Massachusetts Stock Option Agreement by Telocity, Inc.

Description

How to fill out Stock Option Agreement By Telocity, Inc.?

If you wish to full, down load, or printing authorized papers themes, use US Legal Forms, the largest assortment of authorized varieties, which can be found on-line. Take advantage of the site`s basic and practical research to get the documents you need. Various themes for enterprise and individual reasons are categorized by groups and states, or key phrases. Use US Legal Forms to get the Massachusetts Stock Option Agreement by Telocity, Inc. in just a number of clicks.

If you are already a US Legal Forms customer, log in in your bank account and click on the Download key to have the Massachusetts Stock Option Agreement by Telocity, Inc.. You can even entry varieties you formerly delivered electronically inside the My Forms tab of your own bank account.

If you work with US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have chosen the form to the appropriate area/land.

- Step 2. Use the Review solution to look over the form`s articles. Never forget about to read the outline.

- Step 3. If you are unhappy with all the develop, utilize the Search industry near the top of the screen to find other models in the authorized develop web template.

- Step 4. After you have located the form you need, go through the Purchase now key. Select the prices program you prefer and add your accreditations to sign up on an bank account.

- Step 5. Process the purchase. You may use your charge card or PayPal bank account to perform the purchase.

- Step 6. Find the formatting in the authorized develop and down load it on your gadget.

- Step 7. Complete, change and printing or signal the Massachusetts Stock Option Agreement by Telocity, Inc..

Each authorized papers web template you buy is your own property for a long time. You have acces to each and every develop you delivered electronically in your acccount. Click the My Forms area and choose a develop to printing or down load yet again.

Contend and down load, and printing the Massachusetts Stock Option Agreement by Telocity, Inc. with US Legal Forms. There are many skilled and condition-specific varieties you can utilize for your enterprise or individual demands.

Form popularity

FAQ

Remember: If you hope to purchase and sell your stock someday, accepting your stock option grant is the first step you have to take.It doesn't cost anything to accept the grant, and you're not obligated to actually exercise your options.

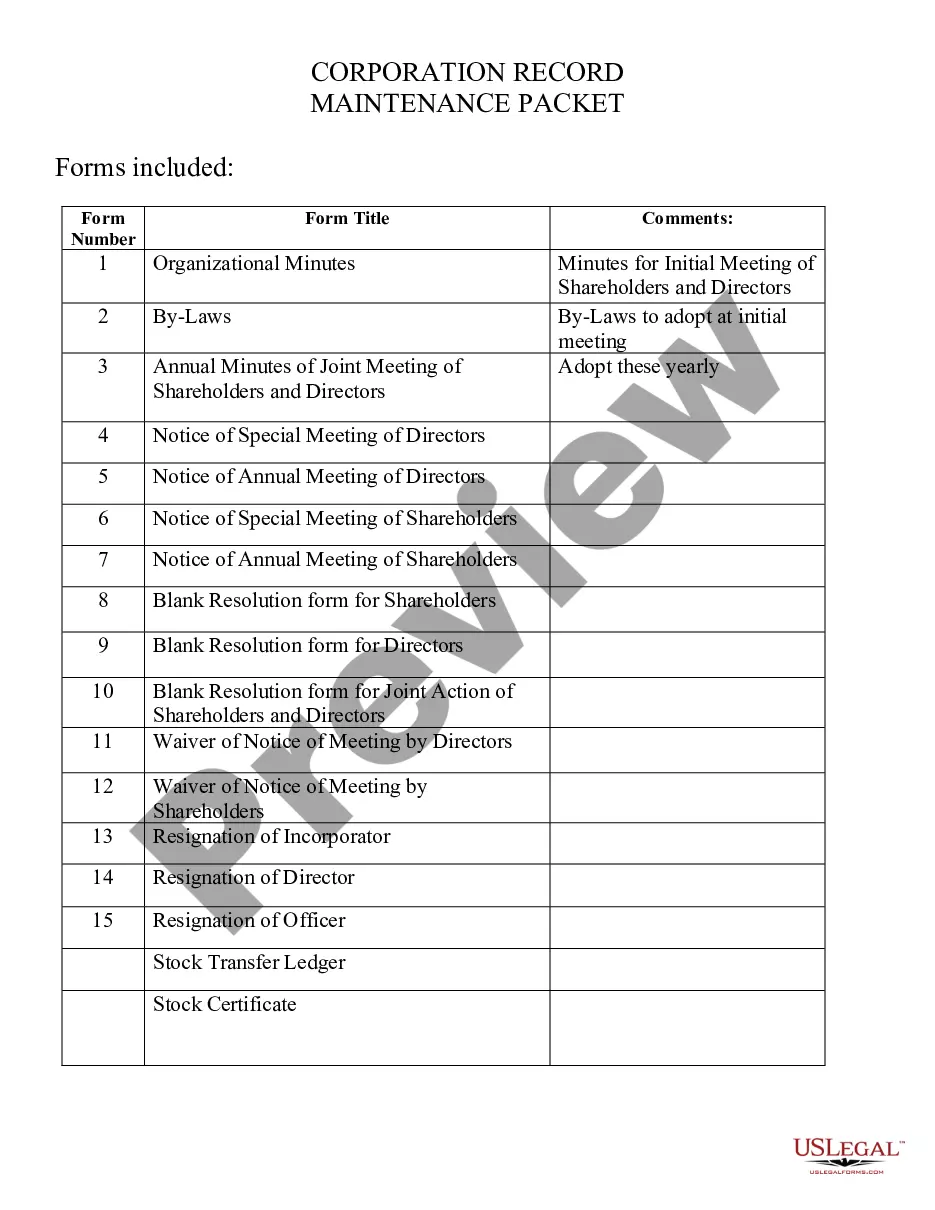

A. The Key Documents Stock Option Plan. This is the overarching general plan that is adopted by the startup regarding issuances of stock options. ... Stock Option Agreement. ... Exercise Agreement. ... Dates. ... Number and Type of Shares. ... Exercise Price. ... Type of Option. ... Vesting Schedule.

When an employee exercises stock options, you'll credit Common Stock for the number of shares x par value, debit Cash for the number of shares x the exercise price, then debit Additional Paid-In Capital for the difference, representing the increase in value of the shares during the service period.

Exercising stock options means you're purchasing shares of a company's stock at a set price. If you decide to exercise your stock options, you'll own a piece of the company. Owning stock options is not the same as owning shares outright.

Stock options are also compensation expense to the company. This expense is recognized as the employee earns service time up to the vesting date. The appropriate debit is made to compensation expense each accounting period with a credit to additional paid-in capital.

The use of employee stock options effectively involves two types of transactions: the payment of compensation in the form of employee stock options (reflected on the income statement) and, when the options are exercised, a financing transaction (reflected on the balance sheet).

For example, you may be granted the right to buy 1,000 shares, with the options vesting 25% per year over four years with a term of 10 years. So 25% of the ESOs, conferring the right to buy 250 shares would vest in one year from the option grant date, another 25% would vest two years from the grant date, and so on.

Stock option expensing is a method of accounting for the value of share options, distributed as incentives to employees within the profit and loss reporting of a listed business.