Maryland Certificate of Service Regular Estate

Description

Key Concepts & Definitions

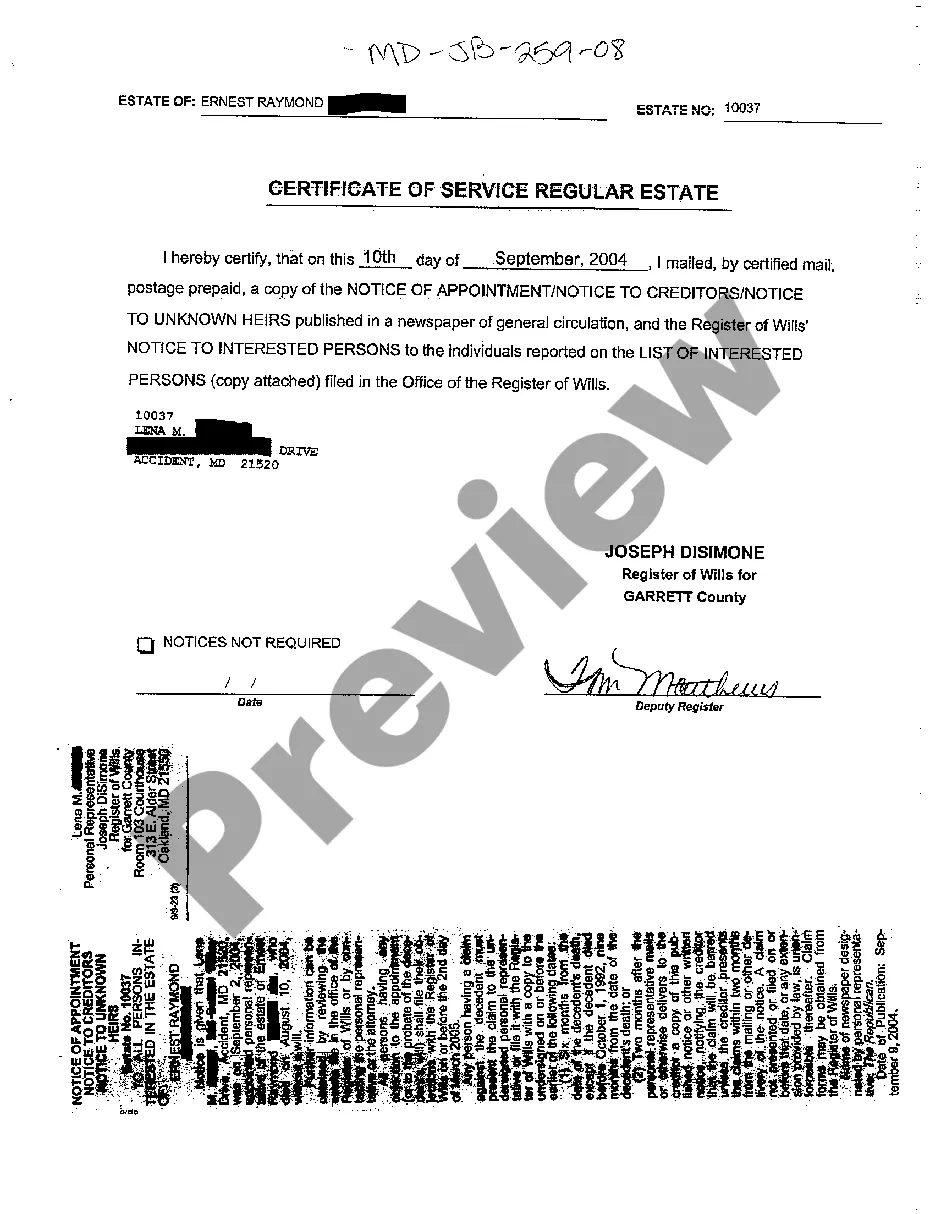

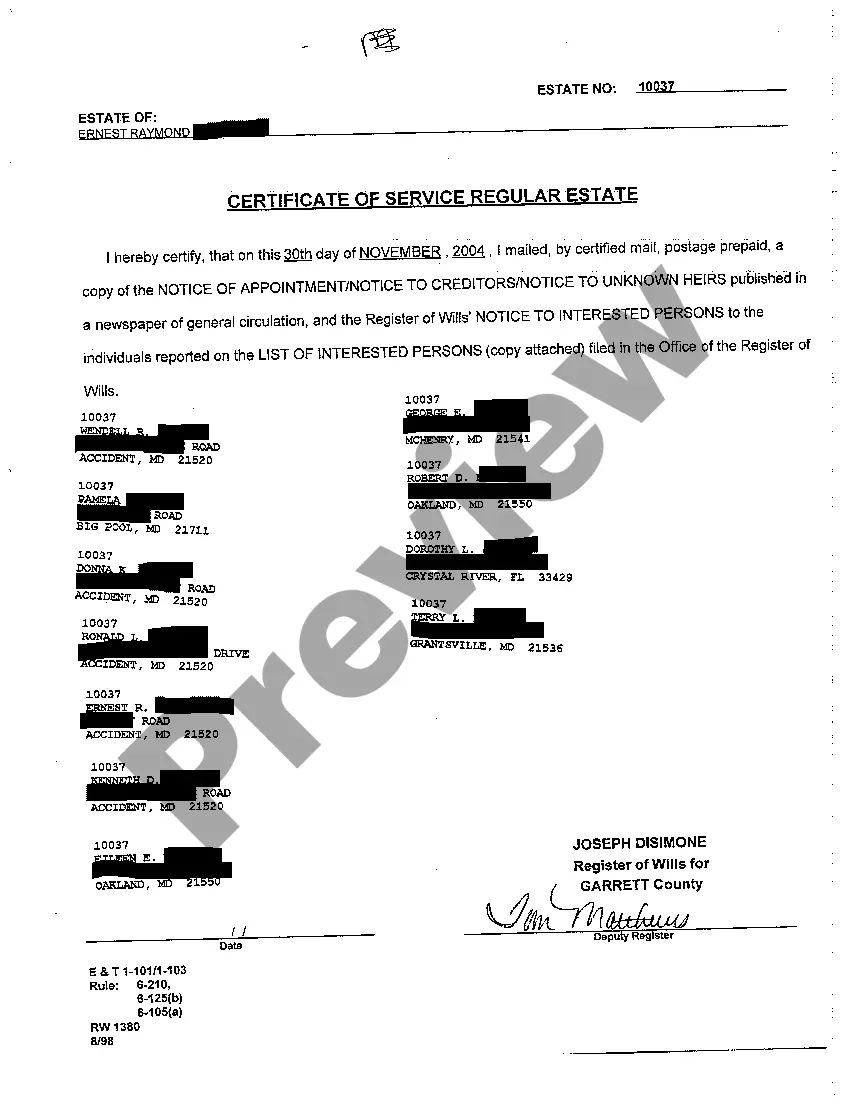

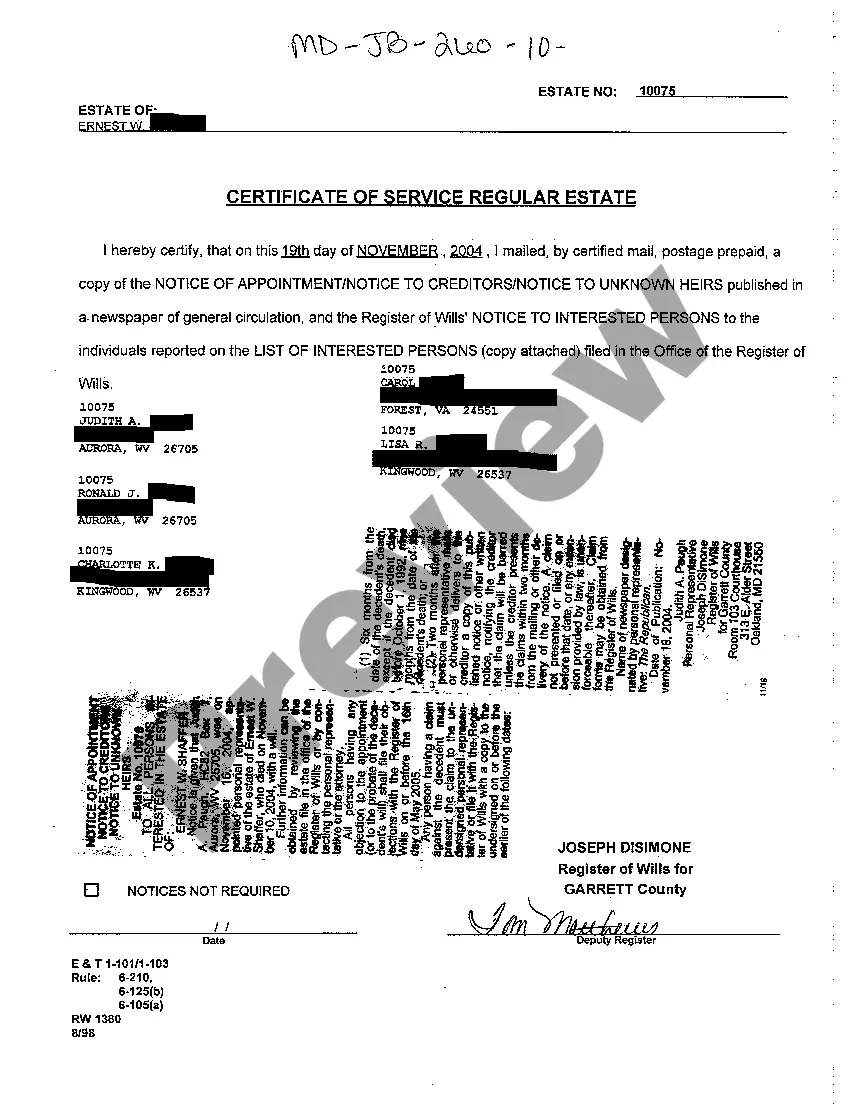

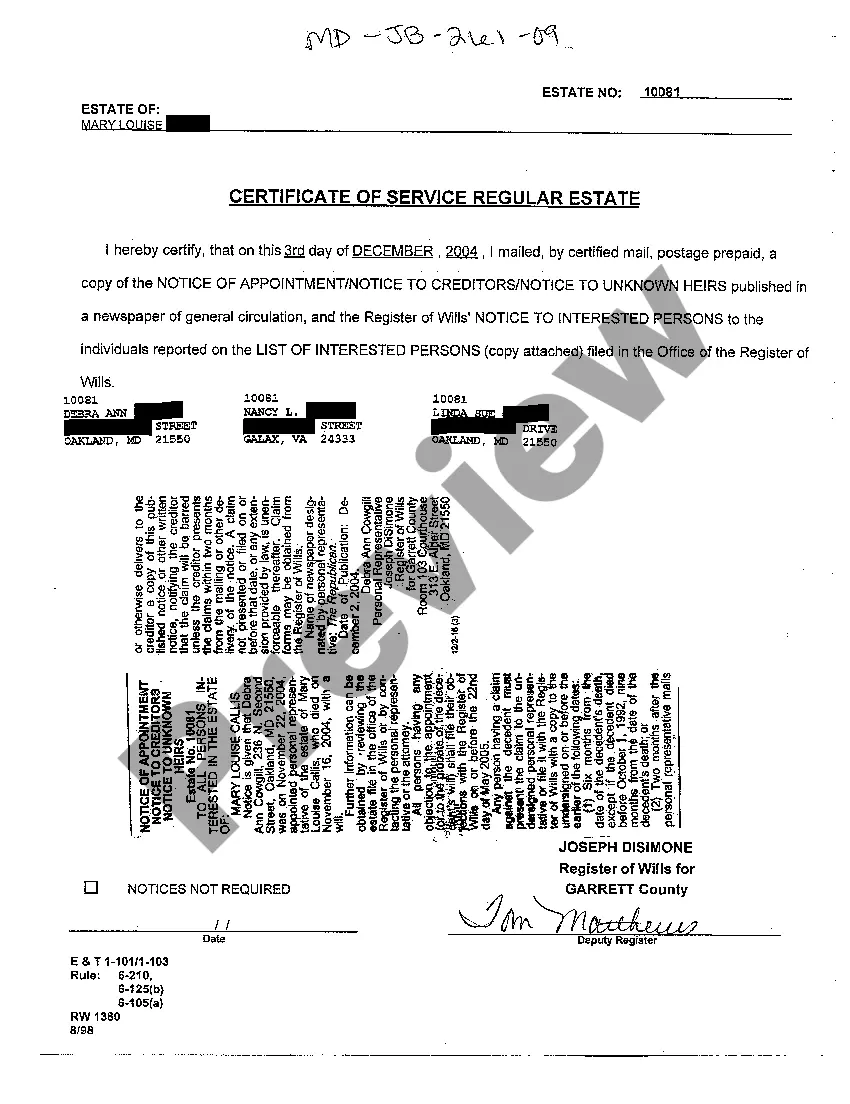

A08 Certificate of Service Regular Estate: A legal document used in the state of Maryland when administrating a regular estate. It certifies that proper notifications regarding the estate's administration have been served to all relevant parties. IP Block Security, Legal Forms Trusts, Name Change Service, Real Estate Certificate, Landlord Tenant Law: These are all related legal and security concepts that intersect with handling sensitive personal and property information securely.

Step-by-Step Guide

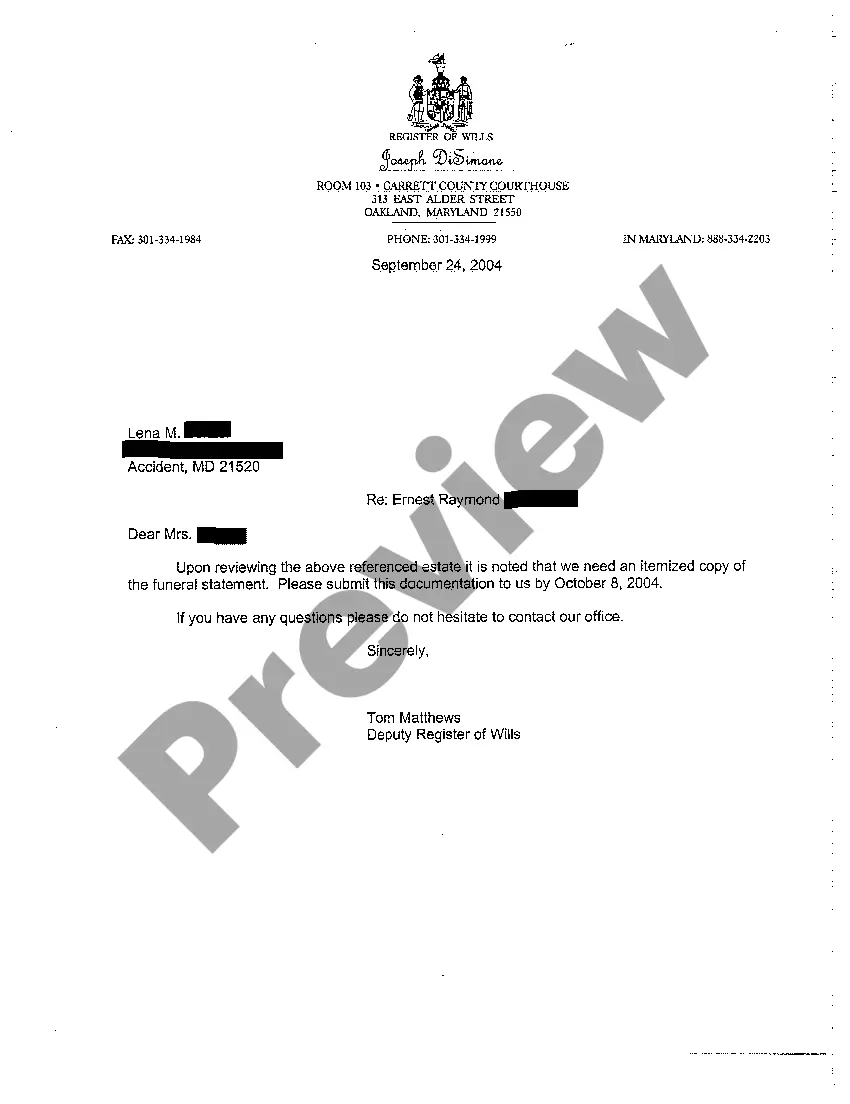

- Collect all necessary documentation related to the estate including any real estate certificates and medical certificates.

- Complete the A08 form by entering details of the estate and beneficiaries.

- Ensure compliance with Maryland's landlord tenant laws and small business laws if applicable.

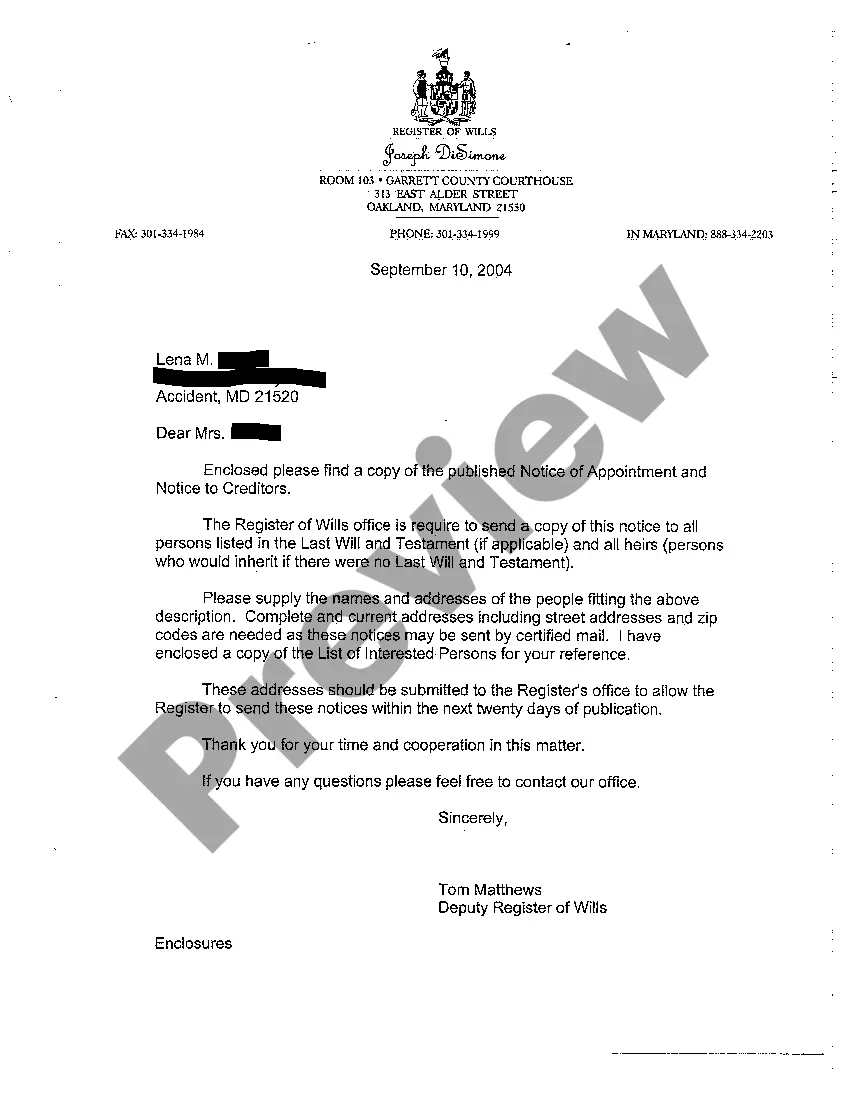

- Notify all relevant parties as mandated by law, using the correct legal forms and ensuring that personal security codes remain secure.

- File the completed A08 certificate with the local court and retain proof of service.

Risk Analysis

- Non-compliance Risk: Failure to properly serve all parties can lead to legal complications or delays in estate administration.

- Data Security Risk: Mishandling of personal information, such as IP block security and personal security codes, during the notification process.

- Legal Challenges: Incorrect or incomplete form submissions can result in disputes over estate distribution or name changes.

Best Practices

- Use verified and standardized forms for notifying parties to avoid legal repercussions.

- Engage with a professional familiar with Maryland certificate service to oversee the process.

- Maintain a high level of security when handling personal information to comply with relevant laws.

Common Mistakes & How to Avoid Them

- Ignoring Local Law Requirements: Each state has unique requirements for estate notification; always check local regulations.

- Insufficient Proof of Service: Always keep copies and receipts of notifications sent.

- Data Breach: Implement strict controls on who can access personal data within the estate documents.

How to fill out Maryland Certificate Of Service Regular Estate?

Greetings to the paramount library of legal documents, US Legal Forms. Here, you can discover any example including Maryland Certificate of Service Regular Estate templates and obtain them (as many as you desire or need). Prepare formal documents in merely a few hours, instead of days or weeks, without having to spend a fortune on a lawyer.

Acquire the state-specific sample in just a few clicks and feel confident knowing it was created by our state-certified attorneys.

If you’re already a registered user, simply Log In to your account and then click Download next to the Maryland Certificate of Service Regular Estate you wish to obtain. Since US Legal Forms is online, you’ll always have access to your downloaded templates, regardless of the device you’re using. View them within the My documents section.

After you’ve completed the Maryland Certificate of Service Regular Estate, forward it to your attorney for verification. It’s an additional step but an essential one for ensuring you’re completely protected. Join US Legal Forms now and gain access to a vast selection of reusable templates.

- If you don't have an account yet, what are you waiting for? Check our instructions listed below to get started.

- If this is a state-specific form, verify its validity in your residing state.

- Review the description (if available) to determine if it’s the suitable template.

- Explore additional content using the Preview feature.

- If the template meets your needs, simply click Buy Now.

- To create your account, choose a pricing plan.

- Use a credit card or PayPal account to register.

- Download the template in the format you prefer (Word or PDF).

- Print the document and fill it in with your/your business’s information.

Form popularity

FAQ

Rule 2-341 in Maryland addresses the service of pleadings and other documents in civil cases. Specifically, it emphasizes the importance of filing certificates of service when parties submit motions or responses. Understanding and adhering to this rule is essential for anyone working with the Maryland Certificate of Service Regular Estate, as it ensures all parties remain informed and involved throughout the process.

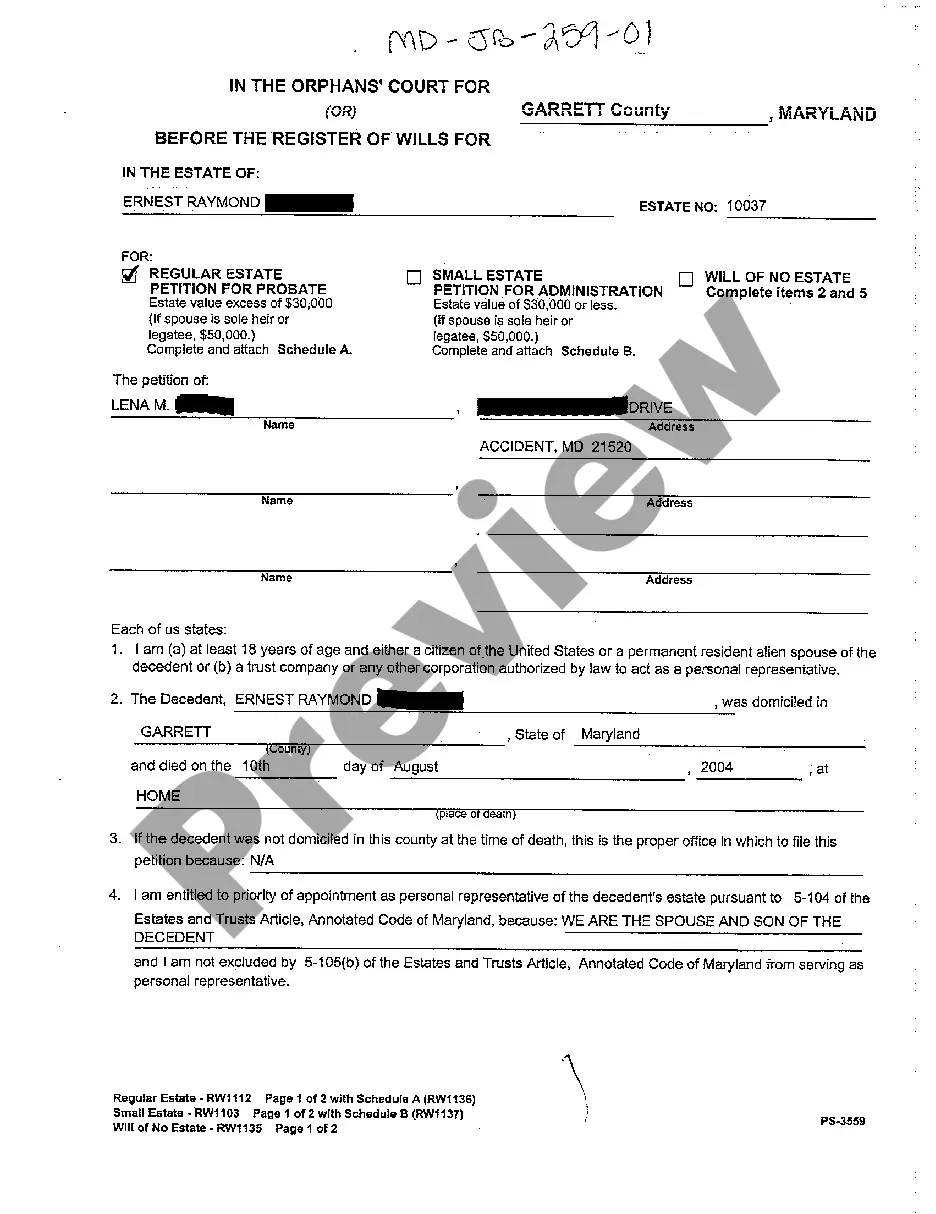

The Will must be filed in the Orphan's Court in the county where the decedent lived. The Will must be filed within a reasonable amount of time at the Register of Wills.

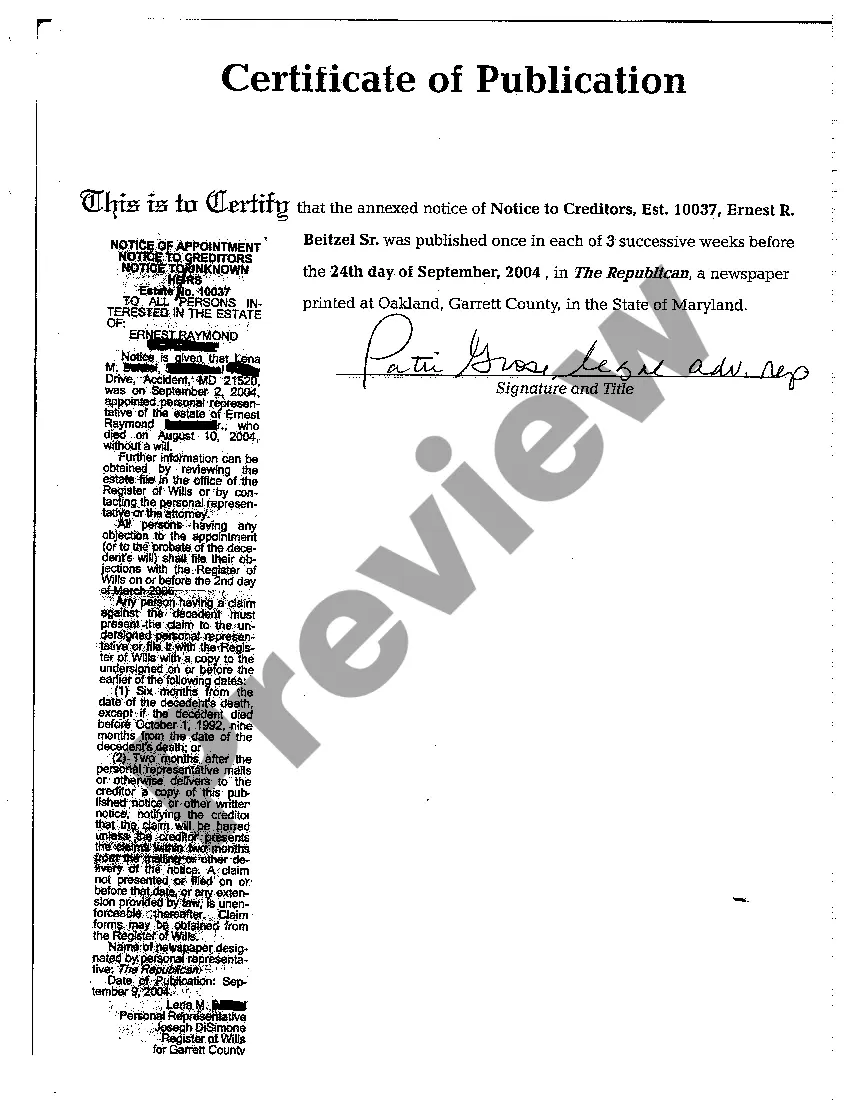

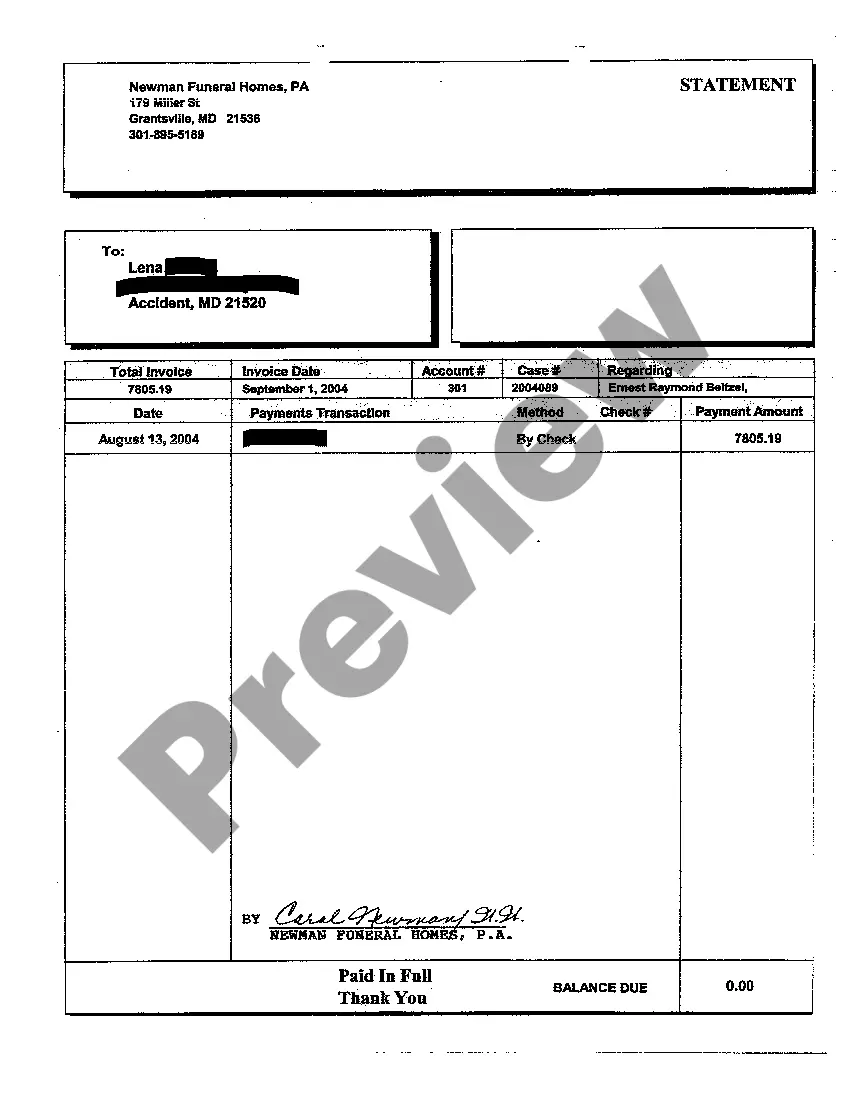

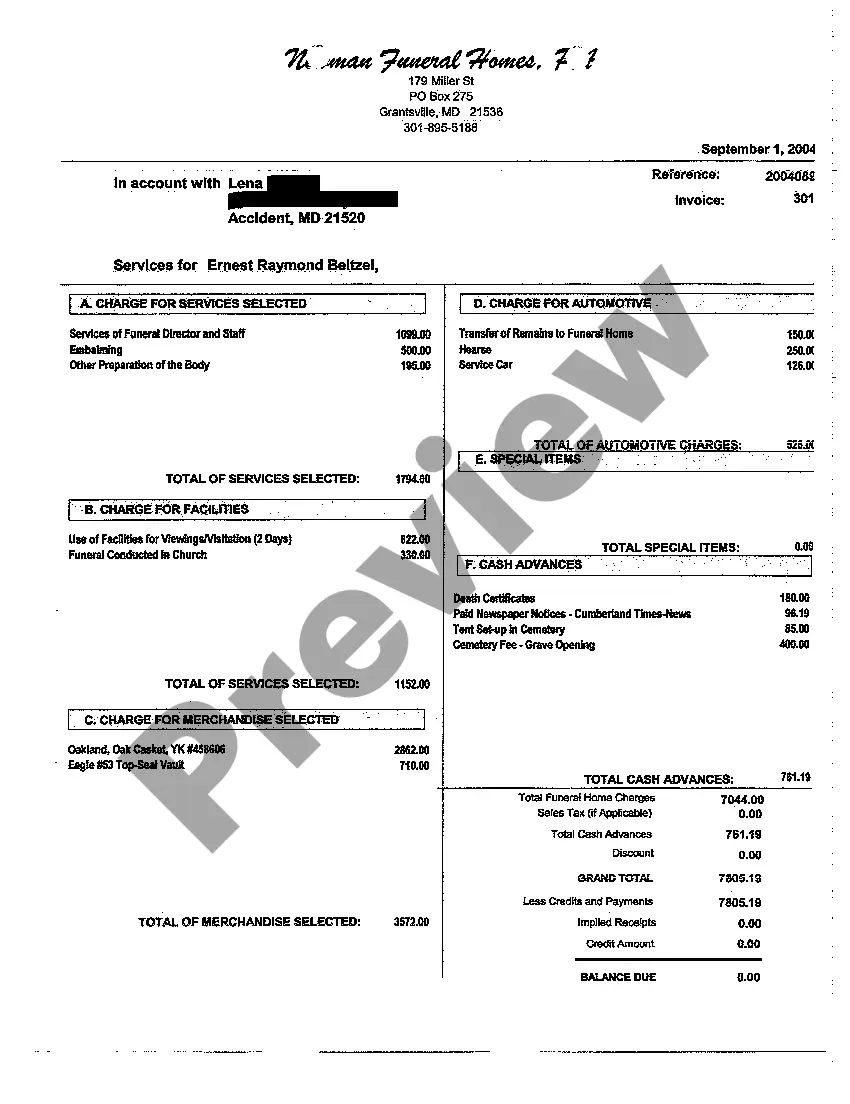

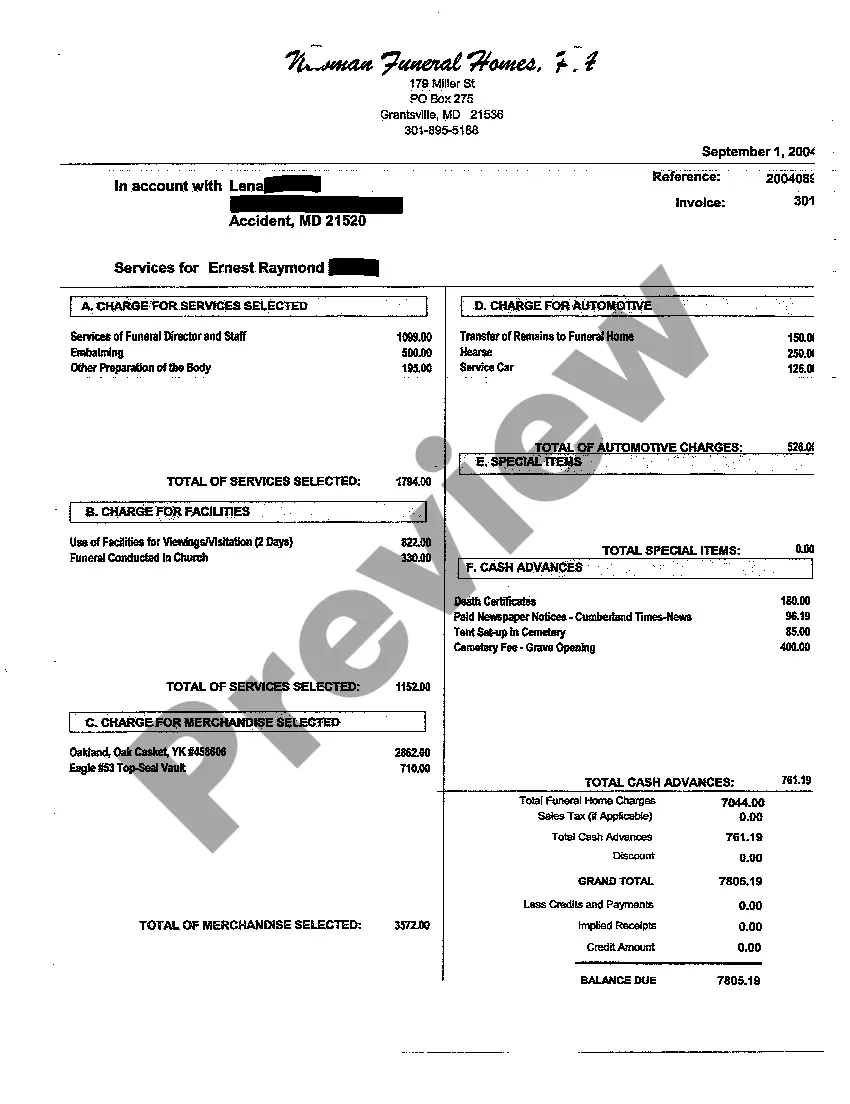

Petition for Administration. List of Assets and Debts. Notice of Appointment / Notice to Creditors / Notice to Unknown Heirs. Bond of Personal Representative Form. List of Interested Persons. Paid Funeral Bill. Copy of Death Certificate - available from Division of Vital Records.

Small Estate: property of the decedent subject to administration in Maryland is established to have a value of $50,000 or less ($100,000 or less if the spouse is the sole heir).

Maryland Law requires that any one holding an original Will and/or Codicil(s) must file that document with the Register of Wills promptly after a decedent's death even if there are no assets. However, although the Will and/or Codicil are kept on file, no probate proceedings are required to be opened.

Letters of Administration are granted by a Surrogate Court or probate registry to appoint appropriate people to deal with a deceased person's estate where property will pass under Intestacy Rules or where there are no executors living (and willing and able to act) having been validly appointed under the deceased's will

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

After a loved one dies, his or her estate must be settled. While most people want the settlement process to be done ASAP, probate in Maryland, including Howard County, can take between 9 to 18 months, presuming there is no challenges to a Will or any litigation.