Maryland Executive Employee Stock Incentive Plan

Description

How to fill out Executive Employee Stock Incentive Plan?

You might devote several hours online trying to locate the legal document template that meets your state and federal requirements.

US Legal Forms offers a vast array of legal forms that are reviewed by experts.

It is straightforward to obtain or print the Maryland Executive Employee Stock Incentive Plan from our service.

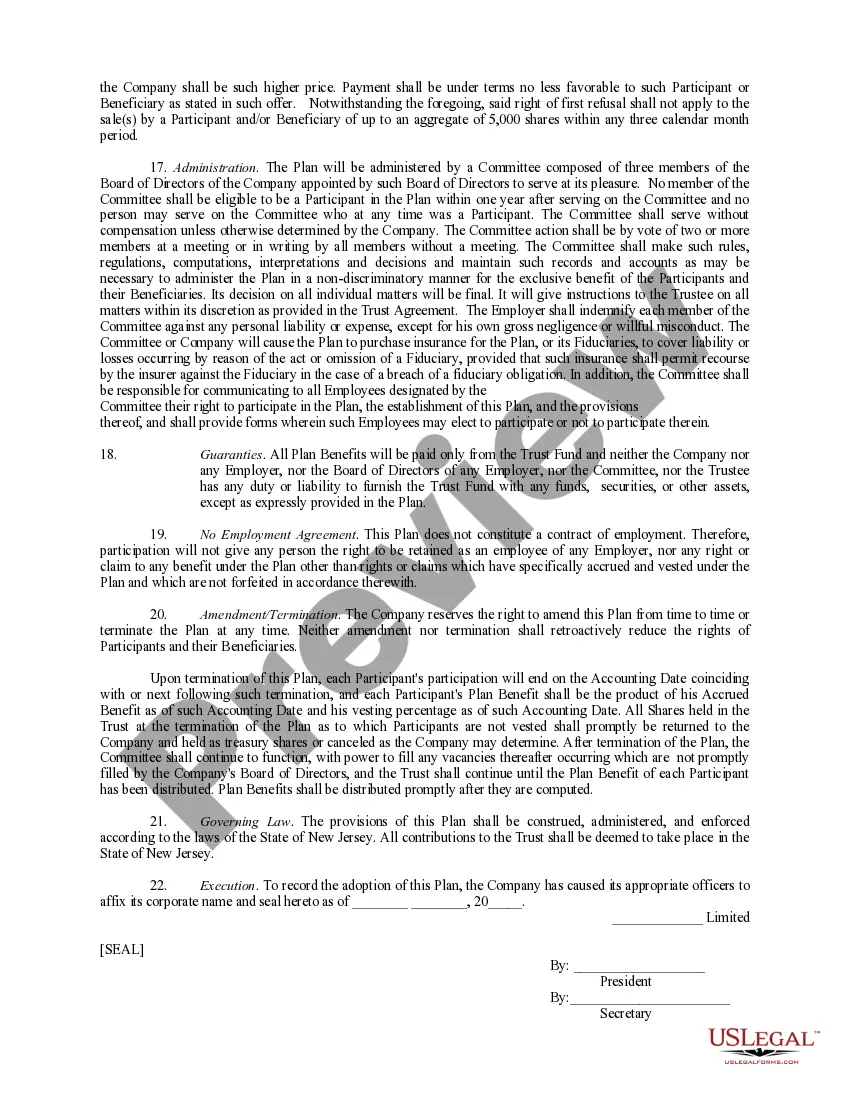

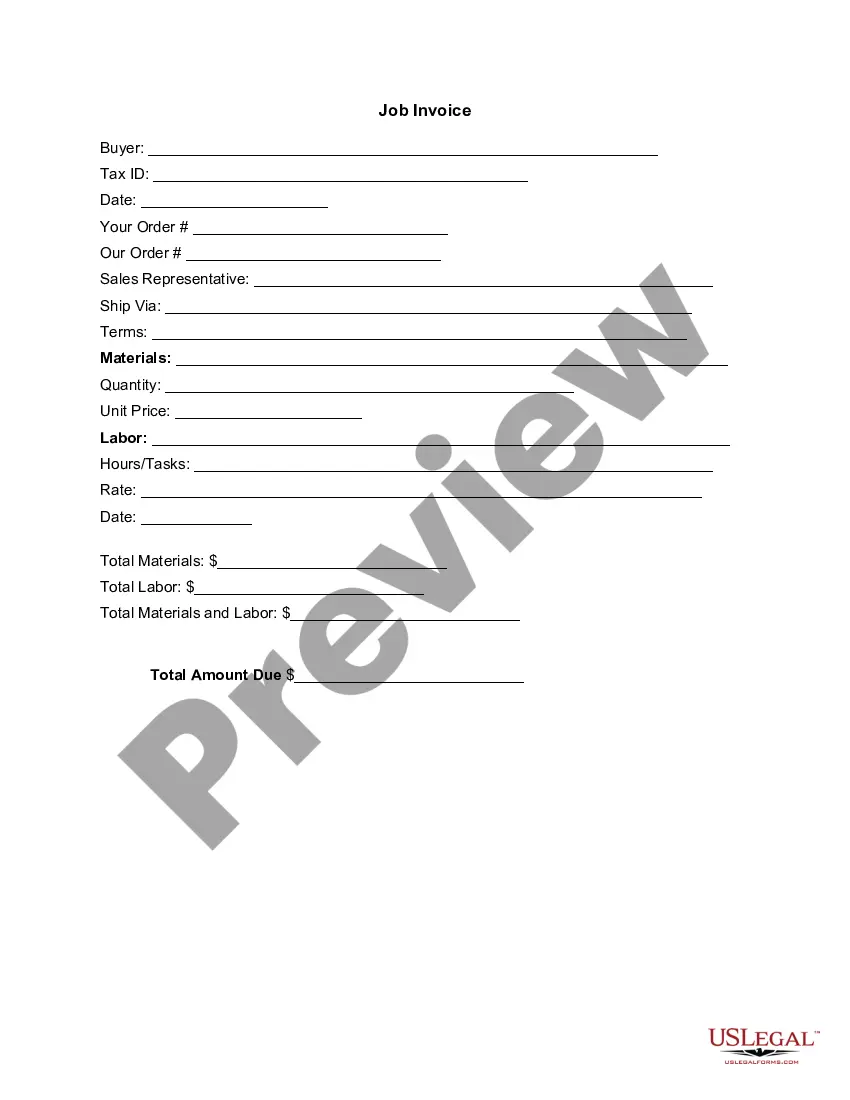

If available, utilize the Preview option to look through the document template as well.

- If you possess a US Legal Forms account, you can Log In and select the Acquire option.

- Subsequently, you can complete, modify, print, or sign the Maryland Executive Employee Stock Incentive Plan.

- Every legal document template you purchase is your property forever.

- To obtain an additional copy of any purchased form, visit the My documents section and click the appropriate option.

- If you are utilizing the US Legal Forms site for the first time, follow the simple instructions provided below.

- First, make sure you have selected the correct document template for the state/city of your choice.

- Review the document details to confirm you have chosen the suitable form.

Form popularity

FAQ

Yes, an employer can gift stock to an employee as part of a compensation strategy. This approach can enhance employee engagement and loyalty, especially when connected to a Maryland Executive Employee Stock Incentive Plan. By offering stock gifts, employers motivate employees to contribute to the company's success, as the employees will have a vested interest in the performance of the business. Additionally, navigating this process through a platform like US Legal Forms can provide clarity on the necessary legal requirements and documentation needed for such transactions.

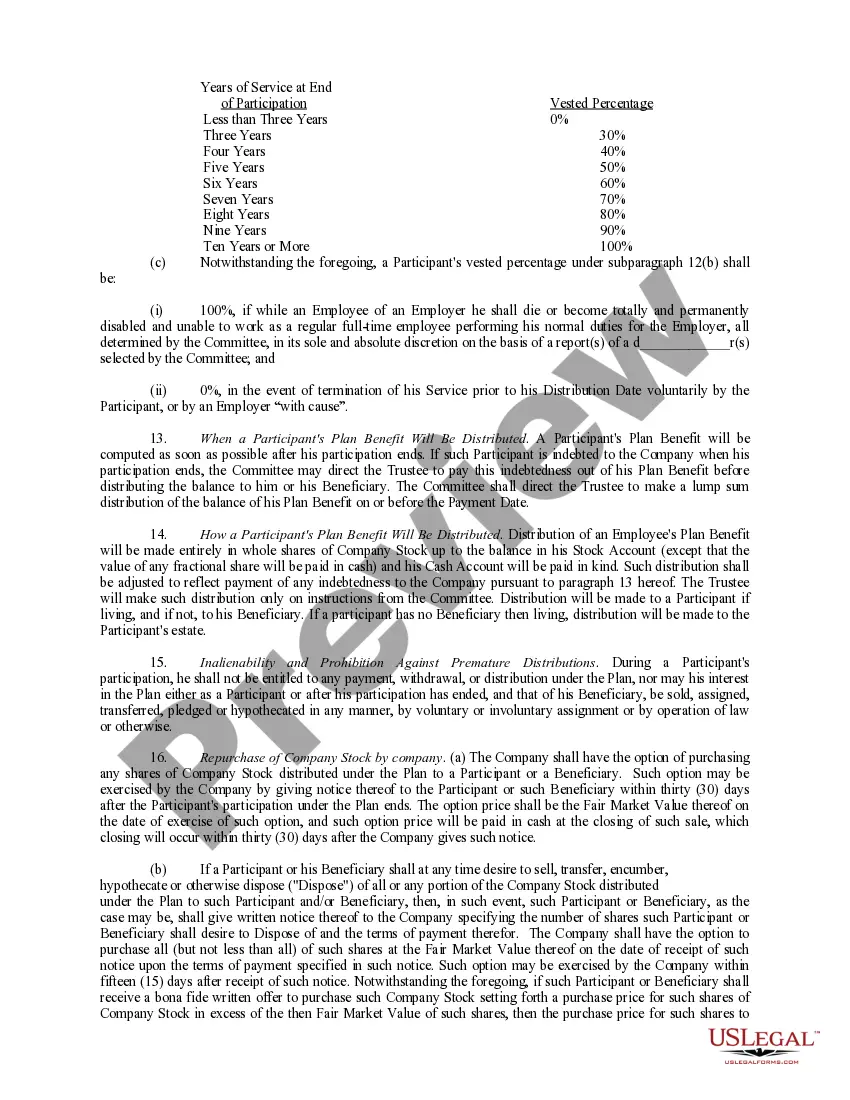

While both ESOPs and equity incentive plans provide employees with a stake in the company, an ESOP typically involves employee ownership of stock directly. In contrast, equity incentive plans often offer options or restricted stock units that may not provide immediate ownership. Understanding these distinctions is essential for businesses considering the Maryland Executive Employee Stock Incentive Plan.

An ESOP focuses on providing employees with shares of the company, creating a sense of ownership and loyalty, while an incentive plan can provide bonuses based on performance metrics. The key difference lies in the type of reward—ownership versus financial bonuses. Companies often combine these strategies, like in the Maryland Executive Employee Stock Incentive Plan, to achieve broader engagement.

The employee stock incentive program is designed to motivate and reward employees by integrating stock options or shares into their compensation package. This program aligns employee interests with company performance and long-term success. A well-structured Maryland Executive Employee Stock Incentive Plan can enhance employee engagement and loyalty.

The ESOP incentive plan is a type of employee benefit plan that allows employees to become part owners of the company. Through this plan, employees receive stock ownership, which can motivate them to work harder for the organization's success. In the context of the Maryland Executive Employee Stock Incentive Plan, it serves to align the interests of employees and the company.

One downside of an Employee Stock Ownership Plan (ESOP) is the potential for employee wealth to be overly concentrated in one asset—namely, the company's stock. This can create financial risks for employees. It's crucial to understand these risks when considering the Maryland Executive Employee Stock Incentive Plan, as diversification in retirement savings can help mitigate potential losses.

A typical executive compensation package often includes a base salary, bonuses, stock options, and additional benefits such as retirement plans. The Maryland Executive Employee Stock Incentive Plan can enhance compensation packages by offering performance-based equity options. This approach not only rewards executives for their efforts but also helps attract and retain top talent in a competitive market.

The primary purpose of providing executive stock options within a compensation package is to align the interests of executives with those of shareholders. By tying compensation to company performance, the Maryland Executive Employee Stock Incentive Plan motivates executives to drive growth and profitability. Ultimately, this alignment fosters a commitment to long-term success, benefiting both the company and its employees.

To report incentive stock options on your taxes, you need to first determine if you exercised the options during the tax year. If you did, you should receive a Form 3921 from your employer, which provides key details for reporting. When you sell the acquired stock, you will report any profits or losses on Schedule D of your tax return. The Maryland Executive Employee Stock Incentive Plan may have specific reporting considerations, so it's wise to consult a tax professional for guidance.