a document format and download the sample.

- Once it is downloaded, print it and fill it out.

Save your time and effort using our service to find, download, and fill in the Form name. Join a huge number of satisfied subscribers who’re already using US Legal Forms!

Form popularity

FAQ

A Regulation D offering is intended to make access to the capital markets possible for small companies that could not otherwise bear the costs of a normal SEC registration. Reg D may also refer to an investment strategy, mostly associated with hedge funds, based upon the same regulation.

Rule 144A was implemented to induce foreign companies to sell securities in the US capital markets.For firms registered with the SEC or a foreign company providing information to the SEC, financial statements need not be provided to buyers.

Government bonds, municipal bonds, and Small Business Investment Company issues are all exempt securities under the 1933 Act. Corporate bonds are non-exempt securities that must be registered with the SEC under the Securities Act of 1933.

Exempt securities are financial instruments that do not need to be registered with the Securities Exchange Commission (SEC). They are generally backed by the government and may carry a lesser risk than securities offered by public companies.

While there are some exceptions, in general, investment advisors with $100 million or greater in regulatory assets under management (AUM) must register with the SEC as Registered Investment Adviser (RIA).

Private offerings to a limited number of persons or institutions; Offerings of limited size; Intrastate offerings; and. Securities of municipal, state, and federal governments.

Any note, stock, treasury stock, security future, security-based swap, bond, debenture, evidence of indebtedness, certificate of interest or participation in any profit-sharing agreement, collateral-trust certificate, preorganization certificate or subscription, transferable share, investment contract, voting-trust

Rule 501: Definition of an Accredited Investor. Securities are exempt if sold to accredited investors, individuals or institutions with a lot of money and the financial wherewithal to invest in risky unregistered securities.

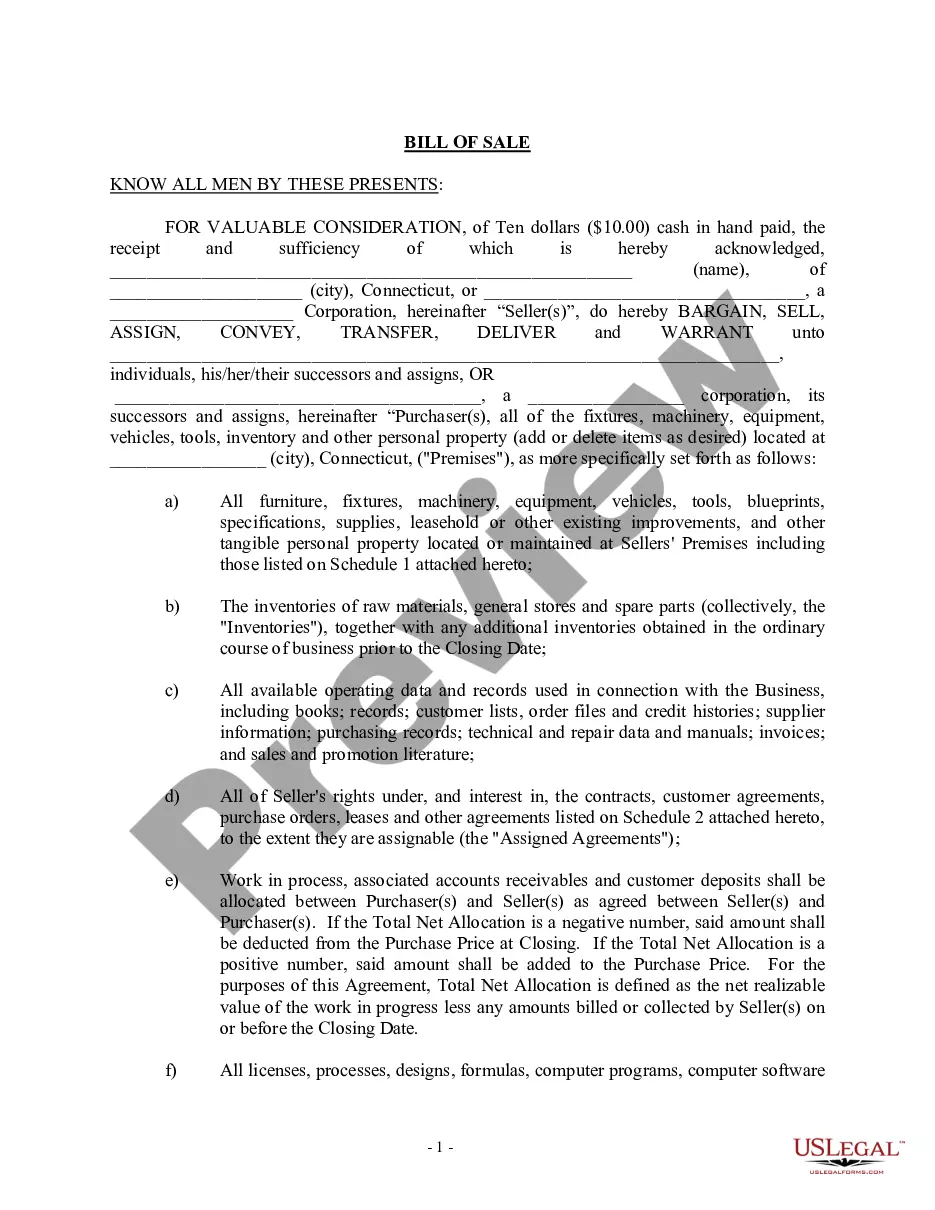

A Limited Offering includes any offer to you to purchase any Securities, whether stock, debt securities, or partnership interests, from any entity, unless those Securities are registered under the Securities Act of 1933 (that is, are publicly offered/publicly traded Securities).