Massachusetts Stock Option Agreement of Ichargeit.Com, Inc.

Description

How to fill out Stock Option Agreement Of Ichargeit.Com, Inc.?

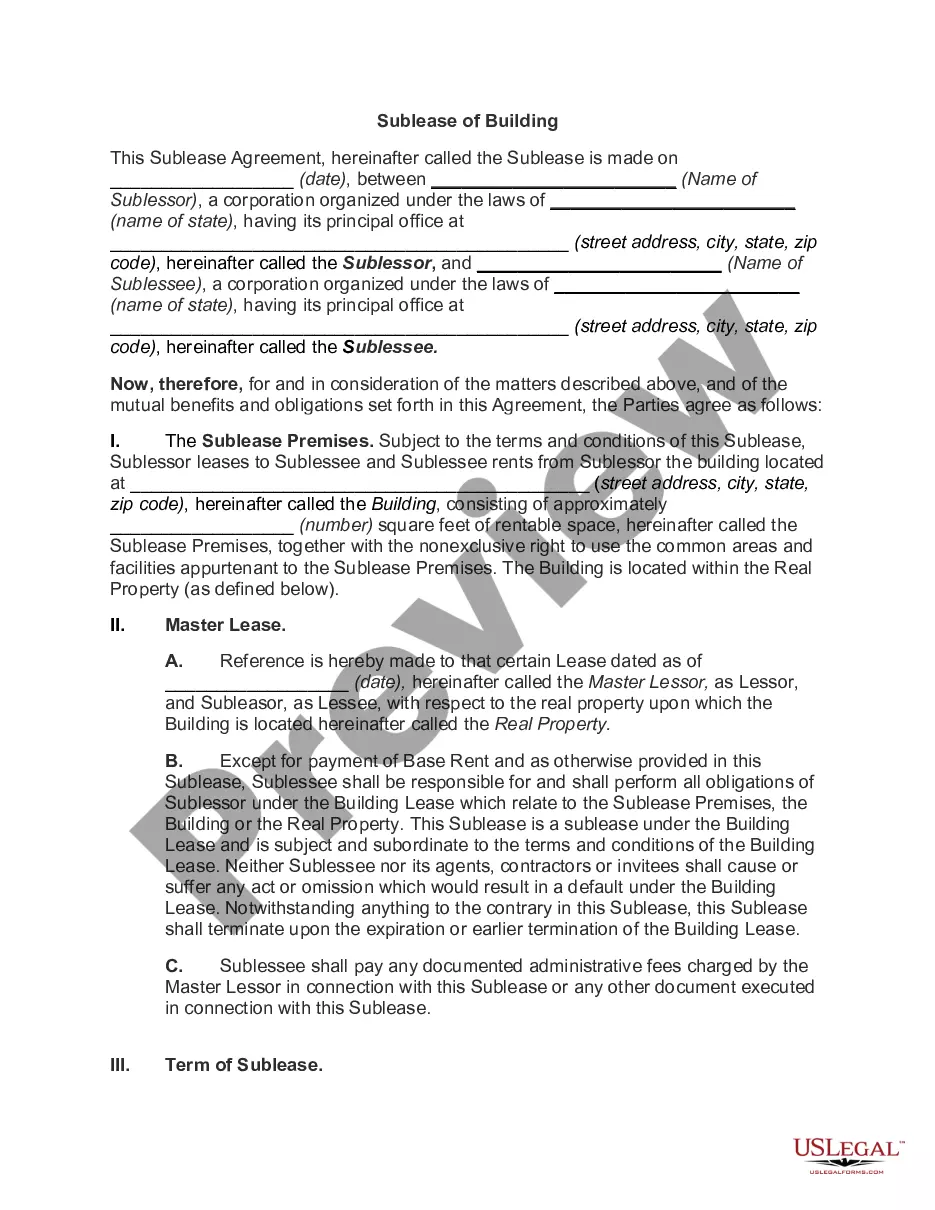

Choosing the best legitimate file web template might be a have difficulties. Naturally, there are a lot of web templates available online, but how will you find the legitimate kind you require? Make use of the US Legal Forms internet site. The services provides a large number of web templates, such as the Massachusetts Stock Option Agreement of Ichargeit.Com, Inc., that can be used for enterprise and private demands. Each of the kinds are checked out by specialists and meet federal and state demands.

In case you are previously authorized, log in to the profile and then click the Acquire button to get the Massachusetts Stock Option Agreement of Ichargeit.Com, Inc.. Utilize your profile to look from the legitimate kinds you possess bought previously. Check out the My Forms tab of your own profile and have one more copy from the file you require.

In case you are a new customer of US Legal Forms, allow me to share easy instructions that you should comply with:

- Initially, ensure you have chosen the correct kind for your personal city/state. You are able to examine the shape making use of the Preview button and read the shape information to make certain it is the best for you.

- If the kind is not going to meet your requirements, take advantage of the Seach area to discover the proper kind.

- Once you are positive that the shape is proper, select the Purchase now button to get the kind.

- Choose the pricing program you desire and type in the essential information. Build your profile and buy an order making use of your PayPal profile or credit card.

- Choose the file structure and down load the legitimate file web template to the device.

- Full, modify and printing and signal the received Massachusetts Stock Option Agreement of Ichargeit.Com, Inc..

US Legal Forms will be the most significant library of legitimate kinds for which you will find numerous file web templates. Make use of the service to down load appropriately-manufactured documents that comply with status demands.

Form popularity

FAQ

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them. What is a stock grant? | Global HR glossary | Oyster® Oyster HR ? glossary ? stock-grant Oyster HR ? glossary ? stock-grant

For example, you may be granted the right to buy 1,000 shares, with the options vesting 25% per year over four years with a term of 10 years. So 25% of the ESOs, conferring the right to buy 250 shares would vest in one year from the option grant date, another 25% would vest two years from the grant date, and so on.

A share vesting agreement (SVA) is a contract between a business and an employee, whereby the employee is provided with new shares that vest over time. These agreements lay out the terms and conditions regarding vested shares, as well as the options in relation to vesting.

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the ?exercise? or ?strike price.? You take actual ownership of granted options over a fixed period of time called the ?vesting period.? When options vest, it means you've ?earned? them, though you still need to ... What are stock options & how do they work? - Empower empower.com ? the-currency ? money ? ho... empower.com ? the-currency ? money ? ho...

If the stock value increases, you could make significant financial gains?but only if you've exercised (purchased) your options. And you can only do that if you've accepted your grant. The earlier you understand your options and the financial implications of exercising, the sooner you can make smart financial decisions. Stock Grants: Why You Should Always Accept Them - Carta carta.com ? blog ? why-accept-your-stock-grant carta.com ? blog ? why-accept-your-stock-grant

Stock option grants are how your company awards stock options. This document usually includes details about: The type of stock options you'll receive (ISOs or NSOs) The number of shares you can purchase. Your strike price.

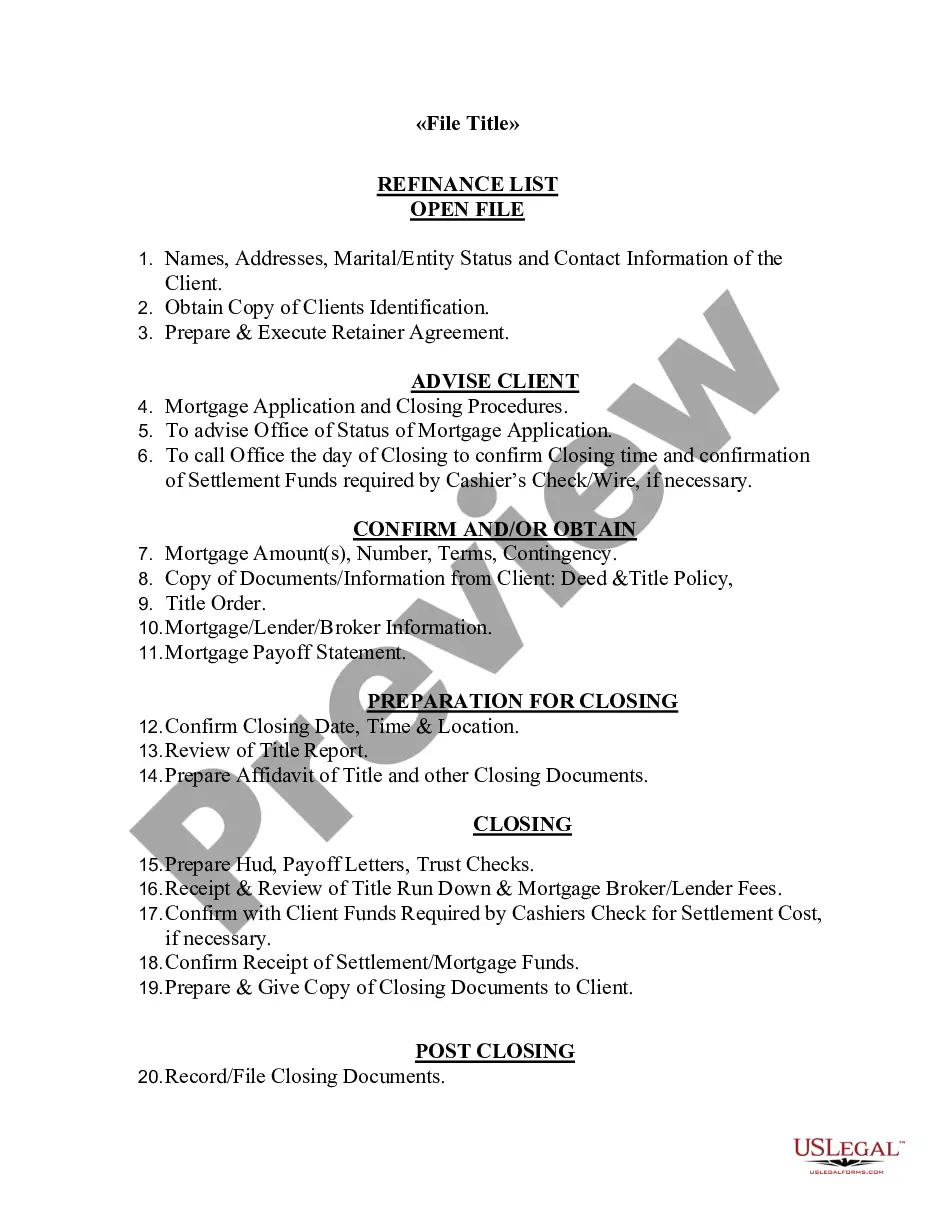

A. The Key Documents Stock Option Plan. This is the overarching general plan that is adopted by the startup regarding issuances of stock options. ... Stock Option Agreement. ... Exercise Agreement. ... Dates. ... Number and Type of Shares. ... Exercise Price. ... Type of Option. ... Vesting Schedule.

A stock option provides an employee with the opportunity to purchase a set number of shares of company stock at a certain price within a certain period of time. The price is called the ?grant price? or ?strike price.? This price is usually based on a discounted price of the stock at the time of hire. 10 Tips About Stock Option Agreements When Evaluating a Job ... melmedlaw.com ? how-to-evaluate-stock-op... melmedlaw.com ? how-to-evaluate-stock-op...