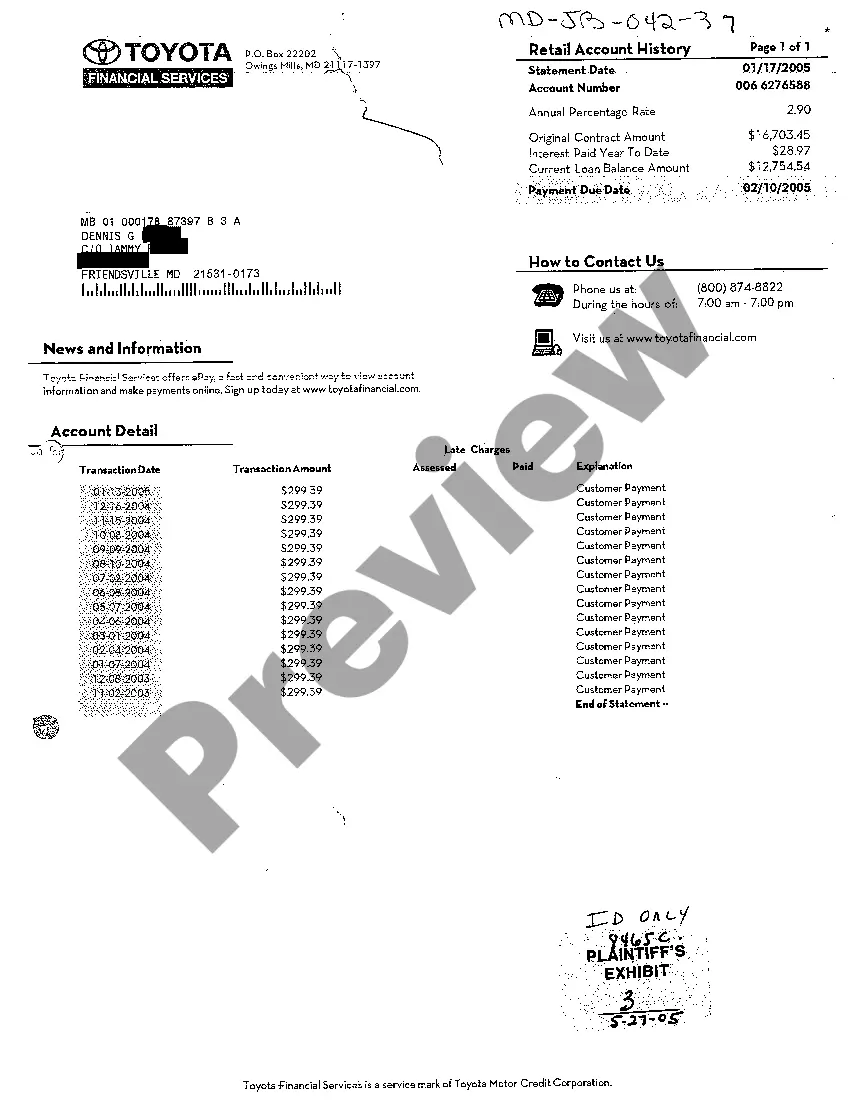

Maryland Account Detail

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Account Detail?

Greetings to the most extensive repository of legal documents, US Legal Forms. Here you will discover any template including Maryland Account Detail forms and retain as many as you wish or require.

Prepare official documents in mere hours instead of days or weeks, without incurring significant expenses with an attorney. Obtain the state-specific example within moments and feel assured knowing that it was created by our certified lawyers.

If you’re an existing user, simply Log In to your profile and click Download beside the Maryland Account Detail you need. Since US Legal Forms is online, you will continuously have access to your saved files, regardless of the device you are using. View them in the My documents section.

Print the document and fill it with your or your business’s information. Once you have finalized the Maryland Account Detail, forward it to your attorney for confirmation. This is an extra step but a crucial one to ensure you are completely covered. Register with US Legal Forms today and gain access to countless reusable templates.

- If you do not possess an account yet, what are you waiting for.

- Review our instructions listed below to get started.

- If this is a state-specific form, verify its relevance in your state.

- Check the description (if available) to ascertain if it’s the appropriate template.

- Explore more details using the Preview feature.

- If the document fulfills all of your requirements, simply click Buy Now.

- To create an account, select a pricing option.

- Utilize a credit card or PayPal account to register.

- Download the document in your preferred format (Word or PDF).

Form popularity

FAQ

The Central Registration number is an eight digit number assigned by Maryland when you register to open a state business account.

To file, you must download and print the Annual Personal Property Return form from the Secretary of State website. Then, complete it mail in to the Maryland State Department of Assessments and Taxation along with the filing form.

If you have applied for unemployment insurance benefits and have been approved, you will receive a notice from the Maryland Department of Labor's Division of Unemployment Insurance entitled "Notice of First Benefit Payment Approval and Mailing of Your Bank of America Debit Card."

The Form PV is a payment voucher you will send with your check. or money order for any balance due in the Total Amount Due line of your Forms 502 and 505, Estimated Tax Payments and Extension Payments.

Look up your Central Registration Number online by logging into the Comptroller of Maryland's website. Locate your eight digit (XXXXXXXX) Central Registration Number on any previously filed Annual Reconciliation Return (Form MW-508). Call the Comptroller's office: 800-MD-TAXES.

You can locate your EIN on your confirmation letter from the IRS, old tax returns, old business loan applications, your business credit report, or payroll paperwork. You can also call the IRS to look up your federal tax ID number.

A Federal Tax Identification Number, also known as a "95 Number", "E.I.N. Number," or "Tax I.D. Number", all refer to the nine digit number issued by the IRS. They are different names for the same number.

You can apply for a FEIN online or download the form through the IRS' website, or can call them at 1-800-829-4933. Remember, you must have a Maryland SDAT Identification Number in order to apply for a Federal Employer Identification Number. Once approved, your FEIN will be a nine-digit number.

This process typically takes 21 days. However, most PUA and PEUC applications will be processed much faster than this average time frame due to the streamlined eligibility verification process. Every individual's claim can be very different, so some claims may take longer to process than others for numerous reasons.