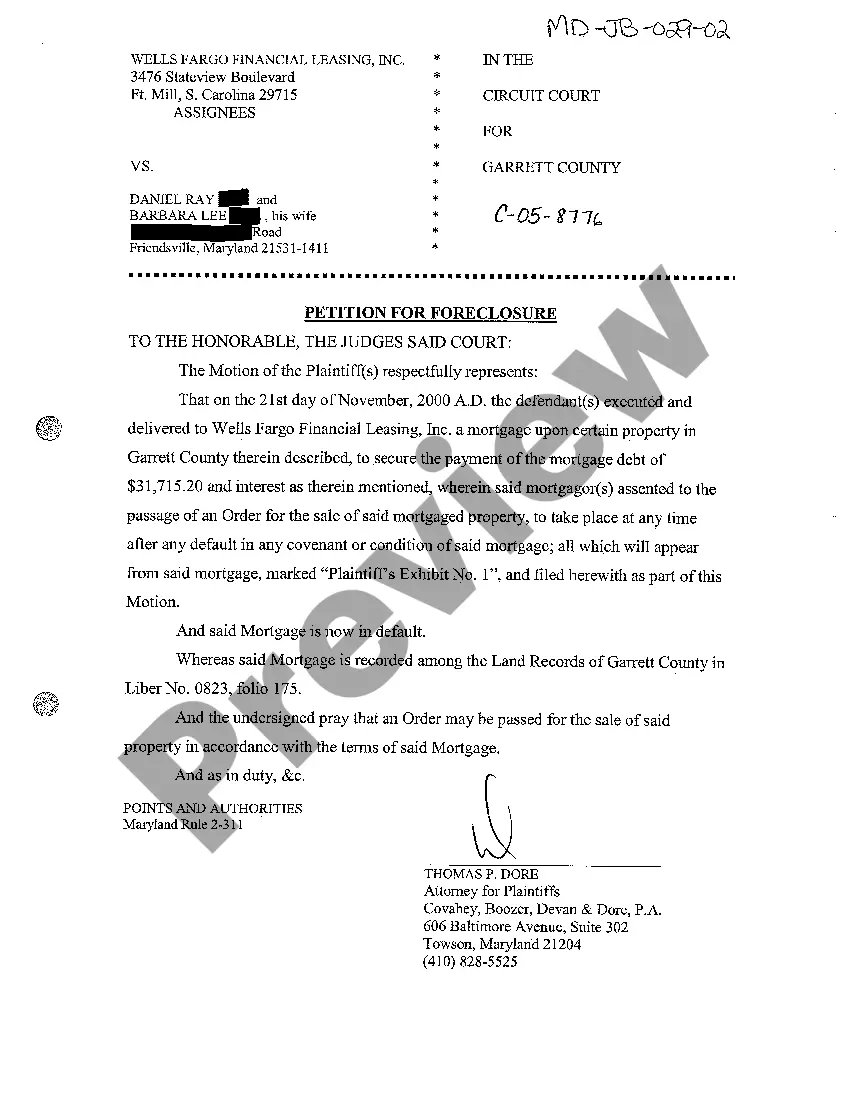

Maryland Petition for Foreclosure

Description

How to fill out Maryland Petition For Foreclosure?

Greetings to the finest legal documentation library, US Legal Forms. Right here you can discover any template such as Maryland Petition for Foreclosure forms and download them (as many of them as you wish/need). Prepare official documents within hours, rather than days or weeks, without spending a fortune on an attorney.

Obtain your state-specific template in just a few clicks and be confident knowing that it was created by our licensed lawyers.

If you’re already a registered user, simply Log Into your account and click Download adjacent to the Maryland Petition for Foreclosure you seek. Since US Legal Forms is an online solution, you’ll always have access to your downloaded templates, no matter the device you’re using. Locate them in the My documents section.

Print the document and complete it with your/your company’s details. Once you’ve finished the Maryland Petition for Foreclosure, send it to your attorney for validation. It’s an additional step but an essential one to ensure you’re fully protected. Join US Legal Forms today and receive a multitude of reusable templates.

- If you don't yet have an account, what are you waiting for.

- Review our instructions below to get started.

- If this is a state-specific template, verify its legality in your residing state.

- Check the description (if available) to see if it’s the right template.

- Examine more details with the Preview feature.

- If the template fits all of your requirements, click Buy Now.

- To create your account, choose a pricing option.

- Utilize a credit card or PayPal account to register.

- Download the file in the format you desire (Word or PDF).

Form popularity

FAQ

While you can't redeem your home after the foreclosure sale in Maryland, you do get what is called an "equitable right of redemption" before the sale is finalized.Ratification typically takes place 30 to 45 days after the sale, though this varies from county to county.

Notice of Intent to Foreclose (NOI) The NOI is a warning notice to the homeowner that a foreclosure action could be filed against them in court. The mortgage company must send the NOI by certified and first-class mail to the homeowner no less than 45 days before a foreclosure action is filed in court.

(Md. Code Ann., Tax-Prop. § 14-833). These six months are called a "redemption period." (In Baltimore City, the redemption period is nine months from the date of sale for owner-occupied residential properties.

In a foreclosure by judicial sale, the redemption period is six months from the date of the foreclosure decree, unless the court orders a shorter time. Redemption is also available before the sale takes place, even if the initial redemption period expired.

Typically, it takes about 90 days to foreclose on a Maryland property if the borrower does not object to the foreclosure. If a lender pursues a judicial foreclosure in Maryland then the time frame for foreclosure will vary depending on the court's schedule and orders.

Get Pre-Approved for a Mortgage. Explore Foreclosed Properties with Your Agent. Get a Thorough Inspection on the Home. Resolves Liens on the Home. Prepare for Problems and Have a Ready Solution. Related Articles. You May Also Like.

Foreclosure Sale and Eviction If the borrower does not request mediation, the sale can occur as soon as 45 days after receipt of a Final Loss Mitigation Affidavit, or 30 days from the date the Final Loss Mitigation Affidavit was mailed to the homeowner.

Currently, 22 states in the U.S. only allow banks to attempt judicial foreclosures, including Arkansas, Connecticut, Delaware, Florida, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Nebraska, New Jersey, New Mexico, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, Virginia, and

Maryland Foreclosures: A Quasi-Judicial Process. Most foreclosures in Maryland are what's called nonjudicial or quasi-judicial. With a nonjudicial foreclosure, the lender must complete specific out-of-court steps detailed in state law before selling the property.