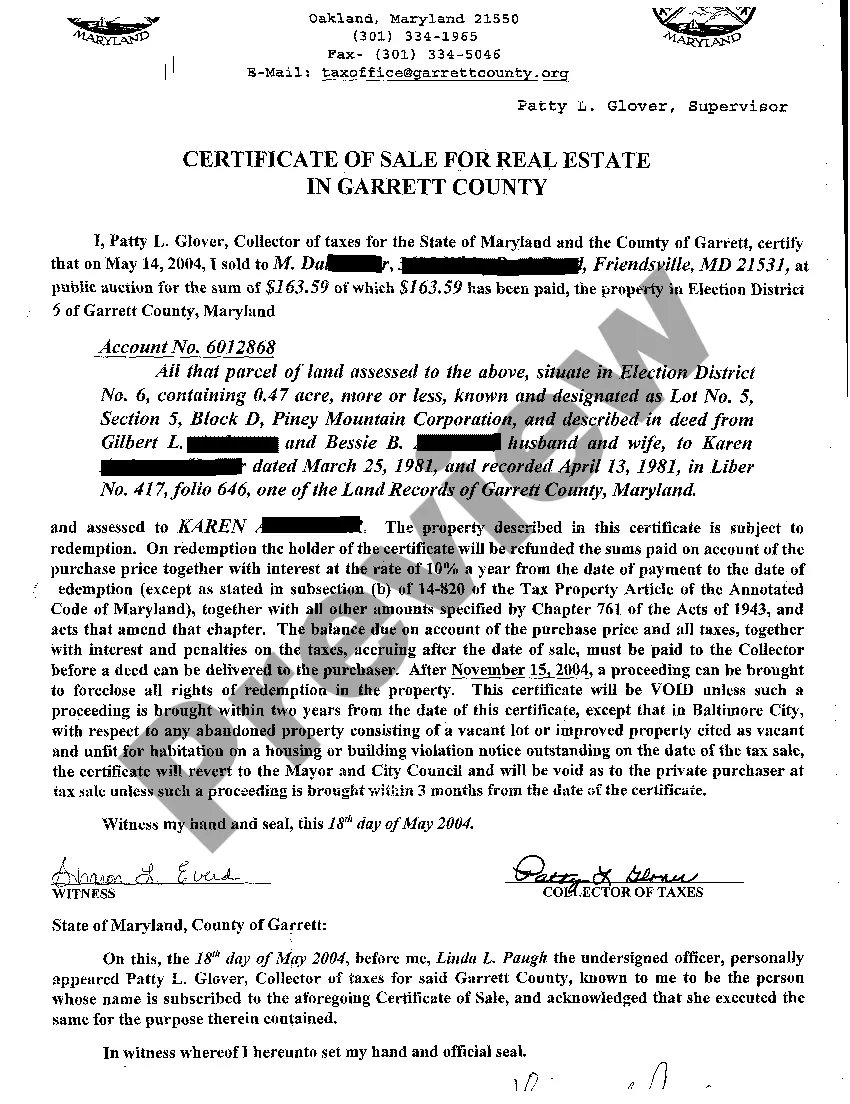

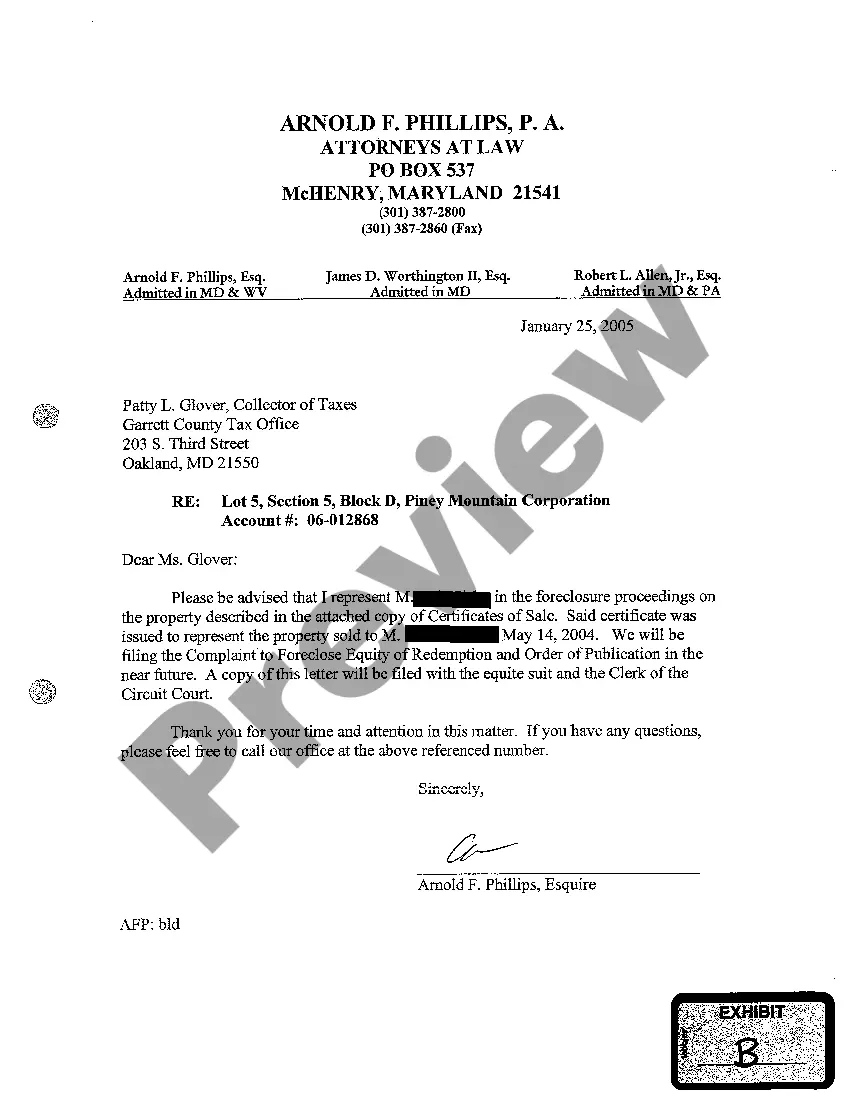

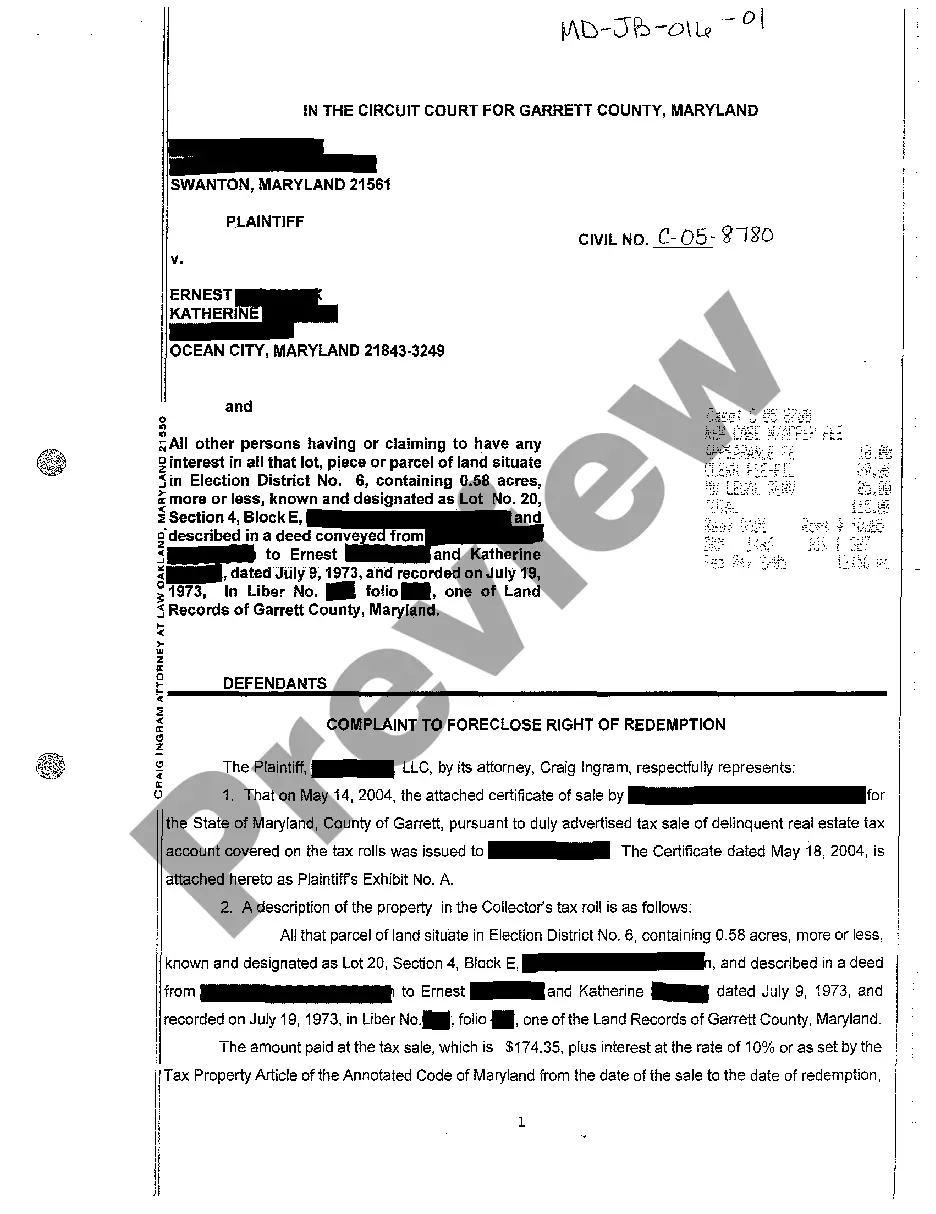

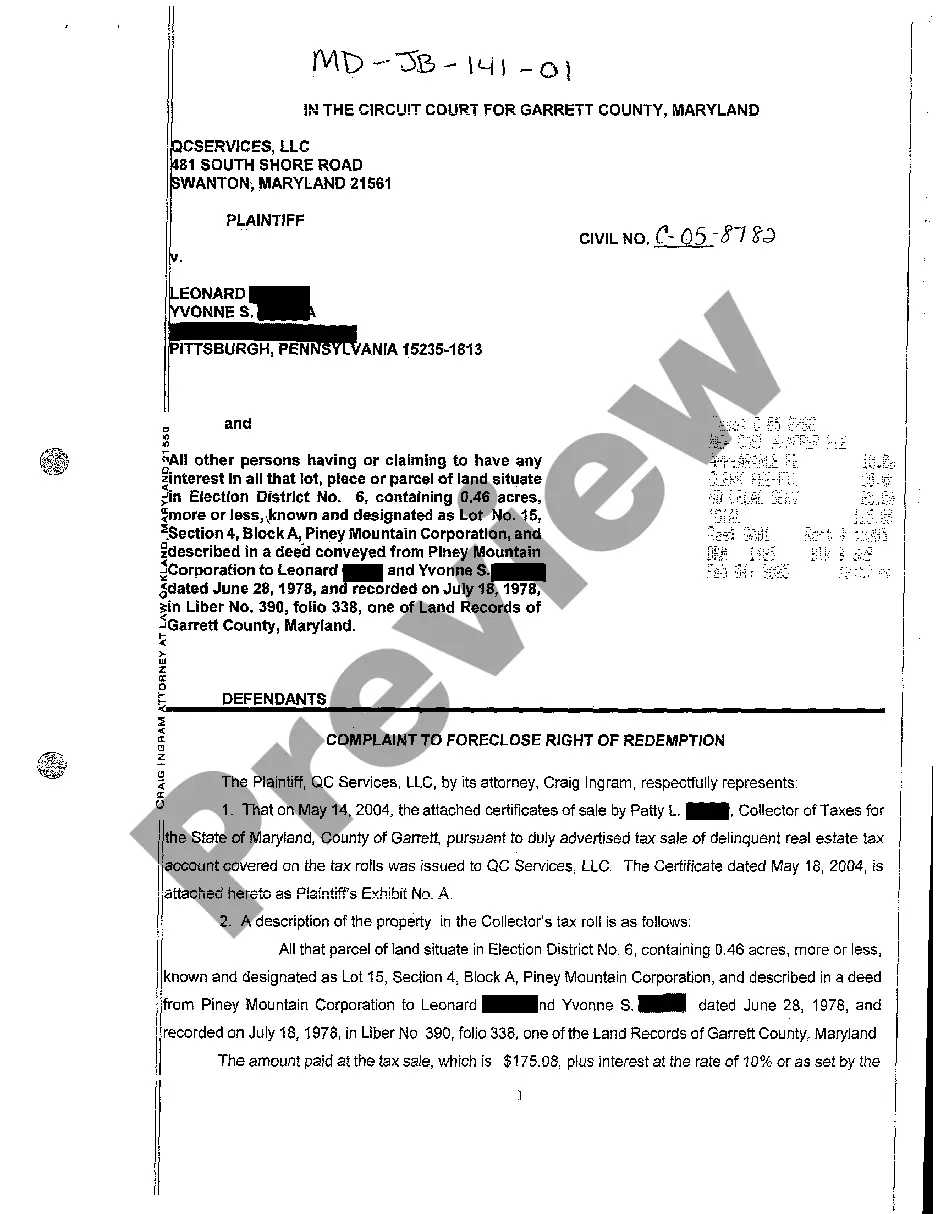

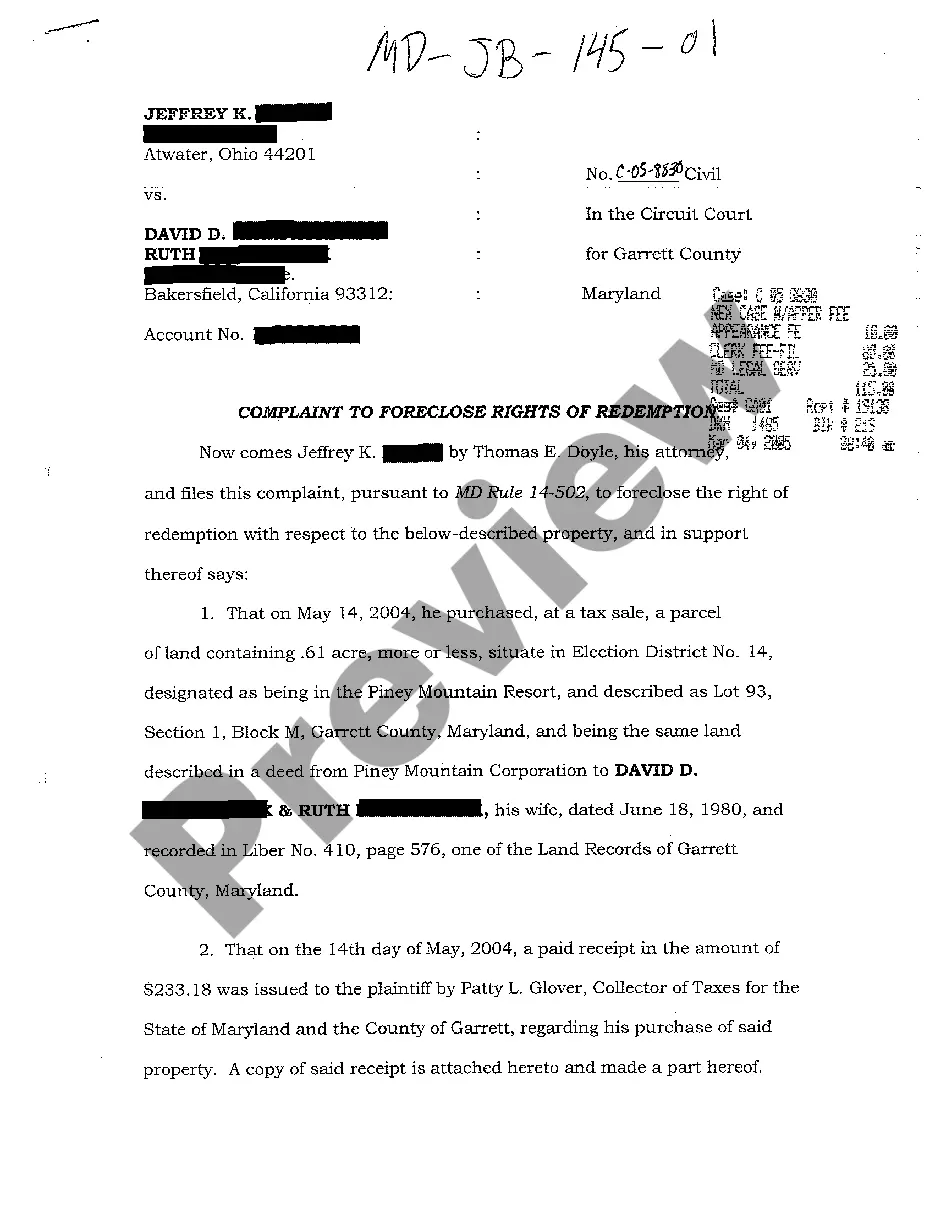

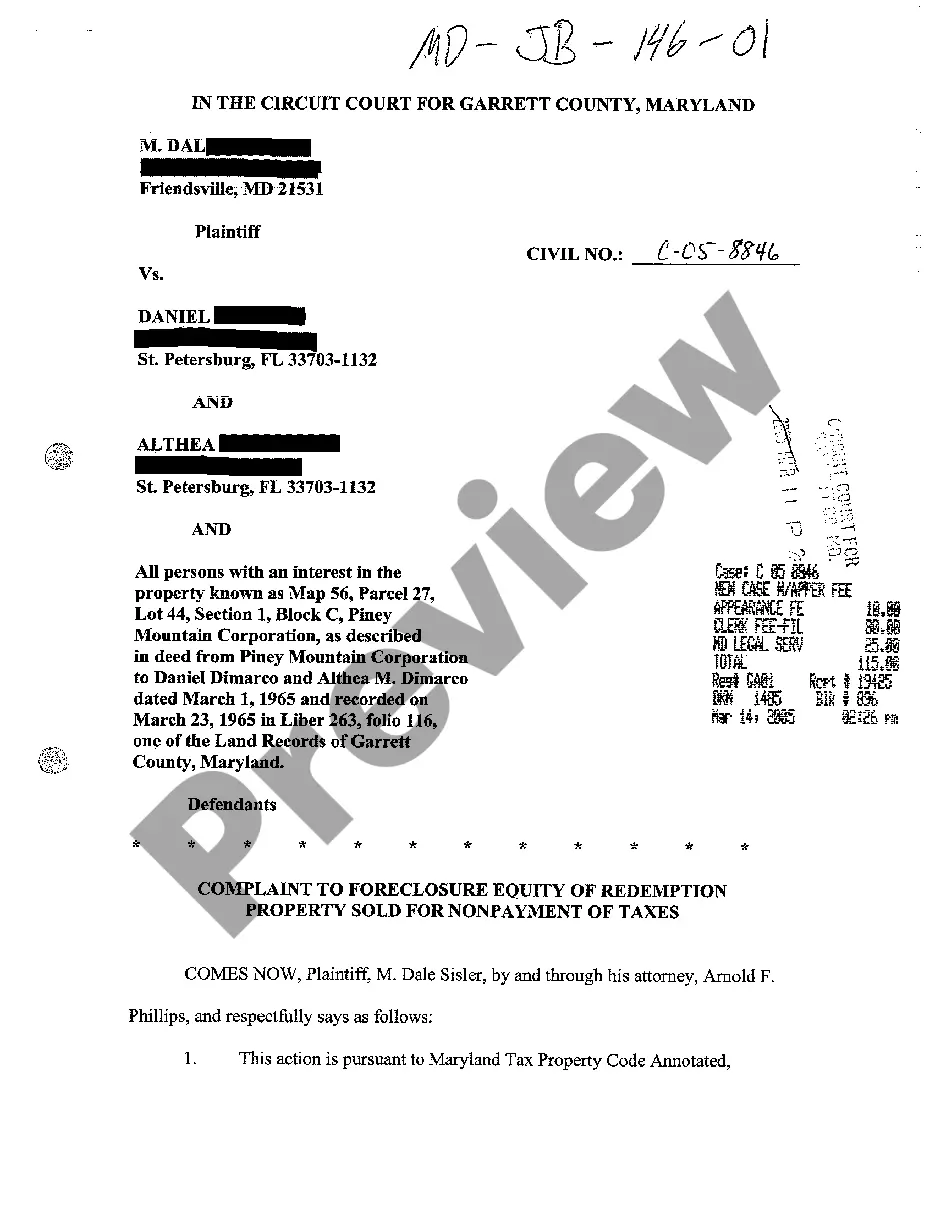

Maryland Complaint to Foreclosure Equity of Redemption Property Sold For Nonpayment of Taxes

Description

How to fill out Maryland Complaint To Foreclosure Equity Of Redemption Property Sold For Nonpayment Of Taxes?

Greetings to the largest legal documents repository, US Legal Forms. Here you can obtain any template such as Maryland Complaint to Foreclosure Equity of Redemption Property Sold For Nonpayment of Taxes and download as many as you desire.

Prepare official documents in just a few hours rather than days or even weeks, without spending a fortune on a lawyer. Obtain the state-specific sample with a few clicks and be confident it was crafted by our certified legal experts.

If you’re already a registered user, just Log In to your account and click Download next to the Maryland Complaint to Foreclosure Equity of Redemption Property Sold For Nonpayment of Taxes you need. Since US Legal Forms is online, you’ll have perpetual access to your downloaded files, regardless of the device you’re using. Find them in the My documents section.

Once you’ve completed the Maryland Complaint to Foreclosure Equity of Redemption Property Sold For Nonpayment of Taxes, submit it to your lawyer for validation. It’s an extra measure, but an essential one to ensure you’re fully protected. Sign up for US Legal Forms today and gain access to a wealth of reusable templates.

- If you do not have an account yet, what are you waiting for? Follow our instructions below to begin.

- If this is a state-specific document, verify its relevance in the state you reside.

- Review the description (if available) to ensure it's the correct template.

- Preview more content using the Preview option.

- If the document fulfills all your requirements, click Buy Now.

- To create your account, choose a pricing plan.

- Utilize a credit card or PayPal account to register.

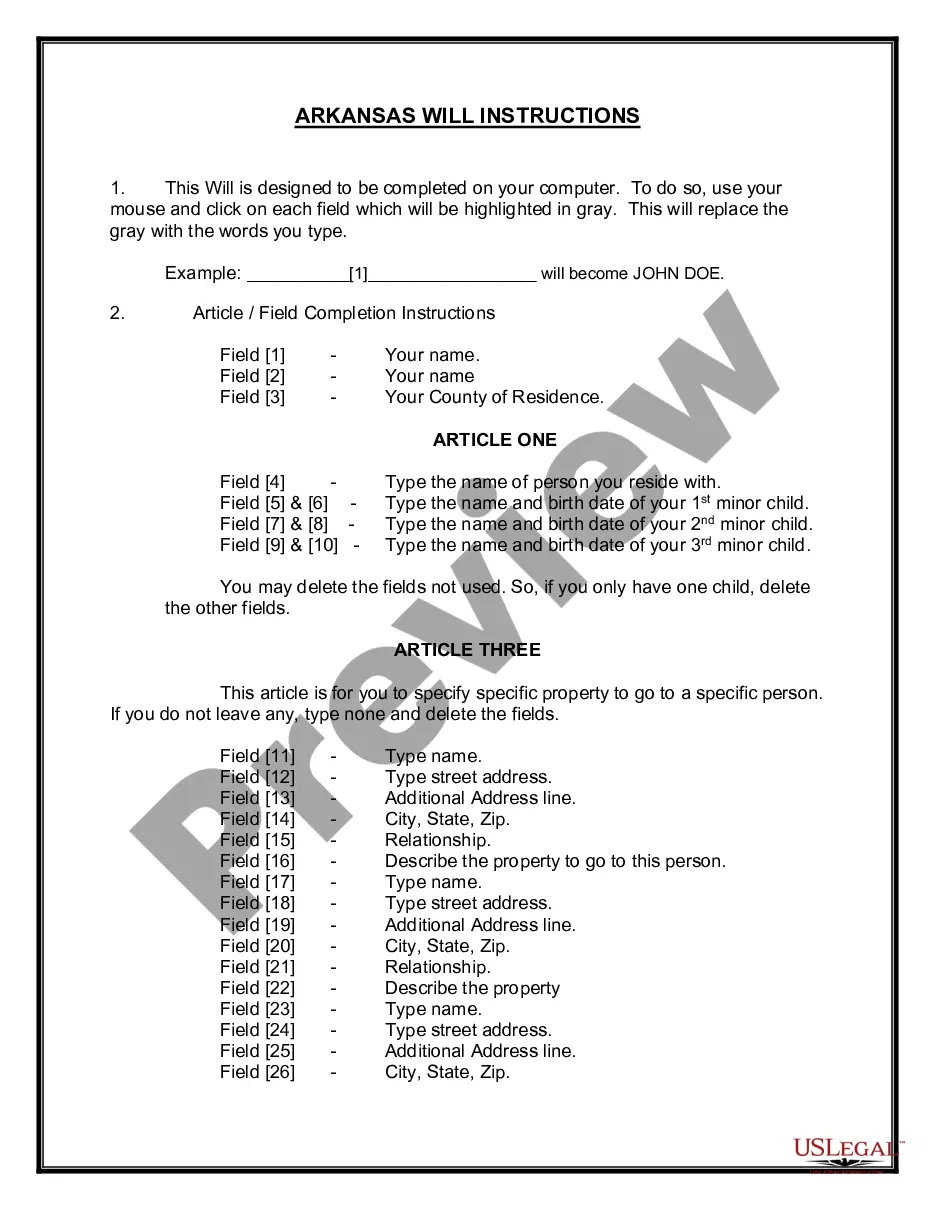

- Download the document in the format you need (Word or PDF).

- Print the document and fill it with your or your business’s information.

Form popularity

FAQ

Maryland operates as a tax lien state, which means that when property taxes go unpaid, the county issues a tax lien on the property. This tax lien can lead to the sale of the property through a foreclosure process if taxes remain unpaid. When considering a Maryland Complaint to Foreclosure Equity of Redemption Property Sold For Nonpayment of Taxes, it's important to understand that property owners have specific rights and options available. Utilizing platforms like US Legal Forms can help you navigate through the legal complexities and ensure you're prepared for any potential foreclosure situation.

In Arizona, the statutory redemption period for properties sold for back taxes is typically three years. During this time, the original owner can reclaim their property by paying the back taxes, interest, and any fees incurred. It’s important to understand that this period is critical when dealing with a Maryland Complaint to Foreclosure Equity of Redemption Property Sold For Nonpayment of Taxes.

The "right of redemption" is the right of a homeowner to either: stop a foreclosure sale from taking place by paying off the mortgage debt or. repurchase the property after a foreclosure sale by paying a specific sum of money within a limited period of time.

Redemption is a period after your home has already been sold at a foreclosure sale when you can still reclaim your home. You will need to pay the outstanding mortgage balance and all costs incurred during the foreclosure process. Many states have some type of redemption period.

You may want to pay off your mortgage before the end of your term to sell your property or remortgage to a better deal elsewhere. Paying off your loan early in this way is called 'redeeming' your mortgage.

When available, the redemption period generally ranges from thirty days to a year. In most states that provide a post-sale redemption period, specific factors often change the redemption period's length. For example: The redemption period might vary depending on whether the foreclosure is judicial or nonjudicial.