Maryland Gift Deed from Two Grantors to a Non-Profit Corporation as Grantee.

Definition and meaning

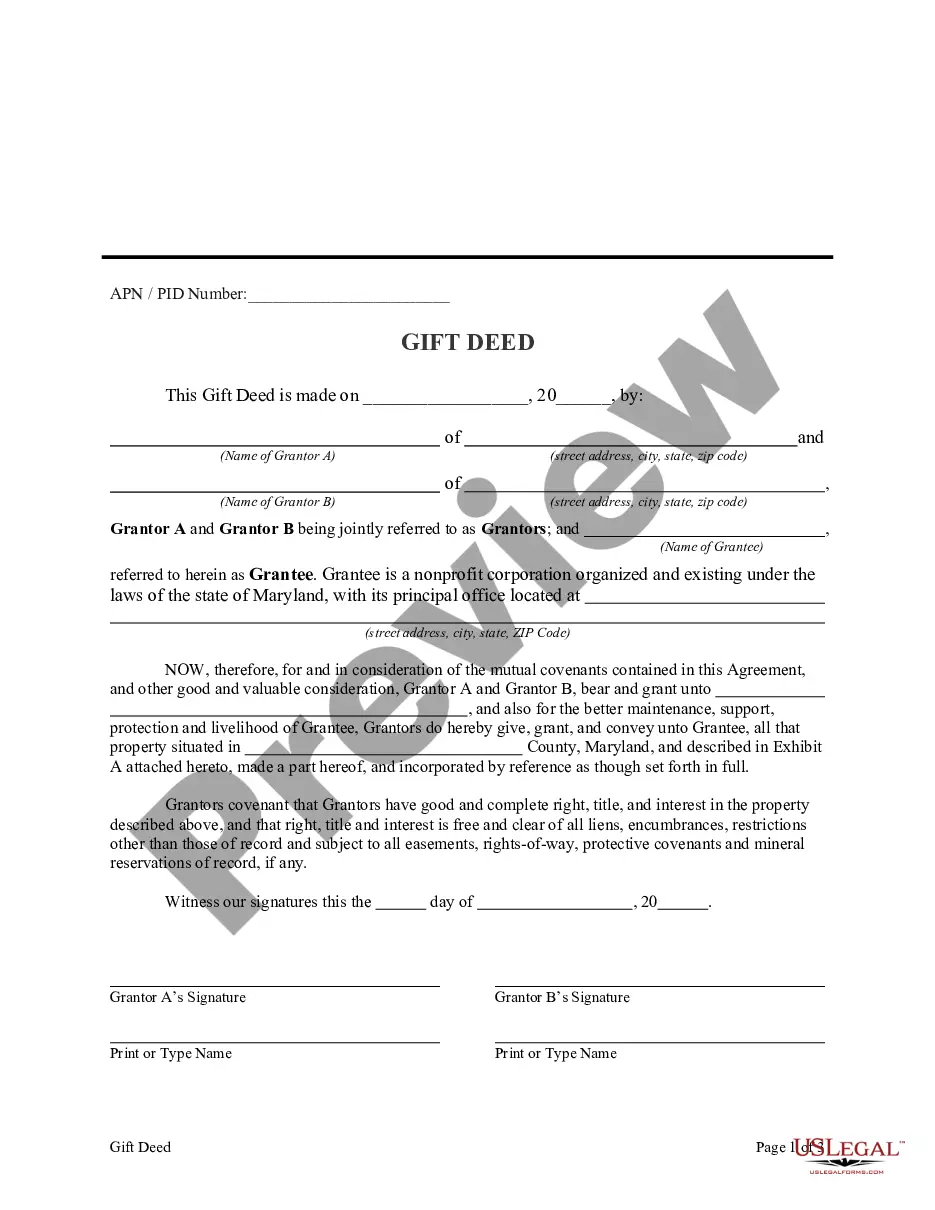

A Maryland Gift Deed is a legal document that allows individuals, known as grantors, to transfer property ownership to a non-profit corporation, referred to as the grantee, without any exchange of monetary value. This type of deed is often used as a means of charitable giving, allowing grantors to support worthwhile causes by donating real estate or other assets to organizations that serve public interests.

How to complete a form

Completing a Maryland Gift Deed involves several key steps:

- Identify the Parties: Clearly state the names and addresses of both grantors and the grantee.

- Provide the Property Description: Include an accurate legal description of the property being gifted, as specified in Exhibit A.

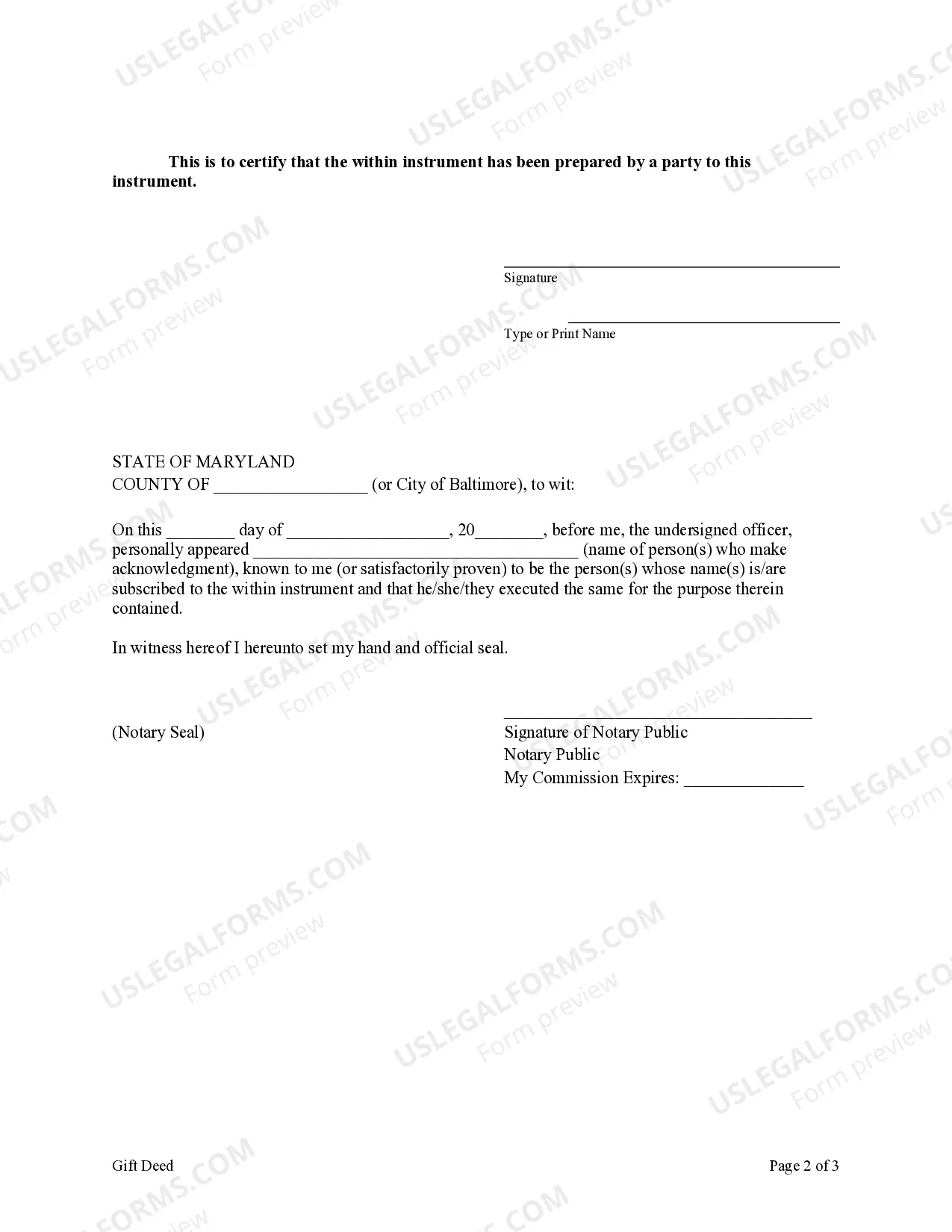

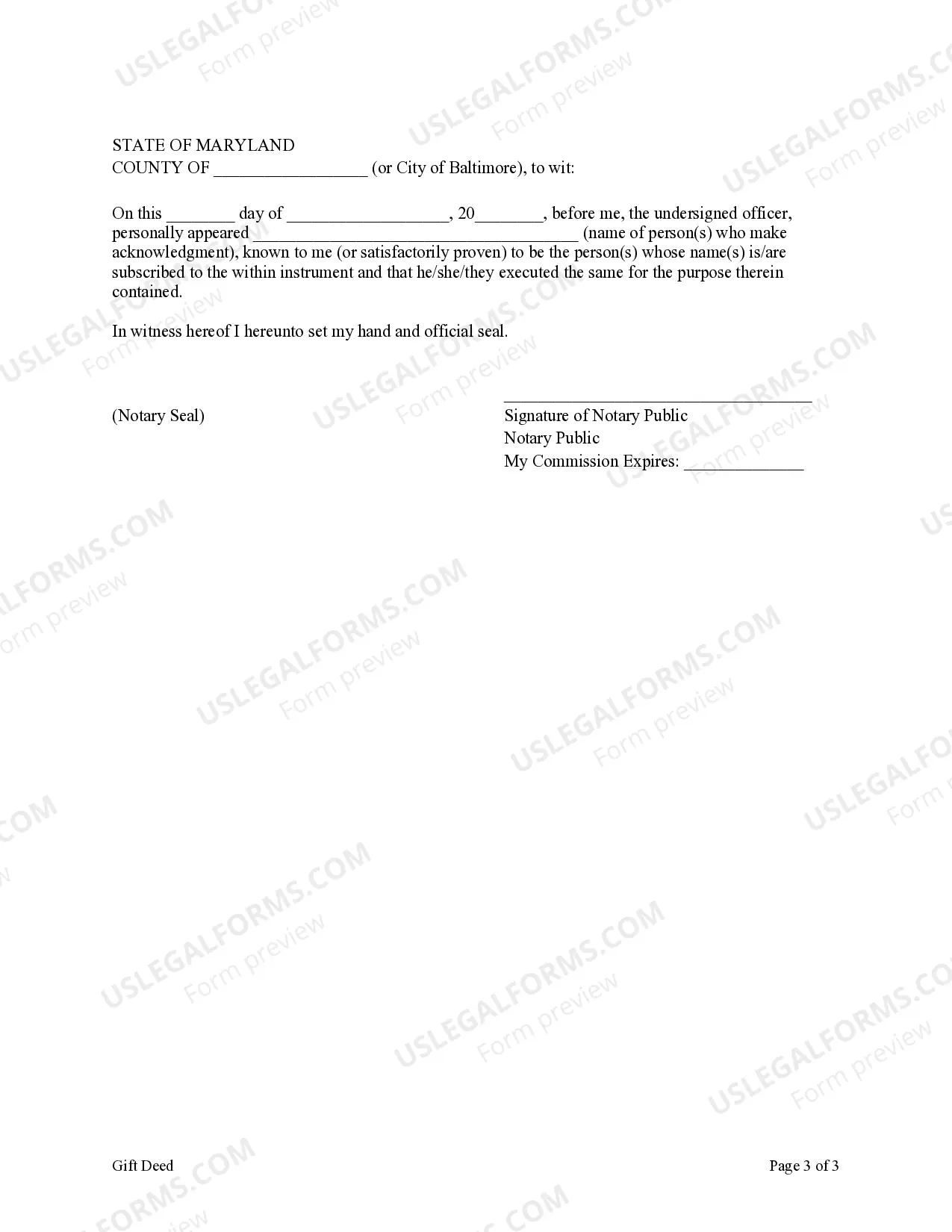

- Signatures: Ensure both grantors sign the document in the presence of a notary public.

- Notarization: The notary will verify the identities of the signers and affix their signature and seal.

This ensures that the document is legally binding and recorded properly.

Who should use this form

This form is intended for individuals or couples who wish to donate property to a non-profit corporation in Maryland. It is suitable for private individuals looking to honor a cause they care about by transferring property ownership without expecting compensation in return. Non-profit organizations accepting these gifts can also benefit from this form, ensuring the legality of their received donations.

Key components of the form

The Maryland Gift Deed includes the following essential components:

- Grantors' Information: Names and addresses of the individuals giving the gift.

- Grantee Information: Details of the non-profit corporation receiving the property.

- Property Description: A detailed legal description of the property being transferred.

- Signatures: Signatures of grantors and a notary public to validate the transaction.

These elements ensure that the deed meets legal standards and clearly outlines the transfer of property rights.

Common mistakes to avoid when using this form

When completing a Maryland Gift Deed, avoid these frequent pitfalls:

- Incomplete Property Description: Failing to provide a full legal description can lead to challenges in property transfer.

- Notary Oversight: Not having the signatures notarized can invalidate the deed.

- Incorrect Grantee Information: Ensure the non-profit corporation's details are correctly specified to avoid complications in ownership transfer.

By being mindful of these common errors, you can ensure a smoother process for gifting your property.

What to expect during notarization or witnessing

During the notarization of a Maryland Gift Deed, both grantors must appear in person before a notary public. The notary will:

- Verify the identities of the grantors through valid identification.

- Ensure that the grantors understand the content of the document they are signing.

- Witness the signing of the deed and provide their official seal and signature.

This process affirms the authenticity of the document, making it legally enforceable.

Form popularity

FAQ

You can gift a self-acquired property to anyone, as long as you are competent to contract, as per the provisions of the Indian Contract Act.An immovable property can be gifted, by executing a gift deed. You need to pay stamp duty on the market value of the property, as on the date of execution of the gift deed.

Details of the donor and donee (name, date of birth, residence, relationship to each other, father's name, etc.) The amount of money being gifted, Reason for gifting, if any.

To change the names on a real estate deed, you will need to file a new deed with the Division of Land Records in the Circuit Court for the county where the property is located. The clerk will record the new deed.

The law provides that any gift that is made and accepted by the donee, is final and cannot be revoked later on. So, if all the conditions of a valid gift are present, the same cannot be annulled by the donor later on, except on the ground that the consent of the donor was obtained by fraud, undue influence or coercion.

Typically, the only cost is between $25 and $55 to record the new deed and obtain a certificate from the city/county to show that all taxes are current. The deed should be notarized and must be prepared by one of the parties or under the supervision of a Maryland attorney.

To do this, you will need to fill out Transfer Form 01T on the Land and Property Information website (NSW only). If you are transferring the property as a gift, then you will fill out and sign a gift deed, which allows you to gift your assets or transfer ownership without any exchange of money.

In case the transfer is in the name of other relatives such as the father, the mother, the son, the sister, the daughter-in-law, the grandson or the daughter, 2.5 per cent of the property value has to be paid as stamp duty.

The steps to follow in order to register a gift deed are: An approved valuation expert will evaluate the property to be gifted. The Donor and the Donee will sign the gift deed in the presence of 2 witnesses. Submit the signed document at the office of the Sub-Registrar nearest to the gifted property.

Any valid owner of an existing property can gift property. A minor is incompetent to gift a property though a guardian can accept such a gift on his behalf. WHAT is the law that governs gifts by one person to another? Transfer of Property Act, 1882.