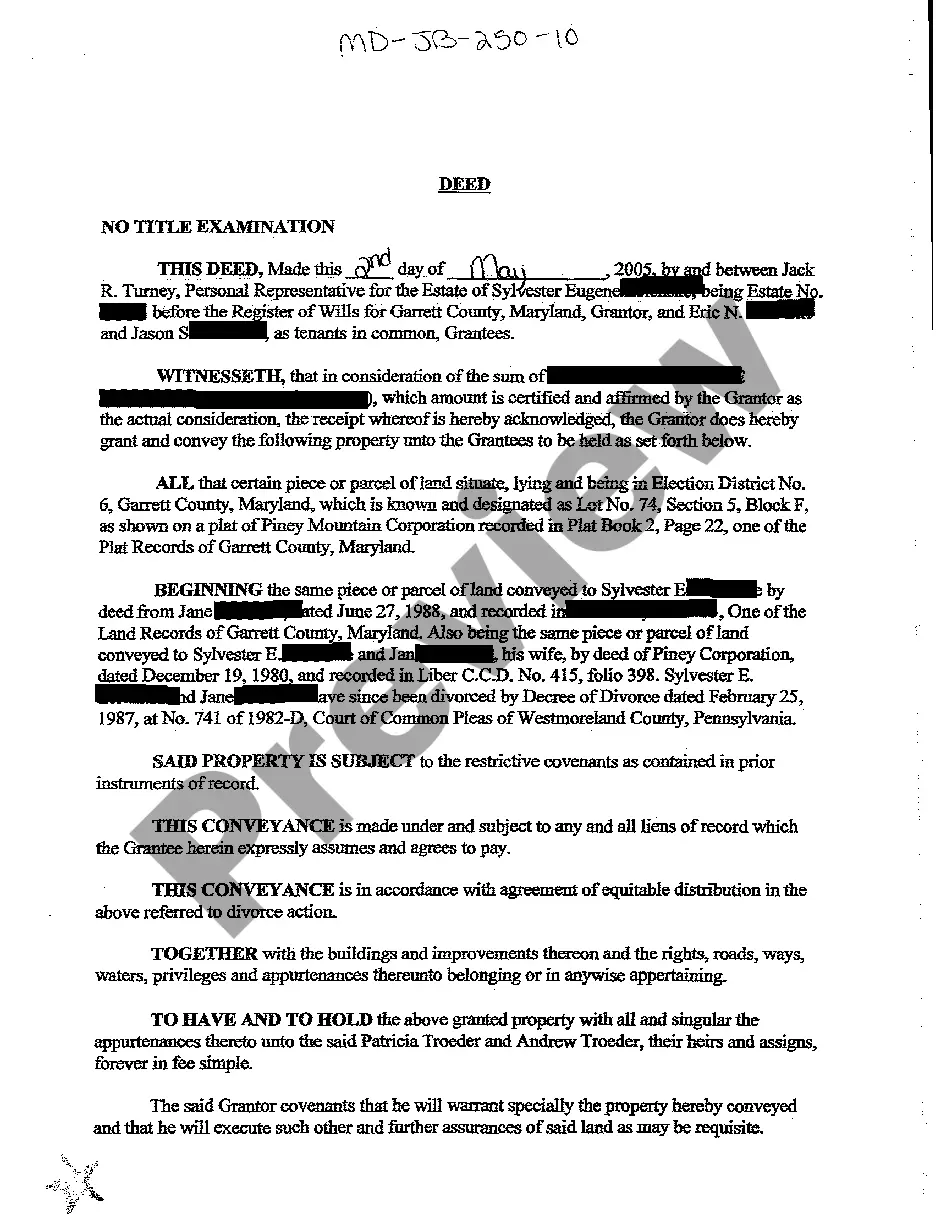

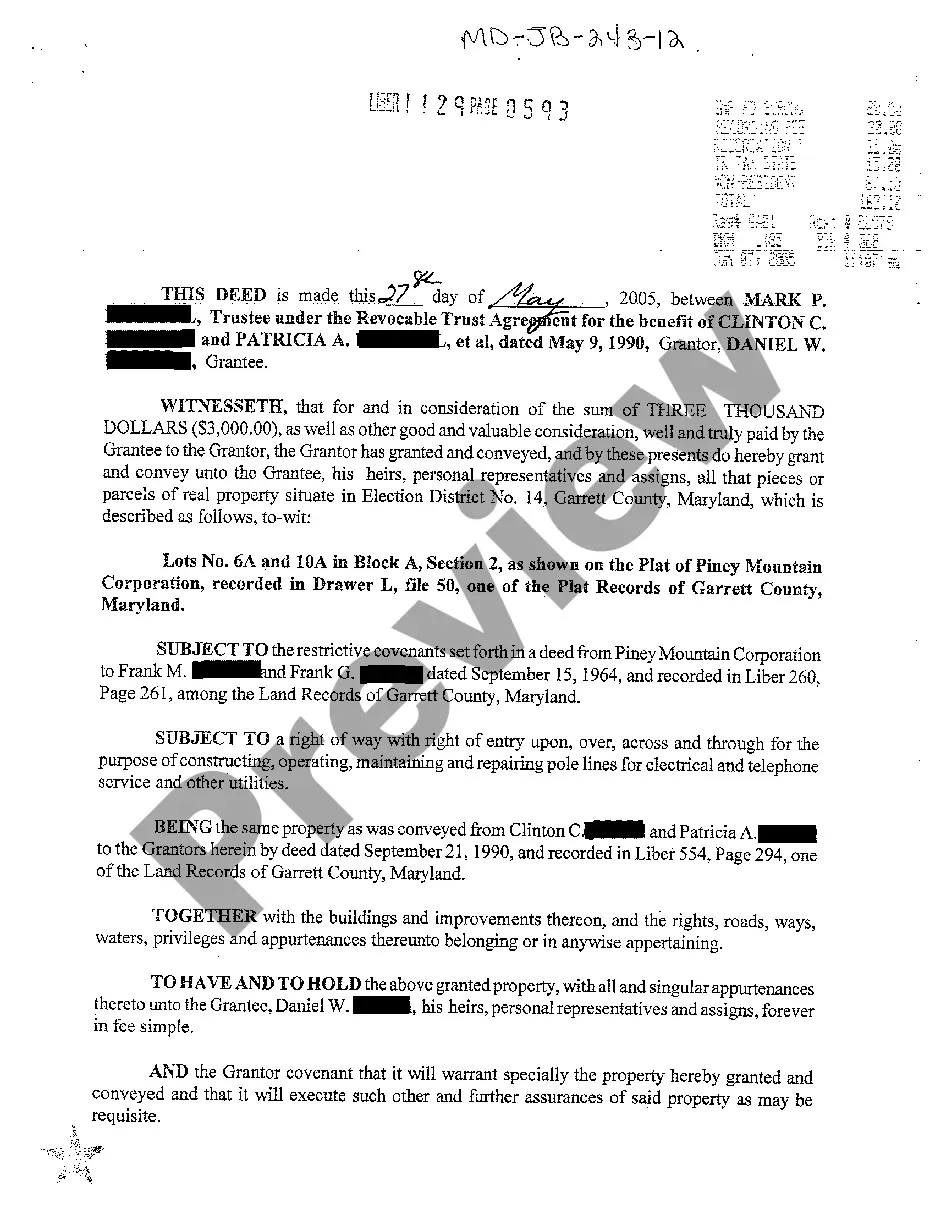

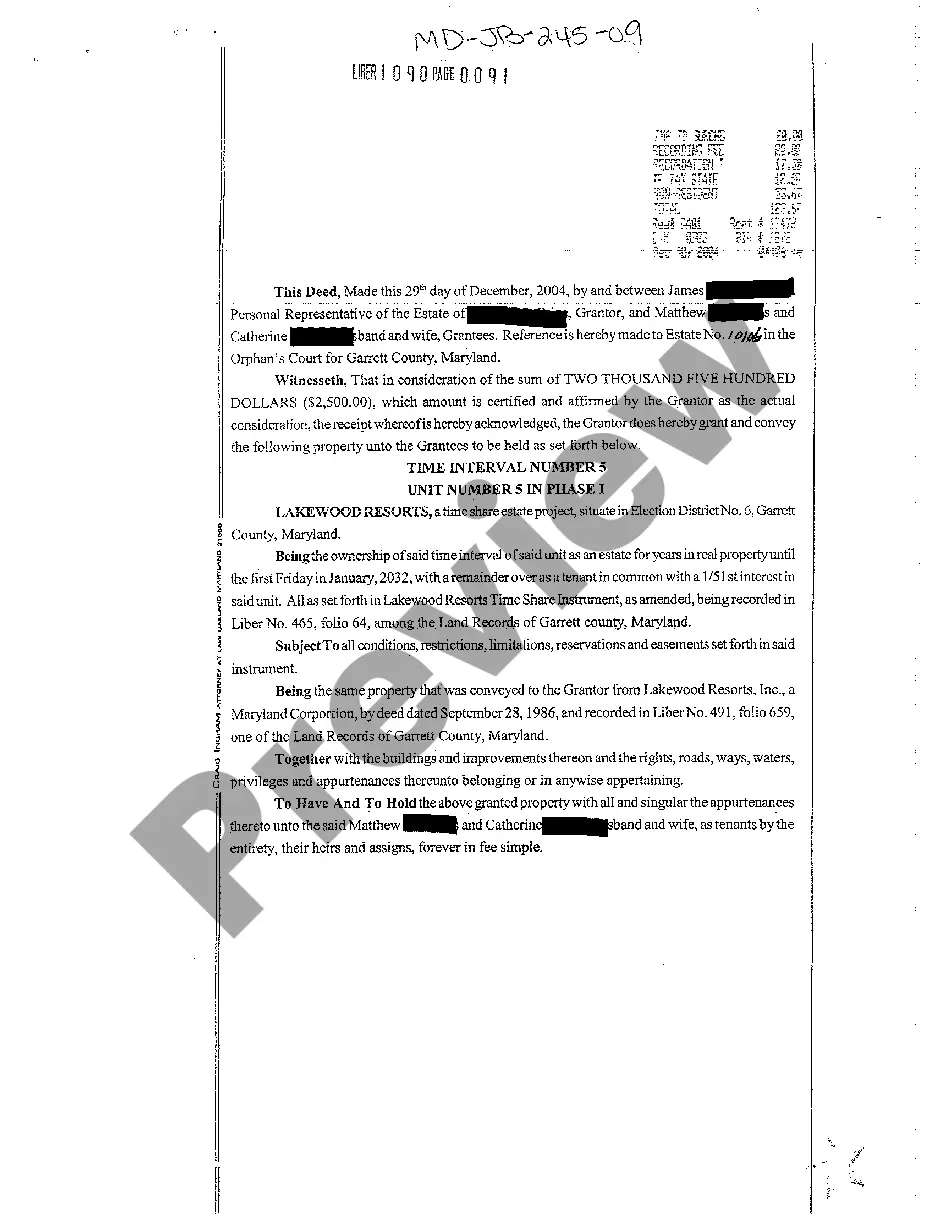

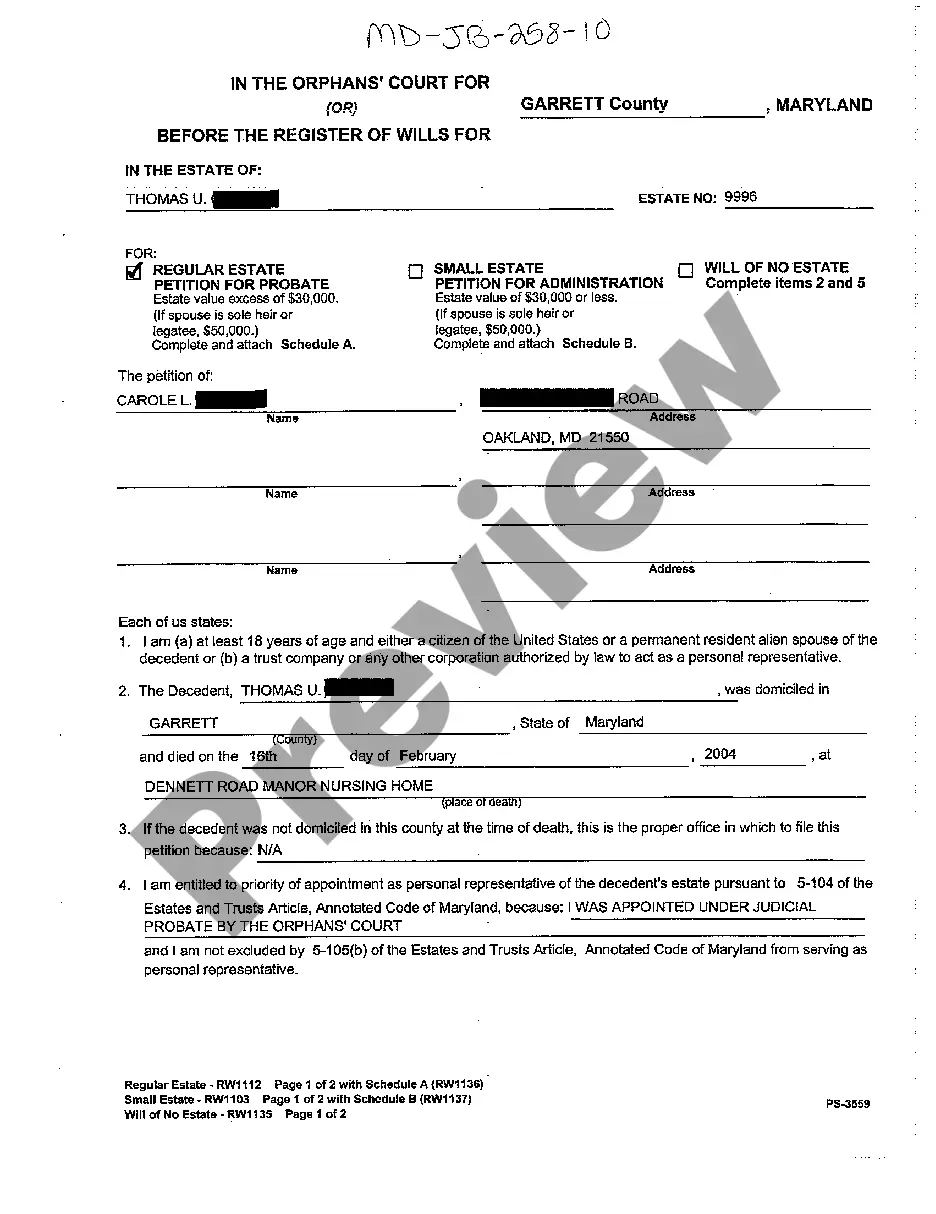

Maryland Deed Conveying Decedent's Property to Grantees

Description

How to fill out Maryland Deed Conveying Decedent's Property To Grantees?

You are invited to the premier library of legal documents, US Legal Forms. Here you can acquire any template, including Maryland Deed Conveying Decedent's Property to Grantees forms, and download them (as many as you desire or require). Prepare official documents in a few hours, rather than days or even weeks, without spending a fortune on a lawyer. Obtain the state-specific template in just a few clicks and be assured knowing it was created by our skilled attorneys.

If you are already a registered user, simply Log Into your account and click Download next to the Maryland Deed Conveying Decedent's Property to Grantees you need. Since US Legal Forms is an online platform, you will always have access to your downloaded documents, regardless of the device you are using. Locate them in the My documents section.

If you have not yet created an account, what are you waiting for? Follow our instructions below to get started.

Once you have completed the Maryland Deed Conveying Decedent's Property to Grantees, submit it to your attorney for validation. This is an additional step but a crucial one for ensuring you are fully protected. Join US Legal Forms today and gain access to a vast collection of reusable samples.

- If this is a state-specific template, verify its relevance in your state.

- Review the description (if available) to ensure it’s the right sample.

- Explore additional information with the Preview feature.

- If the sample satisfies your requirements, click Buy Now.

- To create an account, select a pricing option.

- Utilize a credit card or PayPal account to register.

- Download the document in the format you need (Word or PDF).

- Print the document and complete it with your/your business’s information.

Form popularity

FAQ

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

While nothing needs to be done, the best practice is for a surviving owner to formally record the transfer of the interest. File an affidavit of survivorship with the recorder's office to remove the deceased person's name from the title.

Presently, Maryland law permits individuals to transfer personal property to a named beneficiary outside of probate.The owner may sell the property, transfer it to someone other than the beneficiary named in the transfer-on-death deed, or place a mortgage on the property.

Benefits of a California TOD Deed Form Probate Avoidance A transfer-on-death deed allows homeowners to avoid probate at death.Saving Legal Fees Although the goals of a transfer-on-death deed could also be accomplished with a living trust, a transfer-on-death deed provides a less expensive alternative.

Typically, the only cost is between $25 and $55 to record the new deed and obtain a certificate from the city/county to show that all taxes are current. The deed should be notarized and must be prepared by one of the parties or under the supervision of a Maryland attorney.

200bAlaska. Arizona. Arkansas. California. Colorado. District of Columbia. Hawaii. Illinois.

No a will does not override a deed. A will only acts on death. The deed must be signed during the life of the owner. The only assets that pass through the will are assets that are in the name of the decedent only.

Presently, Maryland law permits individuals to transfer personal property to a named beneficiary outside of probate.The owner may sell the property, transfer it to someone other than the beneficiary named in the transfer-on-death deed, or place a mortgage on the property.

In order to change any information in a Deed, a new Deed has to be prepared. One of the questions this office is most frequently asked is how to remove the name of a deceased person from the deed to property. Unfortunately, this is not a process that can be accomplished by merely providing a death certificate.