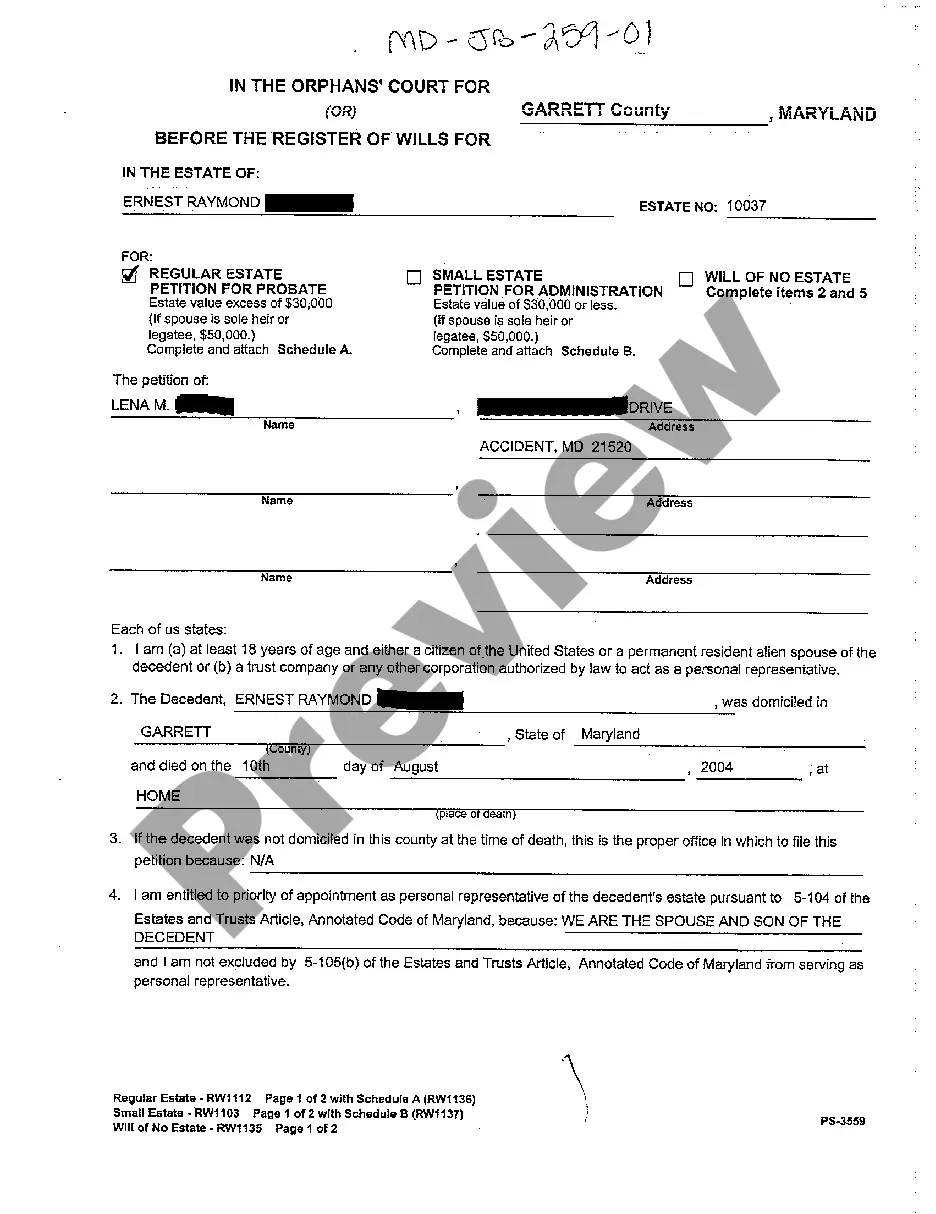

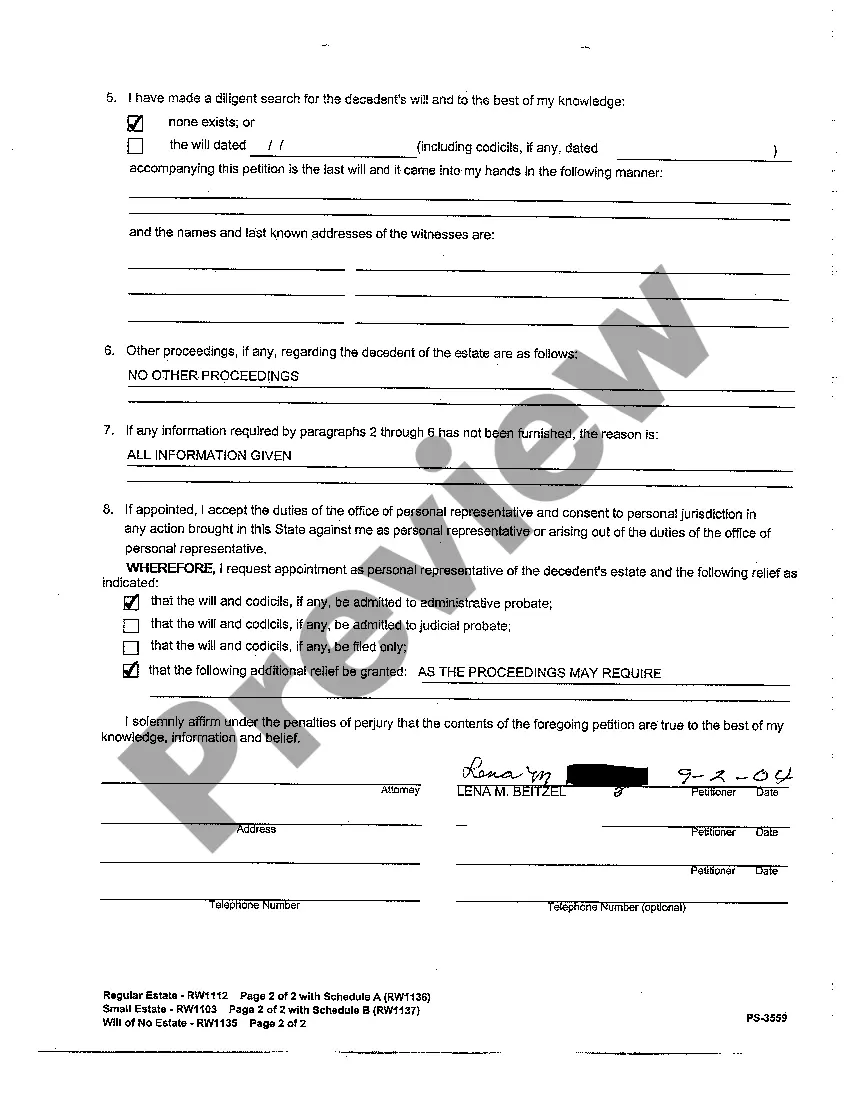

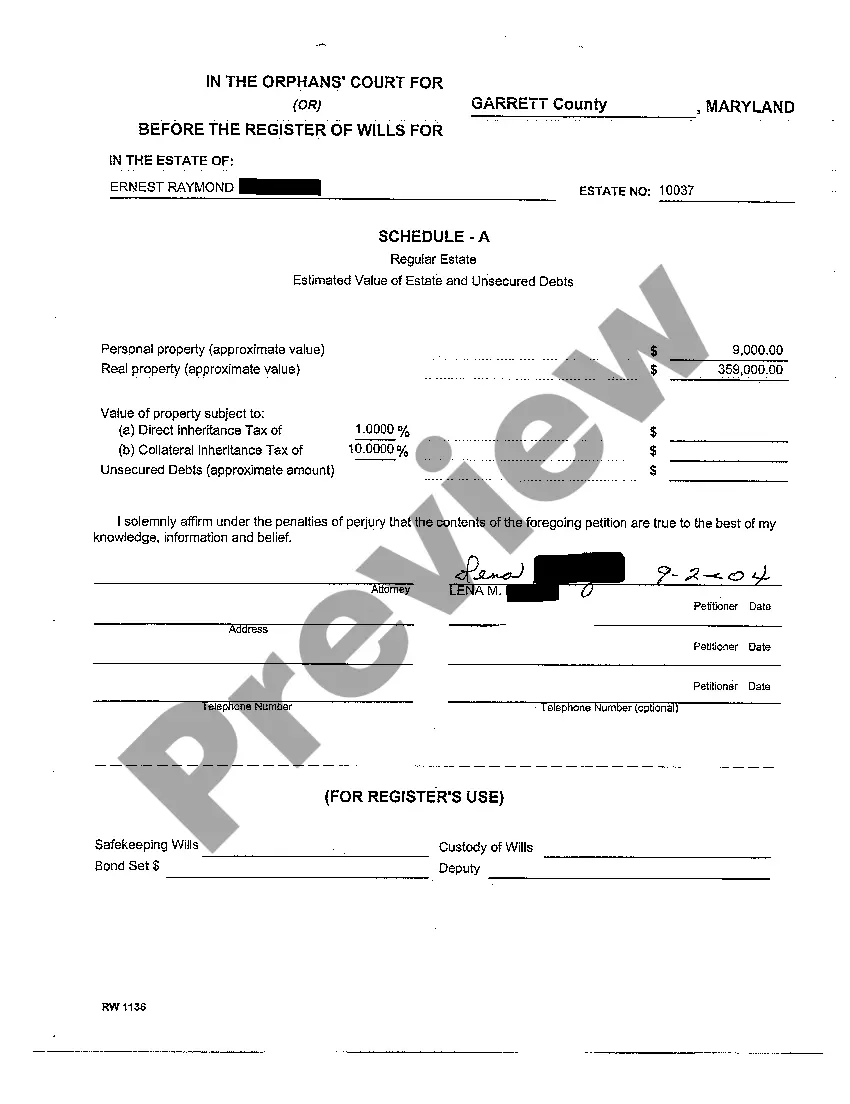

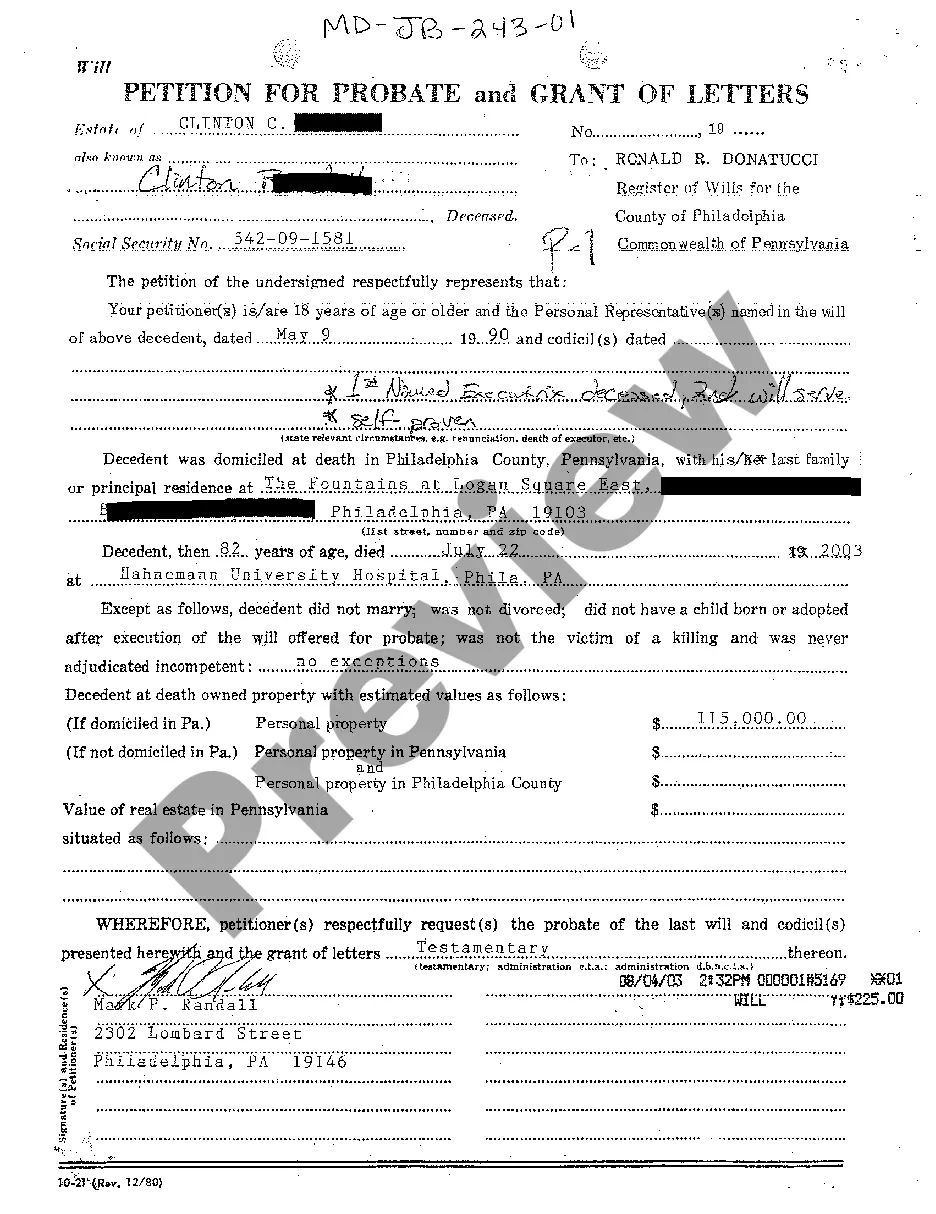

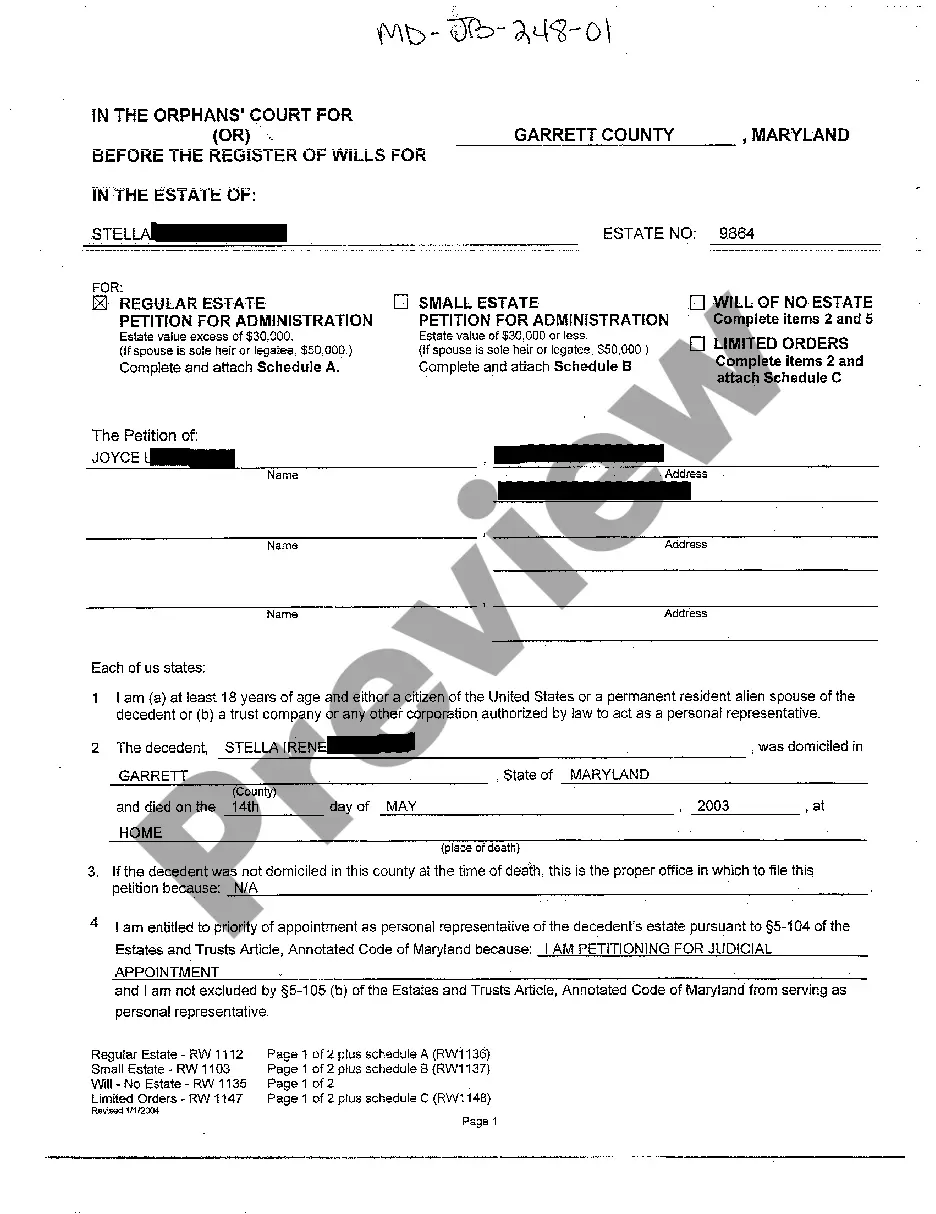

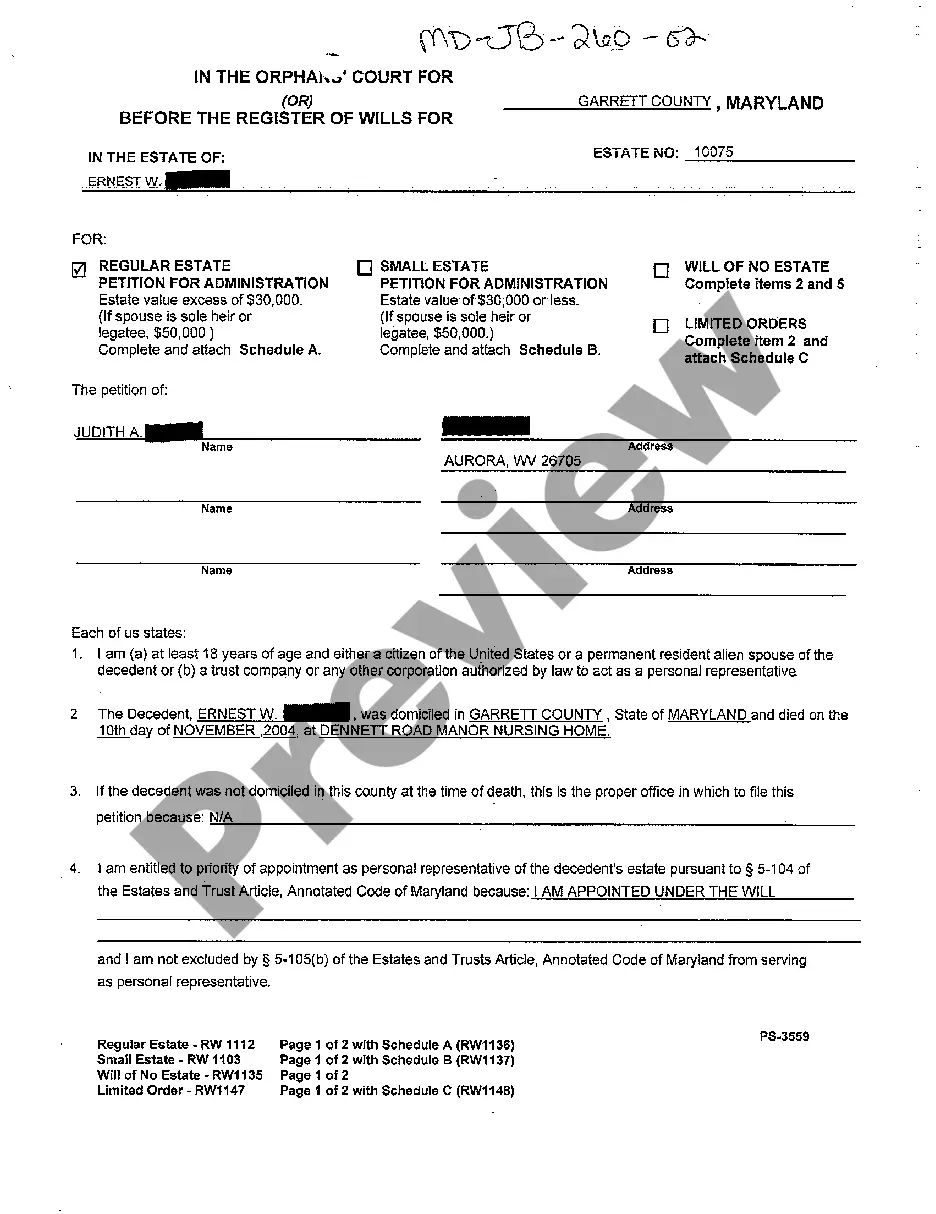

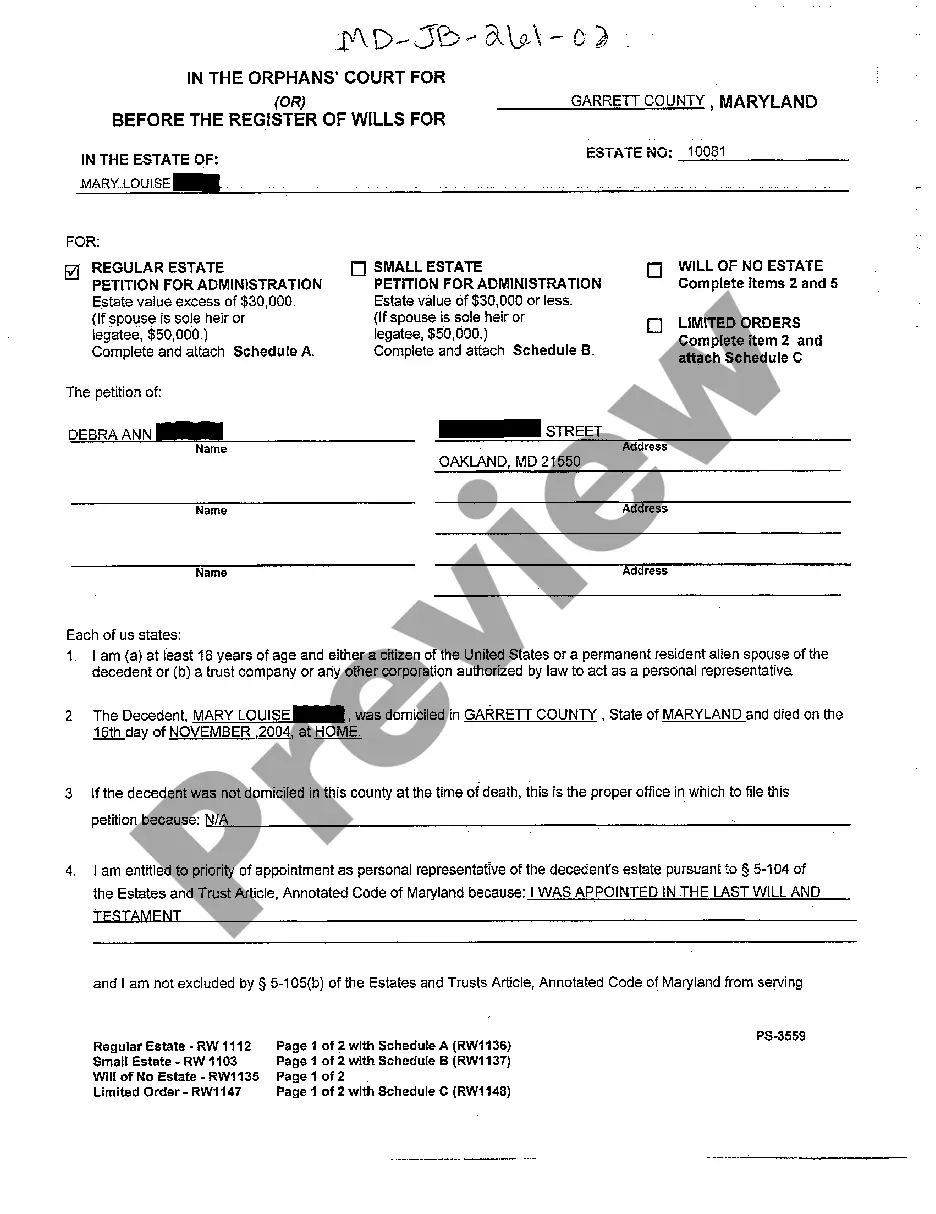

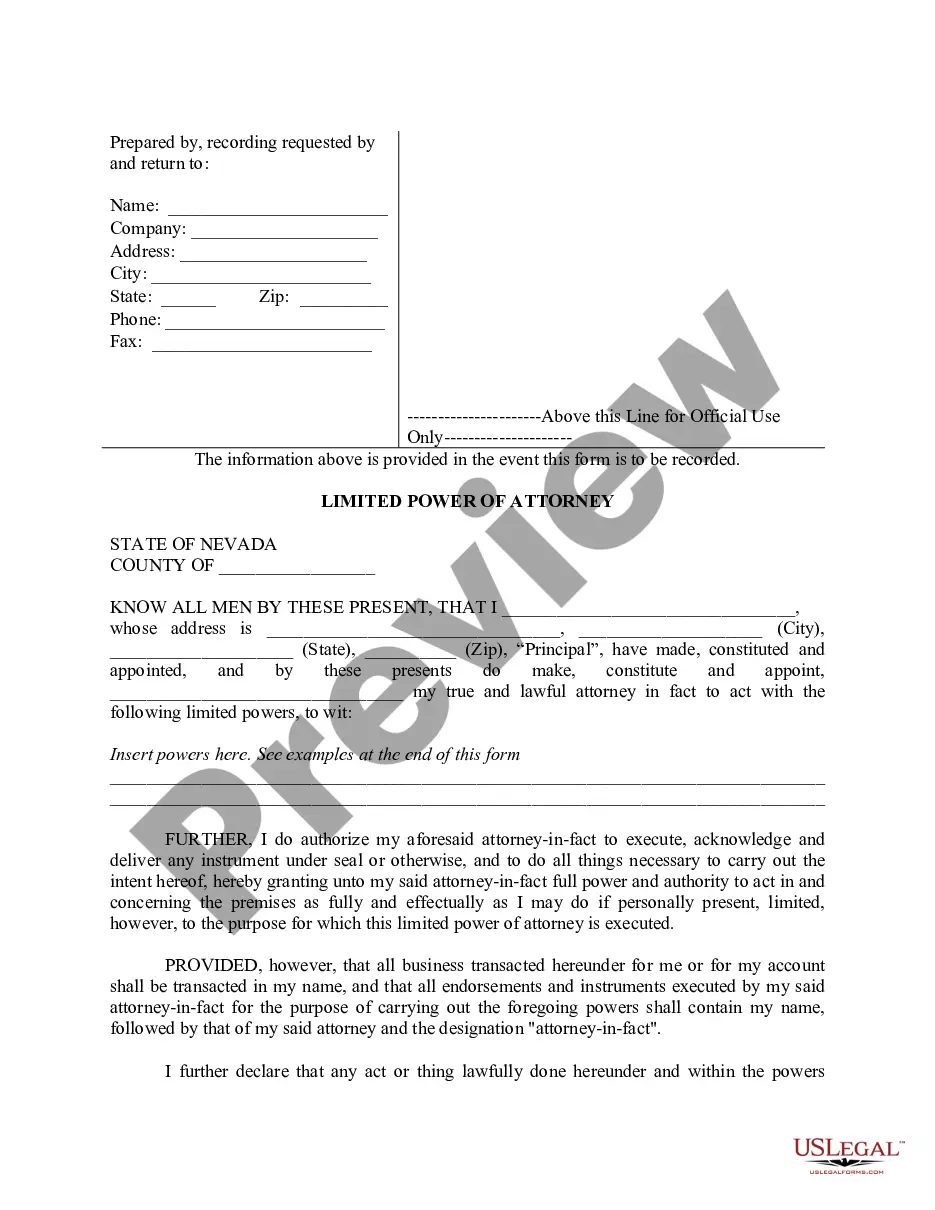

Maryland Regular Estate Petition for Probate

Description

How to fill out Maryland Regular Estate Petition For Probate?

Greetings to the most notable legal documentation repository, US Legal Forms. Here, you will discover various examples, including Maryland Regular Estate Petition for Probate templates and can save as many of them as you desire. Create formal documents within a couple of hours rather than days or even weeks, without spending a fortune on an attorney.

Obtain your state-specific form in just a few clicks and feel secure with the assurance that it has been crafted by our experienced lawyers.

If you’re already a registered user, simply Log In to your account and then click Download next to the Maryland Regular Estate Petition for Probate you need. Since US Legal Forms operates online, you will always have access to your downloaded templates, no matter which device you are using. Find them in the My documents section.

Print the document and complete it with your/your company’s details. Once you’ve filled out the Maryland Regular Estate Petition for Probate, present it to your attorney for validation. This is an additional step but a crucial one to ensure you’re fully protected. Register for US Legal Forms now and gain access to a vast array of reusable templates.

- If you don't possess an account yet, what are you waiting for.

- Review our instructions below to begin.

- If this is a state-specific template, verify its legality in the state where you reside.

- Examine the description (if present) to see if it’s the suitable example.

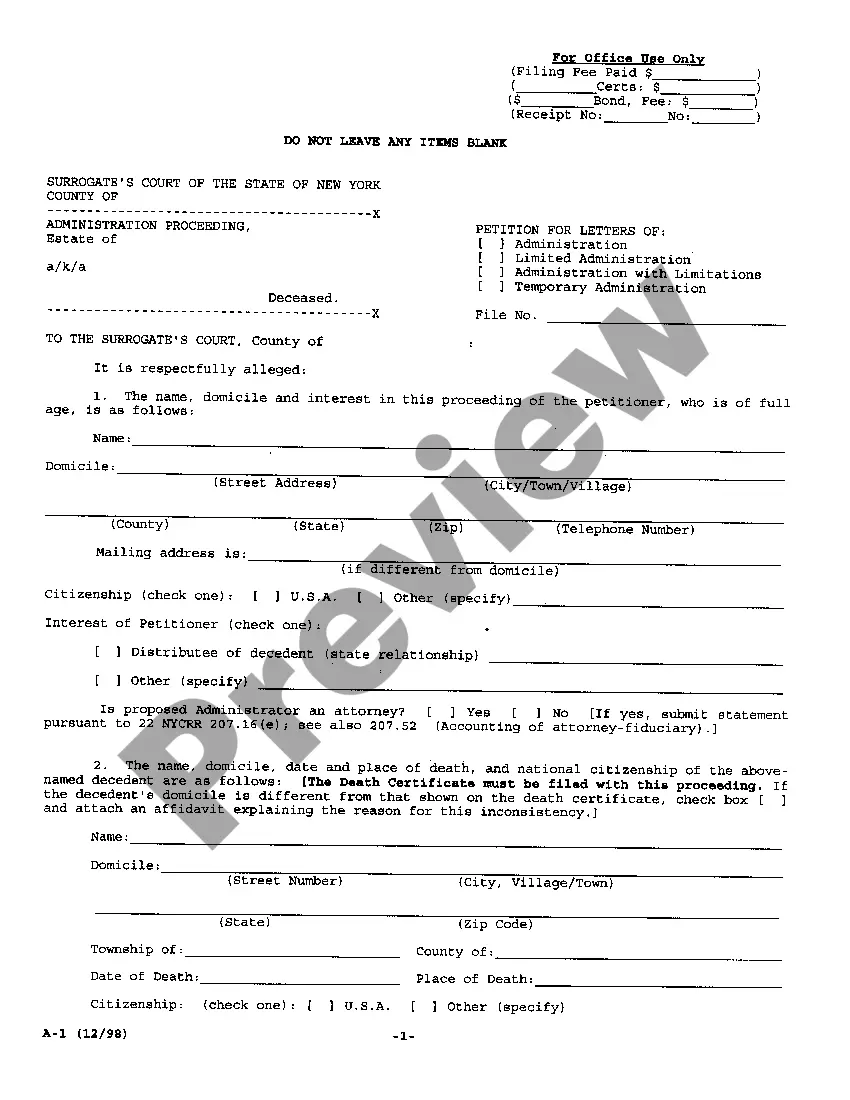

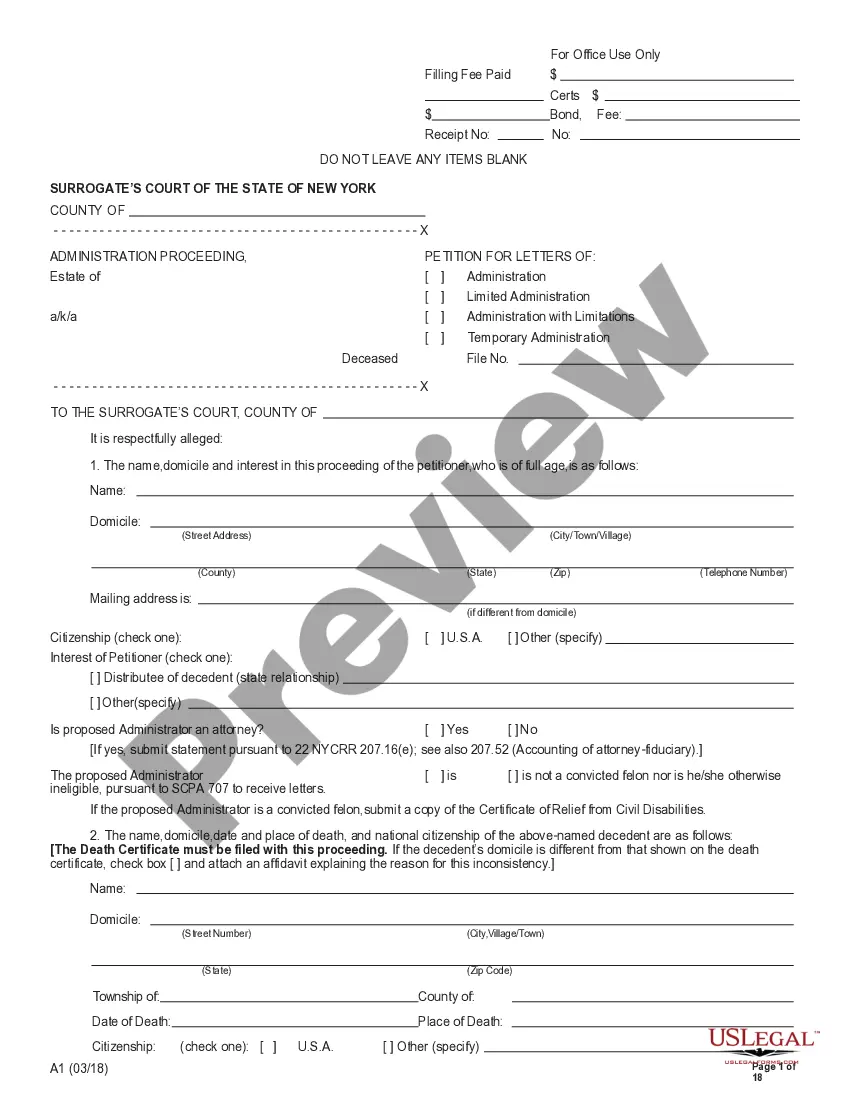

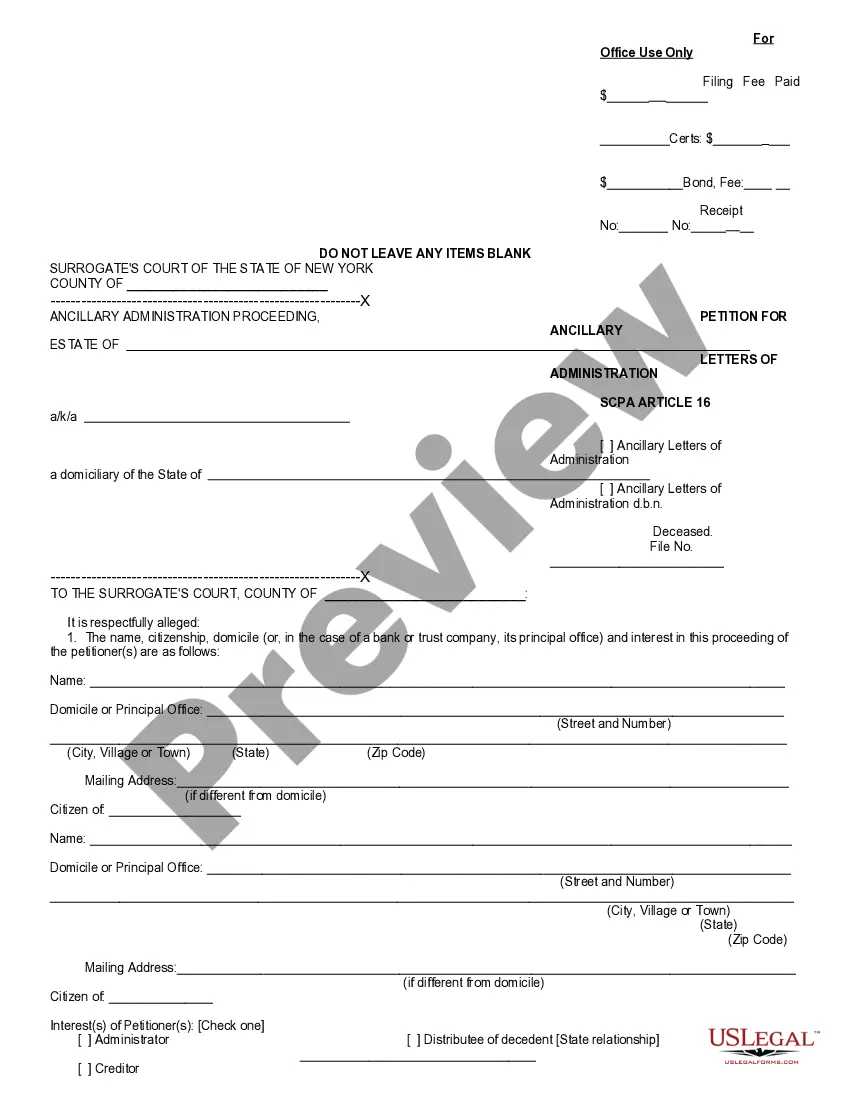

- Explore additional content using the Preview feature.

- If the template meets all your requirements, click Buy Now.

- To create an account, select a subscription plan.

- Utilize a credit card or PayPal account to register.

- Download the file in the format you need (Word or PDF).

Form popularity

FAQ

Step 1, Determine whether You are the Personal Representative. Step 2, Petition to Probate the Estate. Step 3, Make an Inventory of the Estate. Step 4, Assess any projected Inheritance Taxes. Step 5, Consolidate the Estate and Manage Expenses.

Create an inventory of the deceased person's property and determine the estate size according to Maryland Law. Petition the Maryland Register of Wills to begin the probate process. Prove the will in court. Pay the deceased person's debts and expenses.

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

Maryland Law requires that any one holding an original Will and/or Codicil(s) must file that document with the Register of Wills promptly after a decedent's death even if there are no assets. However, although the Will and/or Codicil are kept on file, no probate proceedings are required to be opened.

But generally if the total value of the Estate is less than £15,000 then usually Probate will not be required. But if the deceased owned assets worth more than the threshold, you'll need to go through the Probate process.