Maryland Owner Financing Contract for Vehicle

Description

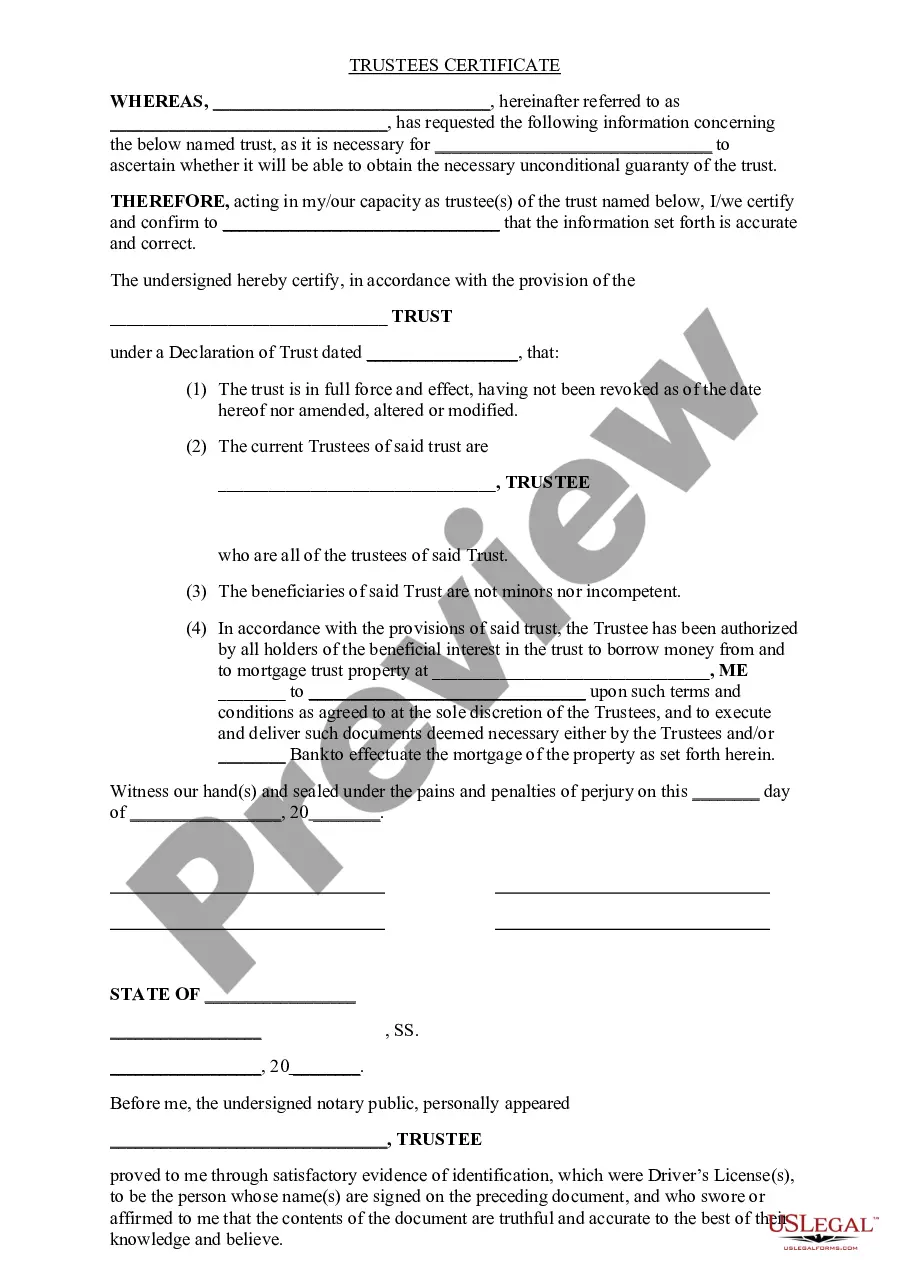

How to fill out Owner Financing Contract For Vehicle?

US Legal Forms - one of the largest compilations of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By utilizing the site, you can access thousands of forms for business and personal purposes, sorted by categories, states, or keywords. You can obtain the most recent forms, like the Maryland Owner Financing Contract for Vehicle, in moments.

If you already possess a subscription, Log In and download the Maryland Owner Financing Contract for Vehicle from the US Legal Forms database. The Download button will appear on every form you view.

If you are content with the form, confirm your choice by clicking the Buy now button. Then, select the payment plan you prefer and provide your information to register for an account.

Process the payment. Use your credit card or PayPal account to complete the transaction. Select the file format and download the form onto your device. Make modifications. Complete, edit, print, and sign the downloaded Maryland Owner Financing Contract for Vehicle.

- You can access all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have chosen the correct form for your area/region.

- Click the Preview button to review the contents of the form.

- Examine the form summary to ensure you have selected the right form.

- If the form doesn’t meet your requirements, use the Search field at the top of the screen to find one that does.

Form popularity

FAQ

There are several types of owner financing options available, including contract for deed, lease options, and straight loans. Each method has unique terms, conditions, and benefits for both buyers and sellers. For example, a contract for deed allows the buyer to make payments while gradually gaining ownership of the car. To get started, a Maryland Owner Financing Contract for Vehicle can guide you through these options.

To file a lien on a vehicle in Maryland, you must complete the necessary paperwork through the Maryland Department of Transportation. This process typically includes submitting a Lien Certificate along with any required fees. Filing a lien protects your financial interest in the vehicle until the buyer fully pays off the owner finance contract. If you need assistance with the paperwork, consider using US Legal Forms for guidance on the Maryland Owner Financing Contract for Vehicle and related processes.

Good terms for seller financing generally feature a reasonable interest rate, flexible repayment terms, and a clear schedule for payments. Ensuring both the buyer and seller are comfortable with the terms can lead to a successful transaction. When creating a Maryland Owner Financing Contract for Vehicle, make sure these terms are explicitly stated to prevent misunderstandings.

Typical terms for owner financing include a down payment, monthly payment amounts, and payment durations. Interest rates can vary based on the agreement and the buyer's credit profile. By utilizing a Maryland Owner Financing Contract for Vehicle, both parties can clarify these terms to foster a smoother transaction.

Standard owner financing terms usually include the interest rate, repayment schedule, and consequences for defaulting. Buyers often negotiate these terms based on their financial capabilities and the seller's requirements. When engaging in a Maryland Owner Financing Contract for Vehicle, be sure to review these terms carefully to avoid future disputes.

Typically, seller financing agreements range from five to fifteen years. However, the specific duration depends on the negotiations between the buyer and seller. When drafting a Maryland Owner Financing Contract for Vehicle, consider the timeline that suits both parties, ensuring clarity on payment schedules.

One downside of owner financing is the potential for higher interest rates compared to traditional loans. Additionally, as a buyer, you may face a lack of regulation that usually accompanies conventional financing. It’s crucial to thoroughly review the Maryland Owner Financing Contract for Vehicle to ensure you understand all terms and conditions.

Owner financing a vehicle involves a seller providing the buyer with financing directly. With a Maryland Owner Financing Contract for Vehicle, this agreement outlines terms like payments, interest, and the repercussions for missed payments. This process often results in fewer barriers compared to traditional financing. It can be an effective way for buyers to secure a vehicle with manageable payments.

To calculate the payment for a $30,000 vehicle over 60 months, consider the interest rate that will apply. If we assume an average rate, the monthly payment might range from $500 to $600. You also need to factor in potential taxes and fees, which could affect the final payment amount. A Maryland Owner Financing Contract for Vehicle might offer you options to adjust terms, ideal for personalized payments.

Placing a lien on a vehicle in Maryland requires you to file a specific form with the Motor Vehicle Administration. This process is often completed using the Maryland Owner Financing Contract for Vehicle to establish proof of the debt obligation. Both the lienholder and the vehicle owner must agree to this process. Successfully filing a lien helps secure your financial interest in the vehicle, increasing your protection.