Maryland Agreement to Compromise Debt

Description

How to fill out Agreement To Compromise Debt?

Selecting the finest legal document template can be challenging.

Clearly, there are numerous templates accessible online, but how do you find the legal form you need.

Utilize the US Legal Forms website. This service provides thousands of templates, such as the Maryland Agreement to Compromise Debt, suitable for both business and personal use.

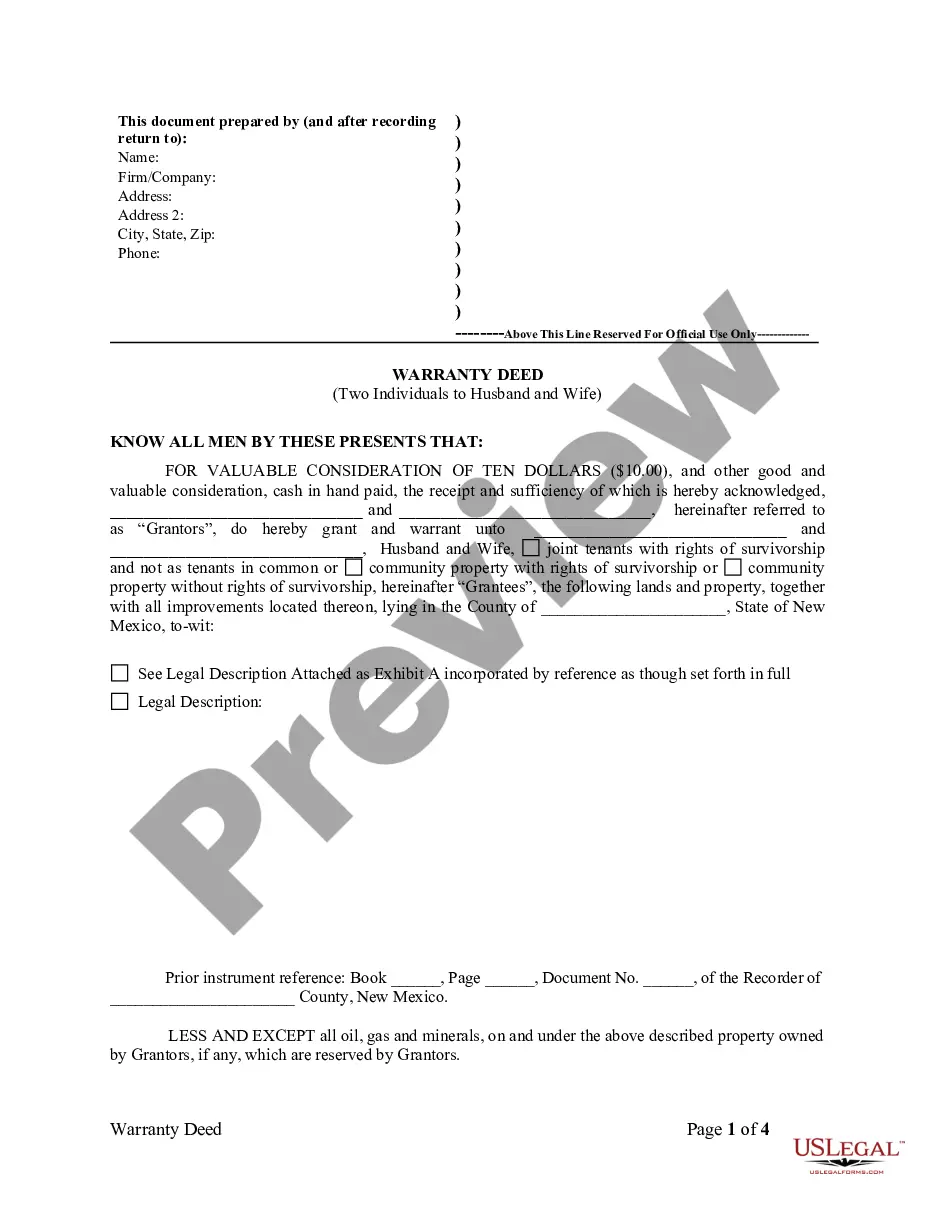

You can preview the form using the Preview button and read the form description to confirm it is suitable for you.

- All forms are vetted by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the Maryland Agreement to Compromise Debt.

- Use your account to browse the legal documents you have previously acquired.

- Go to the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your city/state.

Form popularity

FAQ

Yes, there is a statute of limitations on taxes in Maryland. Generally, the Maryland statute of limitations for tax collection lasts for three years, similar to many other debts. Understanding this limit can help you make informed decisions about your finances, particularly in conjunction with a Maryland Agreement to Compromise Debt. This knowledge allows you to navigate your obligations with greater confidence and clarity.

In Maryland, the state has a three-year period to collect back taxes, starting from the due date of the tax return. After this period, tax debts may become uncollectible, allowing you more freedom in addressing your financial issues. If you're struggling with back taxes, a Maryland Agreement to Compromise Debt may provide a solution to ease your burden and settle your debts. Consulting a tax professional can help clarify your options.

Yes, Maryland state tax liens do expire. Typically, they remain in effect for a certain period, usually 12 years, but this can vary based on specific circumstances. When the lien expires, it can significantly impact your financial situation, especially if you consider a Maryland Agreement to Compromise Debt. It’s essential to understand these timelines to manage your financial obligations effectively.

The Offer in Compromise 656 form allows taxpayers to settle their tax debt for less than the full amount owed. This form is integral to the Maryland Agreement to Compromise Debt, as it outlines your proposal for settling your obligations. Completing this form accurately can significantly ease your financial stress. For assistance, consider using platforms like USLegalForms for guidance throughout the process.

In Maryland, the statute of limitations on tax debt is generally ten years from the date it was assessed. This means that after this period, the state may not be able to collect the owed tax. Understanding this timeframe is crucial when considering options like the Maryland Agreement to Compromise Debt. Engaging with tax professionals can provide clarity on your specific situation.

Maryland does have a tax forgiveness program aimed at assisting taxpayers in managing their liabilities. This program can be accessed through the Maryland Agreement to Compromise Debt, which helps negotiate lower payments. By understanding your eligibility and the options available, you can make informed decisions regarding your tax responsibilities. Utilize resources like USLegalForms to help simplify your journey.

Yes, the state of Maryland offers tax forgiveness options to individuals who qualify. This can be part of the Maryland Agreement to Compromise Debt, allowing you to reduce or eliminate your tax liabilities. By exploring these options, you can find relief from overwhelming tax burdens. Consider consulting with tax professionals or platforms like USLegalForms to navigate the process effectively.

The tax amnesty program in Maryland offers a chance for individuals and businesses to settle outstanding tax liabilities without facing penalties or interest. This program is particularly beneficial for those who want to resolve their tax debts efficiently. If you are exploring options related to the Maryland Agreement to Compromise Debt, participating in the amnesty program may help lower your overall financial burden. Always consult with a tax professional to ensure you make the best decision.

Eligibility for the IRS amnesty program typically includes individuals who owe back taxes and want to settle for a reduced amount. The program is designed for taxpayers who are willing to come forward and resolve their tax liabilities. In some cases, individuals with specific financial hardships may be prioritized. Leveraging the Maryland Agreement to Compromise Debt can provide additional avenues for eligible persons seeking relief from their tax burdens.

The offer of compromise in Maryland is a formal proposal made to settle a tax debt for less than the total amount owed. It allows taxpayers facing financial hardship to resolve their debts without incurring additional penalties. An agreement can provide relief and a fresh start, making it an invaluable option for managing financial obligations. Utilizing the Maryland Agreement to Compromise Debt process ensures that you can take control of your tax situation effectively.