Massachusetts I.R.S. Form SS-4 (to obtain your federal identification number)

Description

How to fill out I.R.S. Form SS-4 (to Obtain Your Federal Identification Number)?

You may commit hours on-line looking for the legitimate document template that suits the state and federal demands you will need. US Legal Forms gives a large number of legitimate forms which can be reviewed by specialists. It is simple to down load or print the Massachusetts I.R.S. Form SS-4 (to obtain your federal identification number) from my service.

If you already have a US Legal Forms account, it is possible to log in and click on the Acquire option. Following that, it is possible to comprehensive, edit, print, or sign the Massachusetts I.R.S. Form SS-4 (to obtain your federal identification number). Every single legitimate document template you purchase is your own property forever. To get one more copy for any obtained type, proceed to the My Forms tab and click on the related option.

If you use the US Legal Forms site the very first time, stick to the easy recommendations listed below:

- First, ensure that you have chosen the proper document template to the county/metropolis of your liking. Browse the type description to ensure you have picked out the right type. If accessible, take advantage of the Preview option to appear through the document template at the same time.

- In order to find one more model of the type, take advantage of the Research discipline to find the template that fits your needs and demands.

- When you have found the template you desire, simply click Get now to carry on.

- Select the pricing strategy you desire, type your accreditations, and sign up for your account on US Legal Forms.

- Complete the purchase. You can use your charge card or PayPal account to cover the legitimate type.

- Select the file format of the document and down load it for your gadget.

- Make alterations for your document if necessary. You may comprehensive, edit and sign and print Massachusetts I.R.S. Form SS-4 (to obtain your federal identification number).

Acquire and print a large number of document layouts utilizing the US Legal Forms Internet site, which offers the most important assortment of legitimate forms. Use expert and condition-particular layouts to take on your organization or specific needs.

Form popularity

FAQ

Your previously filed return should be notated with your EIN. Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at 800-829-4933.

SS-4 Confirmation Letter: This letter acts as an official statement from the IRS, confirming your authorized EIN. It outlines your entity's legal name, address, EIN, and the date of issuance.

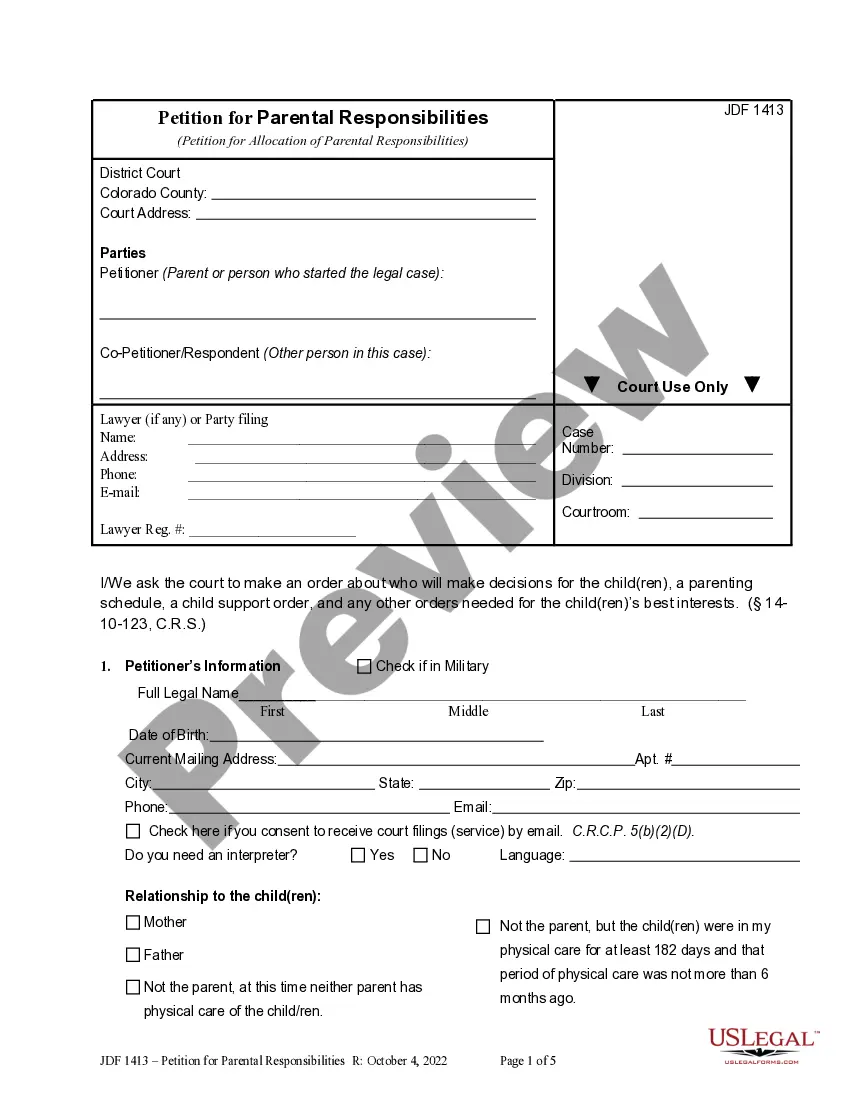

Partnerships and corporations with or without employees, and sole proprietors with employees, must obtain an Employer Identification Number (EIN) (Form SS-4) from the IRS. The form can be obtained from the IRS at .irs.gov or 800-392-6089.

The U.S. Taxpayer Identification Number may be found on a number of documents, including tax returns and forms filed with the IRS, and in the case of an SSN, on a social security card issued by the Social Security Administration.

You can start a business in minutes. COVID-19 has impacted organizations around the world and the IRS is no exception. Due to COVID-19 the IRS has relaxed some ?wet signature? requirements which means you are able to digitally sign Form SS-4 (Application for an EIN)!

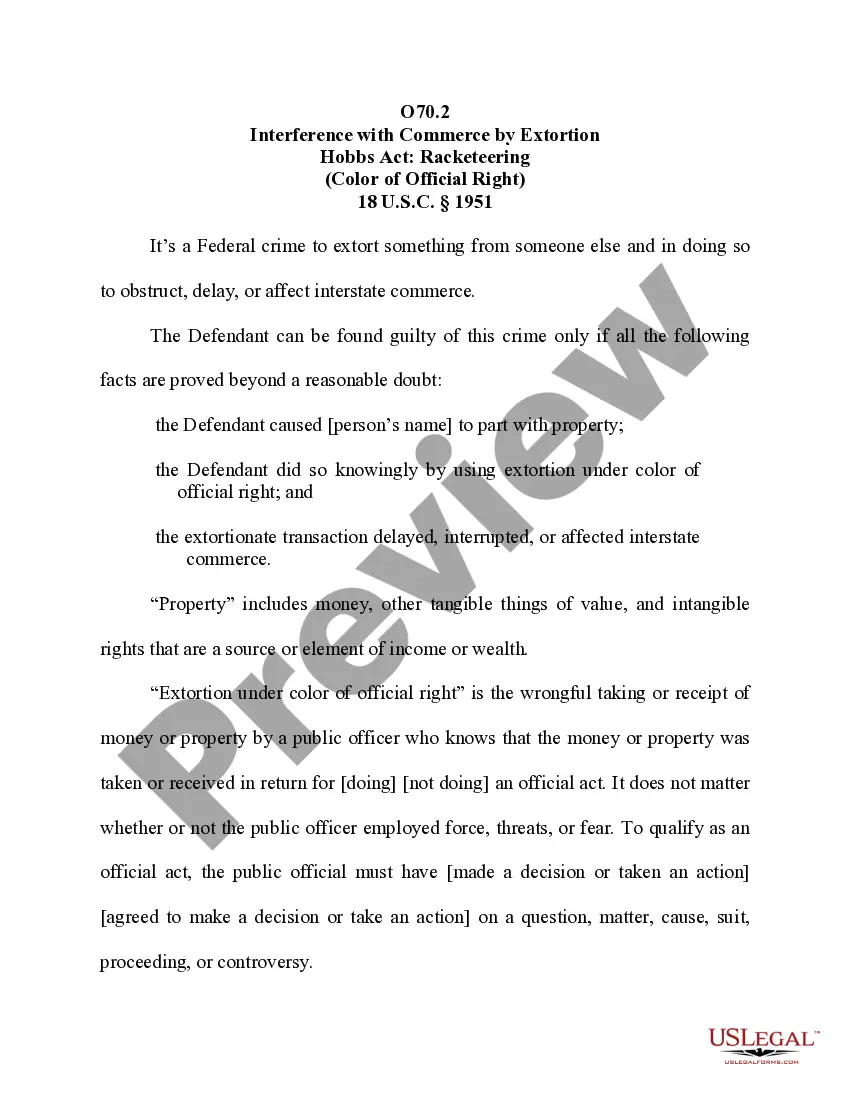

You can use Form SS-4 to request an Employer Identification Number (EIN) from the IRS. An EIN is assigned to a business for business activities such as tax filing and reporting purposes. The following types of entities can apply for an EIN: Employers (including corporations, partnerships, and sole proprietors)

You can apply for an EIN by filing an Application For Employer Identification Number (Form SS-4) with the Internal Revenue Service (IRS). The form can be submitted online, by mail, telephone, or fax. There is no filing fee.

6 Steps to Complete SS-4 Gather the Information Necessary To Complete Form SS-4. You'll want to gather information on the business. ... Complete the General Information Section. ... Complete the Business Type Information Section. ... Complete the Other Business Information Section. ... Sign the Form. ... Submit Your Form SS-4.