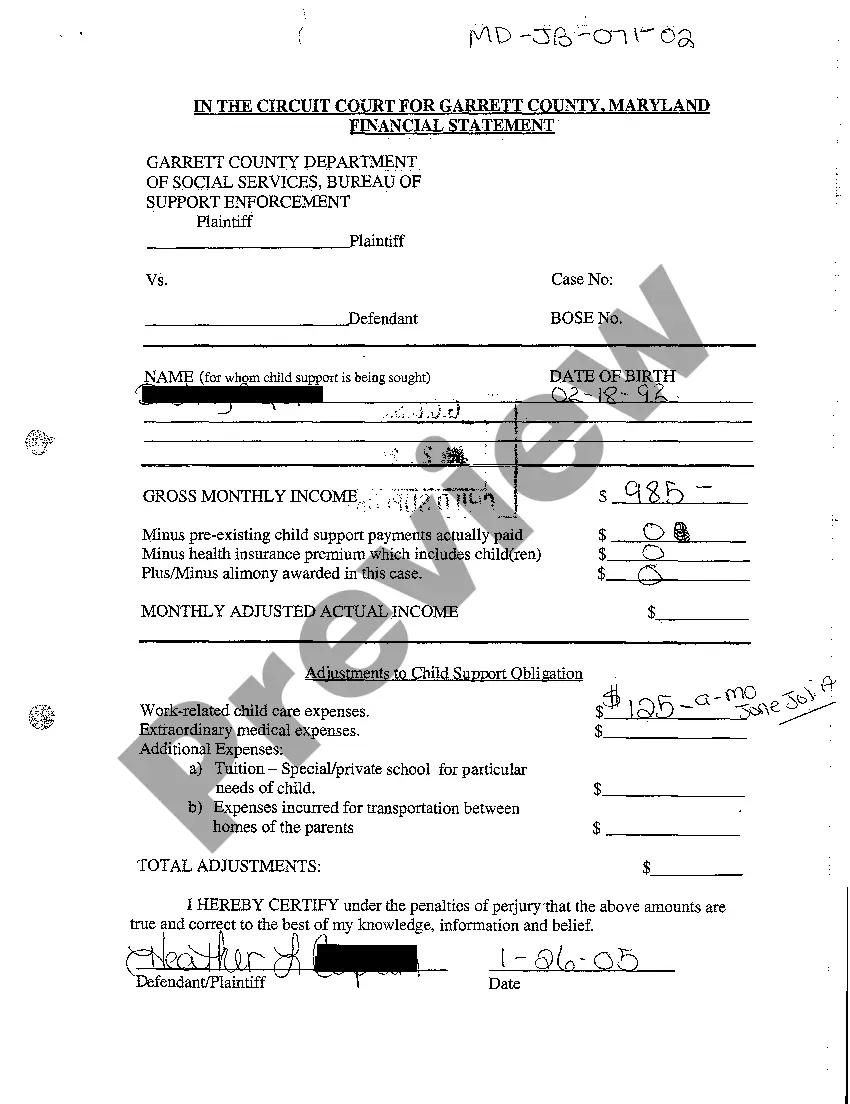

Maryland Financial Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Financial Statement?

Greetings to the finest legal documents repository, US Legal Forms. Here you can discover any template like Maryland Financial Statement forms and acquire them (as numerous as you desire/need). Prepare official paperwork in a few hours, rather than days or even weeks, without spending a fortune with an attorney. Obtain your state-specific form in just a few clicks and feel assured knowing it was crafted by our experienced lawyers.

If you are already a registered user, just sign in to your account and click Download next to the Maryland Financial Statement you require. Since US Legal Forms is an online platform, you will always have access to your downloaded files, regardless of the device you are utilizing. Locate them in the My documents section.

If you don't have an account yet, what are you holding out for? Review our instructions below to get started.

Once you have completed the Maryland Financial Statement, send it to your attorney for verification. It’s an additional step, but a necessary one to ensure you are fully protected. Join US Legal Forms now and gain access to thousands of reusable templates.

- If this is a state-specific template, verify its validity in your state.

- Examine the description (if present) to see if it’s the correct template.

- View additional details with the Preview feature.

- If the sample satisfies all your requirements, click Buy Now.

- To create your account, select a pricing plan.

- Utilize a credit card or PayPal account to register.

- Download the document in the format you need (Word or PDF).

- Print the form and fill it out with your/your business’s information.

Form popularity

FAQ

Possessions, money, financial assets, and debt acquired during (and sometimes before) marriage are divided between former spouses. In fact, divorcing individuals need a more than 30% increase in income, on average, to maintain the same standard of living they had prior to their divorce.

The financial burdens of divorce cause children to spend less time with parents, have fewer extracurricular opportunities, lose health insurance, and refrain from going to college. Less time with parents.They are also less likely to attend college because they lack the financial support to enroll. Insurance.

Because California law views both spouses as one party rather than two, marital assets and debts are split 50/50 between the couple, unless they can agree on another arrangement.

If the alimony is being paid on a monthly basis, the Supreme Court of India has set 25% of the husband's net monthly salary as the benchmark amount that should be granted to the wife. There is no such benchmark for one-time settlement, but usually, the amount ranges between 1/5th to 1/3rd of the husband's net worth.

It may take up to five years for an ex-spouse to regain his or her former financial equilibrium. A recent investors' survey revealed that most individuals recovered from both the psychological and financial setbacks following a divorce after a five-year adjustment period, as reported by Reuters.

Divorced spouses may be eligible to file for Social Security spousal benefits at retirement. You're entitled to these benefits if you were married to your spouse for at least 10 years, and he or she has reached age 62.

When the spouses are legally separated, any new debts are usually considered the separate debt of the spouse that incurred them. However, not all states recognize legal separation. In that case, debts may continue to allot until the divorce filing or the divorce decree, depending on state law.

Sell the House. A jointly-owned home is a source of financial devastation and tension for many couples contemplating divorce. Divide the Debts. One of the biggest issues during separation is how to distribute and protect assets after divorcing. Establish New Accounts. Monitor Your Credit History.

But divorce, on the other hand, is expensive. Marital property, including assets and debts acquired during the marriage (and sometimes even before the marriage), is divided between the parties.For the more affluent couples, divorce might shake up their finances, but it won't necessarily ruin them financially.

In California, there is no 50/50 split of marital property. When a married couple gets divorced, their community property and debts will be divided equitably. This means they will be divided fairly and equally.