Maryland Request for Judgment — GarnishmentRINGJG) is a legal form used to recover a debtor's unpaid debt by garnishing wages or other financial assets. The form is used by creditors to obtain a court order to garnish a debtor's wages, bank accounts, and other assets to satisfy a judgment. There are two types of Maryland Request for Judgment — Garnishment: wage garnishment and bank account garnishment. Wage garnishment is a legal process by which a creditor can garnish a debtor's wages from their employer. Bank account garnishment is a legal process by which a creditor can garnish a debtor's bank accounts to recover unpaid debts. Both types of garnishment require a court order for the creditor to be able to access the debtor's assets.

Maryland Request for Judgment - Garnishment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

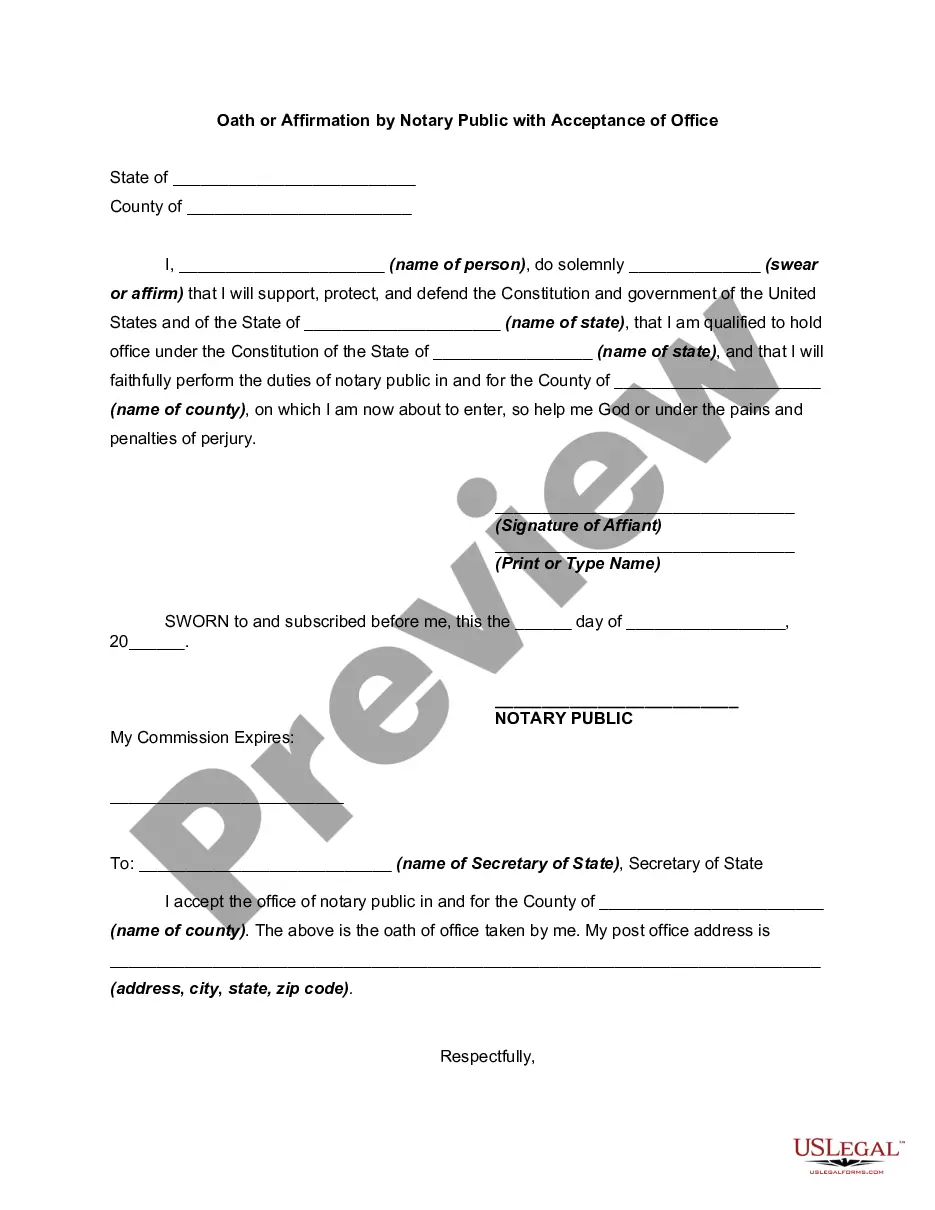

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Request For Judgment - Garnishment?

If you’re looking for a method to correctly complete the Maryland Request for Judgment - Garnishment without engaging a legal expert, then you’re in the perfect location.

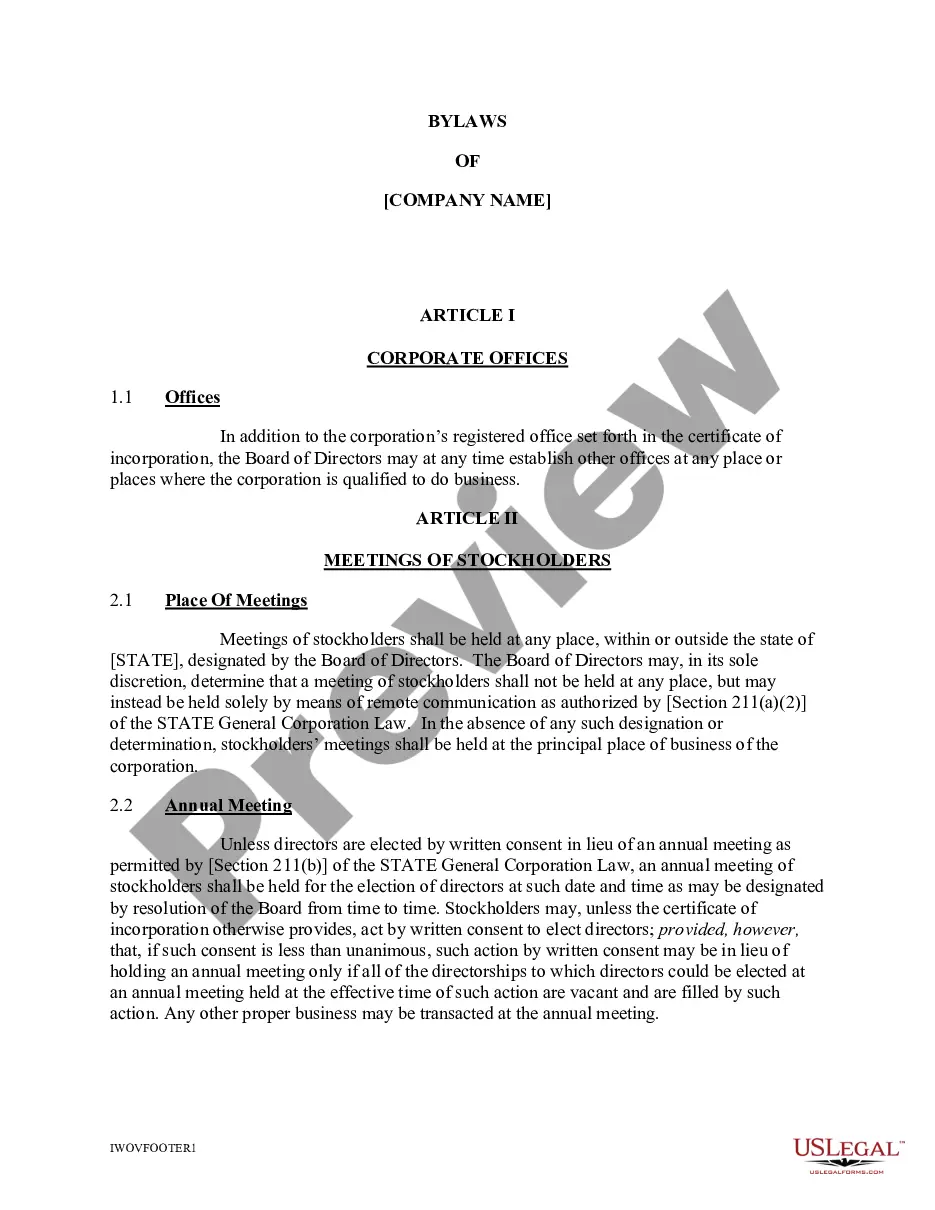

US Legal Forms has established itself as the most comprehensive and trustworthy collection of official templates for every personal and business situation. Every document you find on our online platform is created in compliance with national and state regulations, ensuring your paperwork is accurate.

Another fantastic aspect of US Legal Forms is that you will never misplace the documentation you obtained - you can access any of your downloaded templates in the My documents section of your profile whenever you require it.

- Verify that the document displayed on the page aligns with your legal circumstance and state regulations by reviewing its text description or exploring the Preview mode.

- Input the form title in the Search tab at the top of the page and select your state from the dropdown to find an alternative template if there are any discrepancies.

- Conduct the content verification again and click Buy now when you are assured of the document’s adherence to all requirements.

- Log in to your account and press Download. If you haven't signed up for the service yet, register and select a subscription plan.

- Use your credit card or the PayPal option to settle your US Legal Forms subscription. The document will be ready for download immediately after.

- Select the format you wish to receive your Maryland Request for Judgment - Garnishment in and download it by pressing the suitable button.

- Import your template into an online editor to finish and sign it swiftly or print it to prepare your physical copy manually.

Form popularity

FAQ

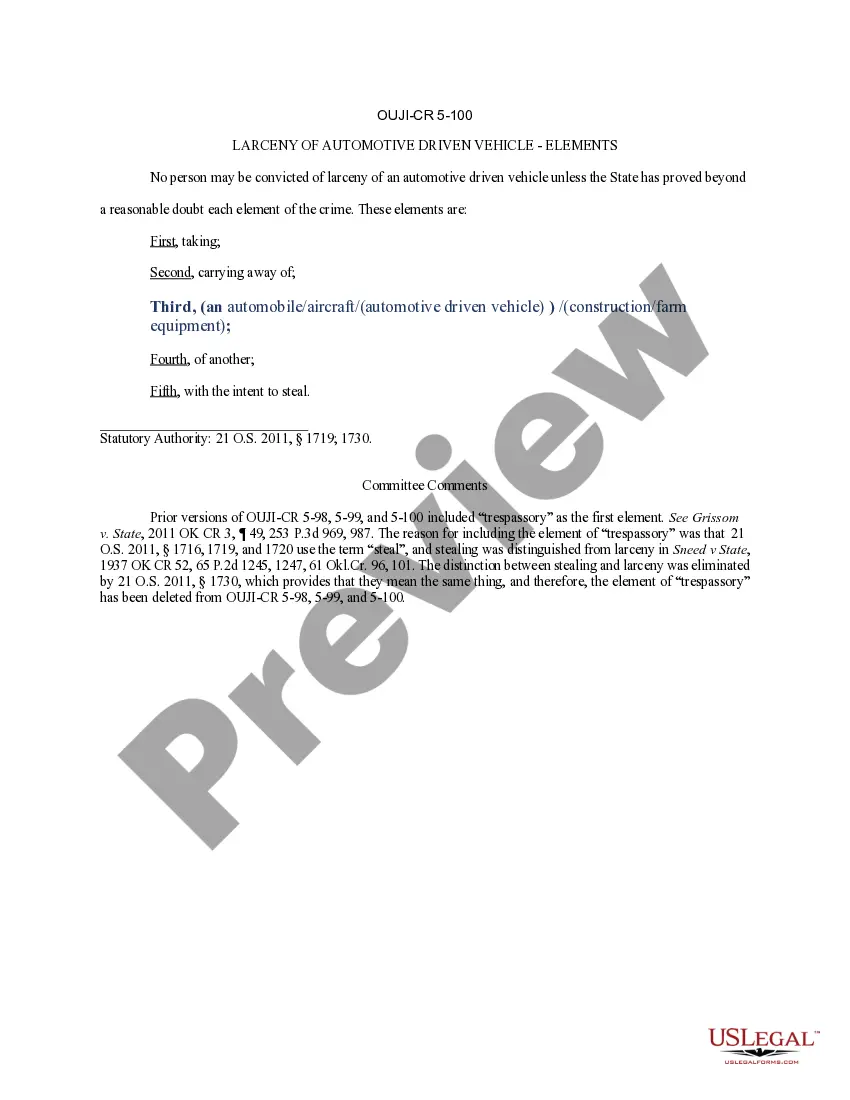

The final judgment rule in Maryland states that only final judgments are appealable. This means that you cannot appeal interim decisions or orders that do not resolve all claims. Understanding this rule is essential when navigating the court system, especially if you are pursuing a Maryland Request for Judgment - Garnishment.

Rule 2-625 in Maryland governs the procedure for enforcing judgments. This rule outlines specific steps necessary for a creditor to seek enforcement through a court. Understanding this rule is vital when you consider a Maryland Request for Judgment - Garnishment, as it ensures adherence to legal requirements.

In Maryland, judgments have a lifespan. A judgment generally expires after 12 years from the date of entry. However, you can extend this period by filing certain actions. Therefore, staying proactive is crucial if you aim to enforce a Maryland Request for Judgment - Garnishment.

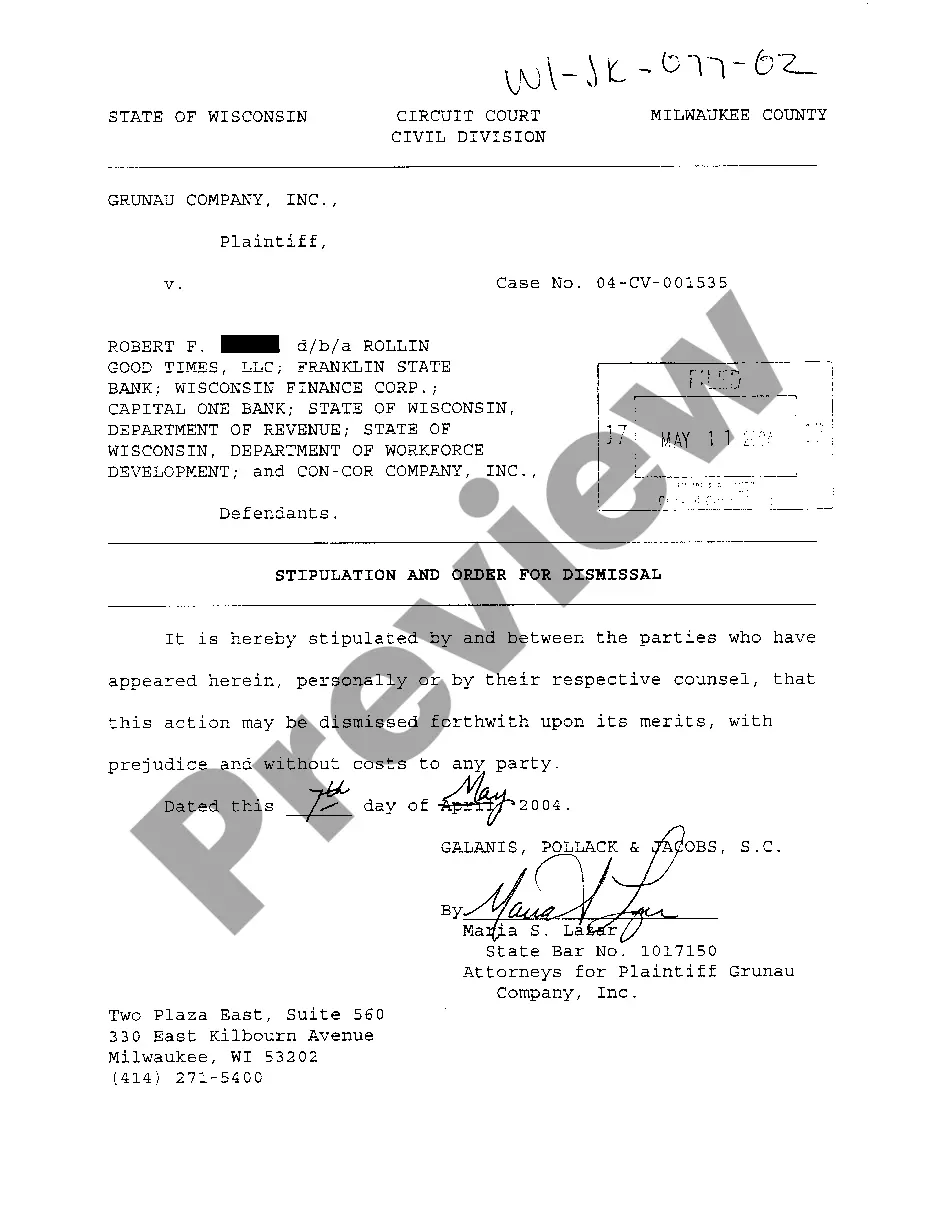

Collecting on a judgment in Maryland involves several steps, especially when you navigate through the Maryland Request for Judgment - Garnishment. You can use wage or bank account garnishment as methods to obtain owed funds. Additionally, filing a lien against the debtor's property can be effective. Utilizing templates from platforms like USLegalForms can simplify this process.

10 days following the judgment, the creditor becomes a judgment creditor and can begin the wage garnishment process. Under Md. Rule 3-646, the judgment creditor must file a Request for Writ of Garnishment in the case, which is served upon the judgment debtor.

A Writ of Garnishment is a court order to the garnishee. It orders the garnishee to hold any property of the judgment debtor that the garnishee possesses at the time the Writ is filed. The Writ of Garnishment must be served on the garnishee via certified mail, restricted delivery, private process or sheriff/constable.

10 days following the judgment, the creditor becomes a judgment creditor and can begin the wage garnishment process. Under Md. Rule 3-646, the judgment creditor must file a Request for Writ of Garnishment in the case, which is served upon the judgment debtor.

The 12-year limit starts at the date of the judgment, which is often the date the creditor went to court. If a court ordered you to pay a creditor money more than 12 years ago, the creditor will not be able to enforce that debt against you. This means they will not be able to garnish your wages or attach your property.

A garnishment proceeding determines whether the debtor has any assets that can be used to pay a judgment. Once a judgment has been entered, the creditor can collect what is owed. Judgments are enforceable in Maryland for 12 years and they can be renewed. Interest accrues on judgments at the legal rate of 10% or 6%.

In Maryland, a judgment is only valid for 12 years. If you have not been able to collect your judgment within that time, you will have to renew the judgment to continue your collection efforts. Complete the Request to Renew Judgment (form DC-CV-023) and file it with the court.