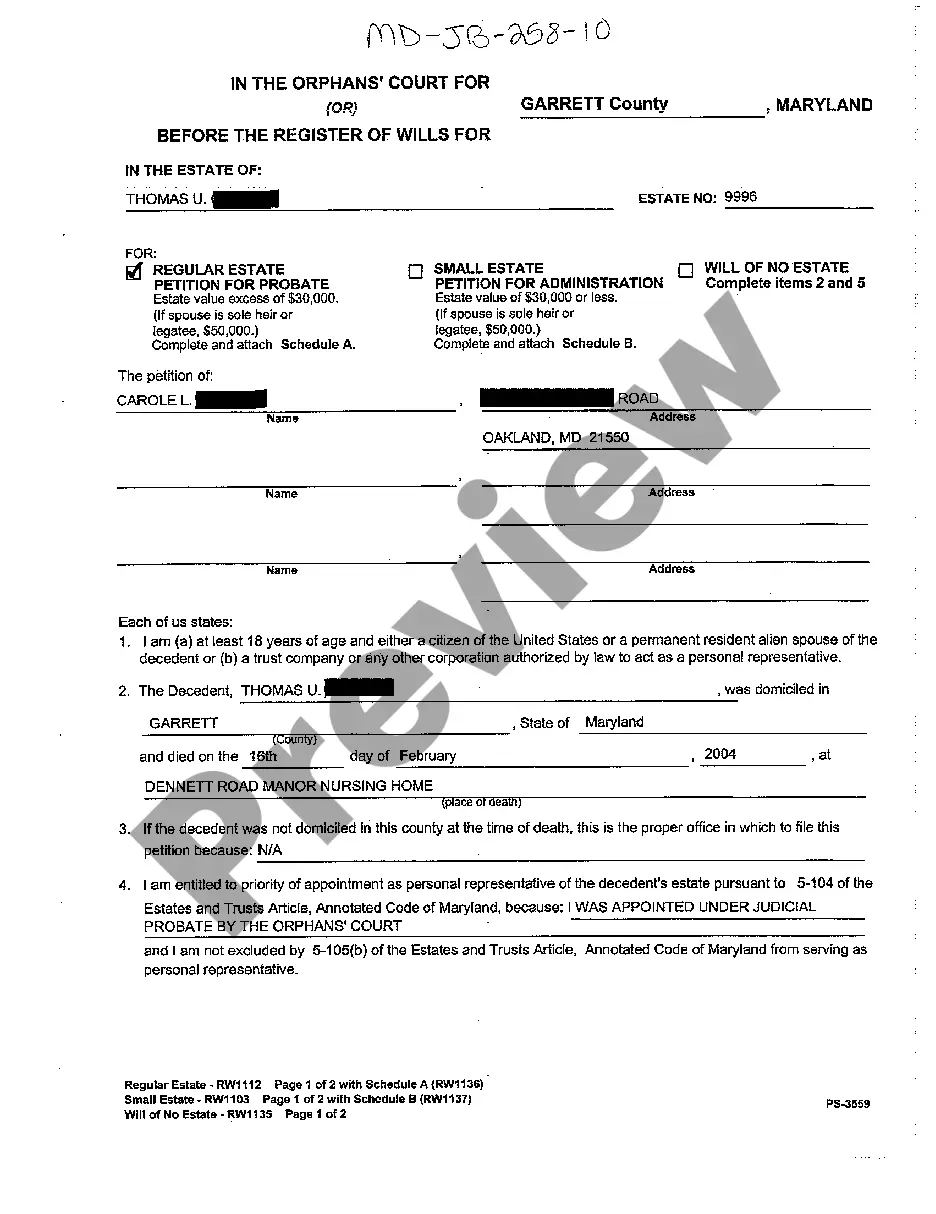

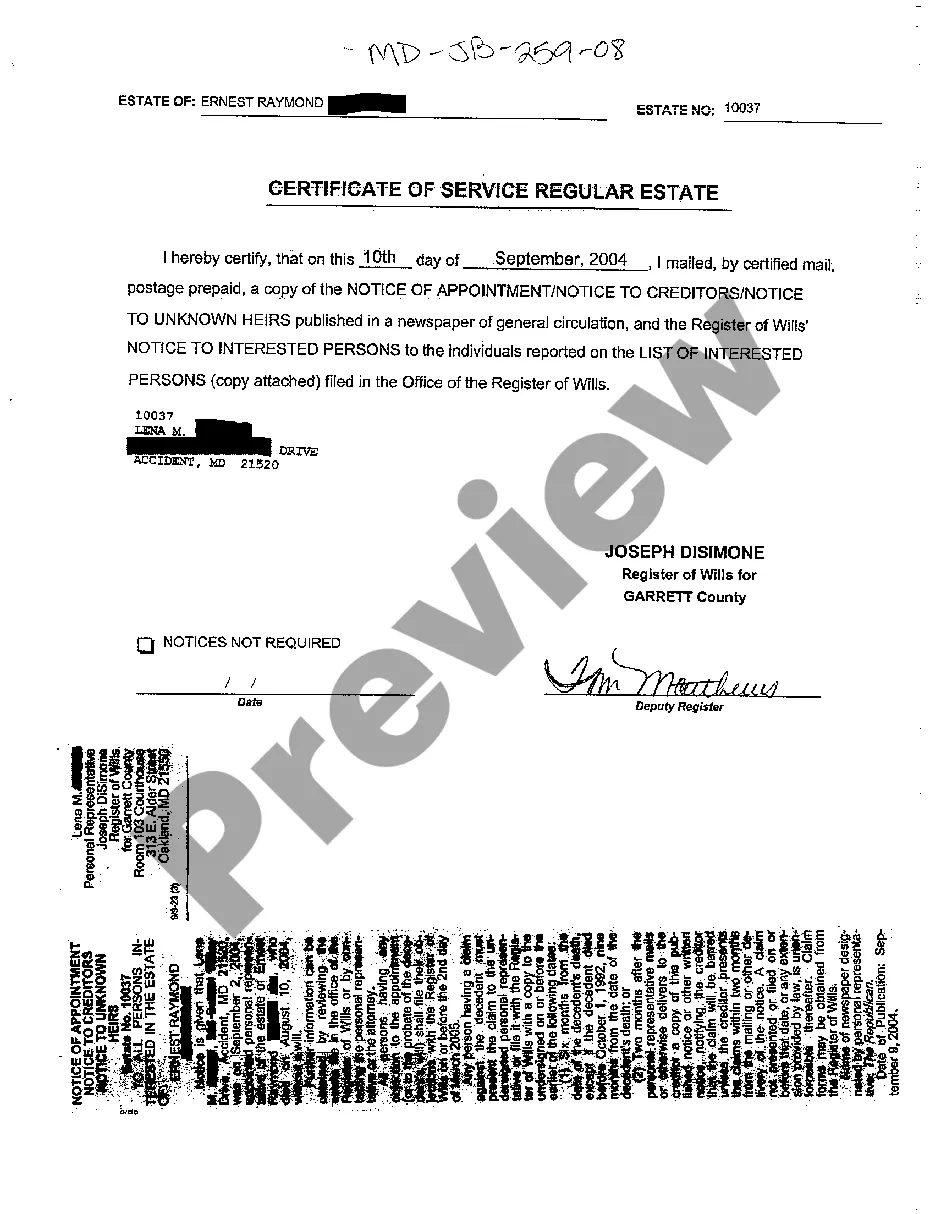

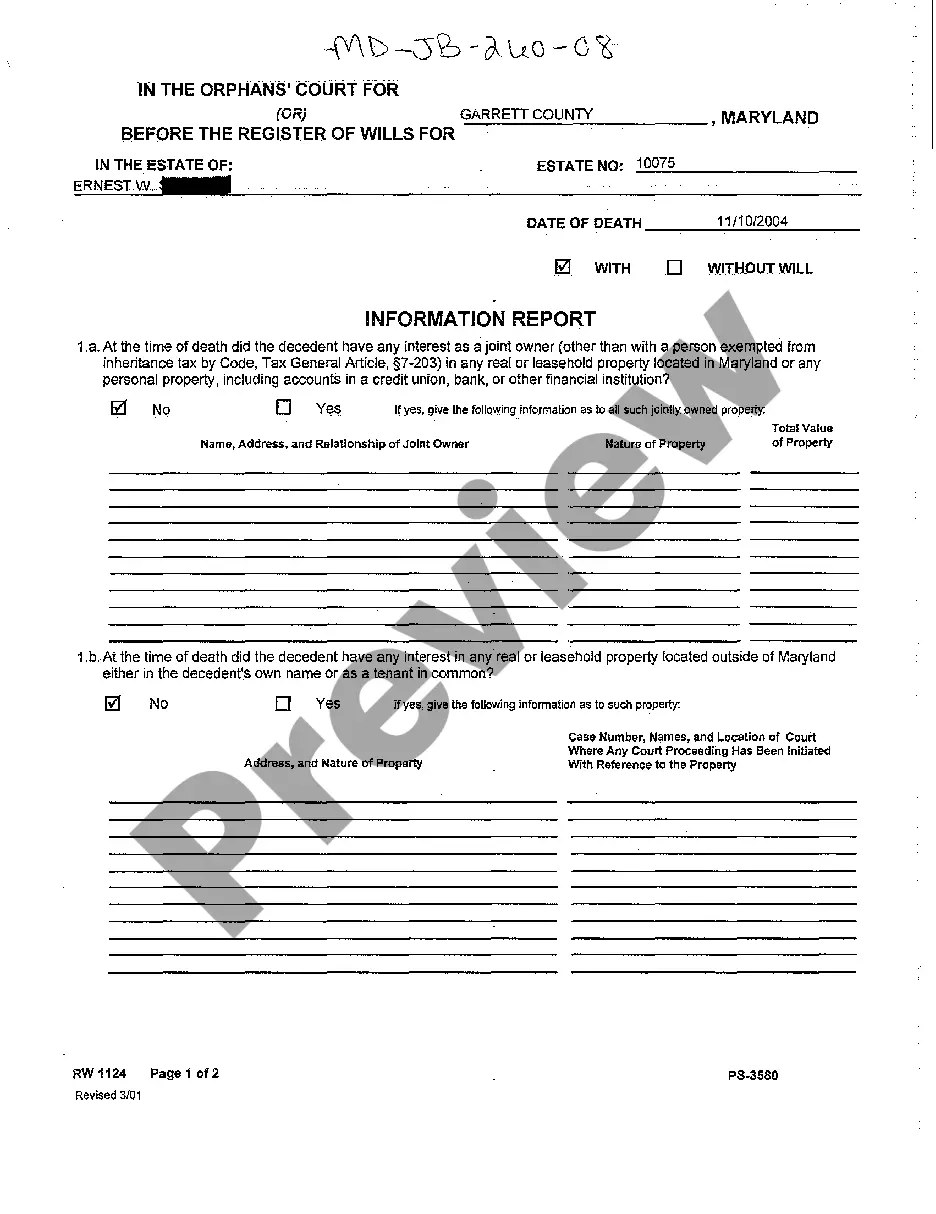

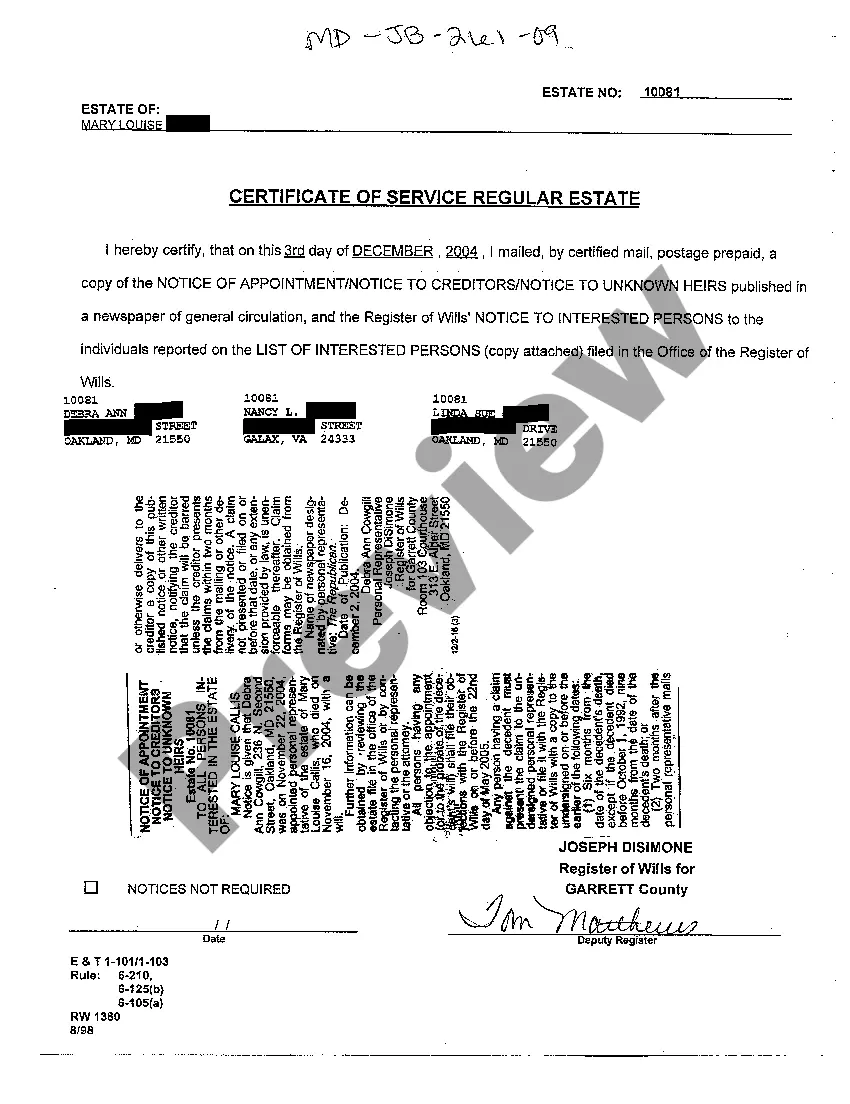

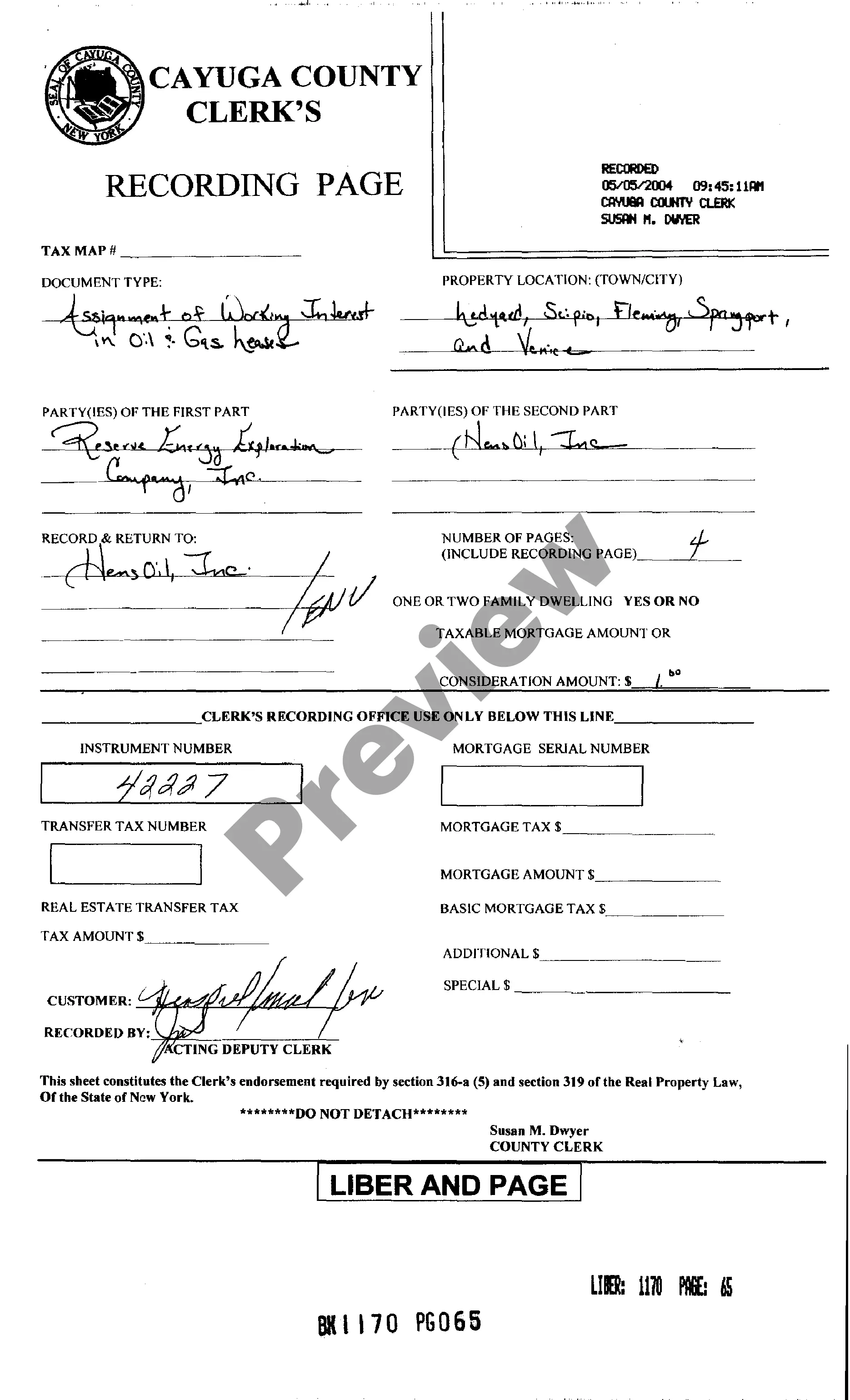

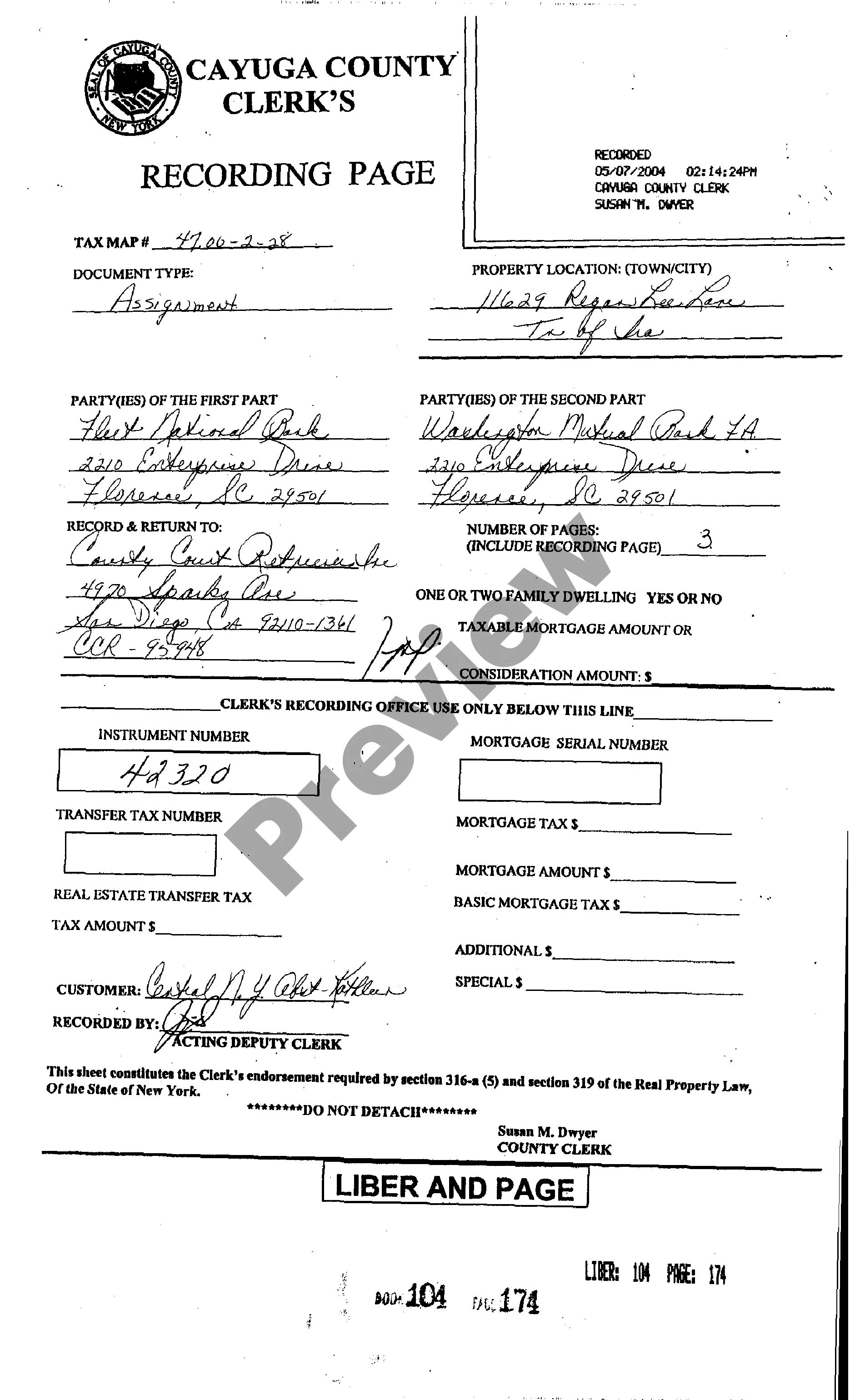

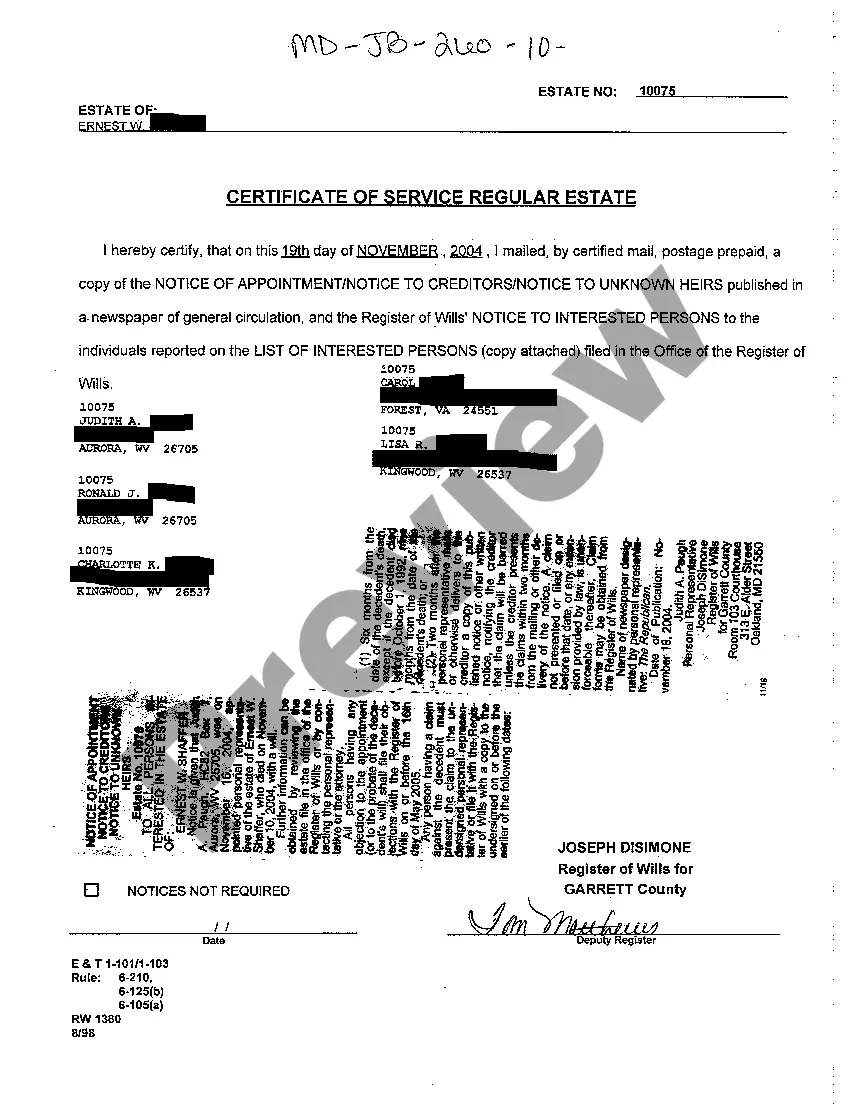

Maryland Certificate of Service Regular Estate

Description

How to fill out Maryland Certificate Of Service Regular Estate?

Greetings to the finest legal document repository, US Legal Forms. Here you can discover any template such as Maryland Certificate of Service Regular Estate forms and store them (as many of them as you desire/require). Prepare formal documents within a few hours, rather than days or weeks, without paying a fortune to an attorney. Acquire your state-specific example in just a few clicks and feel assured knowing that it was crafted by our skilled lawyers.

If you’re already a registered user, just Log In to your account and hit Download next to the Maryland Certificate of Service Regular Estate you need. Since US Legal Forms operates online, you’ll always have access to your saved documents, regardless of the device you’re using. Locate them in the My documents section.

If you do not possess an account yet, what are you waiting for? Review our guidelines below to get started.

Once you’ve completed the Maryland Certificate of Service Regular Estate, send it to your lawyer for confirmation. It’s an extra step but a crucial one for ensuring that you’re fully protected. Join US Legal Forms today and gain access to a vast collection of reusable samples.

- If this is a state-specific document, verify its applicability in your state.

- Review the description (if available) to determine if it’s the correct sample.

- Explore additional content with the Preview feature.

- If the sample meets your needs, click Buy Now.

- To create an account, select a pricing plan.

- Utilize a card or PayPal account to subscribe.

- Download the document in the format you require (Word or PDF).

- Print the document and complete it with your/your business’s details.

Form popularity

FAQ

The 2-341 rule in Maryland outlines the requirements for serving documents in various legal matters. This rule emphasizes the importance of providing proper notice to all parties involved by ensuring they receive essential legal documents, especially in regular estate cases. By following this rule, individuals can better manage their responsibilities concerning the Maryland Certificate of Service Regular Estate.

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

Small Estate: property of the decedent subject to administration in Maryland is established to have a value of $50,000 or less ($100,000 or less if the spouse is the sole heir).

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

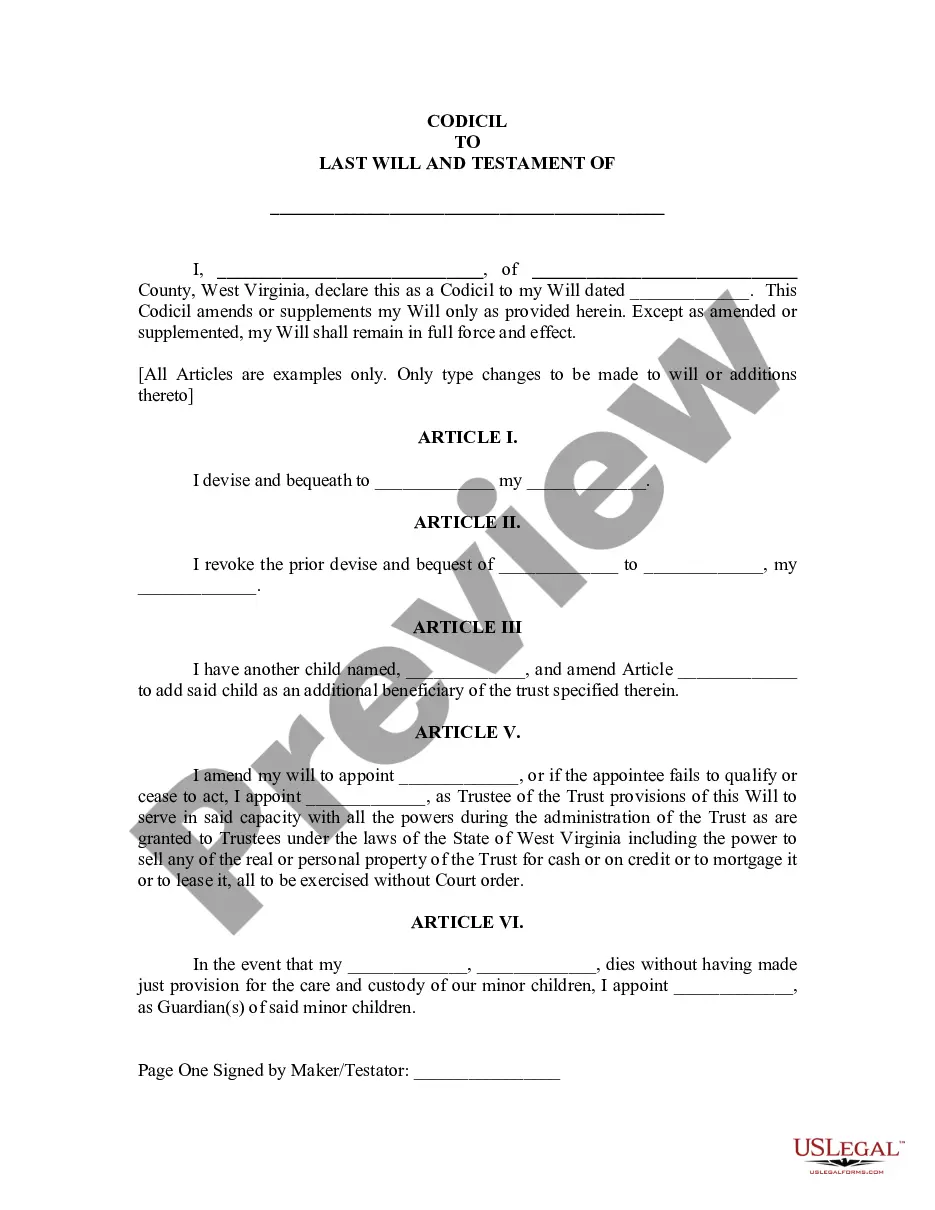

Maryland Law requires that any one holding an original Will and/or Codicil(s) must file that document with the Register of Wills promptly after a decedent's death even if there are no assets. However, although the Will and/or Codicil are kept on file, no probate proceedings are required to be opened.

Maryland is a reasonable compensation state for executor fees. Maryland executor compensation has a restriction, though. Maryland executor fees, by law, should not exceed certain amounts. Reasonable compensation is not to exceed 9% if less than $20,000; and $1,800 plus 3.6% of the excess over $20,000.