Maryland First and Final Account of Property

Description

Key Concepts & Definitions

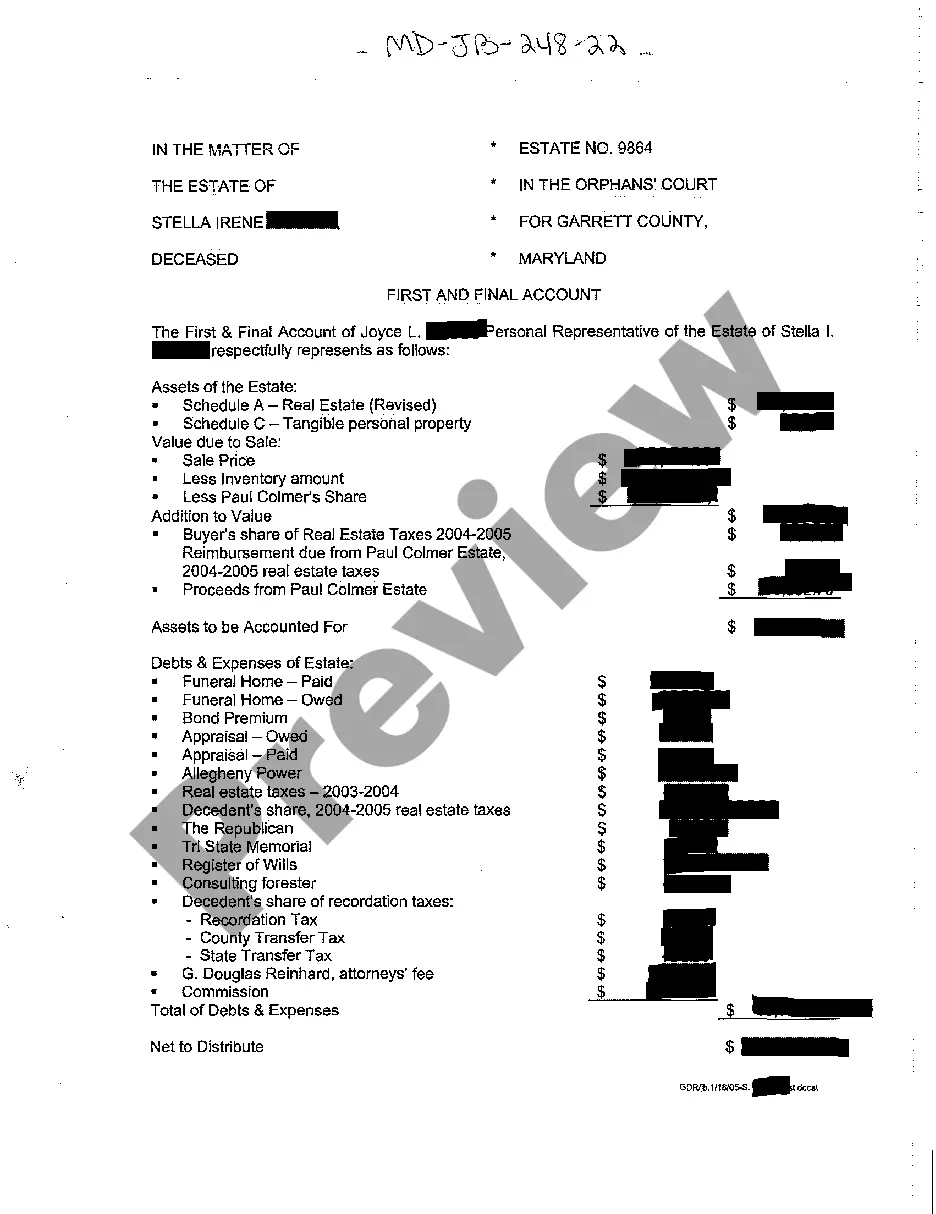

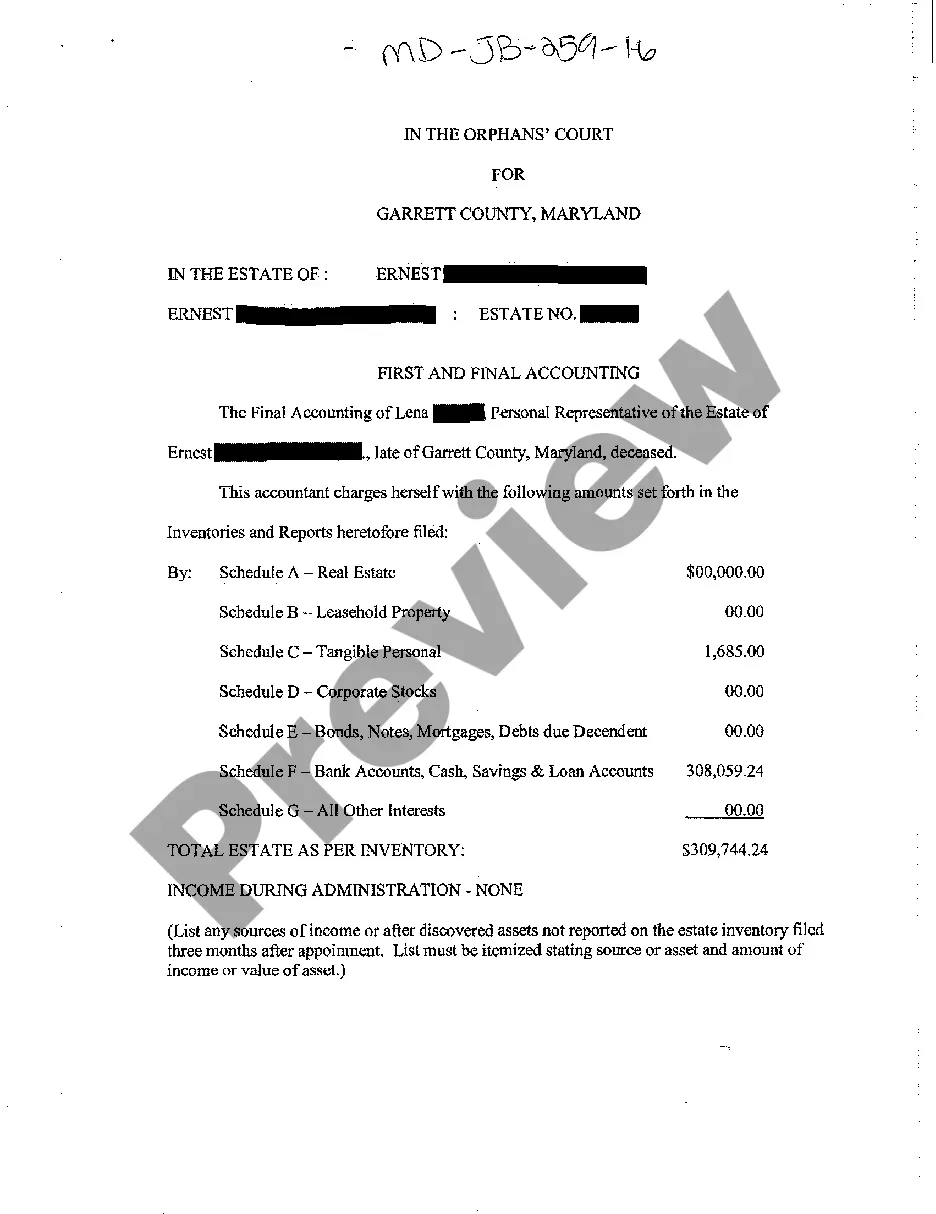

A22 First and Final Account of Property refers to the legal document used in estate or trust administration in the United States. This document summarizes the financial transactions and the assets handled during the administration process. It provides an account of all receipts, disbursements, gains, losses, and the final distribution plan for the estate's assets.

Step-by-Step Guide

- Gather Financial Documents: Compile all financial records related to the estate or trust, including bank statements, receipts, and invoices.

- Record Keeping: Track all transactions, including assets received and expenses paid out during the administration period.

- Prepare the Account: Organize the information into a formal account statement, detailing all financial activities sequentially.

- Review and Audit: Ensure accuracy of the account by reviewing all entries and, if necessary, hiring an accountant for an audit.

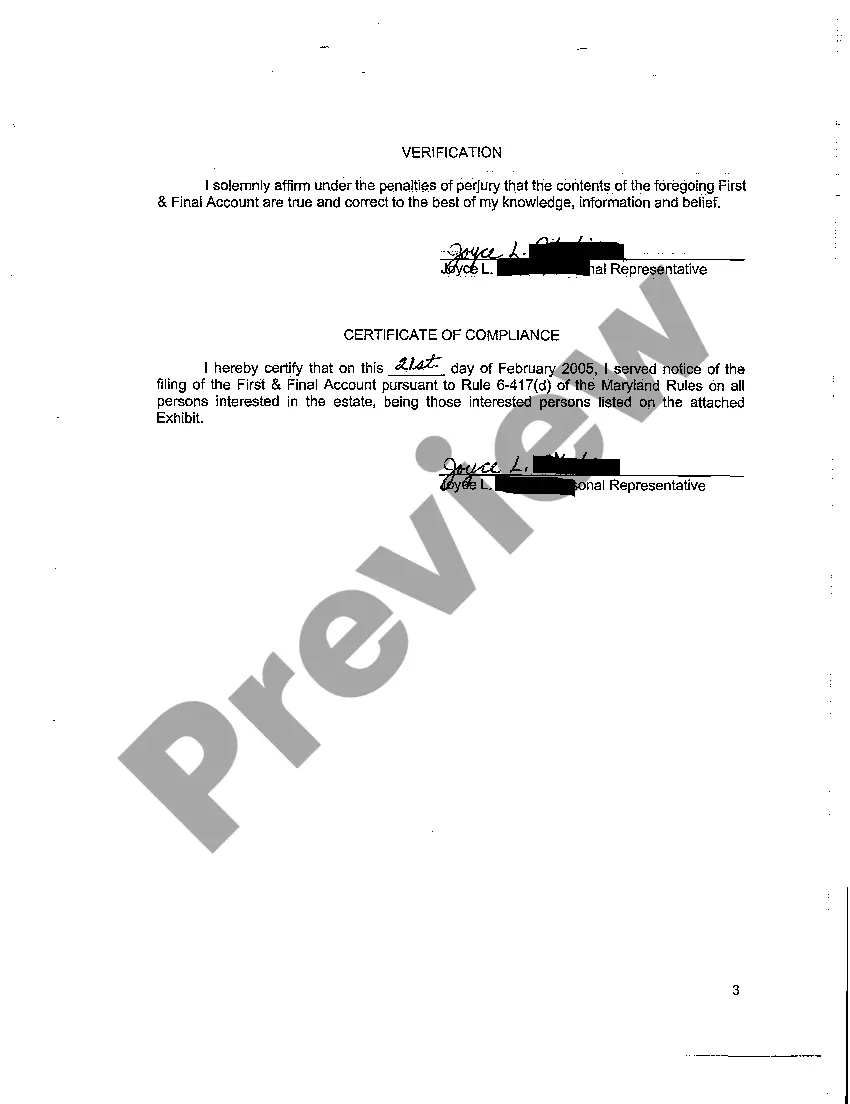

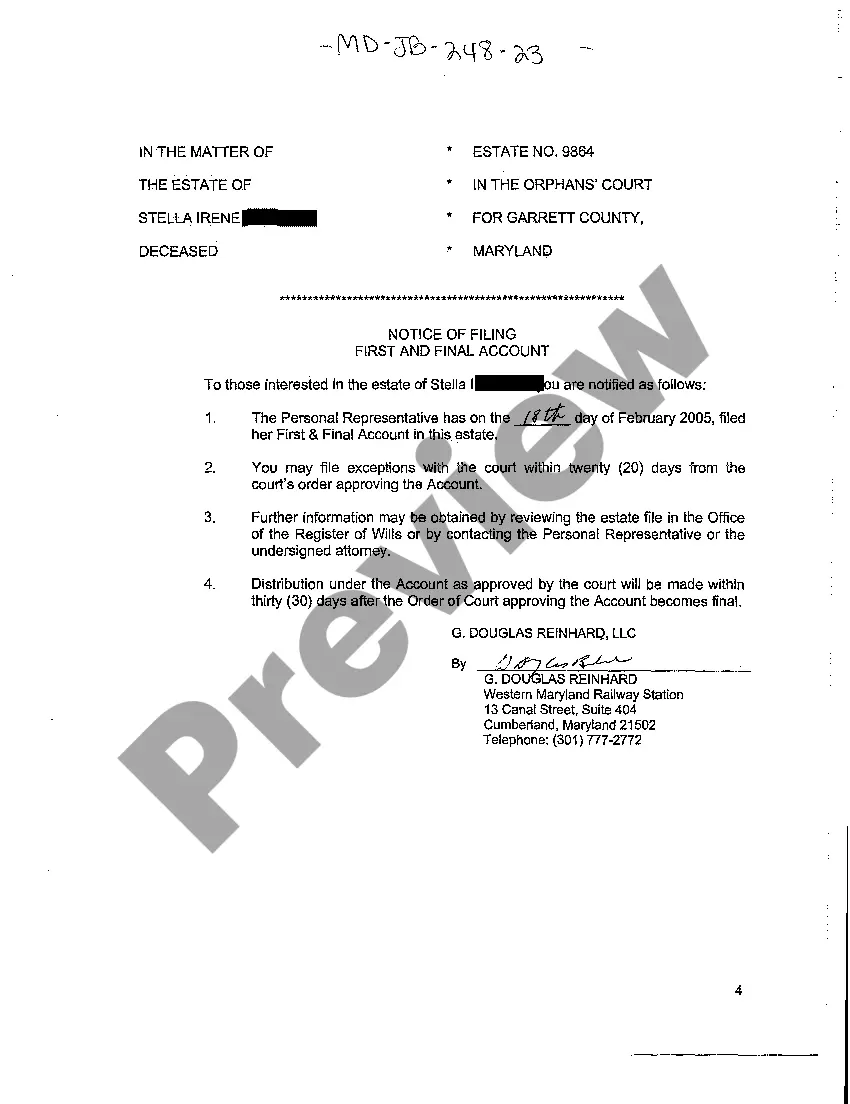

- File with Court: Submit the completed A22 first and final account of property to the appropriate probate court for approval.

- Notify Stakeholders: Inform all parties involved, including beneficiaries and creditors, about the filing and provide them with a copy of the account.

Risk Analysis

Filing an inaccurate A22 account can lead to legal disputes, financial discrepancies, and potential penalties. Risks include

- Legal Challenges: Beneficiaries or creditors may contest the accounts if discrepancies or incomplete information is found.

- Audit Risks: Incorrect or fraudulent entries may result in fines or legal action against the executor or trustee.

- Delays: Inaccurate accounts may cause delays in the distribution of assets, affecting the closing of the estate.

Best Practices

- Meticulous Documentation: Keep detailed records of all transactions to avoid discrepancies.

- Professional Help: Consider hiring a professional accountant or attorney to assist in preparing the A22 account.

- Stakeholder Communication: Regularly update all stakeholders about the estate's financial status to prevent misunderstandings and disputes.

- Timely Filing: File the A22 account as per the timelines set by the court to avoid penalties.

Common Mistakes & How to Avoid Them

- Lack of Detailed Records: Maintain comprehensive documentation to support every item listed in the A22 account.

- Procrastination: Avoid delays in record-keeping and filing to ensure timely processing of the estate.

- Ignoring Professional Advice: Utilize the expertise of financial and legal professionals to accurately execute the A22 account.

How to fill out Maryland First And Final Account Of Property?

Greetings to the finest library of legal documents, US Legal Forms. Here you can locate any template, including the Maryland First and Final Account of Property forms, and download as many as you desire.

Generate official documents within hours instead of days or weeks, without incurring hefty fees for a legal expert. Obtain your state-specific template in just a few clicks and feel secure knowing it was created by our experienced attorneys.

If you’re an existing subscriber, simply Log In to your account and click Download next to the Maryland First and Final Account of Property you wish to acquire. Since US Legal Forms is internet-based, you’ll always have access to your downloaded templates, regardless of the device you are using. Find them under the My documents section.

After completing the Maryland First and Final Account of Property, send it to your attorney for verification. It’s an added step, but an essential one to ensure you’re completely protected. Register for US Legal Forms today and gain access to a plethora of reusable templates.

- If you haven’t registered for an account yet, what are you waiting for? Refer to our guidelines below to get started.

- If this is a state-specific sample, verify its relevance in your state.

- Examine the description (if provided) to ensure it’s the correct template.

- Explore additional content utilizing the Preview feature.

- If the template meets all your requirements, click Buy Now.

- To create an account, choose a pricing plan.

- Utilize a credit card or PayPal account to sign up.

- Download the file in your preferred format (Word or PDF).

- Print the document and complete it with your or your business’s information.

Form popularity

FAQ

A first account of an estate in Maryland is the initial financial report submitted by the executor or personal representative. This account details assets and liabilities, allowing beneficiaries to understand the estate's financial status. It serves as a foundation for future accounting and is essential for the proper administration of the estate. For guidance, consider using US Legal Forms to learn more about the Maryland First and Final Account of Property.

Generally, the minimum probate fee for an estate of $75,000 or under is $1500 + 283-500 in court and other miscellaneous costs.

Petition for Administration. List of Assets and Debts. Notice of Appointment / Notice to Creditors / Notice to Unknown Heirs. Bond of Personal Representative Form. List of Interested Persons. Paid Funeral Bill. Copy of Death Certificate - available from Division of Vital Records.

After a loved one dies, his or her estate must be settled. While most people want the settlement process to be done ASAP, probate in Maryland, including Howard County, can take between 9 to 18 months, presuming there is no challenges to a Will or any litigation.

Decedent's Last Will and Testament. Death Certificate. Funeral Contract/Bill. Approximate value of assets in the decedent's name alone. Title to decedent's automobiles and/or other motor vehicles.

An estate account for probate is typically opened with the assistance of your probate lawyer. However, any executor appointed by a probate court is authorized to do so, as well. If you're doing it yourself, it's often most convenient to open the estate account at the same bank as the decedent.

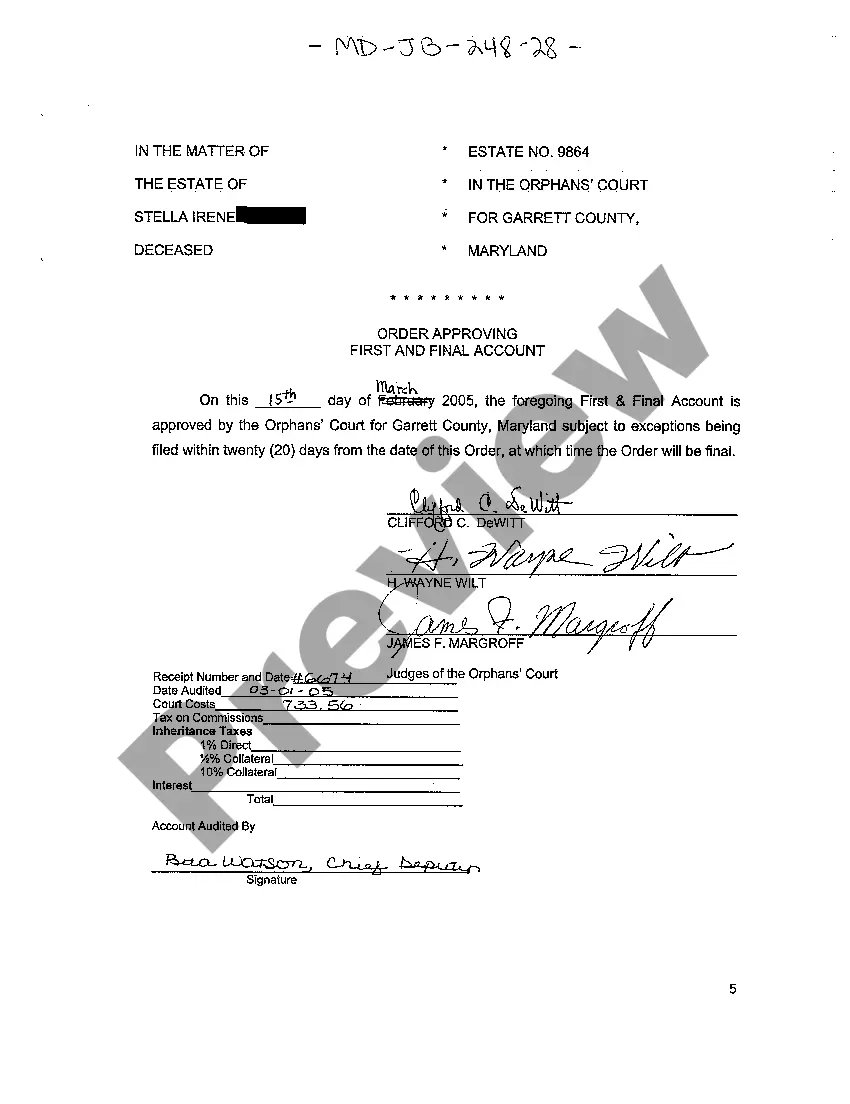

How to Close an Estate in Maryland Probate. Under Maryland law, Estates & Trusts, the final approval of the final account, as submitted to the register of wills, automatically closes the estate.

Begin the probate process. The steps for beginning this process depend on the state in which the deceased person resided. Obtain a tax ID number for the estate account. Bring all required documents to the bank. Open the estate account.

If a person owns assets in his or her individual name and dies without a Will, assets remaining after payment of administration expenses, debts and taxes (if any) are distributed to the person's heirs as provided under Maryland Intestacy Laws (the person is said to have died intestate).

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.