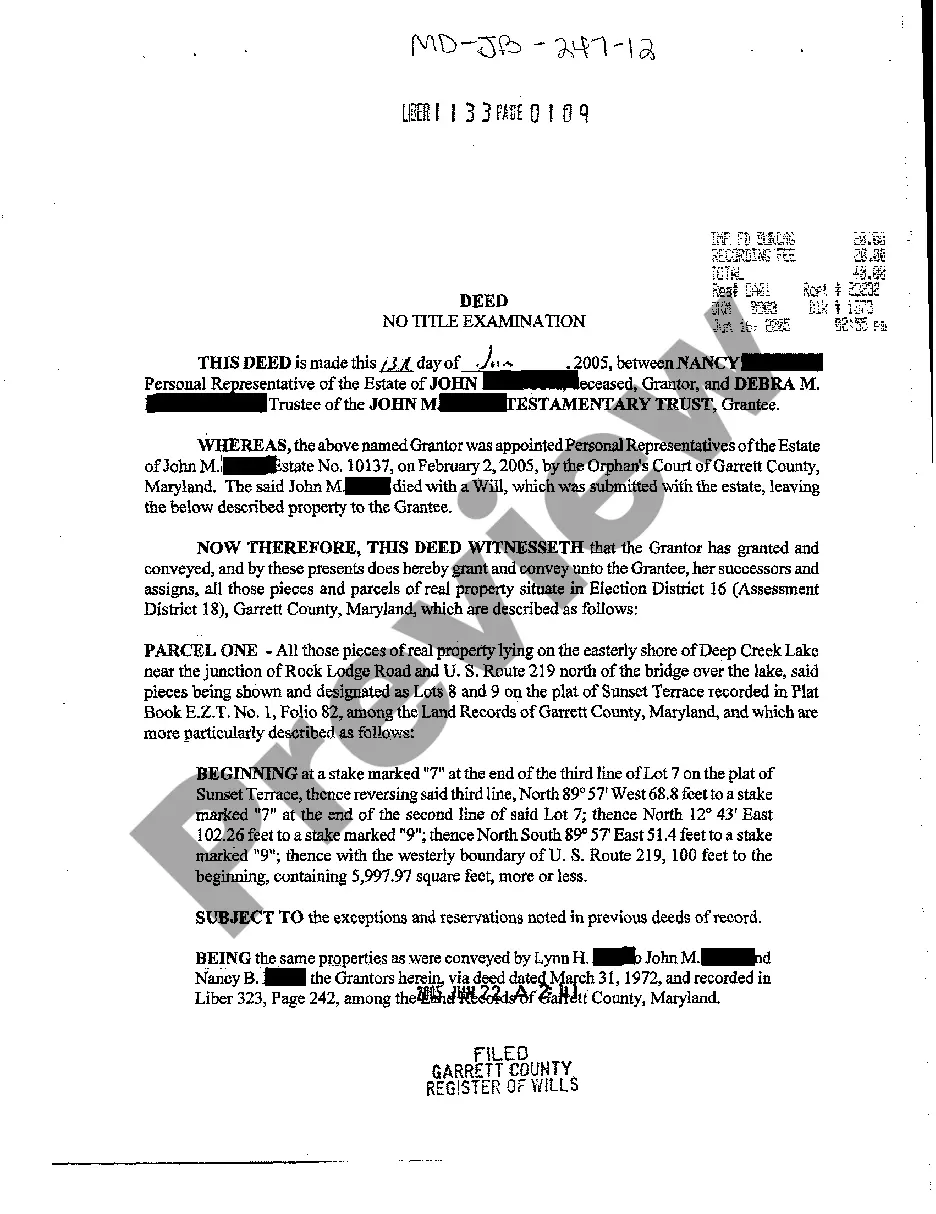

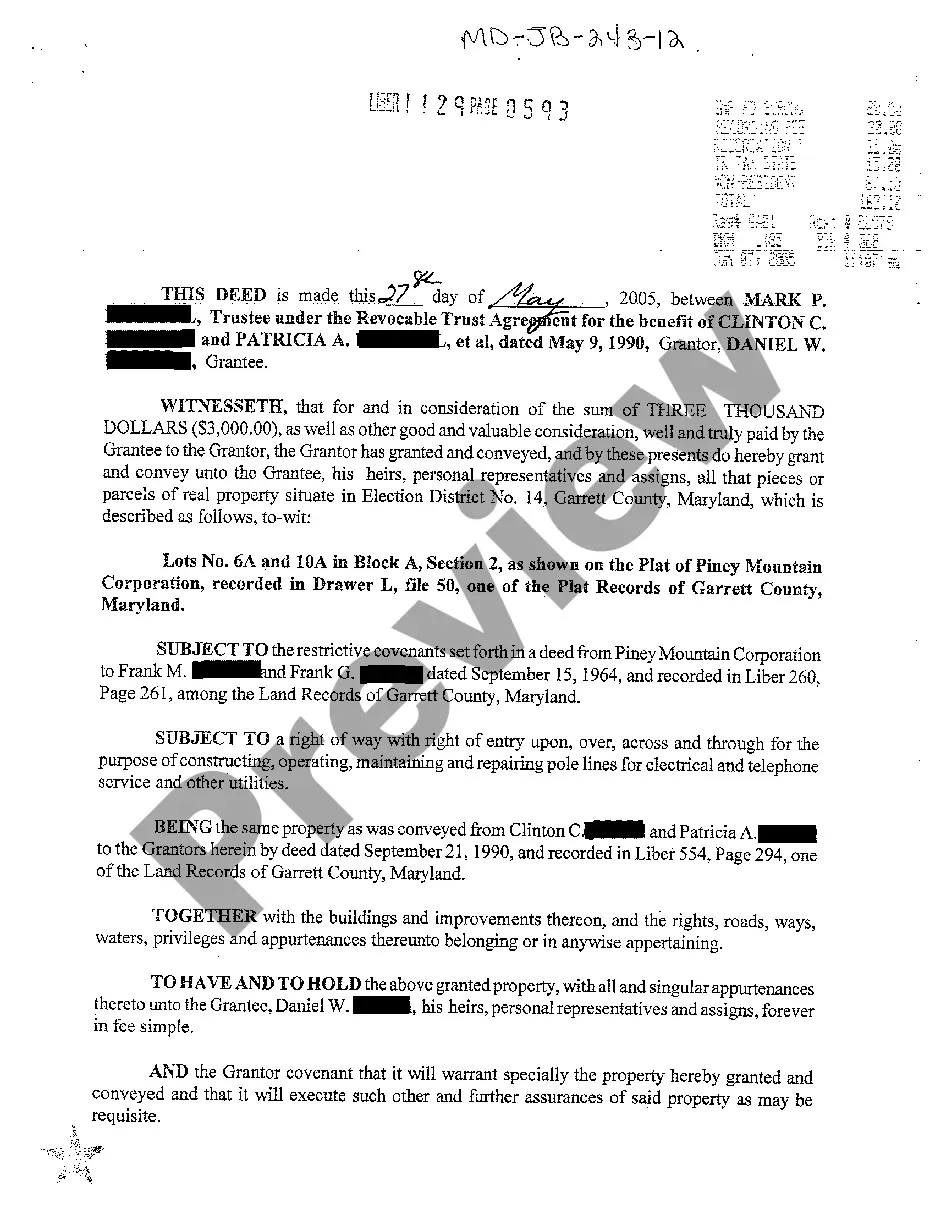

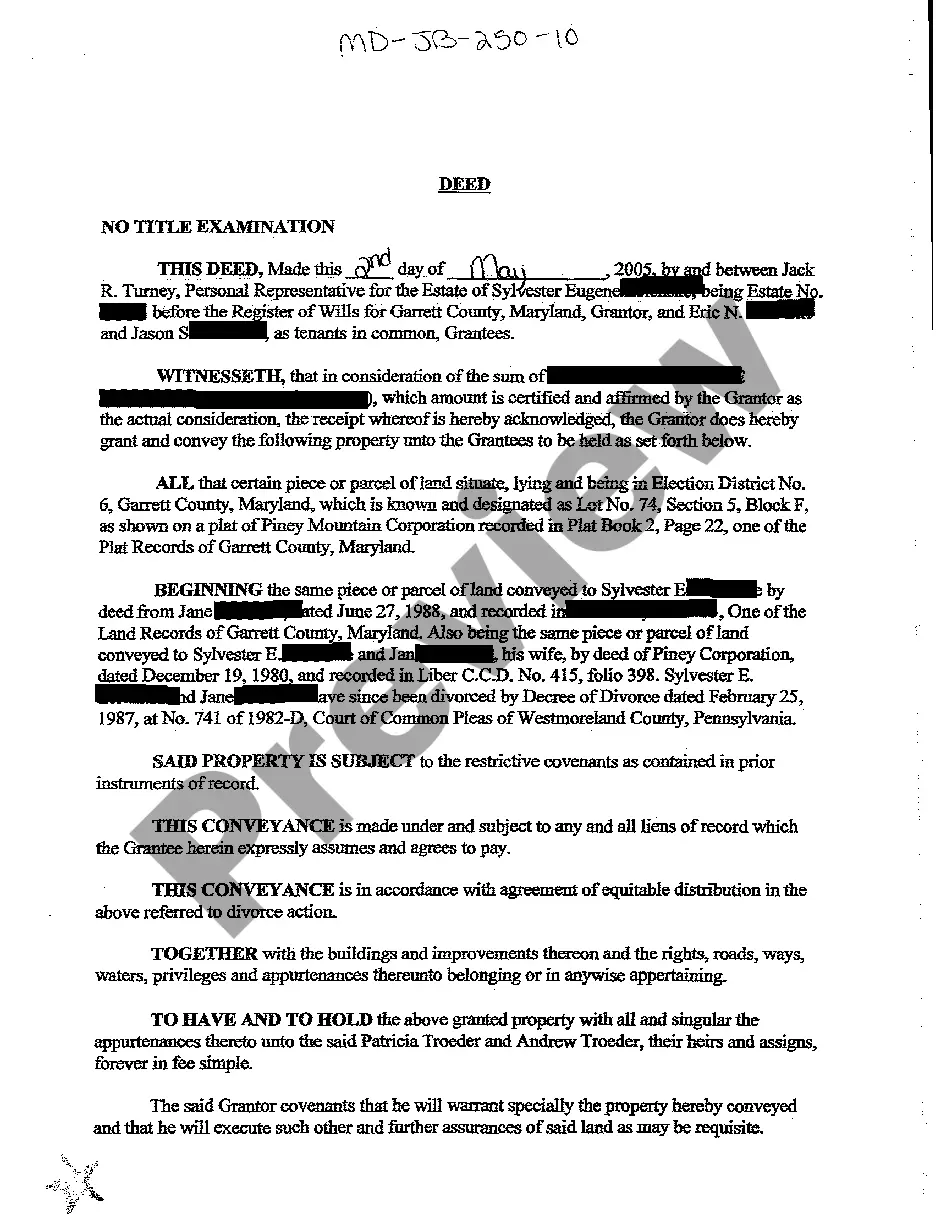

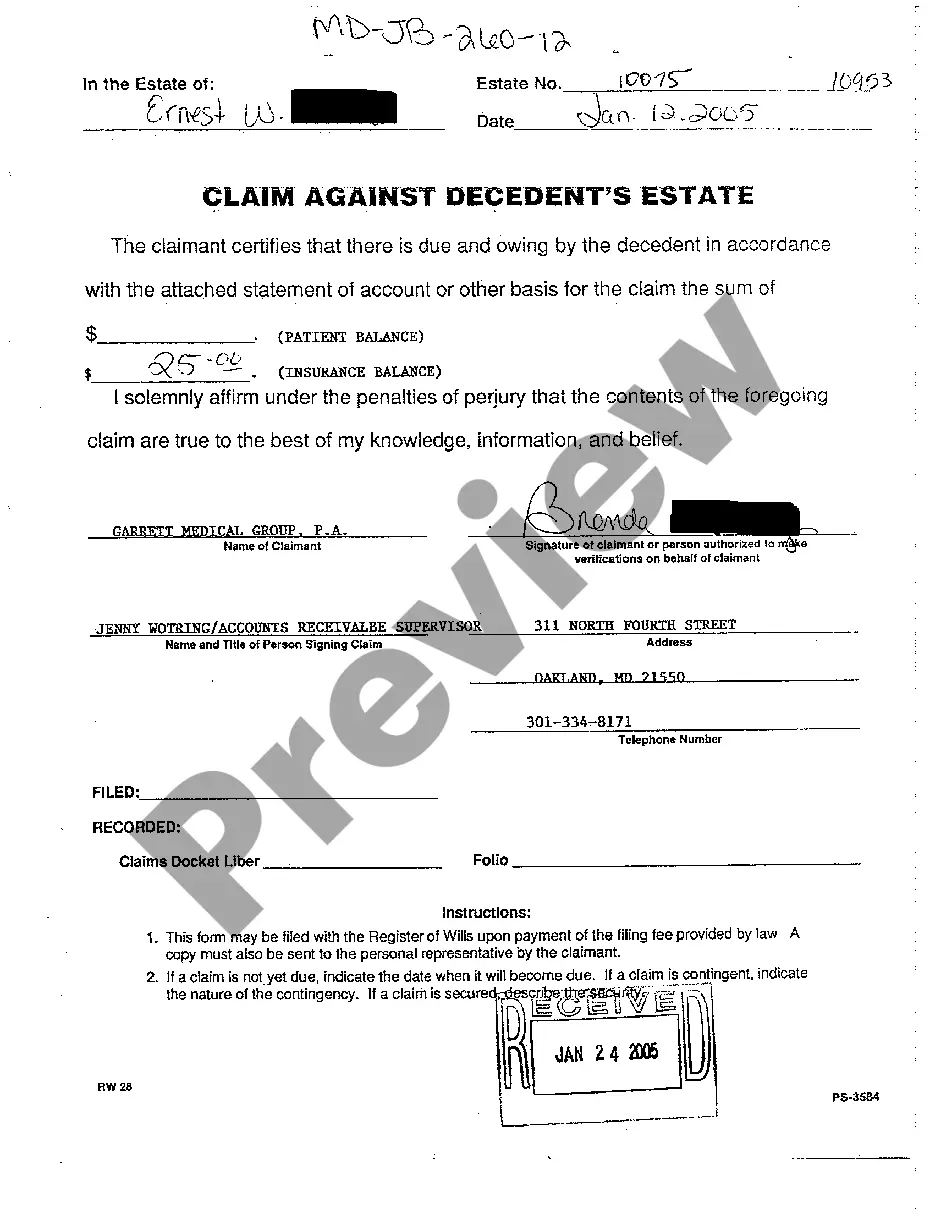

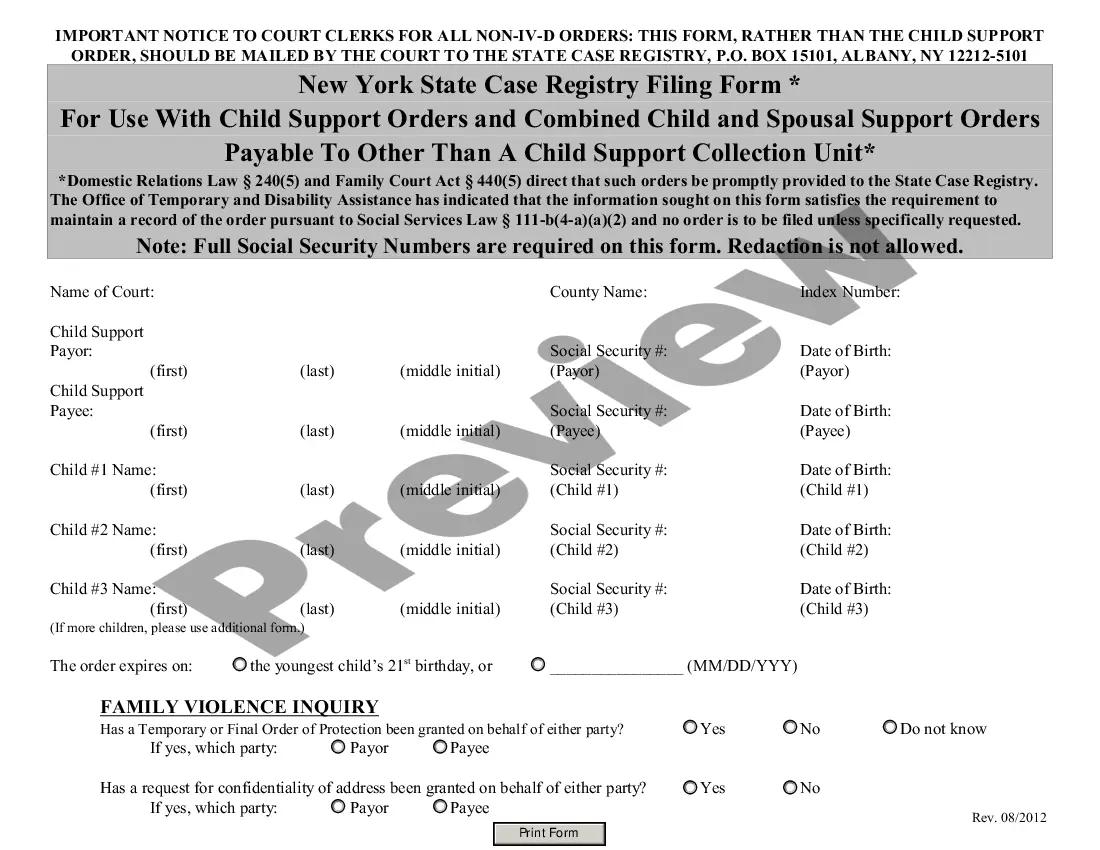

Maryland Deed No Title Examination Conveying Decedent's Property to Grantee Daughter

Description

How to fill out Maryland Deed No Title Examination Conveying Decedent's Property To Grantee Daughter?

Greetings to the largest legal documents repository, US Legal Forms. Here you will discover any template such as Maryland Deed No Title Examination Conveying Decedent's Property to Grantee Daughter forms and download them (as numerous as you wish/need). Prepare legal documentation in just a few hours, rather than days or weeks, without having to spend a fortune on a lawyer or attorney.

Obtain the state-specific template in a few clicks and have the assurance that it was created by our licensed attorneys.

If you’re already a subscribed client, just Log Into your account and then click Download next to the Maryland Deed No Title Examination Conveying Decedent's Property to Grantee Daughter you need. Since US Legal Forms is an internet-based solution, you’ll always have access to your saved documents, regardless of what device you’re on. Find them within the My documents section.

Print the document and complete it with your or your business’s information. Once you’ve filled out the Maryland Deed No Title Examination Conveying Decedent's Property to Grantee Daughter, send it to your attorney for validation. It’s an additional step but a crucial one to ensure you’re completely protected. Register for US Legal Forms now and gain access to thousands of reusable templates.

- If you do not have an account yet, what are you waiting for.

- Check our instructions below to get started.

- If this is a state-specific document, verify its suitability in your state.

- Review the description (if available) to see if it’s the correct template.

- View more details with the Preview option.

- If the document fulfills all your requirements, click Buy Now.

- To create your account, select a pricing plan.

- Utilize a credit card or PayPal account to register.

- Download the document in the format you need (Word or PDF).

Form popularity

FAQ

If the deceased was sole owner, or co-owned the property without right of survivorship, title passes according to his will. Whoever the will names as the beneficiary to the house inherits it, which requires filing a new deed confirming her title. If the deceased died intestate -- without a will -- state law takes over.

When someone who owns real property dies, the property goes into probate or it automatically passes, by operation of law, to surviving co-owners. Often, surviving co-owners do nothing with the title for as long as they own the property. Yet the best practice is to remove the deceased owner's name from the title.

If one co-owner dies, their interest in the property automatically passes to the surviving co-owner(s), whether or not they have a will. As tenants in common, co-owners own specific shares of the property. Each owner can leave their share of the property to whoever they choose.

A consenting individual may be removed from a deed by filing a quitclaim deed. Under Maryland law each county has a separate procedure and requirements for filing a quitclaim deed.

In case a male dies intestate, i.e. without making a will, his assets shall be distributed according to the Hindu Succession Act and the property is transferred to the legal heirs of the deceased. The legal heirs are further classified into two classes- class I and class II.

It will depend what state the property is in. For example, the minimum fee payable when changing the title to have someone removed from a property title in NSW is $133.48. This fee must be paid to the NSW Government Land & Property Information Department.

If you are adding your spouse or other party to the deed, put your name in the "Transferred From" line and place both your name and the other person's name in the "Transferred To" section. Failure to put your name in the "Transferred To" section will make the new person the sole owner of the house.

So long as the quitclaim deed is valid (properly notarized, etc.) it can be recorded even after the grantor's death, so property owned by the deceased which has been deeded in that quitclaim deed should not need to pass through probate.

If the deceased owned real property in NSW as 'joint tenants' with another person, the property will need to be transferred to the surviving joint tenant.You do not need to apply for a grant of probate or letters of administration to transfer property held in joint names.