A Maryland Motion for Release of Property From Levy/Garnishment or to Exempt Property from Execution is a court document filed in Maryland courts when a debtor or creditor wants to challenge a levy or garnishment or to exempt certain property from execution. Maryland's law sets out certain requirements for this motion, including that the motion must include a detailed description of the property and the basis for the request to release or exempt the property. This motion can be filed for two main reasons: (1) to release property that has already been levied or garnished, or (2) to exempt certain property from execution. In either case, the motion must provide sufficient information to support the debtor's or creditor's position. The two types of Maryland Motion for Release of Property From Levy/Garnishment or to Exempt Property from Execution are: 1. Motion for Release of Property from Levy/Garnishment: This motion requests the court to release property that has already been levied or garnished. 2. Motion to Exempt Property from Execution: This motion requests the court to exempt certain property from execution. This may include exempt property such as wages, public assistance, and retirement benefits.

Maryland Motion for Release of Property From Levy/Garnishment or to Exempt Property from Execution

Description

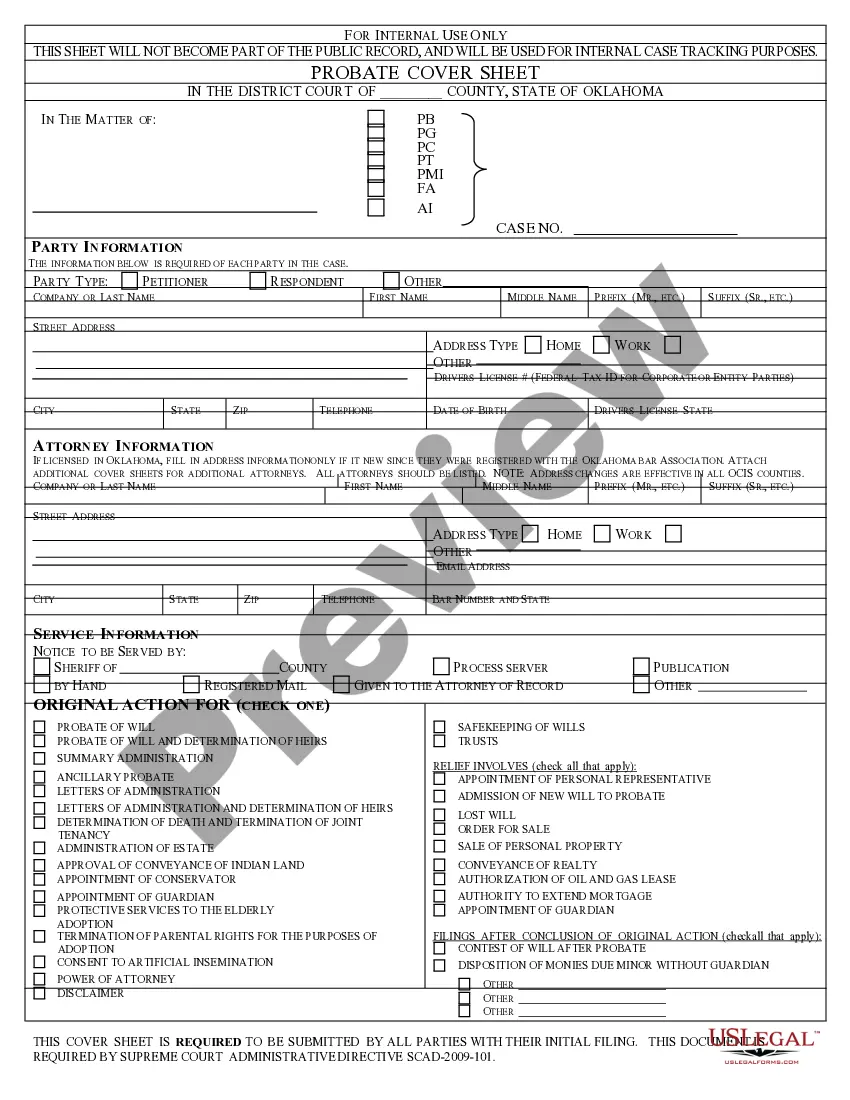

How to fill out Maryland Motion For Release Of Property From Levy/Garnishment Or To Exempt Property From Execution?

Handling legal documents necessitates focus, accuracy, and employing well-crafted templates.

US Legal Forms has been assisting individuals nationwide with this for 25 years, so when you select your Maryland Motion for Release of Property From Levy/Garnishment or to Exempt Property from Execution template from our service, you can be confident it complies with both federal and state laws.

All documents are prepared for multiple uses, just like the Maryland Motion for Release of Property From Levy/Garnishment or to Exempt Property from Execution displayed on this page. If you require them again in the future, you can complete them without any additional payment - simply navigate to the My documents tab in your profile and fill out your document whenever needed. Try US Legal Forms and complete your business and personal paperwork swiftly and in complete legal compliance!

- Ensure to thoroughly review the form details and its alignment with general and legal standards by previewing it or checking its description.

- Seek another official template if the previously examined one does not align with your circumstance or state laws (the tab for that can be found in the upper page corner).

- Log in to your account and save the Maryland Motion for Release of Property From Levy/Garnishment or to Exempt Property from Execution in your preferred format. If it’s your initial experience with our service, click Buy now to proceed.

- Establish an account, select your subscription tier, and process payment with your credit card or PayPal account.

- Choose the format in which you prefer to receive your form and click Download. Print the blank form or upload it to a professional PDF editor for electronic submission.

Form popularity

FAQ

Filing a motion to vacate a judgment in Maryland involves submitting a formal request to the court explaining the reasons for the request, such as newly discovered evidence or equitable reasons. The process also requires adherence to specific deadlines and procedural rules. For individuals facing garnishments, this may involve the Maryland Motion for Release of Property From Levy/Garnishment or to Exempt Property from Execution to protect your interests after a judgment is vacated.

3-624. When a judgment has been assigned in writing by the judgment holder, the assignment may be filed in the court where the judgment was entered.

Except as otherwise provided by law, the sheriff shall levy upon a judgment debtor's interest in personal property pursuant to a writ of execution by obtaining actual view of the property, entering a description of the property upon a schedule, and (1) removing the property from the premises, or (2) affixing a copy of

Rule 3-644 - Sale of Property Under Levy (a) By Sheriff. Upon request of the judgment creditor, the sheriff, without further order of court, shall sell property under levy in the manner provided by this Rule.

You may request an exemption to the garnishment. You must make your request within 30 days of when the garnishment was served on the bank. Use the form Motion for Release of Property from Levy/Garnishment (DC-CV-036).

Rule 3-643 - Release of Property from Levy (a) Upon Satisfaction of Judgment. Property is released from a levy when the judgment has been entered as satisfied and the costs of the enforcement proceedings have been paid.

A writ of execution directing the sheriff to levy upon property of the judgment debtor to satisfy a money judgment may be issued by the clerk of a court where the judgment was entered or is recorded and shall be issued only upon written request of the judgment creditor.

If there is no further filing within 120 days after the garnishee's answer is filed, after proper notice to both you and the judgment creditor, the garnishee may file a notice of intent to terminate the writ of garnishment (Md. Rule 3-645.)

Rule 3-643 - Release of Property from Levy (a) Upon Satisfaction of Judgment. Property is released from a levy when the judgment has been entered as satisfied and the costs of the enforcement proceedings have been paid.