Massachusetts Self-Employed Steel Services Contract

Description

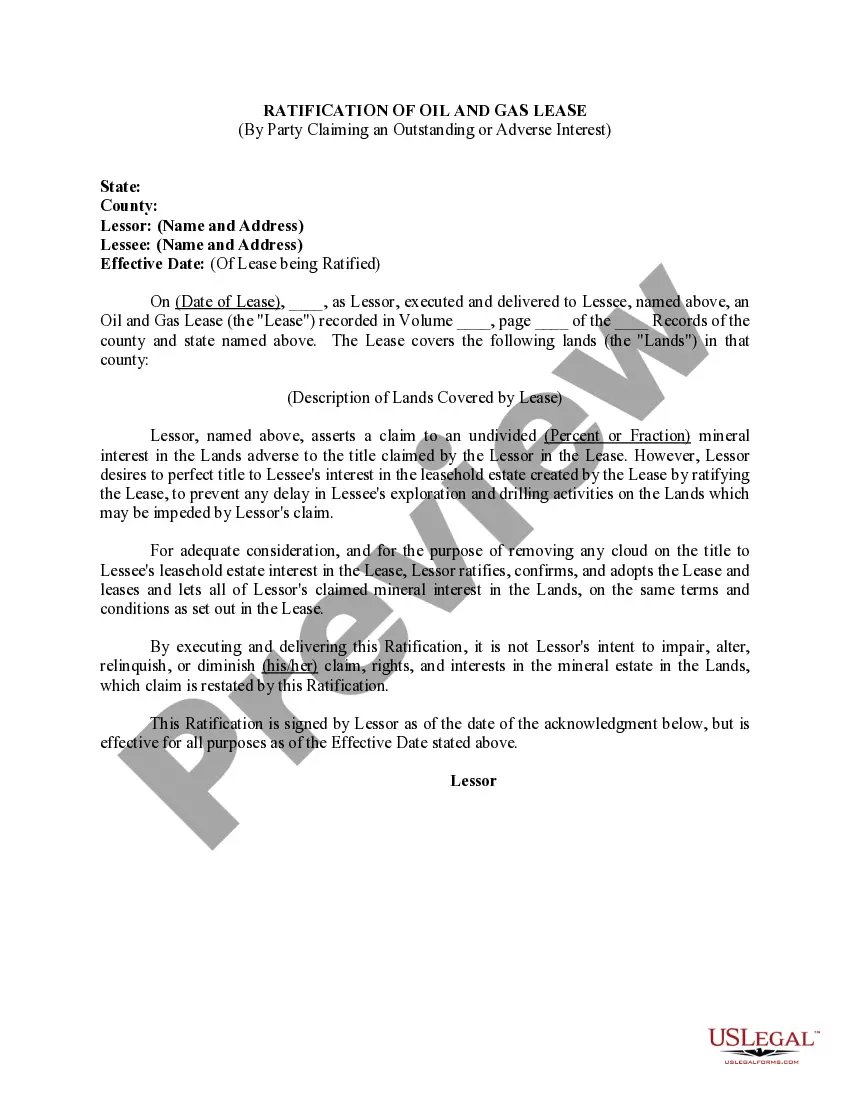

How to fill out Self-Employed Steel Services Contract?

You might spend hours online attempting to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms offers numerous legal forms that are reviewed by experts.

You can easily download or print the Massachusetts Self-Employed Steel Services Contract from my service.

If available, use the Preview button to view the document template as well. If you wish to obtain another version of your form, use the Search field to find the template that meets your needs and requirements. Once you have located the template you want, click Get now to proceed. Choose the pricing plan you prefer, fill in your details, and register for an account on US Legal Forms. Complete the purchase. You can use your Visa or Mastercard or PayPal account to buy the legal document. Select the format of your document and download it to your device. Make adjustments to your document if necessary. You can complete, edit, and sign and print the Massachusetts Self-Employed Steel Services Contract. Download and print numerous document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and then click the Download button.

- Afterward, you can complete, edit, print, or sign the Massachusetts Self-Employed Steel Services Contract.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

- Review the form details to confirm you have chosen the appropriate form.

Form popularity

FAQ

Personal service contracts are generally taxable in Massachusetts. If your services are categorized under a Massachusetts Self-Employed Steel Services Contract, you will likely need to collect sales tax. To navigate this, consider leveraging resources like uslegalforms for assistance in understanding your tax responsibilities.

Yes, if the contract labor falls under taxable services in Massachusetts, it should be taxed. For individuals involved in a Massachusetts Self-Employed Steel Services Contract, understanding the tax obligations for contract labor is crucial. Ensure you comply with all state regulations to avoid penalties.

Yes, service labor can be taxable in Massachusetts. If your work falls under a Massachusetts Self-Employed Steel Services Contract, it’s crucial to determine whether your specific services are subject to tax. This often varies based on the type of service provided and its classification under state tax laws.

In Massachusetts, engineering services are generally considered taxable. If you are engaged in a Massachusetts Self-Employed Steel Services Contract that includes engineering work, you must account for sales tax. It’s wise to review the specific regulations or consult a tax advisor for tailored guidance.

If your services fall under taxable categories, you should add tax to your invoice. This is particularly relevant for those working under a Massachusetts Self-Employed Steel Services Contract. Make sure to keep accurate records of your sales and tax collected, as this will simplify your tax filing process.

Yes, service contracts in Massachusetts can be taxable. The tax implications depend on the nature of the services provided. For those involved in a Massachusetts Self-Employed Steel Services Contract, it’s essential to understand how sales tax applies to your services. Consulting a tax professional can help clarify your specific situation.

To write a self-employment contract, begin with a clear outline of the services provided and the payment details. Be sure to include clauses that address confidentiality, dispute resolution, and termination conditions. Using a Massachusetts Self-Employed Steel Services Contract template can enhance your contract's effectiveness and ensure compliance with legal standards.

In Massachusetts, a contract is legally binding when it includes an offer, acceptance, consideration, and mutual intent to be bound. Both parties must have the capacity to enter a contract and the terms must be clear and specific. By ensuring these elements are present, especially in a Massachusetts Self-Employed Steel Services Contract, you can create an enforceable agreement.

Writing a self-employed contract requires clarity on the services you will provide and the payment structure. Include terms that specify deadlines, revision processes, and conditions for termination. Utilizing a Massachusetts Self-Employed Steel Services Contract template can streamline this task, ensuring you include all essential components.

To set yourself up as an independent contractor, first choose a business name and register it if necessary. Next, obtain the required licenses and permits specific to your industry in Massachusetts. Finally, create a solid Massachusetts Self-Employed Steel Services Contract to establish clear terms with your clients and protect your interests.