Maryland Petition for Probate and Grant of Letters regarding Testate Estate

Description

Key Concepts & Definitions

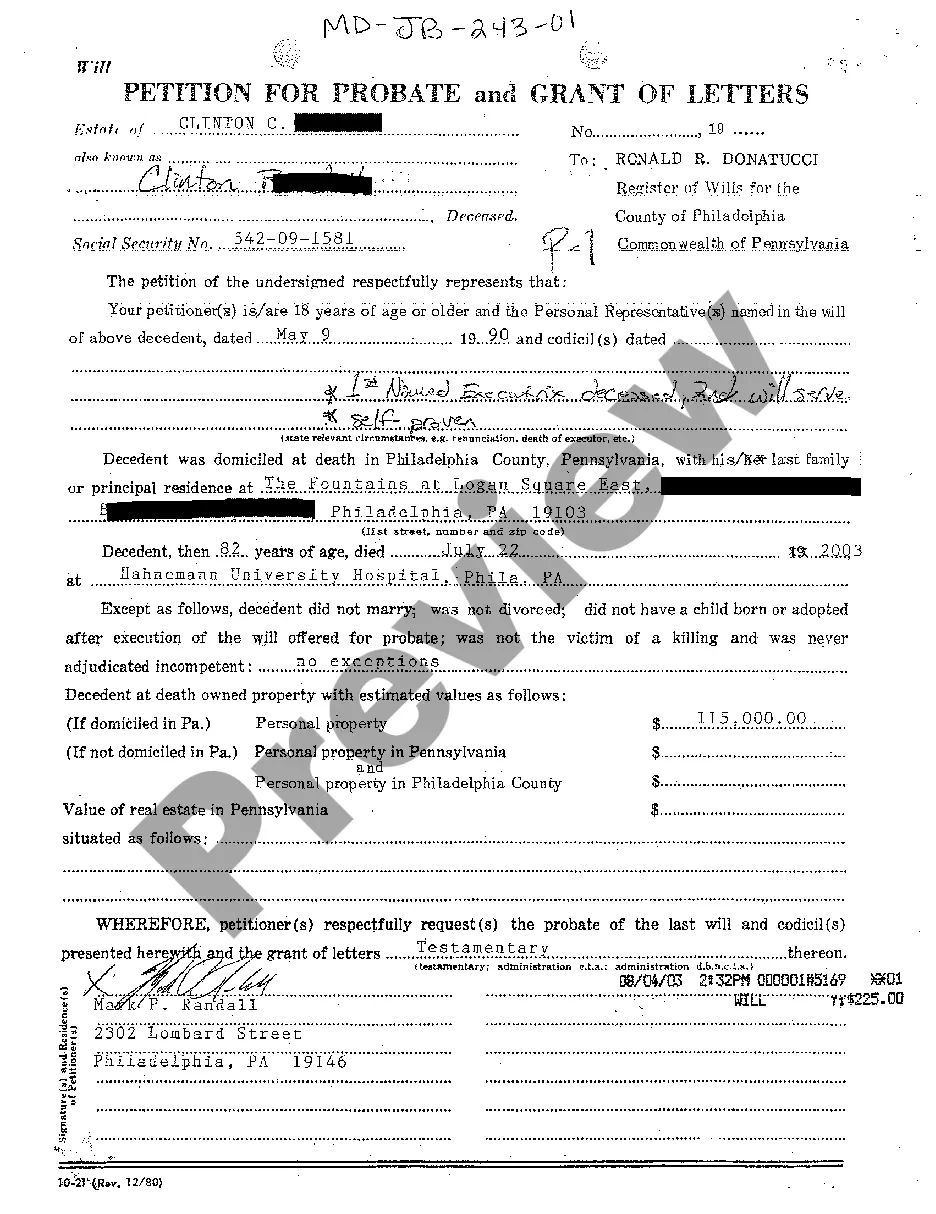

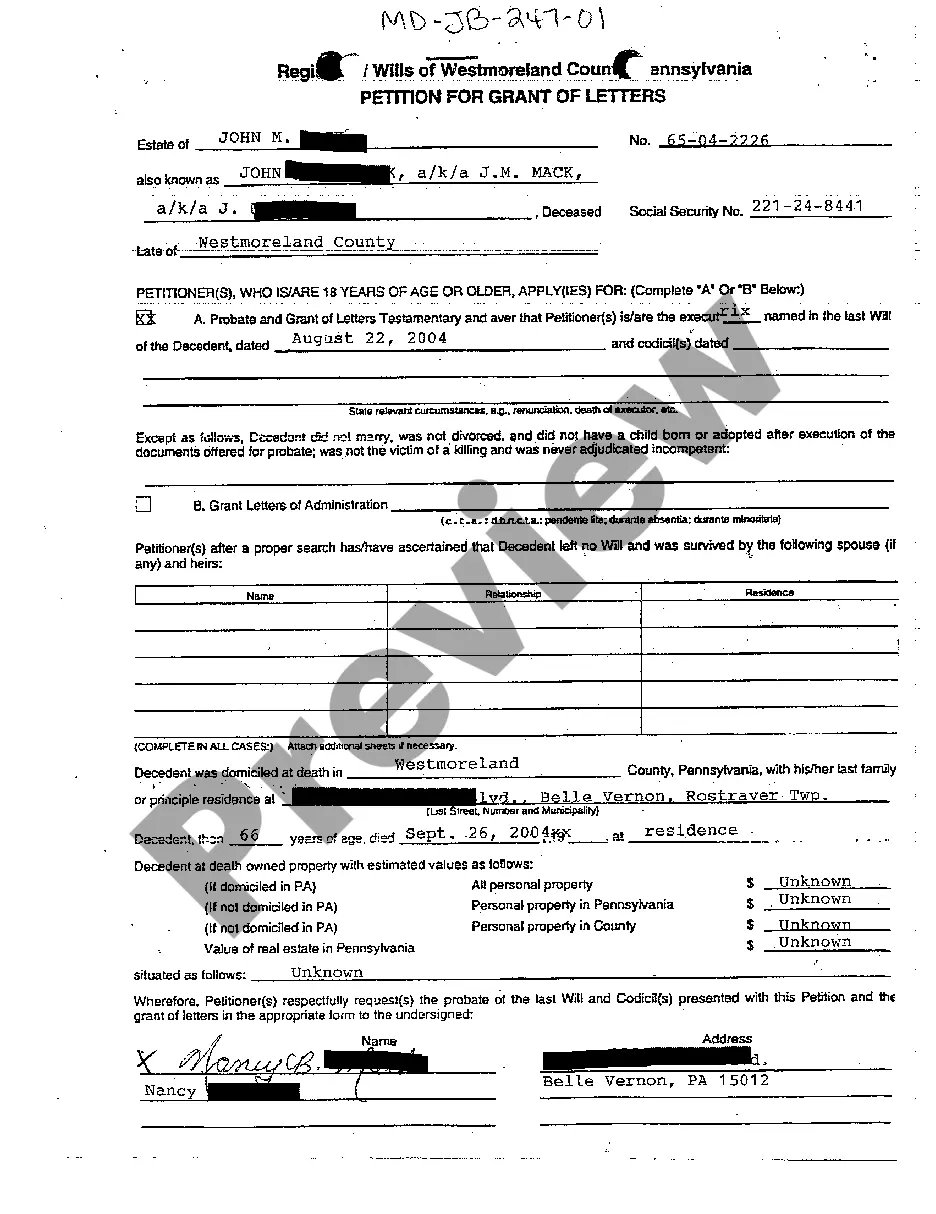

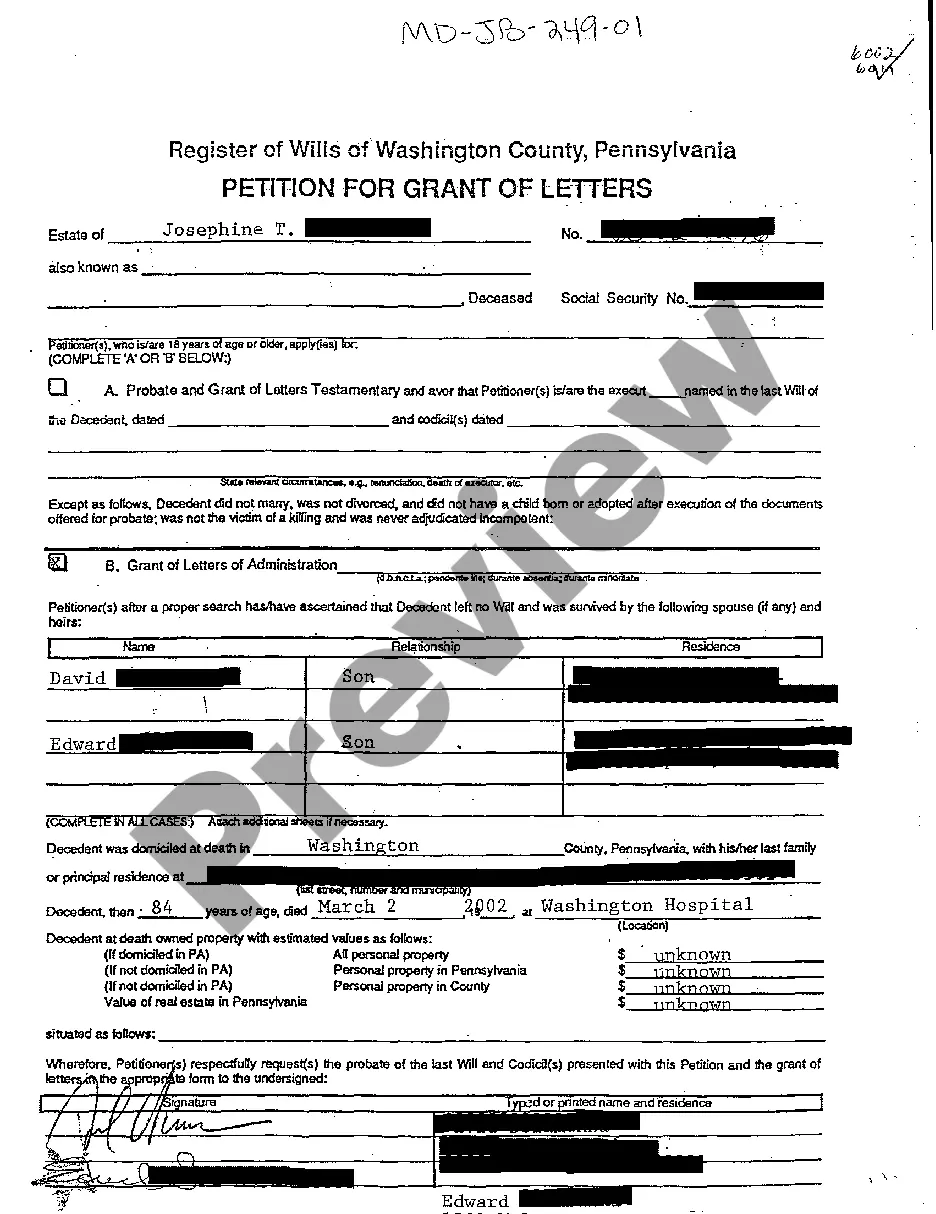

A01 Petition for Probate and Grant of Letters is a legal document filed in a probate court after the death of an individual, requesting the appointment of an executor or administrator to handle the decedent's estate. 'Probate' refers to the legal process by which a deceased person's will is declared valid, and 'Grant of Letters' authorizes the executor or administrator to distribute the deceased's assets and manage their estate accordingly.

Step-by-Step Guide

- Gather Necessary Documents: Collect the original will, death certificate, and asset details of the deceased.

- File the Petition: Submit a completed A01 form at the local probate court.

- Notice to Heirs: Notify all potential heirs and interested parties about the probate application.

- Attend the Hearing: Appear in court if necessary to answer any judge's inquiries.

- Receive the Grant of Letters: Obtain authorization from the court to act as the estates administrator.

- Administer the Estate: Manage and distribute the estate's assets as per the will or state law.

Risk Analysis

- Risks of Rejection: Inadequate documentation or incorrect form filling can lead to rejection of the petition.

- Legal Challenges: Disputes from heirs or contesting of the will can cause delays and additional costs.

- Financial Responsibility: Executors or administrators have significant financial responsibilities and legal liabilities.

Common Mistakes & How to Avoid Them

- Mistake: Neglecting Heir Notification: Ensure all potential heirs are notified to avoid legal complications.

- Mistake: Incomplete Documents: Double-check all documents are complete and accurate to prevent delays.

- Mistake: Underestimating Responsibilities: Understand fully the legal and financial duties as an executor to manage the estate properly.

How to fill out Maryland Petition For Probate And Grant Of Letters Regarding Testate Estate?

Greetings to the largest collection of legal documents, US Legal Forms. Here, you can discover any example such as Maryland Petition for Probate and Grant of Letters concerning Testate Estate forms and obtain them (as many as you desire). Create official paperwork in a few hours, instead of days or even weeks, without needing to spend a fortune on a lawyer. Obtain the state-specific example with just a few clicks and feel confident knowing that it was created by our licensed legal experts.

If you’re already a registered user, simply Log In to your account and click Download next to the Maryland Petition for Probate and Grant of Letters concerning Testate Estate you need. Because US Legal Forms is online, you’ll always have access to your stored files, regardless of the device you’re on. Locate them in the My documents section.

If you don’t have an account yet, what are you waiting for? Follow our instructions listed below to get started.

Once you’ve completed the Maryland Petition for Probate and Grant of Letters concerning Testate Estate, forward it to your lawyer for confirmation. It’s an extra step but a vital one to ensure you’re fully protected. Enroll in US Legal Forms now and gain access to a vast array of reusable examples.

- If this is a state-specific template, verify its legality in the state where you reside.

- Review the description (if available) to determine if it’s the correct document.

- Explore additional content using the Preview feature.

- If the file matches your needs, just click Buy Now.

- To create an account, select a pricing option.

- Utilize a credit card or PayPal account to sign up.

- Download the document in the format you prefer (Word or PDF).

- Print out the document and complete it with your/your business’s details.

Form popularity

FAQ

Rule 6 444 in Maryland pertains to the procedures for filing a Maryland Petition for Probate and Grant of Letters regarding Testate Estate. It outlines the required forms, necessary documentation, and processes needed to initiate the probate process when someone dies leaving a will. By following this rule, you ensure that the estate is administered according to the deceased's wishes, which can significantly ease the transition for heirs. For those seeking clear guidance, uslegalforms offers templates and resources to help streamline this process effectively.

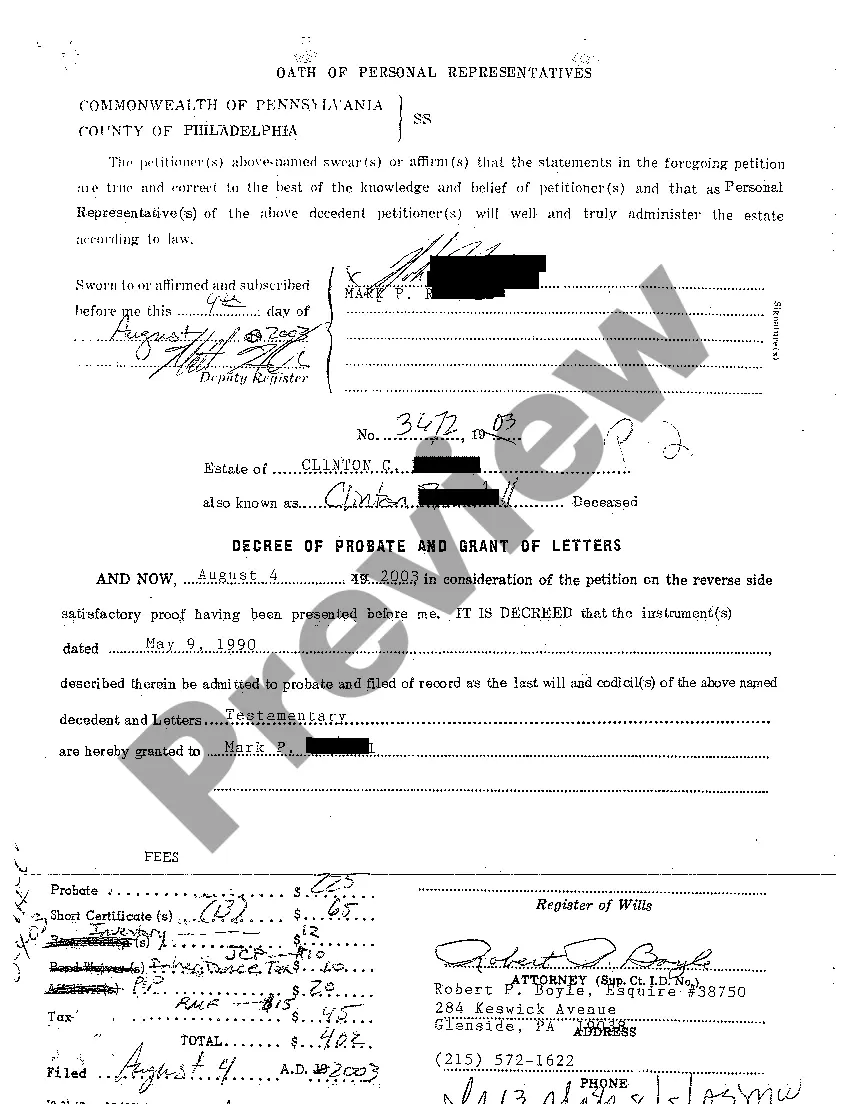

Probate or applying for Letters Probate is the process whereby the Court confirms that a Will is the valid last Will of a person. When the executor files for a grant of probate, he swears that the Will filed with the court is the last Will of the deceased person and that he knows of no later Will.

Letters of Administration are granted by a Surrogate Court or probate registry to appoint appropriate people to deal with a deceased person's estate where property will pass under Intestacy Rules or where there are no executors living (and willing and able to act) having been validly appointed under the deceased's will

When the register of wills or orphan's court appoints a personal representative, it grants the representative letters of administration. Letters of administration empower the representative to distribute the assets in the estate.The court rules for estate administration are found in Title 6 of the Maryland Rules.

Letters of Administration are granted by a Surrogate Court or probate registry to appoint appropriate people to deal with a deceased person's estate where property will pass under Intestacy Rules or where there are no executors living (and willing and able to act) having been validly appointed under the deceased's will

The simple answer is that once you have a grant of probate or letter of administration in hand, it usually takes between six and twelve months to transfer all the funds, assets and property in an estate.Some assets are held abroad. The executor is unable to contact all of the beneficiaries of the will.

The Personal Representative is responsible for identifying probate assets (assets in the sole name of the decedent), filing the necessary forms and tax returns required by Law, paying from the estate assets administration expenses, valid creditor claims (including funeral expenses) and taxes (if there are any), and

If the decedent left a will, the will is filed with the Register of WIlls for the County, along with a Petition for Probate and Grant of Letters Testamentary. The petition includes an estimate of the amount of probate property.

Before applying for a grant you must publish an online notice of your intention to apply for Letters of Administration on the NSW Online Registry.

The time it takes to get probate or letters of administration varies according to the circumstances. It may only take three to five weeks if there are no complications, inheritance tax is not payable, the estate is straightforward and all forms are filled in properly.