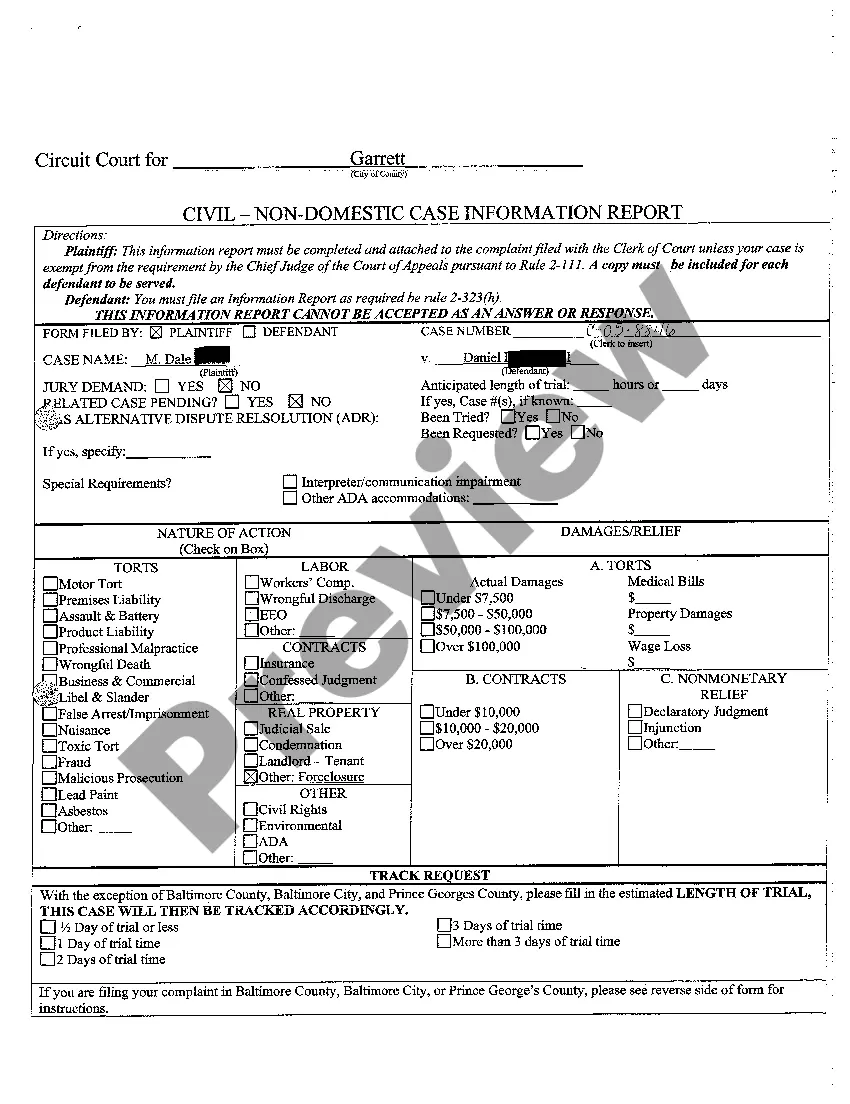

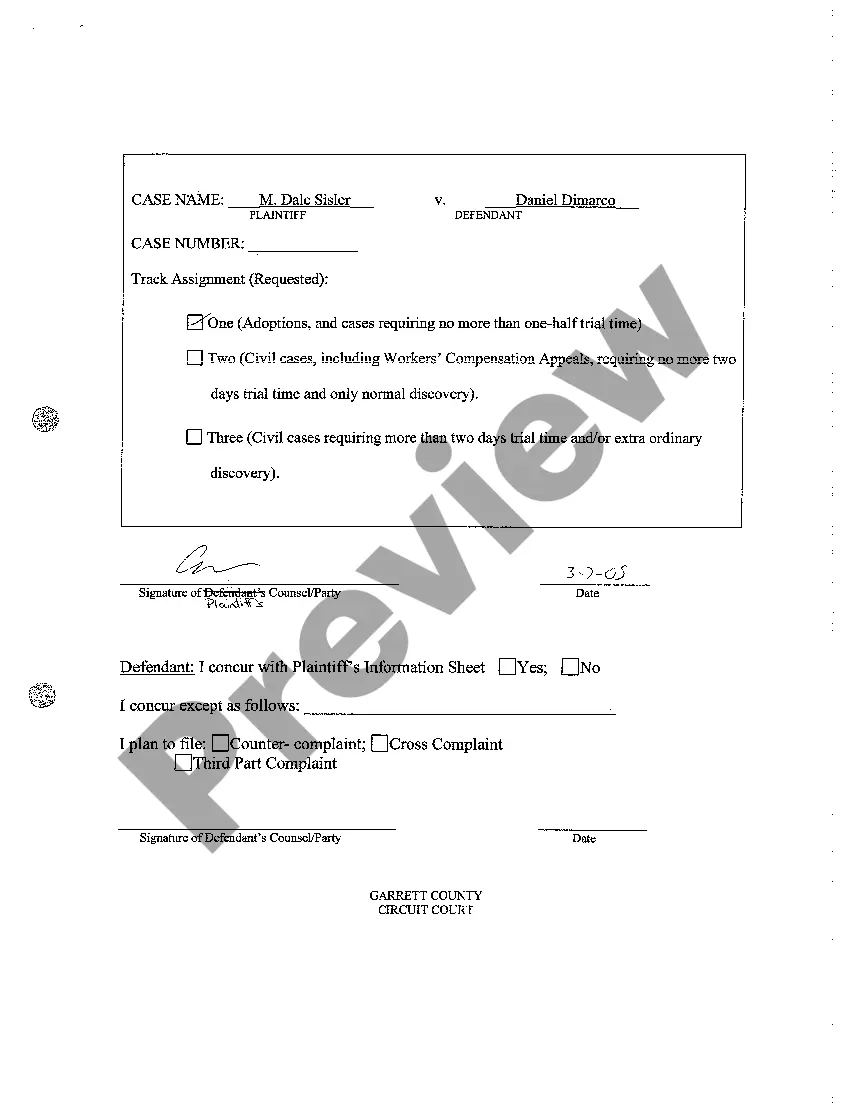

Maryland Complaint to Foreclosure Equity of Redemption Property Sold for Nonpayment of Taxes

Description

How to fill out Maryland Complaint To Foreclosure Equity Of Redemption Property Sold For Nonpayment Of Taxes?

Greetings to the finest legal documents repository, US Legal Forms. Here you will discover various samples including the Maryland Complaint to Foreclosure Equity of Redemption Property Sold for Nonpayment of Taxes templates and download them (as many as you desire/need). Prepare official paperwork in just a few hours, rather than taking days or even weeks, and without the hefty expense of a lawyer.

Obtain the state-specific template in a few clicks and feel confident knowing that it was created by our certified attorneys.

If you’re already a registered user, simply Log In to your account and click Download next to the Maryland Complaint to Foreclosure Equity of Redemption Property Sold for Nonpayment of Taxes you need. Because US Legal Forms is an online service, you'll always have access to your stored templates, no matter the device you’re using. Locate them within the My documents section.

Print the document and complete it with your/your company's information. Once you’ve filled out the Maryland Complaint to Foreclosure Equity of Redemption Property Sold for Nonpayment of Taxes, send it to your attorney for validation. It’s an additional step, but a crucial one to ensure you’re fully protected. Join US Legal Forms today and access thousands of reusable templates.

- If you do not yet have an account, what are you waiting for? Follow our instructions below to start.

- If this is a state-specific sample, verify its legitimacy in your residing state.

- Look at the description (if available) to determine if it’s the correct sample.

- Explore additional content with the Preview feature.

- If the document meets all your requirements, just click Buy Now.

- To create an account, select a pricing plan.

- Utilize a credit card or PayPal account to subscribe.

- Download the file in the format you require (Word or PDF).

Form popularity

FAQ

In Arizona, the statutory redemption period for properties sold for back taxes is three years. During this time, the original owner can redeem the property by paying the tax debt and any associated fees. While this process is specific to Arizona, understanding the implications of tax sales can inform residents in Maryland about the importance of addressing tax payments promptly to avoid a Maryland Complaint to Foreclosure Equity of Redemption Property Sold for Nonpayment of Taxes. Timely action can save you from lengthy complications.

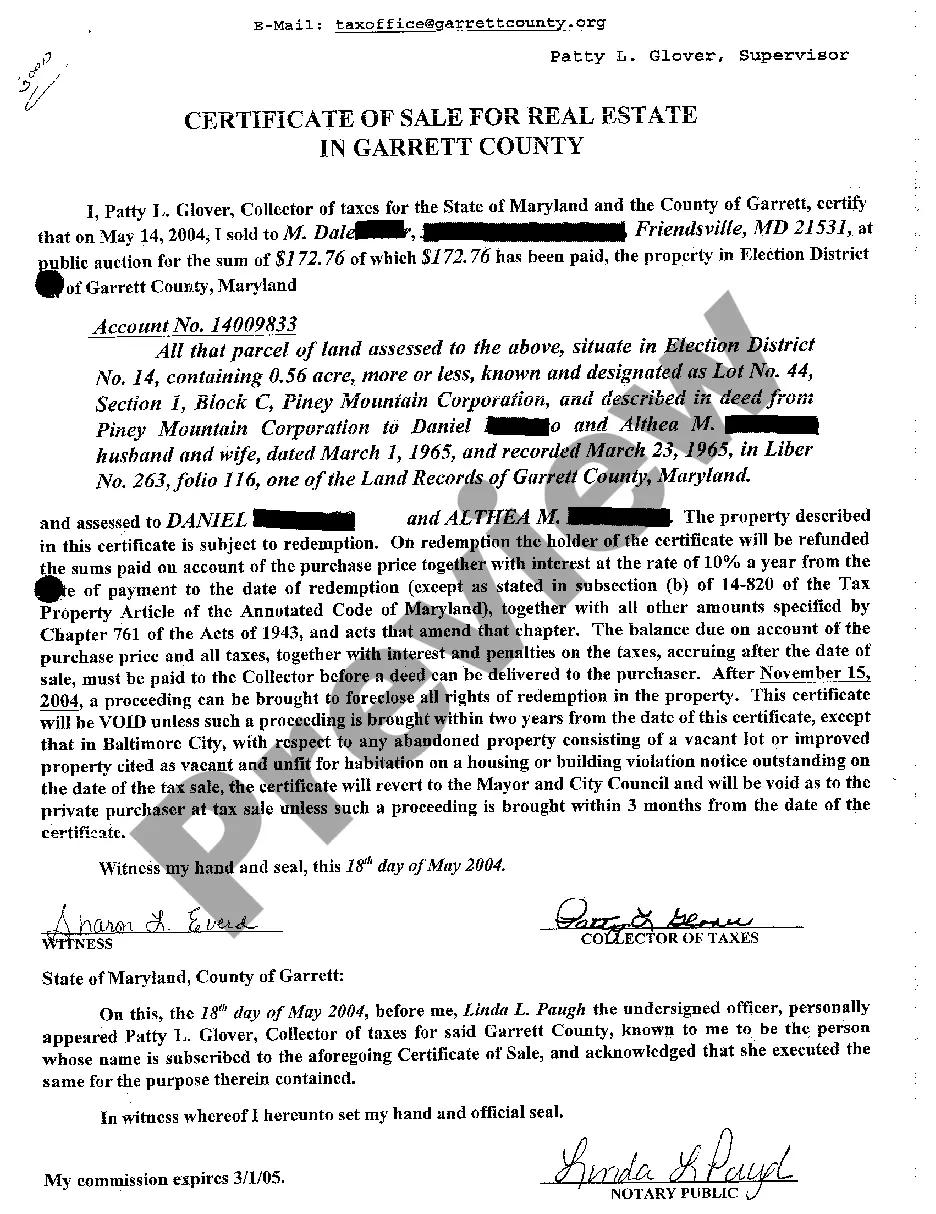

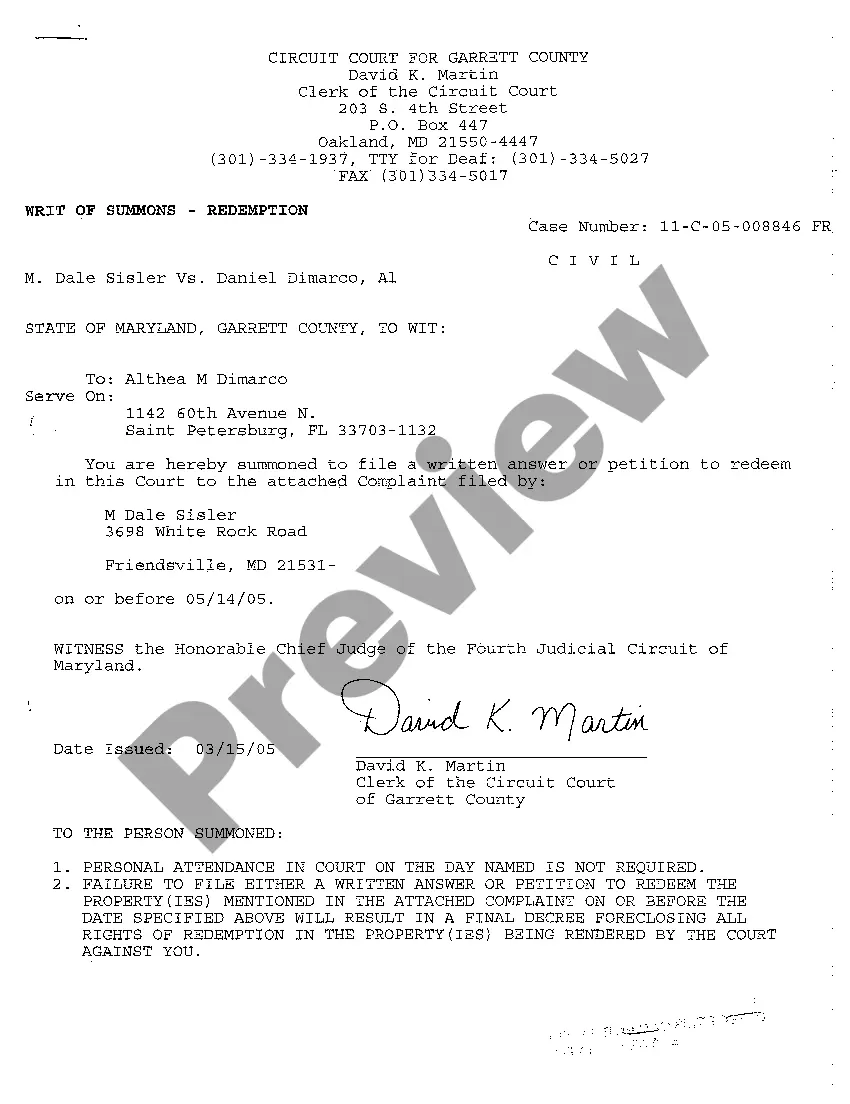

After a tax sale happens, the homeowner might be able to redeem the property. "Redemption" is the right of the property owner to reclaim the property by paying the entire sale price, plus certain additional costs and interest, after the sale so long as it is within the time period allowed by statute.

Legal references herein refer to the Tax Property Article of the Annotated Code of Maryland.Any unpaid State, County and city (municipal) taxes on real property constitute a lien on the real property from the date they become due until paid (Section 14-804).

If all attempts to collect on the delinquent taxes have been exhausted and the redemption period expires, the lien holder can initiate a judicial foreclosure proceeding against the property itself. The court then orders a foreclosure auction be held to collect the money to satisfy the unpaid tax lien.

Normally, because property tax liens are superior to all other liens, their foreclosure eliminates all junior liens, including those for mortgages. Occasionally, buyers of tax-foreclosed properties have discovered that the property actually carries a surviving mortgage lien.

File a lien against you or your property. Prevent you from renewing your State business license. Prevent you from renewing your professional or occupational license(s) Attach your assets including your bank account(s) Suspend payments coming from the State if you do business with the State. Intercept your State returns.

If you default on your property taxes in Maryland, you could lose your home to a tax sale.If you don't pay your Maryland property taxes, the tax collector can sell your home at a tax sale to pay off the delinquent amounts.

A tax lien sale is a method many states use to force an owner to pay unpaid taxes.The highest bidder gets the lien against the property. The tax collector uses the money earned at the tax lien sale to compensate for unpaid back taxes. The homeowner has to pay back the lien holder, plus interest, or face foreclosure.

This means that if the lender forecloses, the federal tax lien on the homebut not the debt itselfwill be wiped out in the foreclosure. If there are any excess proceeds after the foreclosure sale, the IRS may seek to recover that money and apply it to the outstanding debt.

While you can't redeem your home after the foreclosure sale in Maryland, you do get what is called an "equitable right of redemption" before the sale is finalized.Ratification typically takes place 30 to 45 days after the sale, though this varies from county to county.