Maryland Guaranty of Promissory Note by Individual - Corporate Borrower

Description

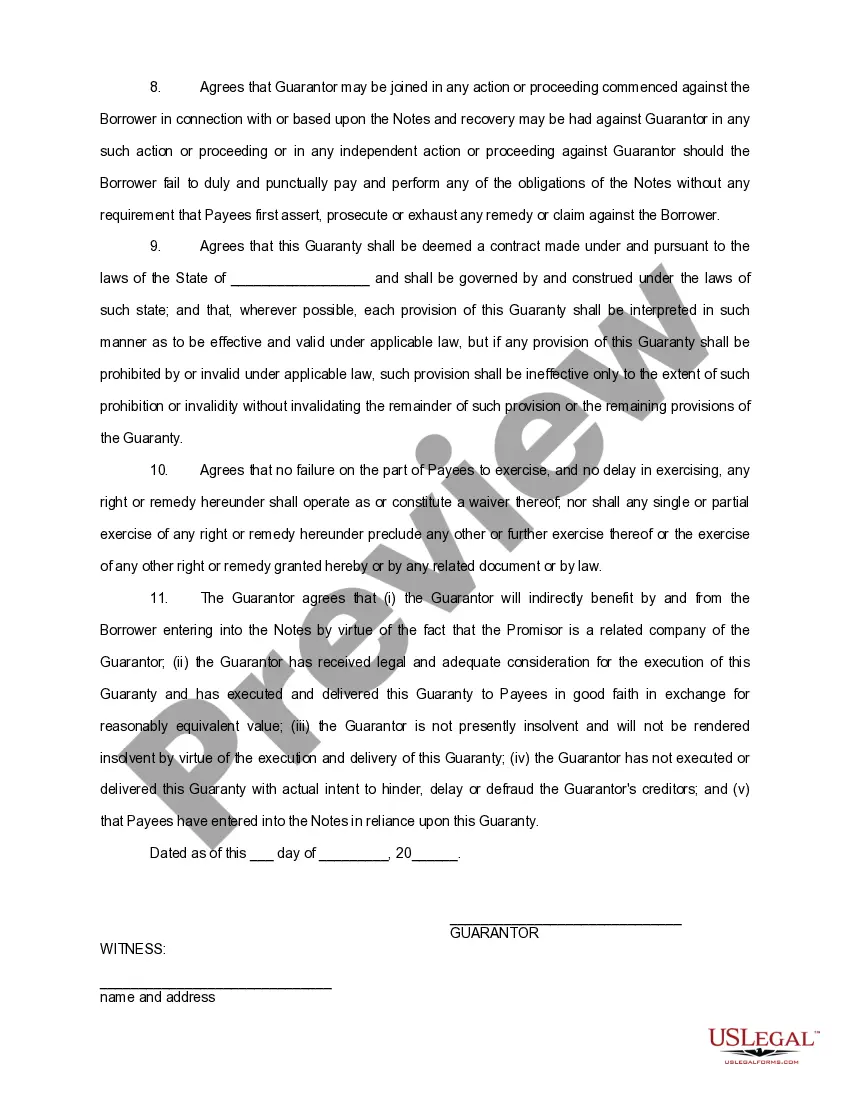

How to fill out Guaranty Of Promissory Note By Individual - Corporate Borrower?

Have you ever found yourself in a situation where you require documents for potential business or personal use nearly every day.

There is a multitude of legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers an extensive array of form templates, including the Maryland Guaranty of Promissory Note by Individual - Corporate Borrower, which is designed to comply with federal and state regulations.

Utilize US Legal Forms, the largest collection of legal documents, to save time and prevent mistakes.

This service provides professionally crafted legal document templates suitable for an array of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the Maryland Guaranty of Promissory Note by Individual - Corporate Borrower template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Select the form you require and verify that it corresponds to your specific city/region.

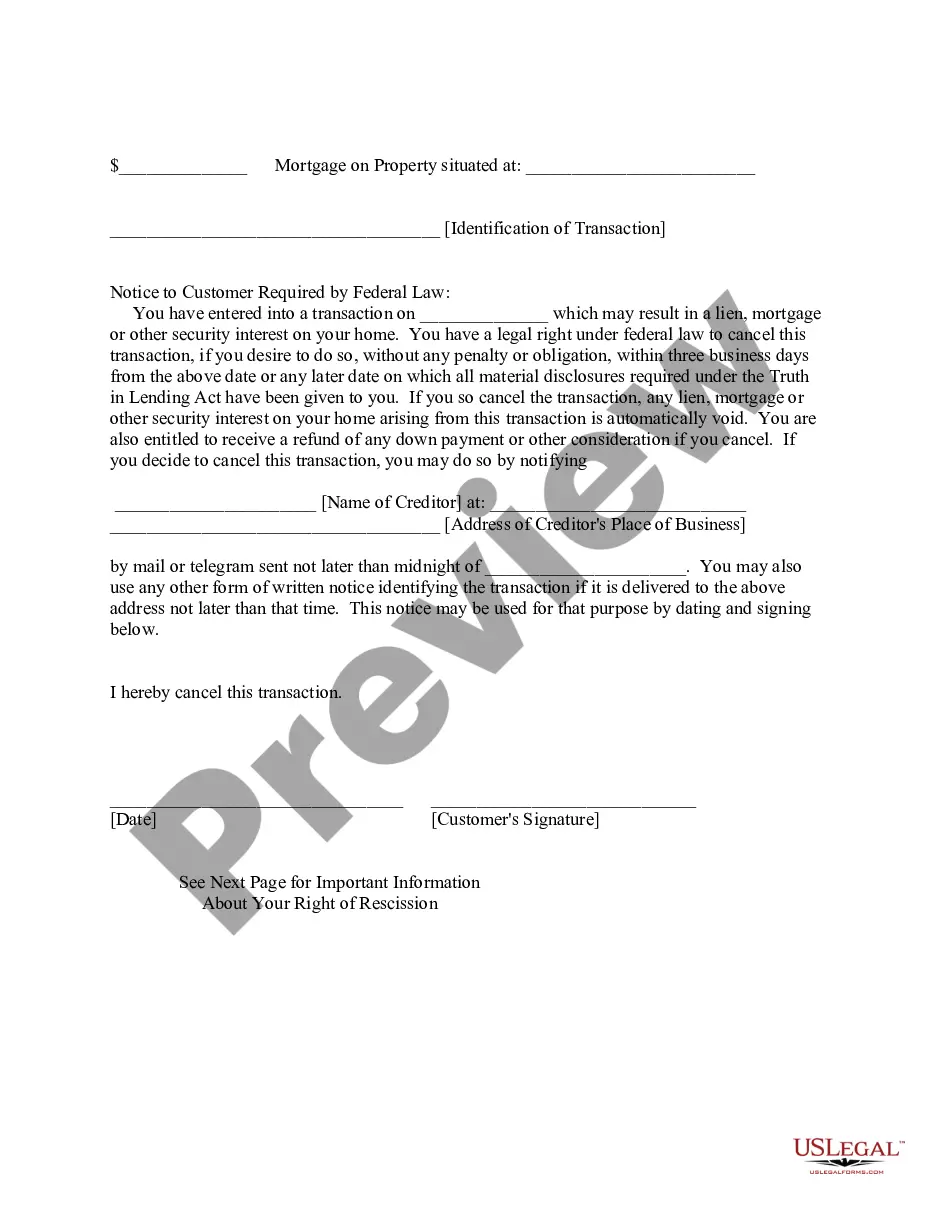

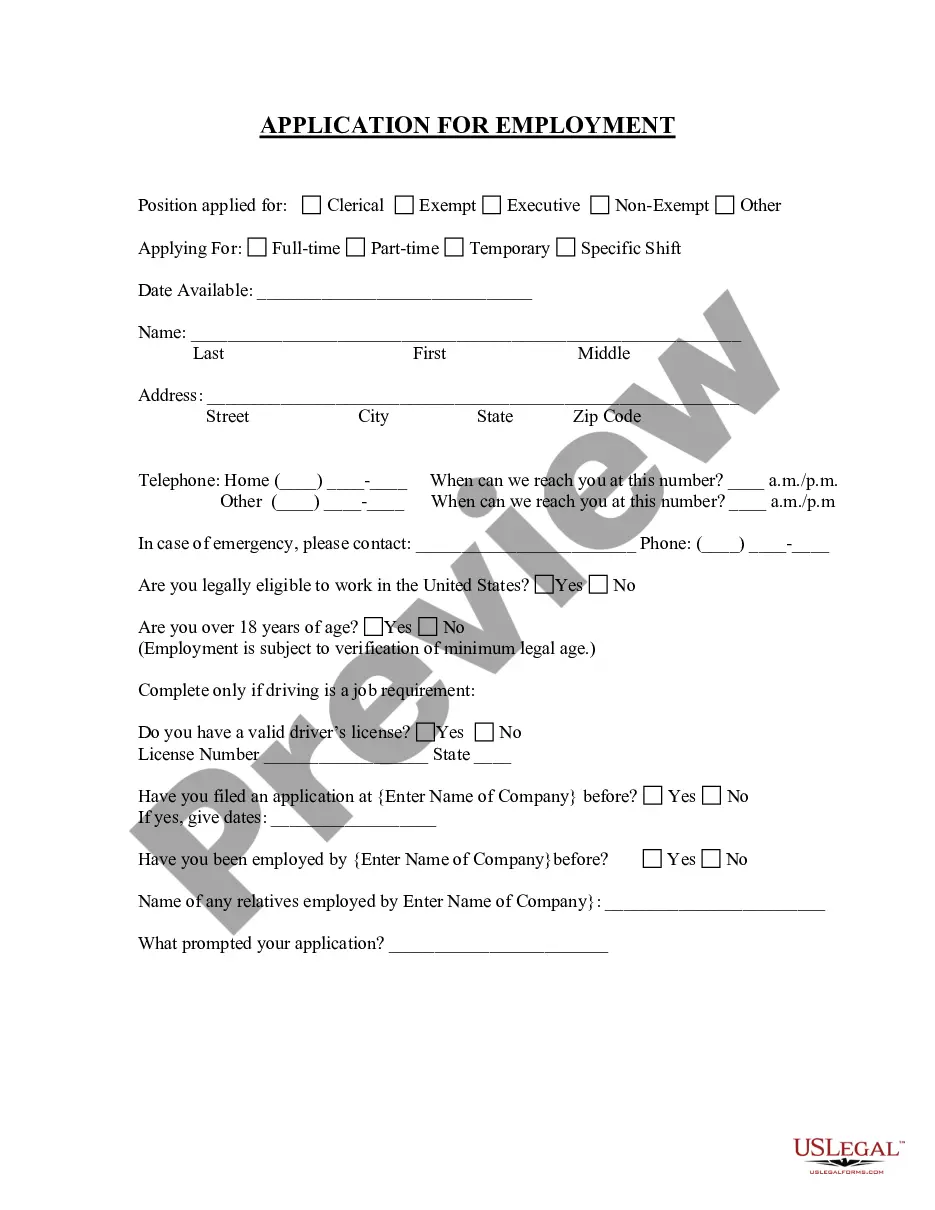

- Use the Preview feature to review the form.

- Read the description to confirm you have chosen the correct form.

- If the form is not what you are seeking, utilize the Search section to find the form that meets your needs and criteria.

- Once you have identified the appropriate form, click Get now.

- Choose the pricing plan you prefer, fill in the necessary information to facilitate your payment, and pay for your order using PayPal or a credit card.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased from the My documents section. You can acquire an additional copy of the Maryland Guaranty of Promissory Note by Individual - Corporate Borrower at any time if needed. Simply click on the required form to download or print the document template.

Form popularity

FAQ

When a personal guarantee is accompanied with a promissory note, a personal guarantee acts like collateral. The asset (promissory note) is protected by the collateral (the guarantor's promise to pay, and the ability to sue the guarantor personally for noncompliance with the terms of the promissory note).

However, in jurisdictions where promissory notes are commonplace, the company (called the payee or lender) can ask one of its debtors (called the maker, borrower or payor) to accept a promissory note, whereby the maker signs a legally binding agreement to honour the amount established in the promissory note (usually,

Personal Guarantee: Taking Responsibility A promissory note alone may not be enough to secure the loan your business needs. That's why your promissory note could include a personal guarantee. Since a promissory note is basically just an IOU, a lender will want some kind of collateral to secure the loan.

A personal guarantee is a provision a lender puts in a business loan agreement that requires owners to be personally responsible for their company's debt in case of default. Lenders often ask for personal guarantees because they have concerns over the credit history, age or financial stability of your business.

Guarantor of payment is a person who guarantees guarantees payment of a negotiable instrument when it is due without the holder first seeking payment from another party. A guarantor of payment is liable only if payment guaranteed or equivalent words are specifically written on the instrument.

Guaranteed promissory note means a written contract obligating a recipient to repay the funds received if the recipient does not fulfill the service obligation, which was a condition of the recipient's scholarship, or grant award.

Guaranteed promissory note means a written contract obligating a recipient to repay the funds received if the recipient does not fulfill the service obligation, which was a condition of the recipient's scholarship, or grant award.

A guarantor is an individual who signs a loan or lease document in addition to the primary borrower. If the primary borrower defaults on the obligation, the guarantor will step in and pay for the debt. Guarantors are sometimes used in rental agreements, on student loans, with mortgages and auto loans.

The person or entity that guarantees the borrower's debt is called a guarantor. A guarantor is one whose promise 'is collateral to a primary or principal obligation on the part of another and which binds the obligor to performance in the event of nonperformance by such other, the latter being bound to perform

A promissory note is a legal document signed by a debtor who promises to pay a debt in a form and manner as described in the document. A personal guaranty, as defined at businessdictionary.com, is an agreement that makes one liable for one's own or a third party's debts or obligations.