Unless the continuation of a trust is necessary to carry out a material purpose of the trust (such as tax benefits), the trust may be terminated by agreement of all the beneficiaries if none of them is mentally incompetent or underage (e.g., under 21 in some states). However, termination generally cannot take place when it is contrary to the clearly expressed intention of the trustor. In the absence of a provision in a trust instrument giving the trustee power to terminate the trust, a trustee generally has no control over the continuance of the trust.

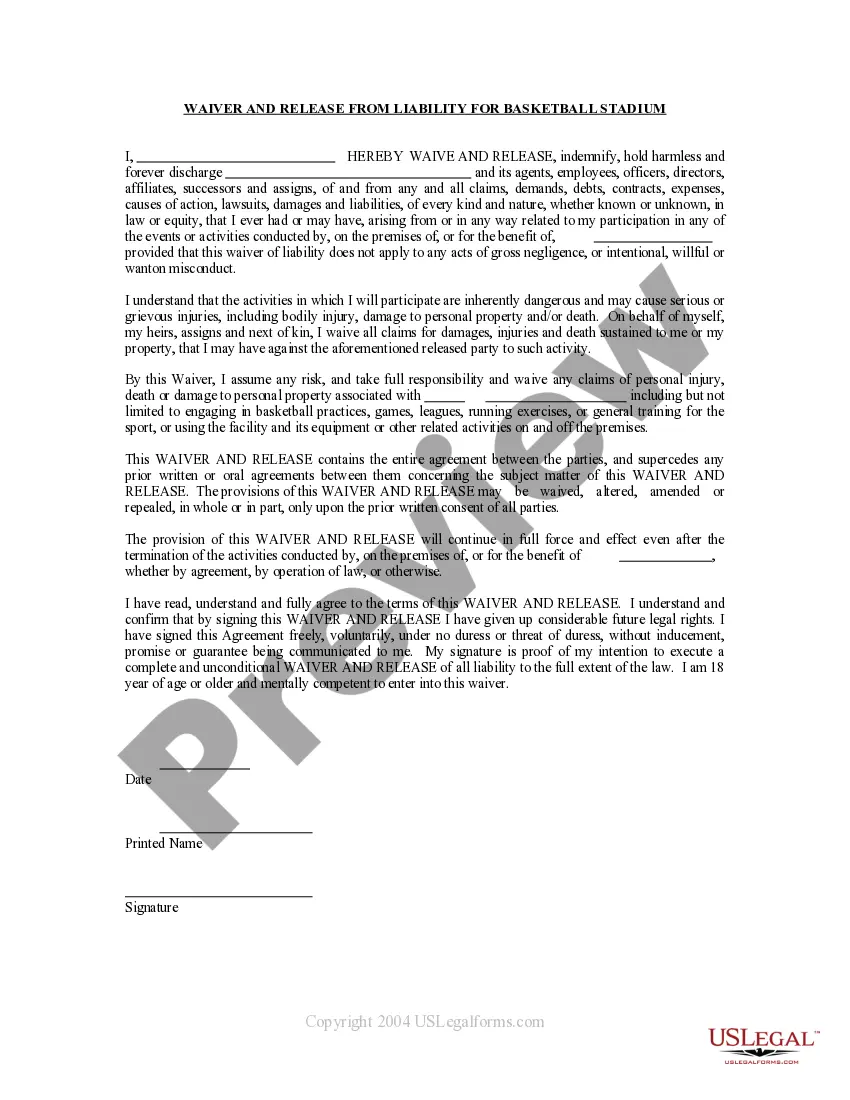

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.